Contemplating Bonds Ahead of The First Hike

When it began in 2008, all the world knew was billions and the Lehman Brothers bankruptcy was the largest the world ever knew at US$613 billion in liabilities which was only preceded by a previous high of Refco Inc in 2005 at a paltry US$74 billion unless we consider Worldcom Inc back in 2002 with US$103 billion in assets and just US$43.83 billion in liabilities.

We have come to 2015 where trillion is the new billion and the quadrillion beckons, particularly if we are talking in Japanese yen terms. Quantitative easing is the norm for the rich developed world and with the developing markets currently caught in economic quagmires that cannot be said to be of entirely of their own doing when half of their problems revolves around the US dollar’s effect on their currencies and commodity prices which is out of their control even if they are guilty of insufficient reforms, corruption, political woes due to corruption and social woes due to income inequality, crime and let’s not get started.

Well, I do not have the mental energy to write about emerging markets on this hazy day because someone will probably write a book about it after this unprecedented episode of economic history we are living through. Thus there is no better time to bring up the big question mark on the Federal Open Market Committee meeting this Wednesday with a decision expected at 2 am Thursday morning, Singapore time.

FOMC

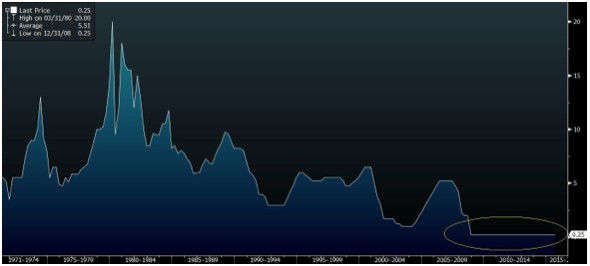

We have lived through the longest period in history of rate inaction by the Federal Reserve and we have come to the D day, the first hike.

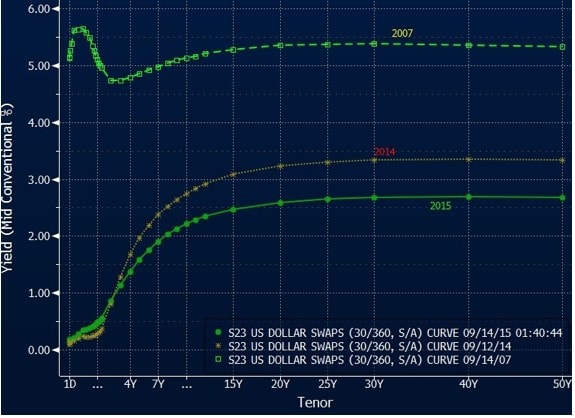

Is it such a big deal? A 0.25% hike? Because 50 year interest rates are still well under 3% as we speak after touching a historic low of 2.15% earlier this year and interest rates in the US are still well below 2014 levels, except for the 6 month– 2 year tenor. I attach a graph for perspective, comparison and contemplation.

Contemplation is something markets have not been doing much of and the panic in currencies and bonds that is being blamed on the FED this week is rather unfair or rather, just an excuse to ramp up volatility for the hapless investors.

30 Year Bull Run For Bond Markets

Ben Bernanke, the former governor of the FED who orchestrated the QE programs and now an advisor to hedge funds and mutual funds, has said in his first blog post that he would not expect higher rates in his lifetime. He is 61.

By that, he probably means that rates would never go back to pre-Lehman levels and he is probably right for we have sat through a 30 year bull run in bond yields.

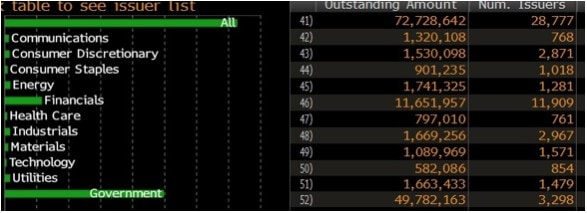

Contemplating this graph, I think my instinct would tell me that it is not going to get much better which means that profits are going to be hard to find in the US$72.73 trillion global bond market, of which US$49.78 trillion comprises of government bonds with half of that coming from America.

Central Banks And QE Programs

Let’s see how much bonds the central banks are holding and I conveniently exclude the Bank of England because billion is a small number.

Federal Reserve – US$4.48 trillion

Bank of Japan – US$ 3.01 trillion

European Central Bank – US$ 2.92 trillion

People’s Bank of China – US$ 5.23 trillion (4.3 trillion in foreign assets)

A 0.25% move in rates will be quite devastating on bond prices indeed especially when the Fed’s balance sheet has risen from US$ 700 billion end 2008 to its current US$ 4.5 trillion today.

Yet, all that has been priced in with most bond holders seeing a loss on their holdings for the year to date as I pointed out a fortnight ago that we can now find over 5,000 hard currency benchmark bonds yielding over 6% when there were only 1,000 just a few months back.

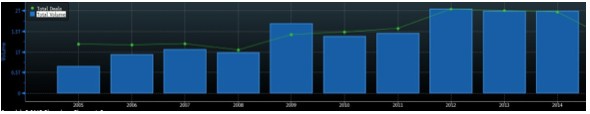

For you see, the rapid rise in monetisation (because when central banks buy bonds from the market, they are releasing cash into the system), has led to an explosion in corporate bond issuance globally with issuance more than doubling since 2008.

Looking Ahead

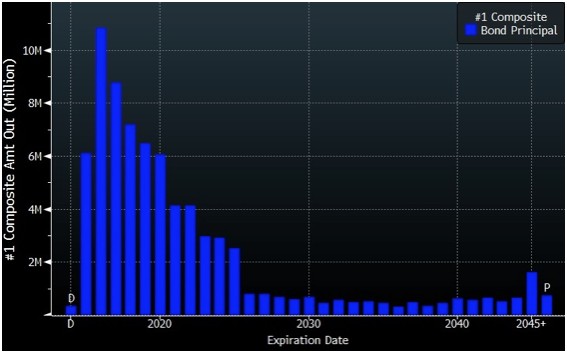

- The recent turmoil in the markets has led to a huge backlog of new deals, waiting to be priced with issuance falling nearly 20% in the past month which is not an encouraging trend because 2016 is looking to be a heavy year for maturing papers at US$ 10 trillion, including governments and we have another US$ 6 trillion or so left for 2015.

- It does not help that the USD’s strength is making it expensive for companies to raise USD funds to repay their debt, the same USD funds that was cheap to borrow just a few years back. And it does not help that companies cannot raise money in any other currency (except maybe the EUR) because there is insufficient demand.

- My personal gauge for the health of the bond markets is the S&P Buyback Index which is coming off its historic highs which coincided with peak bond issuance earlier this year with the ECB’s €1.1 trillion Q€ program and negative yields in Europe (which are still negative in certain places).

- Liquidity has been an issue for the markets for over a year now as banks hold back from making markets and holding excessive inventory of anything but the safest bonds. It cannot be more evident than the fact that the FED has noticed it and has scheduled a conference at the New York Federal Reserve on bond market liquidity on Oct. 21 and Oct. 22”.

- This has left investors as the only buyers, investors such as sovereign wealth funds, hedge funds, mutual funds and individuals who are being nurtured and encouraged to partake in bond investment as desperate banks seek new sources of demand to digest the debt pile.

The Final Contemplation

Bonds make the world go round but will not make you rich especially if the markets remain in their crippled state and issuance continues to trickle in the face of the mounting maturities ahead.

The FOMC rate hike suddenly fades in importance because 0.25% does not count for much in the grand scheme of things and another 0.5% will not hurt as much as the 2-5% drop in prices of high yield papers when things go pear shaped.

If anything, Singaporean investors would be best prepared for the higher interest rates given that the country is the first developed nation to buck the trend with interest rates rising to their 6 year highs (and still rising) but it does not look like we shall see 2008 levels again because Bernanke speaks for us as well. And that would be a long story for another day.

For the rest of the world, it is just nearly impossible to wake the mind from that 6 year hiatus of QE and zero rates to contemplate and comprehend anything but panic into the FOMC and the feeling of blessed relief that will dawn after.