Deep Market Thoughts: Post Traumatic Stress Disorder and 64 Million Unhappy Americans on Black Friday

We have had press overdose which we cannot really blame them for, watching in incredulity as each moment unfolds daily as the new US Presidency takes shape, loss for words and not knowing whether to laugh or cry when we read, with a pinch of salt (after reading about fake news), of the list of branded anti-Semites, anti-Islamists, misogynists, racists and maybe even his own son-in-law into his cabinet. As I had predicted, now the rhetoric is swinging to the rise of a European Trump and the break-up of the EU.

I sit back after all this when a dear friend asked me when the press is going to talk about the toupee? And her earnestness on the topic of the toupee got me thinking how this could start a new trend of “coming out” with the toupee and the toupee renaissance! Just Google “toupee images” and Trump occupies top hits which is no wonder he is a winner.

The fact he always wins is consoling enough for the US stock markets to rally to record highs with the Nasdaq finally making its move on Friday after folks decided that Trump won’t be bad for tech given he also tops the polls for millionaires with the most bankruptcies on Investopedia at 4 (although the number has been disputed at 6 because 3 were from the same company), which is good news for the tech companies thinking of bankruptcy the very artistic Trump-way, and retain their millions.

So Facebook and Google are going after the fake news which does not bother me as much as the newspapers going broke and resorting to sensational headlines to continue to engage the increasingly disengaged reader in a world where 88% of Millennials consider Facebook as a news source and Facebook is making “fake news” writers a cool $10k a month.

No Merry Xmas or Thanks Giving

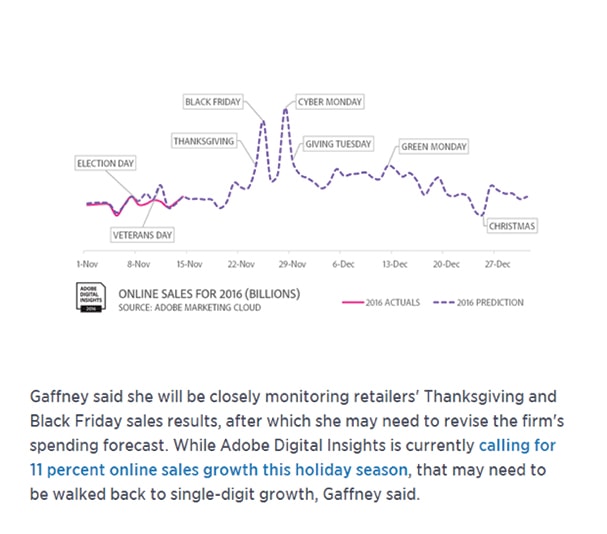

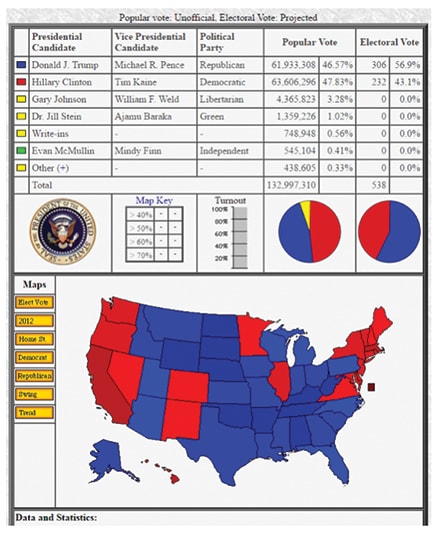

Of course we are not here to talk about Trump’s hair or fake news today but rather the fact that majority of America is sad after the triumphant elections (because Hillary did win the popular vote) and we can expect post-election blues to cut right into holiday spending as reported by “non-poll” sources, which should be considered reliable.

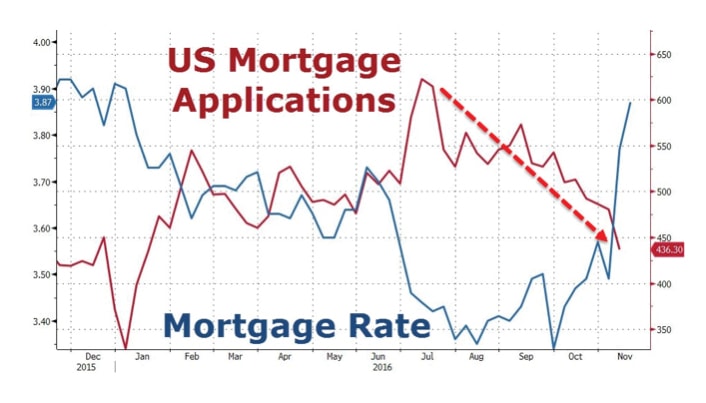

With Black Friday coming up on the 25th of November, it will be a litmus test indeed for the general mood of the population and their personal economic outlook which is hard to imagine to be rosy at this point if anyone has checked mortgage rates in the past week.

Source: Zerohedge

Real Estate and Interest Rates and Inflation and Migration

It is reality (not a poll) that loan applications have collapsed and the Purchase Index has dropped drastically as bonds suffered their worst fortnightly loss in a quarter century, driving mortgage rates higher which does not bode well for buying or any intentions of as latest data (not poll) shows “The refinance index sank 11% to its lowest level in 8 months, while the purchase index dropped 6% to its lowest level since January.”

Higher interest rates = higher mortgage rates which should translate to higher rentals = inflation. If that does not happen, then property returns will fall which will translate to lower prices.

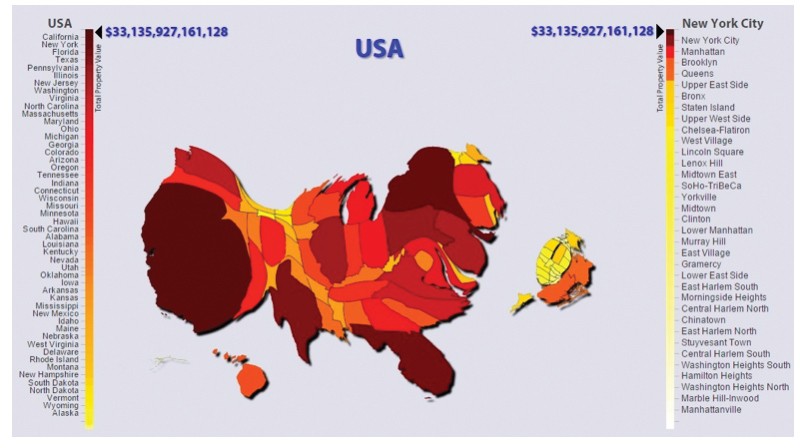

Which US cities hit hardest? Hillary Clinton’s states—the ones where America’s property values are concentrated, starting with New York City where 5% of the nation’s property value is concentrated and rebel-state California.

Higher rentals = sticky demand, where renters have no choice which is unlikely today when NYC is facing a glut of upscale apartments and falling rents as WSJ reports that “At Trump Tower, the Fifth Avenue home of President-elect Donald Trump, a two-bedroom apartment on the 45th floor with park views was leased with an asking price of $25,000 a month in 2013. In August, it was listed for $20,000; in October, the price was cut to $18,000.”

Demand is definitely unlikely to pick up anytime soon with President-elect Trump’s purported stance on immigration and his pretty far-right team so far that is scaring all foreigners, from international students to tech workers away as Canadian universities see a surge in foreign applications (including US students) in the past week.

With tech workers leaving, perhaps San Francisco real estate will finally get that breather and we will not read anymore about the housing crunch that is driving, no pun intended, Tesla owners to the trailer parks.

The Next 4 Years

It does not look like the foreign students will be rushing back to the US with pent up emotions coming to the fore for some Americans as we read in real news channels “White Nationalists Celebrate “an Awakening” after Donald Trump’s Victory” and Muslim immigrants speak of their worries and the child immigrants of their fears.

It really does not look too bad at all for the country except that we can be sure that Trump is most unlikely to change economic theories and that we are in the 7th year of an unnaturally long economic cycle (against a 80 year average of 5 years), which is why we have Goldman Sachs raising the risk of a 2017 US recession at 20% and Fed’s Kashkari predicting a 67% chance of another financial crisis.

Working against Trump would be Reaganomics that many are expecting except that no one is reading or thinking about right now and the uphill task of reasoning with logic that Bloomberg has summarised for us below.

- Reagan had to deal with stagflation – the nasty combination of high inflation and high unemployment that plagued much of the 1970s.

- Trump will have to wrestle with a U.S. economy that has failed to keep pace with its long-term growth rate since the 2008 financial crisis.

- Trump, like Reagan, hopes to kick-start the U.S. economy through a combination of aggressive tax cuts, regulatory relief, and an increase in military spending (and, in Trump’s case, an increase in infrastructure spending as well).

- Reagan took office when U.S. asset prices were at extreme lows, whereas Trump will take office when asset prices are at extreme highs.

- S. stocks were at historic lows when Reagan took office – When Reagan took office in January 1981, the CAPE ratio was 9.3. Today the CAPE ratio is 26.6.

- S. interest rates were at historic highs when Reagan took office – the 10Y yield was 12.6%. It’s now 2.1%.

- Equity real estate investment trusts yields 7.9% when Reagan took office. Today that yield is 4%.

In short, let’s be realistic. It is going to take a miracle to achieve prosperity for an America that will be closing its doors to the world.

The Markets Now

Beaten to submission by the Trump Wall Streeter Wolf Richter says, “The markets now have a new interpretation: Every time a talking head affiliated with the future Trump administration says anything about policies — deficit-funded stimulus spending for infrastructure and defense, trade restrictions, new tariffs, walls and fences, keeping manufacturing in the US, tax cuts, and what not — the markets hear “inflation.””

Therein lies the irony as Bloomberg points out.

“Higher growth will almost certainly be accompanied by rising interest rates, and rising rates are kryptonite for nearly every conceivable investment.

Rising interest rates mean lower bond prices, for starters. They mean higher discount rates for cash flows, which may translate into lower stock prices. They mean higher mortgage rates, which may translate into lower home prices. And don’t forget about investments that rely heavily on leverage, such as private equity. Higher borrowing costs mean lower returns there too.”

Where is Trump on all this?

He does not have a whole lot of academics on his side albeit his strong team of hedge funders, former Wall Street-ers and the fallen generals.

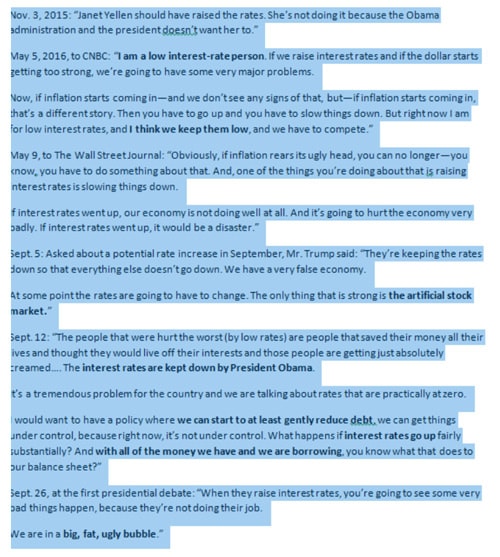

WSJ summarised all his comments which appear to whipsaw over the months.

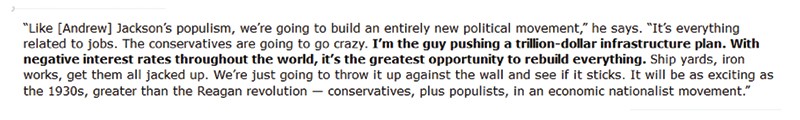

And his chief strategist, Steve Bannon, who has been accused of a lot of unsavoury traits, made a notable comment that was picked up by Zerohedge, amidst his comments on Darth Vader and more.

A little presumptuous to expect they will manage to fund a trillion in spending because negative interest rates are so passé at the moment, as we have Japanese 10Y bonds trading above zero now even as we are unsure if the Trump camp would like rates higher or lower or if they plain do not know where current yields are at the moment and the losses sitting in portfolios which equates to loss of wealth and real estate blues.

While we are unsure of everything before Trump takes office in 2 months time, it is hard to jump the gun to say that everything will work out to plan.

Yet we can be sure that folks would be spending something on Cyber Monday to follow as friends inform me that their iPhones have burnt out after too much Pokemon and perhaps take out some paid subscription with the WSJ, FT or NYTimes for the real news?

Snapping Out of PTSD and My Thoughts

I shall take the liberty of making a call and the inevitability of an early recession inflicted from all this because that infrastructure spending will take a long time to get off the table and not before some trade wars (or trade retaliations) potentially erupt, hurting exporters and perhaps sparking an EM crisis again. While most of us can be secretly pleased with the Trump win vindicating our personal frustrations with the current state of affairs and the ridiculous negative rate environment that was a dampener for inflation expectations and a vicious cycle in perpetuating the inane and ineffective QE programs.

Building bridges and fixing roads will not improve the rental situation in NYC, especially when those foreign students will be going to Canada. The global perception of America has changed for the worse and I see the USD strength as an anomaly to be sold into given that over time, the need for USD will diminish after the short squeeze on USD-reliant economies. The uncertainty of the trade situation and the rising presence of a stable China will probably see America shut out from the rest of the world because global leaders would be wary of US overtures after getting a good glimpse into the true natures of members of Trump’s cabinet (with the exception of Anglo Saxon all-white countries which hardly exist anymore).

Political chess masters like China who has fixed the CNY at a 8 year low against the USD is playing the Trump card well, pitting one 4-times-bankrupt Trump saying “if we raise interest rates and if the dollar starts getting too strong, we’re going to have some very major problems” against Trump economic advisor Malpass hoping the USD to be “the world’s most trustworthy currency”.

Interest Rates?

I am sure that markets are overdone or rather, outdone itself in anticipating a happy ending before Trump even started and it is not just me saying that, as investors overcome their PSTD ( Post Trauma Stress Disorder) on the election results and get thinking again.

We have 63.6 million unhappy Americans in the richest cities of America who will not have too much reason to cheer this Thanksgiving versus the 61.9 mio optimistic, albeit nationalistic, folks. Migration will be changing course and that could spill into investment flows. (Now that VP-elect Pence has not dismissed the idea of waterboarding for terror suspects, anyone who is unfortunate to have a beard and, or, turban better pray they don’t get mistaken for a “suspect”.)

Source: 2016 Presidential General Elections Results

I am not sure why Gold is not trading higher with all that inflation expectations, and I am not sure if the Professor who predicted Trump’s win is right to say he will be impeached now?

And finally, we are really not sure if Trump would prefer higher rates or not that much higher rates or lower rates or if inflation is going to rise at the rate US folks will be spending this Thanksgiving or looking to rent or take on a mortgage. But a slowdown is not hard to envisage at all even if bonds are heavily oversold, as we snap out of the PTSD this week to be frightened into buying something like a spare toupee on Black Friday.