The Uncertain Days Ahead and Gold

Some days you will wake up in the morning and feel like you have not a single care in the world and nothing you can possibly do about anyway in our global problems; with nothing on the agenda, unhurried and calm; feeling healthy enough with little signs of hangover under perfect weather with a perfect breeze and, to top it off, to find a Snorlax pokemon lurking right outside your house.

Wake Me Up When September Ends

Then the mind has to get to work and we have to write about the coming storm in October after a slightly less than perfect US Non Farm payroll number on Friday and a slightly less than perfect unemployment rate of 5%.

For it will be a mad month indeed as we head into the US Presidentials which will happen 5 days after the next FOMC where there is a 17% chance of a rate hike.

With Deutsche Bank hopefully blowing over soon and Wells Fargo well punished, we have the US money market reforms that will hit on the 14th of October which should not be too big a problem, hopefully again, given total assets have fallen to just USD 500 bio with a record outflow of $ 110 bio on the week ended Oct 6.

The main problem left would be the long term one, on the corporates and banks who have so over-relied on issuing short dated debt (commercial papers/certificates of deposit) in the past, pushing Libor rates higher until we come up with a new product such as AAA money market products out of Singapore and Australia, hedged into USD?

And the impossibility of a Donald Trump presidency is looking still faintly possible as domestic and political tensions dominate much of the world, the IMF now recognizing “political discord as major risk to weak global recovery”. And global thinkers seeing A World Besieged as “global order’s fracture points continue to deepen”.

There cannot be really more uncertainty or lack of trust left that can surprise us anymore even with a Trump Whitehouse and to me, the US Presidentials is more about the US Vice Presidentials because if you ask me, both candidates are just as unlikely to last 4 years after elections either on impeachment, lack of confidence or health issues.

Considering the Italian constitution referendum less than a month after the US Presidentials and the official Brexit in March next year, we will be in for a rocky time whilst aware of the developments in the region – the South China Sea, India-Paksitan, North Korea, Philippines and perhaps in Malaysia some time sooner, if the rumoured elections transpire.

The Skirts are Shorter This Fall

In case no one has noticed the week that just passed us has showed the most volatility in a long time with some crazy moves in the GBPUSD (down 4.15%) where sources cannot agree on what was the overnight low on Thursday, whether it was 1.14, as Reuters has, or 1.18, as Bloomberg has, and the sterling pound has fallen to levels not seen in 30 years. US treasury yields saw their biggest 1 week drop since July as gold prices fell the most weekly in 2 years by over 4%, only under-staged by Silver which fell over 8%.

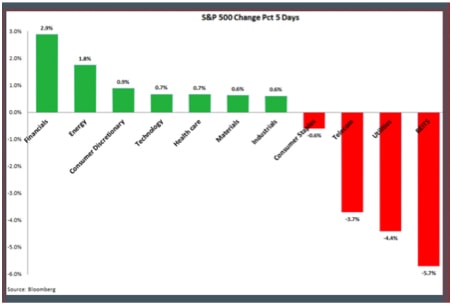

Yet the saving grace is in the equity markets which have proven resilient, because of the hemline index perhaps? That hemlines rise with stock prices? And skirts are short this fall, thus we have stocks holding stable across the globe on the week until you see the undercurrents.

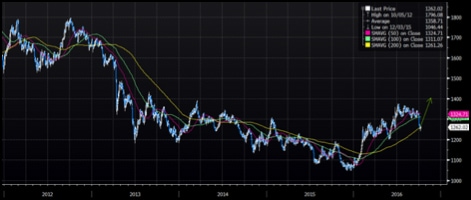

Graph taken from Otterwood Capital Management.

We are living in untried times because global politics has not been considered much by the global markets since the end of the Cold War and we only had the occasion isolated cases of the occasion coup and the short wars and skirmishes, the latest in Syria and Ukraine. This has led to investment complacency for most, expecting central bankers to come to the rescue which has led to painful lessons for Singapore corporate bond investors recently.

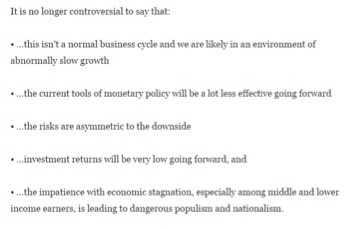

Ray Dalio, of largest hedge fund Bridgewater Associates, best summarises how troubled are these times in his speech delivered last week at the 40th Annual Central Banking Seminar with Fed presidents in attendance.

Missing out little since I advocated the Asset Light Model into the US Presidentials 2 months back and cashing out on the Jaws of Death in rates and stocks, has given me some profits and clarity of thought.

The upside has little legs even though the skirts are shorter and Deutsche may indeed scrap through in the weeks ahead for its DBS of Germany status.

The certainty is in the uncertainty and we have the American Association of Individual Investors Bullish vs Bearish sentiments Index converging with each other (which means a majority of Neutral).

Perhaps Ray Dalio will be right, that there is no upside to bonds left.

“Rarely do we investors get a market that we know is over-valued and that approaches such clearly defined limits as the bond market now. That is because there is a limit as to how negative bond yields can go. Their expected returns relative to their risks are especially bad… At the same time, as bonds become a very bad deal and central banks try to push more money into the market and yields go even lower and price risks increase further, savers might decide to go elsewhere…Right now, a number of the riskier assets look attractive in relationship to bonds and cash, but not cheap in relationship to their risks. If this continues, holding non-financial storeholds of wealth like gold could become more attractive than holding long duration fiat currency flows with negative yields (which is what bonds are), especially if currency volatility picks up.”

Because the IMF has just global growth forecasts again which means everything the central banks have done is not enough! Temporarily because the theme for 2017 would swing back to fiscal policies and like Citi expects, regardless of who wins the US Presidentials, the defence and infrastructure sectors are expected to benefit from increased spending (US is building 3 new ones capable of launching F35’s, China ,2 or 3, UK, 2 etc.).

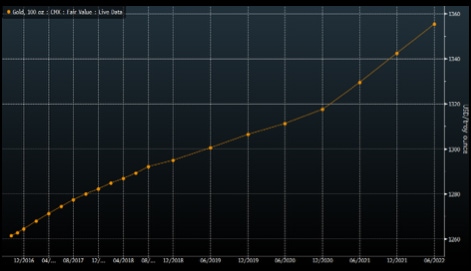

I, for one, have lost faith and prefer to take the Singapore stance of acknowledging that we will be stuck in a rut for a while but within this uncertainty, it is better to over allocate to a neutral currency which can only be Gold or poor-man’s Gold which is Silver.

For yes, currencies will be volatile going ahead and the Gold price crash has been moderated by nearly 12 ton inflow into the GLD ETF over 2 days, a highest level since August this year instead of the liquidation we would expect from such a downward move and Citibank has claimed a correlation in US gold bar and coin sales and Donald Trump’s success in the Republican primary. Common wisdom?

But we really cannot be short sighted to think it would end after the US Presidentials because we have Italy and Brexit, at least to look forward to and the Gold curve is pricing all that in.

We have to wake up to the new reality – that it will never be the same again, as the FT puts, “Even if Mr Trump loses in November, a virulent new kind of politics is here to stay”, as we are seeing with Duterte in Philippines…

We cannot put off the future as the Chinese renminbi becomes a new global reserve currency, majority of world trade still transacts in USD and we can expect hedges to start especially with emerging markets looking more and more “iffy” with the S&P proclaiming that “Emerging market sovereign face rising risks to their credit quality despite still strong foreign investments.”

Central banks and banks are under pressure from rising loss of credibility, from the Bank of Japan to darling Wells Fargo’s scandalous behaviour. It is even joked (seriously) that Donald Trump would let the US default if he had to.

Gold/USD, at its 200 day moving average support? 1,400 is not impossible.