Going for Gold

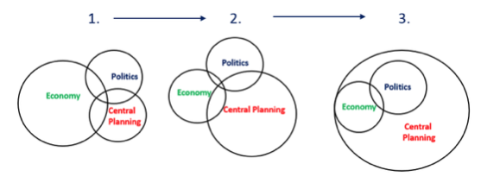

I would sound pretty irrelevant or even irreverent if I do not mention something about China or Greece today after the thrilling week we have gone through. The week’s events have us riveted to news streams that also beholds a déjà vu Wimbledon Men’s Singles Finals, where we shall see a re-match between the two tennis greats, Federer and Djokovic, with last year’s down-to-the-wire finals still fresh in our minds. My view on the situation in China cannot be more simplified than this chart that was illustrated by Rick Santelli on CNBC.

Yet, all will not be imploding anytime soon because China is still a shuttered market, and A-shares can possibly go on rallying another 200% from this point, divorced from reality, if you like, as they are already over a 100% higher-valued than their H-shares counterparts – what is another 200%? Especially with all the measures introduced which include allowing folks to pledge real estate to buy shares, and an embargo on selling by major stakeholders? The main risks would be from outside China, if you ask me, because the first aid measures will come at a price. The Chinese will be looking inwards for a while, which leaves dependent economies, including those in Europe and Americas, in the lurch. Europe is a different can of worms and can only be explained by one word – POLITICS!

If the allegations in Malaysia are any true, wouldn’t the Prime Minister be able to afford to single-handedly bail Greece out?

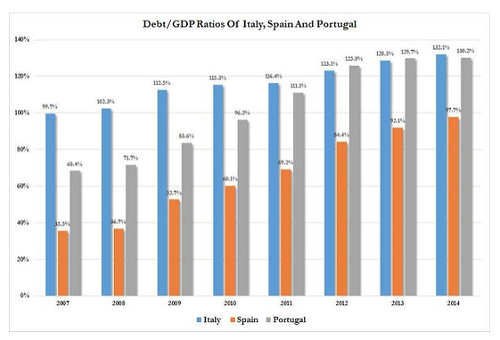

Germany is the big brother in Europe, and whilst Greece is still in the Euro, the Greeks can only turn to the EU Commission for help. They cannot take any external loans from China, Russia, Turkey or the US (and if the allegations in Malaysia are any true, wouldn’t the prime minister be able to afford to single-handedly bail Greece out ?). If Germany supports any debt relief or bailout, they would possibly confront this next chart of high risk and, thus, fragile governments in these three other European countries that are seeing a rise in the leftist movement.

With Germany the largest budgetary and trade surplus country of the bloc, what do you think?

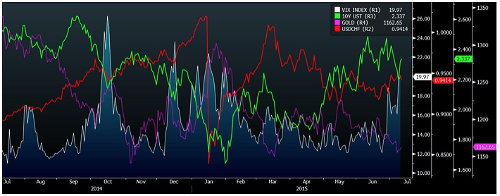

But let’s get to the main point I am making today. I noticed a glaring aberration in the activities of the week, one which cannot be ignored by portfolio managers – it is that all the traditional safe haven instruments have been shunned. US 10Y treasuries rose with the occasion, but its sell off couldn’t have been more abrupt, closing the week lower along with Gold and the Swiss Franc. Only the VIX index managed to pull off an amazing winner, up 7% on the week and up 25% from its low during the week.

And of course, we have Bitcoin, rising 8% on the week as some found it a means of circumventing the capital controls situation in Greece.

Gold

I find it quite uncomfortable to talk about Gold these days since the Swiss Referendum last year that rejected the higher percentage use of Gold as a currency reserve.

The educated folk disdain gold for the Keynes that they have read, that it is indeed a “barbarous relic” from the Middle Ages, for it does not really have any commercial or industrial value.

Investment legend Warren Buffet thinks its an unproductive asset although he invests in Silver. Ben Bernanke has also claimed before that he does not understand Gold which, to me, means he definitely does not understand diamonds too.

Why do central banks hate the idea of gold?

The world operates on a fiat currency system. Currencies that serve just a medium of exchange but not a store of value in itself. If you bring your note to the central bank, you will get blank look instead of being given its worth in gold, like in the old days.

Gold undermines the faith in money (legal tender) and is outside the control of central banks.

In this age of monetary meddling and widespread stimulus, Gold and Bitcoins, for that matter, can be said to be the bane of central bankers who would lose control of the money in the system, although I would think it hardly matters these days with the total amount of Gold in the world (including the half in jewellery) only worth USD6.4 trillion these days (some estimate it as high as US$ 9.6 trillion), less than half of US’s annual GDP of USD17.3 trillion.

And it defeats the purpose of deliberate currency weakening, to beggar thy neighbour in this age of currency wars. Central banks would prefer to weaken their currencies by holding another country’s in their reserves, beggaring no one by holding Gold.

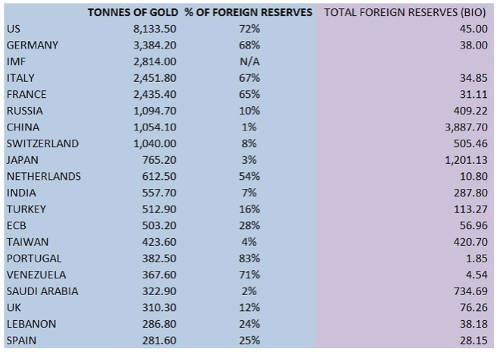

Gold Reserves as a percentage of Foreign Reserves

Some Facts

- Why Gold ? Thank the Bible, or perhaps go even further back to the Egyptians and their shiny gold coffins. They could have chosen anything else, really. Palladium, rare earths, Platinum? or any one ofthese. Reasons : “rarity, socioeconomic importance, non-reactivity and ability to withstand corrosive and oxidative forces”

- Gold can be recycled to be used and used again with annual production rates of approximately 2.5 tonnes, the world should deplete Gold supplies in about 10 years in the highly debatable topic of Peak Gold.Unless the Earth experiences another meteor strike because that is where most of the gold we have is assumed to have come from (because most of the Earth’s gold has sunk to the core).

- All the Gold in the world fits into a cube about 20 metres in length, smaller than a good class bungalow. And the total trade-able physical gold bars is estimated at US 1 trillion (note that China’s total foreign reserves stands at US$ 3.73 trillion).

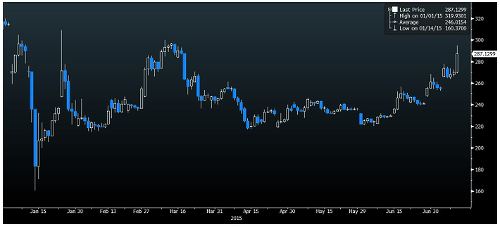

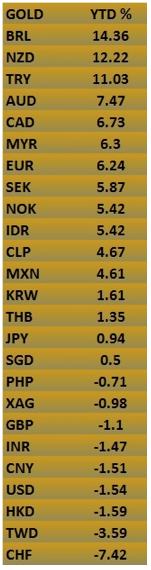

What got me interested in Gold recently has been the rhetoric of Jeff Gundlach, the new bond king of Wall Street. He has been quite bullish on Gold for a while, calling a price of US$ 1,400-1,500 by year end. It has not come close since he made that call in March and prices are lower than ever despite the heightened market volatility and the uncertainty that surely calls for some safe haven demand? If it has not happened, then what does Gold represent? An inflation hedge? Or perhaps, it is not that bad. Look at how Gold has performed against the rest of the world this year.

Between Asia accounting for 70% of world Gold demand, speculators loading up their shorts, central bankers disliking it, record breakingwithdrawals of Gold from the Shanghai Gold Exchange and the megaChinese Gold Investment Fund, I think we have come to a reckoning for Gold after this mad week.

Stocks may have their moment of euphoria, but a return to hard assets as store of value could keep Gold prices where they are and the Fed can talk about hiking all they want. I will be buying Gold on dips.