Capricious Bond Markets Calls for An Ovine ETF Solution

Inflation is the taboo word in bond world given its automatic association with higher interest rates that is entrenched in the mindsets of even experts. Lucky for the world, the worry is for deflation which is good for bonds!

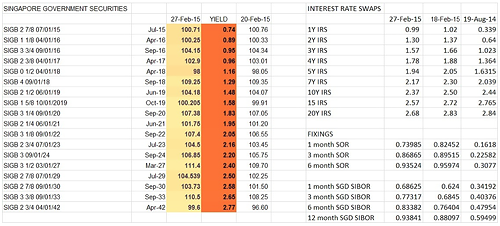

In Singapore, it has been slightly different this time round. For once, the market is flummoxed by the first time in over a decade where we are expecting the SGD dollar to slow down her rate of appreciation against the other currencies in her NEER basket and that has caused short term interest rates to rise between 100-400% in a span of 6 months to the amazement of those unfamiliar with the workings of Singapore’s monetary policy.

The initial furore has abated to a general acceptance that we will be going into a Rising rate cycle, along with the US, whose rates have not risen half as much as Singapore’s.

This phenomenon of SGD rates closing the gap with the US is a rare one indeed and can only be appreciated by mostly the market professionals who make a living from trading the yield curve. For Singapore’s 5 year rates have surpassed 5 year Australian bond yields as well, something which has not happened since the Asian crisis back in 1997/8 and a blue moon event that normalised quickly enough then.

Yet it has not been good for all bonds, in particular the corporate bonds which are fighting the tide of currency weakness (less offshore demand), higher interest rates (lower prices) and extremely poor liquidity (lack of market participants). Capricious times indeed in the year of the Goat.

I have bad news.

It is not going to get better and no one is going to get rich buying these bonds unless you were smart enough to have gone in for the 30Y Singapore government bond auction last Monday for an instant windfall of 1.6% the next day when the bonds were allocated at 97.93 (2.86%) and rallied subsequently to 99.50 (2.77%) which makes it one of the best performing bond this year. There was not much reason for the rally, of course, other than the fact that the demand during the auction was not forthcoming and the bond sold off prior to the auction only to normalise in price thereafter.

Instead we are fixated on the friends we hear about, making money from their Kaisa USD bonds which has been whipping around the 30-60 cent range, depending on where you bought it, you could be sitting on a 100% return or 40% loss.

Bankers are encouraging these days as inflows into Asian bonds continue at the highest rate since June last year.

That worries me a little because while I like the idea of a personal bond portfolio as a nice boast over lunch, the fact is that most banks are scaling back on their trading capabilities which will only exacerbate the poor liquidity situation. Many people I know can attest to the periods where they are unable to liquidate holdings or, for the lucky few, took 3 weeks to find a buyer at a suitable loss.

I know it is not just me because Major Firms Are Saying the Stage Is Set for Another Crisis in the Bond Market, as reported in Bloomberg.

“While the biggest banks have cut back on their positions in risky, speculative-grade debt, it’s steadily migrated to large institutions, insurance companies and mutual funds. Such firms have boosted their holdings of corporate and foreign bonds to $5.1 trillion, a 65 percent increase since the end of 2008, according to data compiled by UBS…ballooning bond funds that own more and more risky debt — may be a less bad option, but one that still threatens to wreak havoc in credit markets.”

Shall they be proven wrong?

ETF’s are expected to hold $5 trillion in assets by 2020 and Jeff Gundlach, arguably the best bond hedge fund manager, prepares to manage SPFR Doubleline Total Return Tactical ETF.

I am increasingly swayed by the ETF option these days, over the idea of individual investment holdings that are not held as a punt or ultra long term investments, and much prefer the ETF to funds and unit trusts which are usually more veiled and include the dreaded management fees that erode profits.

ETFs have the advantage of the law of size and averages, replicating a basket usually representing an index, which most individuals cannot achieve. Indices are transparently priced and, banks are usually beholden to make prices for liquidation as opposed to second class customers, like myself, where they hide behind the excuse of the OTC marketplace. Lastly, there is a likelihood that ETFs could be safer than hedge funds too.

In choosing your ETF, you can also look for customisation in currency hedging as opposed to the local currency ones.

For instance, my favourite high yield ETF, HYG US, is the 4th largest one in the world by asset size has $18 bio of junk bonds in it. It has returned 2.95% year to date and gives a dividend yield of 5.44% which is not too shabby.

iShares iBoxx $ High Yield Corporate Bond ETF is an exchange-traded fund incorporated in the USA. The ETF seeks to track the investment results of an index composed of U.S. dollar-denominated, high yield corporate bonds.

SGX has 5 bond ETFs listed on it.

1. ABF Singapore Bond Index Fund (SBIF) is an exchange-traded fund established in Singapore. The Fund’s objective is to provide returns that correspond closely to the performance of the iBoxx ABF Singapore

Bond Index before expenses, with a target tracking error of 40 basis points on an annual basis.

– a SGD denominated fund holding Singapore government bonds.

– 1 year return 3.78% (much higher than some corporate bond yields)

– dividend yield 2.66%

– market cap SGD 554 mio

2. iShares Barclays USD Asia High Yield Bond Index ETF (AHYG) is an exchange-traded fund incorporated in Singapore. The Fund seeks to track the performance of the Barclays Capital USD Asia High Yield Bond Index.

– USD denominated

– 1 year return 6.97%

– dividend yield 6.38%

– market cap USD 71 mio

3. iShares J.P. Morgan USD Asia Credit Bond Index ETF (AJAC) is an exchange-traded fund incorporated in Singapore. The Fund seeks to track the performance of the J.P. Morgan USD Asia Credit Bond Index. (one of the most used indices by fund managers and central bankers for Asia)

– USD denominated

– 1 year return 8.95%

– dividend yield 4.19%

– market cap USD 46 mio

4. iShares Barclays Asia Local Currency Bond Index ETF (ABLC) is an exchange-traded fund incorporated in Singapore. The Fund seeks to track the performance of the Barclays Capital Asia Local Currency Bond Index. (holding Korea, Philippines, Malaysia, Thai etc sovereign bonds)

– USD denominated

– 1 year return 4.18%

– dividend yield 3.7%

– market cap USD 7 mio

5. iShares Barclays Asia Local Currency 1-3 Year Bond Index ETF is an exchange traded fund incorporated in Singapore. The Fund seeks to track the performance of the Barclays Capital Asia Local Currency 1-3 Year Bond Index. (holding Asian sovereign bonds)

– USD denominated

– 1 year return -2.29%

– dividend yield 2.43%

– market cap USD 659k

In Singapore, we are used to the world of unit trusts and there are plenty of them out there, aggressively marketed by the financial planners and bankers. ETFs are the new kid to the block which do not run their own marketing campaigns and get little attention due to the lack of sales incentives.

Nonetheless, for the reasons I listed above that the situation in our local SGD bond market is unlikely to improve anytime soon, I think there is no harm in exploring the alternative – an ovine solution to capricious times.