Want To Make Money? Try High Frequency Trading

Imagine you always have the winning hand, what a life that would be. A business where you never run a loss, or perhaps just one day of loss in 5 years?

I am describing the business of being Virtu Financial Inc, one of the world’s largest high frequency trading firms whose IPO last year was postponed to March this year because of the negative publicity stemming from Michael Lewis’s book, Flash Boys, about market rigging by high frequency traders that profit at the expense of other market participants.

We wrote about the “Terminator Future” earlier this year and how the world will, like it or not, be overwhelmed with drones and artificial intelligence/robots in the very near future.

Well, like it or not as well, traders are being replaced along with the waitresses, drivers and bank analysts but we are not here to discuss about that today.

You see, I am not over my ranting rampage that started last Monday night with the market flash crash and which I have written unbiasedly about.

While I berate myself most for my stupidity, it was more a case of wounded pride that I had lost out to a machine.

High Frequency And Algorithmic Trading

Let’s get the definition right.

Just as ETFs are part of the world of mutual funds, High Frequency Trading is part of the Algorithmic Trading world.

Algorithmic Trading by definition from wikipedia is also called algo trading and blackbox trading, encompasses trading systems that are heavily reliant on complex mathematical formulas and high-speed, computer programs to determine trading strategies. These strategies use electronic platforms to enter trading orders with an algorithm which executes pre-programmed trading instructions accounting for a variety of variables such as timing, price, and volume. Algorithmic trading is widely used by investment banks, pension funds, mutual funds, and other buy-side (investor-driven) institutional traders, to divide large trades into several smaller trades to manage market impact and risk.

And just to be clear, a high frequency trader is Not a person. Yes, humans work in the firm and human brains are behind the algorithms, but the high frequency trader that was selling the USDJPY last Monday was nothing more than a glorious computer program that is running on state of the art processors and those beautiful fibre optic data cables that make our lives on our iPads look pretty slow-mo because current programs are running on split nanosecond timings now (1 nanosecond = 1 billionth of a second).

Trivia: After nano comes picosecond = 1 trillionth of a second. But it does not really matter because even if the program reacts in 1 nanosecond, the order would still take time to travel to the trading server which makes those cables important (no Wifi please).

There is no proper definition of high-frequency trading (HFT) but Wikipedia has it as a type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. While there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, specialized order types, co-location, very short-term investment horizons, and high cancellation rates of orders.

Why Am I Not Surprised?

Why am I not surprised then that firms like VIRTU (VIRT US) made historic profits last Monday, 24 August 2015?

Historic profits amidst guaranteed daily profits would mean it was darn profitable.

For when VIRTU IPO-ed themselves this year back in March, the company had revealed they only made 1 day of losses ever in their 5 years of operations.

Their share price, at US$22.49, remains 18% higher than their IPO price of US$19, falling from their high of US$24.29 earlier this month because profits were less than estimated but, nonetheless, still (and always will be) profitable. That sure beats the S&P 600 year to date returns of -3.4%.

Mixed Feelings About HFTs

While regulators have successfully proved that high frequency trading caused the S&P flash crash of 2010, policy makers acknowledge that we need these firms more than ever to provide market liquidity that banks are less and less willing to commit to.

Singapore embarked on a campaign to lure more of such firms onshore earlier in 2014 until the Flash Boys exposé which stirred some debates and investigations into their practices.

And there more and more probes these days.

31 July 2015, FT: China targets high-frequency traders in ‘spoofing’ probe

17 July 2015, Reuters Exclusive: SEC targets 10 firms in high frequency trading probe – SEC document

Do The Cons Outweigh The Pros?

For the retail investor, HFT’s are more beneficial than detrimental, as a study shows that “the less high-frequency trading, the worse the small investors did.”

And they provide liquidity, defending us from the big bad hedge fund, banks, central banks and sovereign wealth fund bullies!

Bullies like Norges Bank which was seen complaining last year about the lack of liquidity.

It has become much more a market trading for trading’s sake”, the top trader at Norway’s sovereign wealth fund says. His disadvantage “comes when other traders spot a big investor coming and then push the price down or up, knowing the investor will have many more shares to buy or sell.”

Perhaps HFTs level the playing field for us? As they screw up everyone’s minds with their ability to cancel 25% of all buy orders for large stocks within 25 milliseconds.

Because we really cannot have a world controlled by hedge funds and sovereign wealth funds and major banks, trying to offload their trades to the nearest private bank sucker around.

Can HFTs Remain Flawlessly Profitable?

We note a long list of private HFT firms waiting for their chance to IPO – Jump Trading LLC, Hudson River Trading LLC, Quantlab Financial LLC, Tower Research LLC, and Global Trading Systems Inc.

Yet the success of the robot is dependent on the number of flawed human traders out there and perhaps, lesser robots.

It really depends on how good your algorithm is and we know that at Goldman Sachs, the number of high level programmer/banker roles has risen 43% since 2009.

For the retail man on the street, the WSJ reports that building computer trading models has become the latest DIY craze.

I would caution that the computer model is half of it, the other half is about that fibre optic if you really want a shot at the free profits of HFT trading, although in the larger scheme of things, it would also depend on whether you are going for the speed trade or the smart trade, just do not end up being the free-lunch of a mission-impossible-stop-loss trading algorithm.

And All I Know Is….

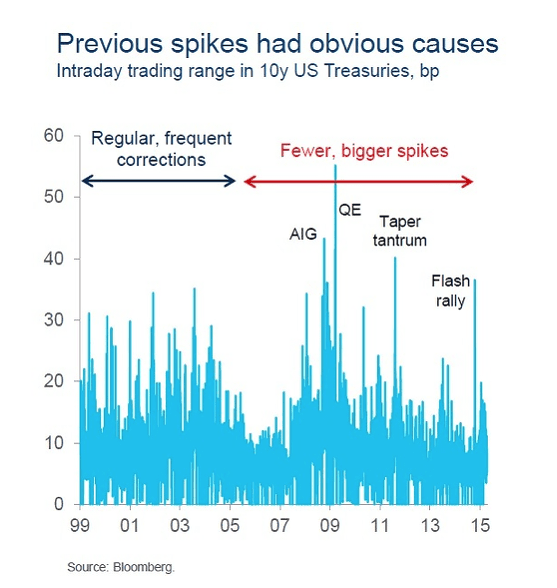

Algos are here to stay and that includes the HFT model, and I slap myself again for writing about the Minsky Moment last month because it looks like we shall have plenty more of them like that 6 year candlestick in the USDJPY and for the 10Y US treasury in the Citibank illustration below.

It is like Asimov foretold back in 1964, prescient to a flaw, that “Not all the world’s population will enjoy the gadgetry world of the future to the full. A larger portion than today will be deprived and although they may be better off, materially, than today, they will be further behind.”