The Goat and The Real Estate Market

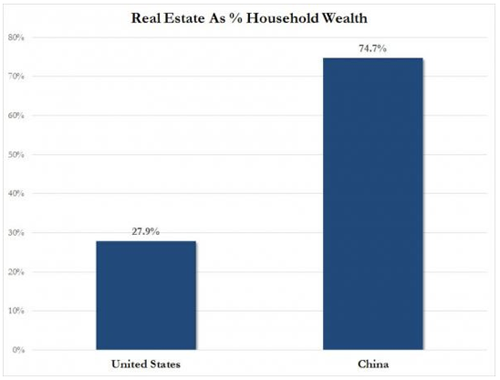

Enter the Lunar New Year of the Sheep or Goat, or as I read, ancient texts had the Dog in this space previously, as the Horse replaced the Deer. I am not sure what this Wooden Goat heralds but chinese astrologers more or less concur that it will be less temperamental than last year’s Horse. My Chinese new year observation is that small businesses are still struggling as another spa opens up on Balestier Road. The former tenant, a hardware shop, simply could not cope with the sudden 200% increase in rental of S$10,500 from S$3,500 previously, which the spa could most certainly afford given the high cash intensity and less transparency, making it easy to book profits. Some landlords have it good these days, unless you happen to be looking to let out our residential investment property in Sentosa, perhaps ? For Asians, real estate investment in the blood and residential investment properties are by far the easiest to understand and manage for the average man on the street investor out there. With 75% of Chinese wealth tied up in real estate and an estimated 47% for Singaporeans, the percentage greatly outstrips that of the American who has just about 28% of their household wealth parked there.

Source: ZeroHedge

Judging from the number of daily sms-es I receive hawking properties down by Kallang River, commercial units in Paya Lebar and condos in Myanmar, Iskandar and wherever you can name with the except of the Middle East and Africa, I think that real estate investment will always be the cornerstone of many a portfolio in Singapore. For me, I believe there are more ways to invest in real estate, observing what astute investors did in the past. People like my former boss who loaded up on Keppel Land shares for years before he committed to buying a property. Stocks, REITs, collective investment schemes, land banking, hedge funds and more, it has got me thinking if home ownership is, as Nobel laureate Robert Shiller suggests, worth more than starting a business or paying for education in the case for the lower income bracket which I extend to the wider spectrum of real estate investment.Reading headlines can certainly make one salivate as our eyes go round with greed hearing about investors flipping Battersea Power Station flats for £150,000 profits even before they are built. Global players are moving in real estate assets with Qatar buying up Canary Wharf and China zooming in on the Royal Albert Docks, both in London.

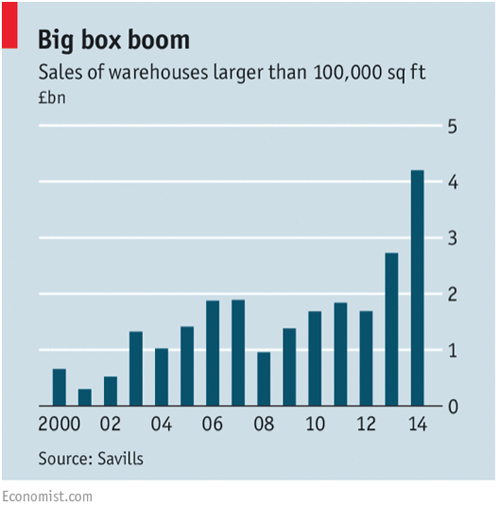

What caught my eye locally was the recent merger of Ascendas with Temasek. That is a lot of real estate we are talking about, although nothing compared to China’s ambitions to revive the Silk Road “a pan-Eurasia trade/commerce utopia weaved by high-speed rail, fiber optic networks, ports and pipelines, and connecting East Asia, Central Asia, Russia, the Middle East and Europe.” Logistics is the future as online shopping continues to boom and Alibaba goes on to dominate the world. The signs could not be more clear as the Bureau of Labour Statistics in the US predicts that employment of truck drivers will grow 11% from 2012 to 2022 and a current shortage of 35,000 drivers in America. From warehouses and factories straight to the doorstep, bypassing the shopping malls.

Just take a look at British warehouse investment trends in the Midlands.

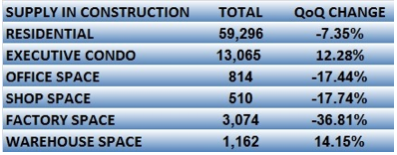

Singapore numbers are crying out to us.

We note that residential vacancies are the highest since Dec 2005, office space vacancies are highest since Jun 2012 and factory space vacancies are highest since Jun 2006.

Taking a pinch of salt from the reports we read about prime office rentals that have jumped 14% last year, I personally would not expect the same for 2015.

The residential property market is unlikely to recover soon with heavy supply in the pipeline.

“An estimated 50,300 new residential units are set to be added to the market in 2015, followed by 71,500 in 2016 and 37,200 in 2017…with average population growth at around 75,000 individuals per annum from 2014 to 2020, and assuming a conservative 3 persons per household, this translates to an incremental demand of 25,000 physical homes per year, he calculated.”

Yet I note that the rout in residential property prices has not dampened the property developer stocks as much, especially the diversified companies and SReits have been totally shunted from the bloodbath even as 3M Sibor continues to ramp higher.

My observations:

- Residential property prices are on a downtrend thus investing in a real estate developer as a proxy makes more sense, noting the outperformance of the developer’s index.

- Warehouses are sticky investments that retail investors will have trouble accessing and thus we are better off investing in the logistics company proxies, especially those who own their real estate like GLP, KPTT and such.

- The evil twin to e-commerce would be the bread and butter retail sector that are making up the tenants in all those mall REITS which I am doubtful about.

- With much wealth parked in Asian real estate, the sensible alternative would be stocks and funds which are diversified as compared to a single asset investment.

- The importance of staying liquid is more imperative than ever in the uncertain interest rate environment.

For many investors, real estate is a leverage game where you can borrow 60-80% of the property price. We should realise that the same can be done for stocks and other investments as well.

Real estate is also a long term game which means we can afford to be as patient as a Goat in waiting for the trends to play out and we can either pray for it to become trendy for Singaporeans to own 2 homes each (perhaps one for the weekends in Sentosa), an explosive population growth or online shopping to become part of our lives.

Oh, and one other little thing. Those 3D printers may do away with the need for too many warehouses in the future, if they manage start printing those tables and chairs as and when you need them.

Good luck.