Singapore Bond Digest: Ahead of The Curve

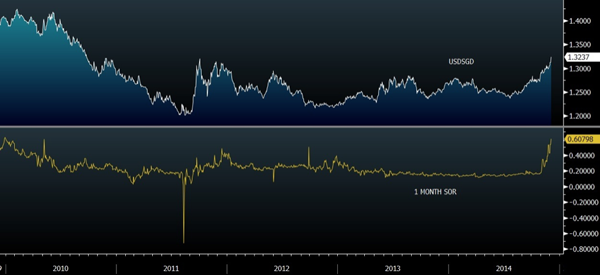

The kiasu spirit has not failed Singaporeans. The Singapore market has managed to pre-empt the Federal Reserve rates hike cycle. Short-end funding rates started rising late September and we have the short-end SOR (Swap Offered Rate) curve inverted, and as I type away, the 1-month implied forwards borrowing cost rose above the 1-year interest rate swaps.

This is a big deal for market participants because inversions are not common of late; this could be a sign of the times for the SGD dollar in the days ahead. The USD/SGD broke its 4-year high last Friday, breaking above 1.32, causing SOR fixings to react in a hurry.

Chart 1: 5-year chart of USDSGD and 1-Month SOR

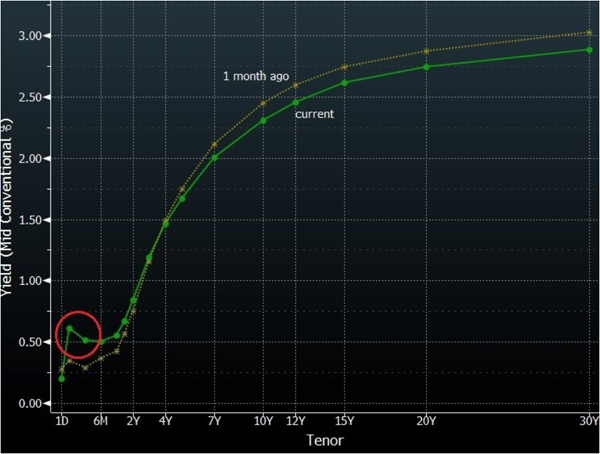

The interest rate curve shows the kink in the 1 month rate which was not present a month ago.

Chart 2: Singapore interest rate swaps current vs 1 month ago

For most Singaporeans who have their loans pegged to Singapore Interbank Offered Rate (SIBOR), the pain started showing up last month when we pointed out that the 1-month SIBOR had broken its 4-year high.

SIBOR has always been the preferred gauge for assessing bank loans from the banks’ perspectives since 2011, when there was a mass exercise to convert loans to SIBOR as the SOR rates traded to negative levels for a few weeks, resulting in many loans running at negative fixings, a situation not unlike present day Germany, Switzerland and Japan, where deposit rates are negative.

In this rates environment, it is no wonder we have not seen a single SGD public corporate bond issue in 2 weeks; this coupled with the distress global bond markets are experiencing in the high-yield space, where O&G bonds are undergoing stress – a situation Singapore is not exempted from. Given the issuance patterns this year, which included an inordinate amount of high-yield O&G issuers in order to assuage yield-hungry retail investors onshore, I worked out that about 29% of 2014 issues are trading at a loss.

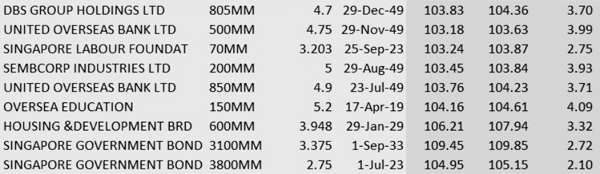

The investor belief in the safety of buying short-end higher-yielding debt proved to be a fallacy as far as capital gains are concerned, because nothing beats doing the credit homework and the interest rate outlook.

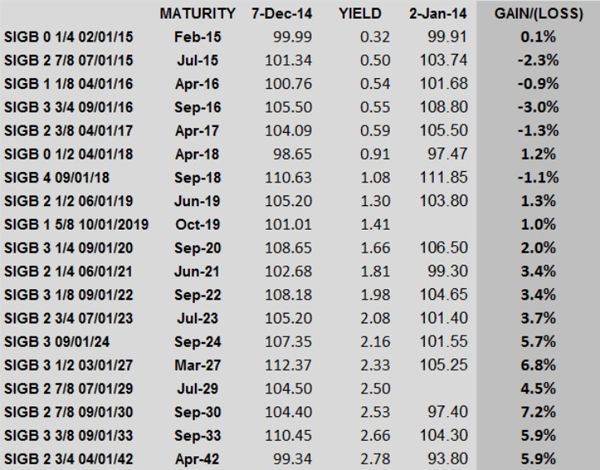

What a horror that the best-performing bonds this year are the low-yielding government papers, which have returned between 2% and 7% for maturities of 6 years or more, assuming you had bought on 2 Jan 2014.

Table 1: Singapore government bonds and their price changes in 2014

Note: Oct 2019 and Jul 2029 were issued this year at 99.88 and 99.336, respectively.

It is an irony because I only managed to find 7 bonds out 284 higher yielding corporate bonds issued between 2013 and 2014 which delivered capital gains north of 3%.

Table 2: Singapore corporate bonds with >3% capital gains as of 3 Dec 14. The 2 government bond issues were thrown in for comparison.

I do not usually recommend government bonds as a buy-and-hold strategy because the fragile coupon gains would be easily wiped out by capital losses in a rising yield environment. Thus, I won’t take credit for the strategy put forth in May this year which would have reaped hefty returns for those long end >10 year papers that I thought were worth a look then.

Fresh off last Friday night’s US Non-Farm Payrolls, and its incredible trouncing of almost every economist’s expectations, should we expect status quo for our bond portfolios? I think not.

While some argue that long-end bonds are still safe, perhaps because slow growth would mean that when the Federal Reserve starts hiking rates, the curve would flatten in response, I believe we will start to see opinions tear up.

Firstly, the Singapore market does not have a significant stake in the global bond markets and much of the offshore investments here are based off the assumption of continued currency appreciation. If the currency enters into a protracted period of weakening, we should expect outflows.

Secondly, the market is moving towards a consensus (that we shall soon be reading a lot more about in the news) that the Fed will start hiking sooner than later, which does not bode well for the SGD dollar’s strength. That would lead to further hedging activity from mortgages portfolios that would drive rates higher.

The macro picture aside, I realise that the local corporate bond market is bifurcated between retail and institution-preferred bonds, where most of the high-yield papers are sitting in retail private bank accounts running on leverage.

Indeed, it has become more profitable and fashionable to leverage on bonds than real estate in the past 2 years, and many a private bank’s bond portfolios are reaping double-digit returns with ready access to cheap funding, which could get more expensive.

With JP Morgan calling for about 40% of high-yield O&G issuers to potentially default if oil prices stay at around US$65, I expect some form of contagion around the world.

Yet if defaults begin to snowball, we would have a reason to hold on to the good quality long-end papers which have not failed us since May.

Then there is the argument of deflation, which should keep a cap on interest rates if oil prices remain at their lows.

The case for holding Singapore government bonds remains intact as the MAS is likely to reduce supply next year.

As for corporates, I notice that the bank loans market is perking up as the bond market fizzles. In the past weeks, we have had several S-REITS tap the bank market for loans, notably Suntec, Cache, Starhill, along with Wilmar and Olam managing to secure several billion in bank financing. Reduced bond supply should keep sellers at bay.

Yet all these will be secondary considerations against the big picture of Fed rates hikes, with more clarity to come on the FOMC on the 18th of December (3am SG time).

It is all not lost as we brace for higher rates in the days ahead, and in the same kiasu spirit, do our homework and get ready for some bargain-hunting in the markets.