Singapore Real Estate 2016: A Landlord’s Insights

Back in 2013, friends and I arrived at the conclusion that the anchor of Singapore’s wealth lay in the thousands per square foot of Raffles Place which is something that will not go away, although we called for the peak back then when we wrote about the $2 million sweet spot in Singapore property prices. 2 million is the furthest we can push median prices to with per capita GDP already one of the highest in the world at USD 60k which we imagined would allow a comfortable 24 year mortgage for a dual income household on a 2 million dollar property assuming average loan rates of 3%.

To back our claim, my dear friend noted last year in her post, The Widow Maker in Real Estate, that with 47% of their wealth tied up in real estate, Singapore registered the slowest millionaire growth in 3 years when the rest of the developed world is seeing some double digit growth.

The planets were in perfect alignment in our fateful re-encounter with our landlord friend whom we wrote about a year ago, with all the elements of good fortune in good whisky at a Pokestop that was next to a Pokegym as we took a peek into what he felt the future beheld as far as landlords were concerned and we were pleasantly surprised to find that glimmer of optimism in the wisdom that only a long term investor could possess, stemming from multi-generational experience that would make this week’s post a refreshing read as opposed to the plethora of negative headlines out there.

Confronting the S&P Rating Agency

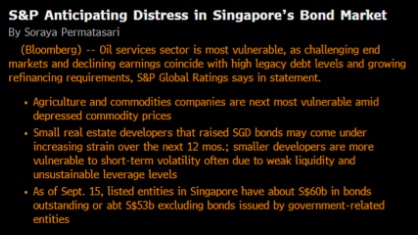

We have to confront that S&P luncheon last Friday where participants took away the knowledge that about half of our 25 property developers will face refinancing issues in the near future.

Reply: The S&P does not cover Singapore real estate developers in depth, given that none of them are rated, at the very least. The credit rating model (as opposed to equity analysis) only focuses on the cashflow and not the asset value.

How many real estate companies failed back in 1997 and 2008? Zero!

The Real Estate Bedrock of Singapore

View: The oil and gas industry’s troubles cannot be extrapolated to real estate space. Listed O&G companies in Singapore are mostly in the services sector compared to the stone and mortar business of real estate.

Artificial impositions of controls in the form of ABSD and TDSR etc., has led us to this juncture.

The relaxation of the TDSR ruling for owner-occupied property is a sign of relent even if it has been denied because we have obvious loopholes now available for home owners to benefit even if they just lived in the property for a month just to secure their financing.

It is a prognosticator that the worst is over for Singapore real estate and that there is little reason to panic going ahead other than the potential for a freak event such as a population exodus.

It was not too long ago that banks boasted substantial real estate arms that were subsequently divested and yet real estate loans are the biggest components of banks’ loan books (roughly 50%), with their exposure to building/construction and housing loans.

The New Economy: SG 51

The new economy takes time to transition thus construction cannot be displaced immediately although returns are likely to remain subdued and poor going forward.

The long term view has not changed from the last time we spoke to him nearly 16 months ago where “he does not think that prices will return to their glory days even if the duties are removed”, giving 2 reasons of interest rates and revenue to rental.

The Alternative Investments

Why would he own bulky real estate that will be delivering poor returns when you can buy the stocks and bonds ? Or private loan deals that pay 8% for 3 years on a 50% LTV covenant on 60 million worth of prime Orchard real estate?

He has been actively sourcing out company bonds of real estate companies he is familiar with and he likes some cheap S-Reits because of their LTV caps (45%) and the potential for directors to be prosecuted (and jailed) if they break that rule!

Some Memorable Comments (not to be construed as investment recommendations)

1. Look at the DNA of the principal of the company! Would you invest in a company whose main shareholder’s mettle is untested ? Or a company that had suffered a near death experience in say 1997, like Wingtai whose convertible bonds yielded 40% at one point?

2. Some billion dollar companies like Oxley, for instance, did not exist before 2010!

3. Companies whose principals have been around and established and diversified their fortunes outside the companies like the Tuan Sing’s, Aspial’s, Wheelock’s, Guoco’s and more, are likely to outlast the companies where the main shareholder’s entire wealth is vested in company shares.

4. Fast growth companies are better as equity partners than bond investments although it is not to be applied outside real estate space.

5. Cashflow matters. He highlighted Perennial as a random example which has mostly underperforming assets, earnings buoyed by “abnormal” gains in the past 2 years and living off the reputations of its chairman (Kuok) and the Wilmar connection even as they antagonise over a lawsuit with yet another tycoon (Pontiac) over Capitol building.

6. Low price to book and regular dividends matter more.

The Game Is Not Over

Easy for him to say, being an expert. For the rest of the real world, secular stagnation will remain at play even as he informs me of the encouraging signs that showrooms are filling up again. He will be looking to buy opportunistically for the long term but there is nothing much interesting out there.

The game is not over for capital. Just look for some parking spaces for the next few years.