Trade not Invest in Deflation

A solemn week with a unique experience of national solidarity with fellow citizens, all of us bound together by the loss of the nation’s founding father, LKY, and it does look like life will not be the same again, missing the complacency that comes from the knowledge that someone is watching over you.

It is the same for bonds, the safe instruments of fixed income that provides higher level protection to holders in the event of default.

As it is, the issuance in the US has been brisk with March on track to be the second busiest month in history, only losing to Sep 2013, in terms of total debt issued. It is the same for Europe as the 2 great engines of the global economy attempt the task of returning the world back to growth.

The icing on the cake is that we have all central banks armed with the “whatever it takes” mindset, determined to make sure that it will happen.

There has been nearly 30 rate cuts year to date, all countries in a hurry to combat deflation and spur growth. This has resulted in the creation of a negative yield world that has become accepted as natural even as it wreaks havoc in many a portfolio.

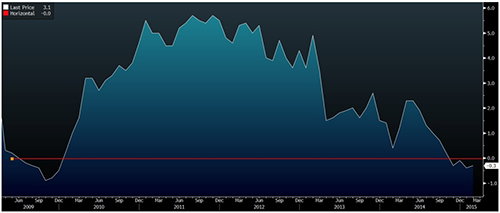

Singapore is the only developed country of the lot that is bucking the trend, tackling deflation with her unique monetary policy that is foreign exchange based and inflation led. As such we have short end interest rates breaking 6 year highs even as our latest CPI print was at -0.3% yoy in February, falling for the 4th consecutive month in the longest drop since 2009.

For inflation in Singapore begets currency strength and the unintended outcome of lower interest rates which, in theory, fuels domestically generated inflation as currency strength only succeeds in containing imported inflation.

Yet the converse is true for deflation, a situation that does not usually occur too often in this resource poor country that is also a global trade leader, chalking the highest surplus as a % of GDP in the world.

Now that 70% of developed countries are facing inflation of under 0.5%, deflation has become a global problem. Even Japan’s remarkable achievements have suffered a set back last week when it emerged that their inflation has slowed to 0% and the UK saw theirs fall to a record low first in January and then again in February, since records began in 1997.

Singapore cannot fight the tide as commodity prices continue to collapse around the world as stock and bonds rise on the back of central bank rate cuts and stimulus.

As I said in December last year. “When confronted with the prospect of deflation, good or bad, expectations change. By good deflation, we are supposing that aggregate supply of goods from e.g. technological advances, improved productivity, etc, increases faster than aggregate demand, resulting in falling prices. Bad deflation happens when aggregate demand falls faster than any growth in aggregate supply, for instance, when we have a recession. In this age of central bank participation, it is impossible to ascertain how price action will develop because we cannot have central banks easing and injecting liquidity for deflation to set in only in selected asset classes which will undoubtedly spill over into the rest of the economy and we can say goodbye to the wage inflation we have been hoping for.”

In Singapore’s case, that has resulted in trying times for bond markets as interest rates hold at 6 year highs, causing bond prices to suffer.

Singapore Interbank Borrowing Rates

It just feels terribly unnatural to me, someone who can confidently claim to understand the workings of the interest rate and bond markets better than the average person. I find it difficult to be as blase as the many experts out there, watching our yields overtake Australia’s.

Investors are caught in a quandary and bond issuance has lagged to its slowest pace since 2009, putting a squeeze on local companies which have grown dependent on debt markets for their financing needs. With non oil domestic exports shrinking, PMI contracting 4 months in a row, industrial production turning negative and retail sales looking poor, I wonder how do we hedge for deflation in the worst case scenario of a potential recession?

The obvious and natural thing to do for investors in the face of sustained deflation would be to seek refuge in the safety of bonds. That has not happened in Singapore as currency fears have led to a disheveled marketplace with investors confused and I daresay, we are not back to an equilibrium in expectations yet.

This should clear up in the next fortnight as we approach the MAS’s semi annual monetary policy meeting where the central bank is expected to re-centre the SGD dollar against its basket, where it is already trading 2% weaker than mid.

Deflation means a dollar today is worth more tomorrow which means hold on to cash or near cash assets. Corporate bonds have the element of credit risk which makes some of them risky as assets, more so than some blue chip bellwether stocks.

It is not prudent to increase leverage in such times to put into risky assets that may implode during a crisis, resulting in margin calls that will impact the rest of the portfolio.

A logical hedge earlier this year was to buy USD and USD assets against the SGD as a deflation hedge. That trade has done well. But we are now facing potential rate hikes from the US which will undo the asset price gains, heighten market uncertainty and, no doubt, volatility in most asset classes. Holding the USD is also the most crowded trade in the world so far, all pining for the first hike to come which does not do any favour for inflation, if you ask me.

The circumspect solution would be to hold cash and to wait for the reflationary trades which to me, would be in commodities, their currencies and their bonds. That would take some time to transpire, I believe.

Meanwhile, facing deflation over here, I will just stick to my lack of conviction, spend less and trade more because investment is less of an option these days.