Are We Done With Demonising China?

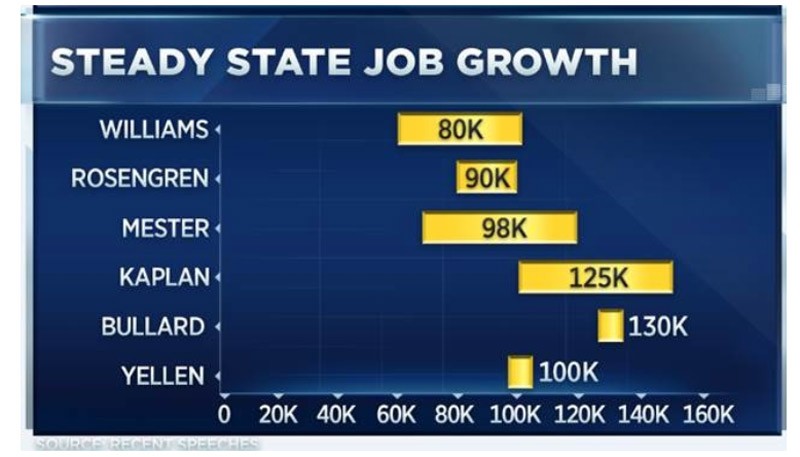

My 2 cents worth on the US Non Farm Payrolls last Friday that has been nothing short of a tragedy as the press would have it, getting every single closet-Chicken Little out in force, remonstrating that the sky is indeed falling when the main question we should be asking ourselves is how were those expectations for 200-300k jobs per month derived and expectations, being expectations, would surely always trend to an “expected expectation” (that is higher than the Fed’s)?

The next rhetorical question is, will there ever be a perfectly star-aligned situation for a rate hike ever?

The rate hike, or lack of, delayed hike or thereafter hike makes the very heart of financial markets all around the world dependent on the fate of the mighty US labour force for economic optimism?

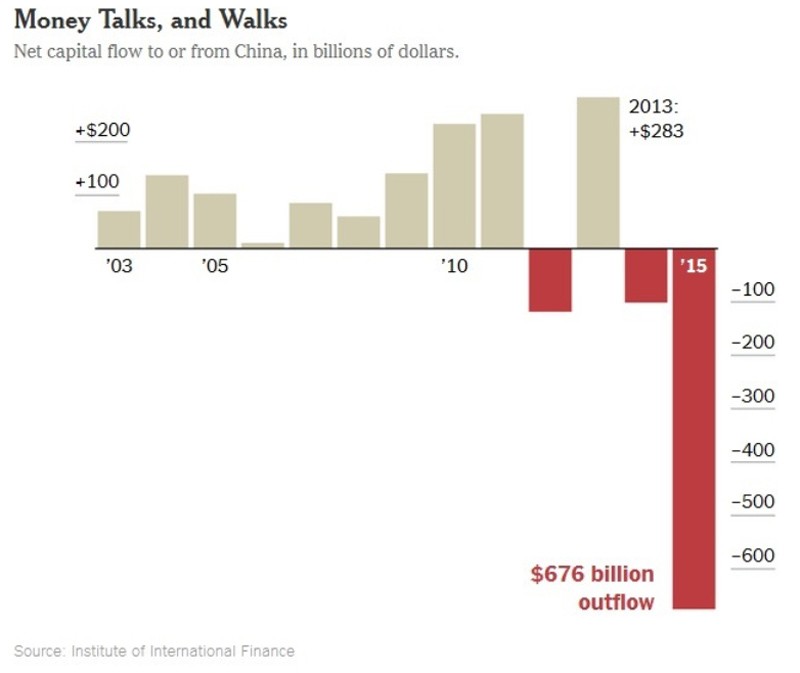

Enough said, as meanwhile the press continues to demonise China, going on about how China is getting it wrong, with Goldman Sachs the latest to proclaim that China is risking further capital outflows and a repeat of Jan’s Chinese yuan rout (when the CNY weakened to a 5 year low against the USD), the NY Times talking about China falling off the miracle path, and possibly 90% of Bloomberg users, including yours truly, who would swear on the debt bubble in China.

It is not probably not easy for anyone outside China to say anything positive about China without a disclaimer or two, one year after the stock market fiasco which left many an investor singed in some way or other.

Yet we cannot help but grudgingly admit to China’s right as a global superpower, something the current IISS 15th Asia Security Summit in Singapore is all about – China’s “unreasonable-to-the-rest-of-the-world-except-themselves” assertions of their rights in the South China Sea (and that silly atoll that before the 1990’s had always been undoubtedly Chinese, according to some historians)—resulting in the little countries rushing for an US alliance which ultimately just divides the world into the big, powerful nations and their vassal states?

As a superpower, and to the little person, China has every right to prosper like the rest of the developed world. It is an inevitable outcome even if they fabricate 488 million social media comments a year, arrests thousands of activists, CEOs’, and just about any enemy of the state, fake everything from condoms to food to their pollution indices, because it is unimaginable that any country would dare try to walk on the wrong side of them.

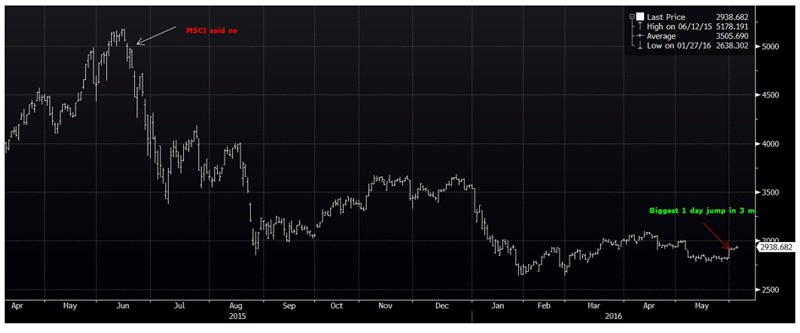

A year after their stock market meltdown that left 71% of the market frozen in July, 84 companies remain suspended since we last checked in Nov 2015 (116 stocks suspended) out of 1142 stocks (1114 stocks + 28 IPOs) in the Shanghai Composite Index. Last year, the MSCI wisely decided against the Chinese inclusion which a few have speculated was one of the causes of the market run-up and collapse.

The hopes are building up again this year with Goldman Sachs most optimistic at 70% (clearly the equity team and economics team do not talk to each other).

Graph of the Shanghai Composite Index

China’s financial markets have plodded on since and we have seen much in the way of reforms that we really cannot keep up with, in terms of foreign exchange (with a new trade weighted basket) and opening up their onshore bond markets after the launch of the HK-Shanghai stock connect last year.

The 13th Plenary Plan set out in November last year saw a less growth based strategy that is now India’s problem after adjusting their GDP calculation model, India now holds the title for highest GDP growth (7.9%) in the world after Ireland (9.2%).

China has chosen to focus on 1. Innovation, 2. Balancing, 3. Greening, 4. Opening Up and 5. Sharing, and of course, the 2 child policy. Less of the pretty unreasonable annual minimum 6% GDP expectations after delivering for over 20 years since record keeping began.

Graph of China’s GDP Growth

And we cannot blame them for being less worried than the journalists because China will single-handedly account for 28% of global urban consumption growth from 2015-2030, according to the McKinsey’s April 2016 report titled Urban World: The Global Consumers To Watch, from roughly 700 large cities in China, most of which we have not heard of, with per capita consumption of the 15-59 year old Chinese expected to double by 2030, spending 12 cents of every global dollar.

It is thus alright for India to build more toilets as it is estimated that India would need to build 1 toilet every 2 seconds to achieve Prime Minister Modi’s target set in 2014, that would add to GDP as they continue to advance their infrastructure and economy. China can sit back and take second place as they go about giving us no choice but to take them seriously this year.

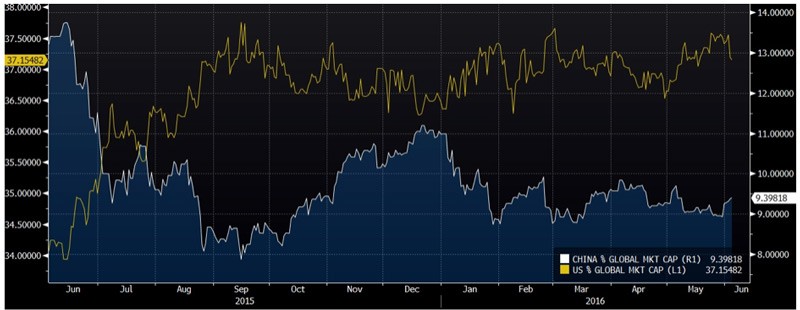

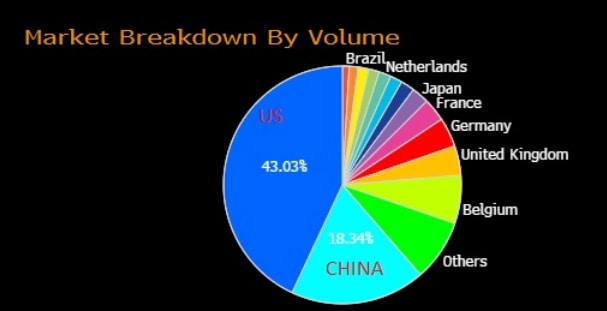

China holds the second highest percentage of global market capitalization.

China ranks as the second largest M&A player as acquirers in the world at $ 340 bio year to date versus US’s $ 708 bio so far. Thus perhaps justifying that capital outflow graph above.

With $363 bio worth IPO’s in the last 12 months, China is top in the world as US companies continue on their share buybacks.

Second largest market share by issuers for corporate bonds issued in 2016.

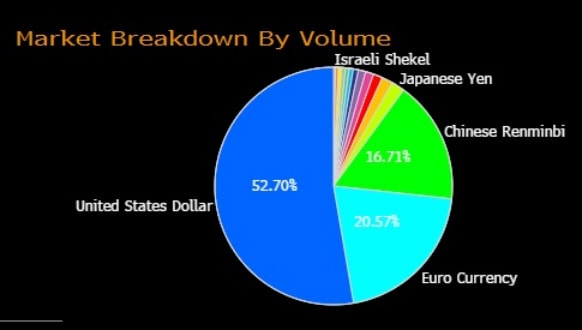

Third largest market share by currency for corporate bonds issued in 2016 as onshore bond issuance grows 42% with local Chinese companies shunning foreign sources of funds after 71 downgrades by S&P and 150 by Moody’s rating agencies for 2016.

We can continue to demonise China as we wrote about the “monkey-style” punting of their stock market last year, all to way to their latest commodity speculation scandal that led to a clampdown, and the latest ugly tourist we read about in the news is almost always a Chinese.

The strategy is not to be too smart or, worse still, try to be an expert. And the biggest no-no is to write them off because even the MSCI cannot do that on the 14th of June or anytime thereafter.