What’s The One Thing You Can Leave Behind?

As the famous Chinese proverb goes, “Wealth does not last three generations”. Many of us spend a great deal of time and energy accumulating our wealth. However, our efforts may go to waste if we fail to consider how to preserve and pass on our hard-earned fortunes to our loved ones and future generations when we are no longer in this world.

This is where legacy planning comes in. Your legacy is one of the most precious gifts you can leave behind for your family, making sure that they are well provided for and given a valuable head start in life.

Manulife Singapore has developed the ManuSignature series, which offer a range of solutions to cater to the distinct financial needs of high-net-worth individuals. The first plan in the series is ManuSignature One, a single premium whole life insurance plan designed to help you preserve and grow the wealth you have built, so that your legacy continues to support the ones you love who matter most to you.

Case Study: How a ManuSignature One plan can help with legacy creation

Mr Lim, aged 55, is a successful entrepreneur. He has set aside S$2 million in cash, with the intention to bequeath S$1 million to his estate and use the remaining S$1 million for his retirement.

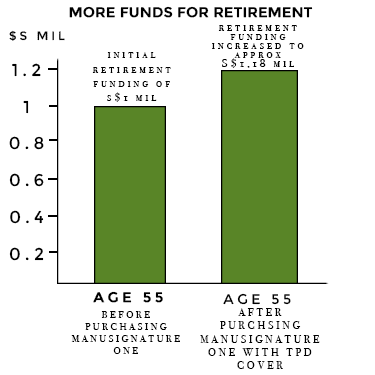

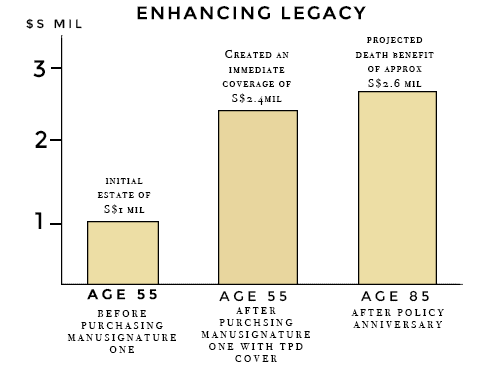

If Mr Lim uses the S$1 million he has set aside for his estate to purchase a ManuSignature One policy including Total and Permanent Disability cover, he would only need to pay a single premium of S$821, 329 for a sum insured of S$1 million. This helps him to free up an additional S$178,671 for his retirement. What’s more, thanks to ManuSignature One’s Minimum Protection Benefit factor applied on his sum insured, he will enjoy immediate coverage of S$2.4 million.

While offering protection against the unexpected, ManuSignature One also provides an immediate and guaranteed source of cash from the day the policy starts, with a guaranteed cash value of 80% of the single premium. The guaranteed cash value will continue to grow with the accumulation of non-guaranteed bonuses earned over time. At age 85, Mr Lim’s projected death benefit will have grown to approximately S$2.6 million with the accumulated non-guaranteed bonuses, based on a projected rate of return of 4.75% per year.

No one can be certain about the future. With ManuSignature One, you will have peace of mind with high immediate protection against the unpredictable. At the same time, you can continue to enjoy your lifestyle while securing the future of your loved ones.

This article is produced with permission from Manulife Singapore. For more details on ManuSignature One, please visit www.manulife.com.sg.