The Monkey Trading Challenge in China

When the Shanghai Composite broke their six-year high last week, many an eyebrow, including mine, rose in disbelief. With margin debt at all time highs, economic data looking lacklustre and even doubtful, something is terribly wrong.

The index then proceeded to break new highs by the day this week, closing the week at another record high.

We know by now that many funds and industry pros have missed out on this massive move because 80-90% of the articles I have come across have been disparaging since late last year with the tone recently turning from dismissive to downright contemptuous.

These are examples of what has been circulating last week, before Friday’s record high.

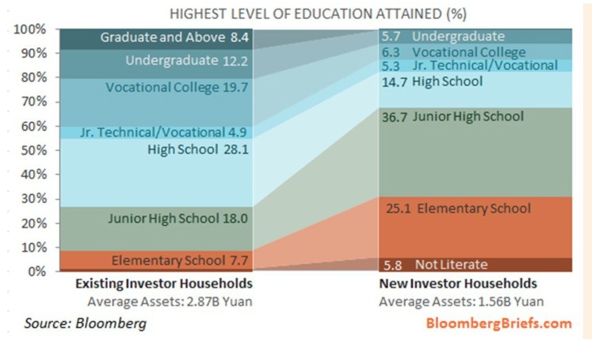

1. New investor accounts dominated by a larger percentage of “uneducated” investors who are likely to be high school drop outs.

2. Speculative nature of investment decisions by Chinese investors who trade for the short term i.e. punting with their portfolios which implies less need for proper financial analysis of the companies they are investing in, possibly indulging in “rumour based” trading and other unorthodox methods by our standards, including numerology and such.

Source: CNN Money

3. Margin debt soaring in China which explains the “madness” we are witnessing in their stock indices. Leverage leads to exacerbated moves on inflated volumes that are unsustainable, resulting in excessive volatility when the de-leveraging occurs.

Source: Bloomberg

So much for the stock investors, what about the companies and their owners or founders ?

I am not sure about recent statistics but back in 2011, we know that 15% of the world’s billionaires never had any formal tertiary education.

The Forbes 29th annual guide to the globe’s richest, a record 1,826 billionaires with an aggregate net worth of $7.05 trillion, up from $6.4 trillion a year ago. The total includes 290 newcomers, 71 of whom hail from China.

These 71 Chinese are bucking the billionaire trend, diluting the billionaire pedigree of the world and the Ivy League origins of regular billionaires.

Source: Times Higher Education

Is it bad that certain investors are doing it all wrong because they are lowly educated when some of the richest people in the world lack formal education as well? Who is to say that there is a proper way of investing?

I have been doing this long enough to know that markets can remain irrational longer than logical investors can stay solvent, courtesy of the father of modern quantitative easing, Keynes. Of late, I have started to doubt the basis of irrationality and if irrationality exists only with the benefit of hindsight?

US markets were accused of bubbling over innumerous times in the course of the post Lehman years but the critics have been proven wrong many times over and we only get a whimper from them these days as the S&P rose an average of 20% per annum over the past 6 years.

By comparison, the SHCOMP Index is only up over a 100% from its Jun 2013 lows and about 60% since 2009.

I think if we know that the Chinese stock market is retail driven and that if we think that Chinese retail investors are illogical, there is a high chance that we have missed out on the rally (because we are logical?).

The level of foreign participation in Chinese stocks is mostly limited to the dual listed mega companies and familiar brand names. Perhaps it is easier to be critical when there is no vested interest involved?

Why do retail investors have to trade in a set way? When profits are not guaranteed as well? When in Rome, do as the Romans do. And we will never be able to replicate what the Chinese investors do with their microblogs, informal news networks and channels of information that only the very local Chinese is able to access.

Our disbelief in the meteoric rise of A shares is only mirrored in the lackadaisical performance of our own stock market in Singapore and the US S&P’s sub par performance year to date.

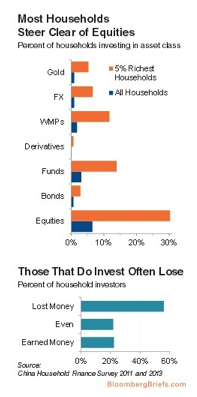

Whilst the traditional methods of equity analysis involves the dual aspects of future earnings potential and the risk free benchmark, we have to learn to factor in the element of irrationality and statistics show that Chinese retail investors have lost more than they made in the past, according to this very useful report on the equity bull run that was written in January this year.

Interestingly, the stock market has rallied further since the report and I certainly hope some of the retail investors managed to recoup their losses by now.

My view on Chinese stocks is one of respectful awe instead of puzzlement these days and I am reluctantly bearish on account of the media barrage I have been reading. Valuation models are important but so are sentiment gauges and guessing where investor mood is heading is the million dollar question.

If you ask me where China is heading now, I would probably say up more than I would dare say down. And I really do not need a doctorate to tell me that. And if anyone disagrees, I would challenge them to the monkey stock trading challenge!

“A blindfolded monkey throwing darts at a newspaper’s financial pages could select a portfolio that would do just as well as one carefully selected by experts.”