Sell Stocks or Sell Bonds?

The Business Times has spoken again, Singapore bonds are screaming happy days again with the recent Commerzbank SGD Tier 2 issue 4 times oversubscribed, for the bond price to rally nearly 2% in 2 days.

That calls for a big WOW because some woeful bondholder of bonds in default would be glad to get just 2% of their capital back, writing off 98% of their investment.

The rally in Singapore junk bonds has rewarded the savvy investors who piled in late last year when we had consecutive restructuring announcements that panicked many a private investor and their RMs who are probably just as clueless about bond analysis or simply just taking orders from their superiors to wash their hands clean, forcing clients on leverage to dump their holdings.

The leverage business is back again with new rules this time, which is actually the old rule pre-Lehman, that bonds cannot command leverage unless it was rated and junk would get the least. Therefore, for the new issues of 2017, we note leverage administered liberally, Commerzbank commanding between 40 to 70%, the UOB sub debt getting 70% borrowing value and more.

Leverage is all good when we are in a trending market like the one we have now as credit spreads compress to multi-year lows. The HYG US junk bond bouncing off its 6-year low in Feb 2016 to a 15 month high last week.

iShares iBoxx $ High Yield Corporate Bond ETF HYG US

Bashing The Dow Rally

It cannot be for retail flows anymore than a hedge, I suspect, against the S&P 500 or the Russell Indices, both making historic highs as the Dow Jones index broke new highs for 11 consecutive days, its longest streak since 1987.

When we have record highs, skeptics in our midst will surface to sell for the correction and imagine 11 days of new highs? It would be a tempting sell especially on a Friday and the weekend risk with Goldman Sachs calling for a sell since day 5, then saying they are “perplexed” a week later but to sell in the “relentless bull market given a long list of near-term drawndowns”.

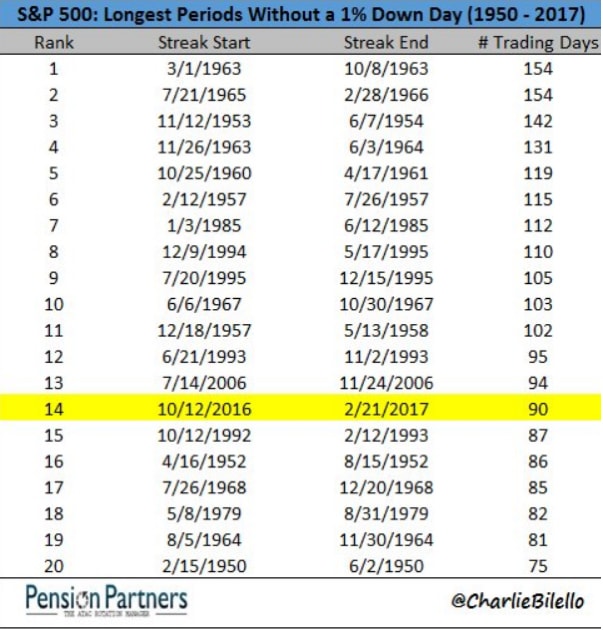

Yet, taking a look at the table below, we would be on 93 days without a 1% correction as of last Friday and that is a good sign because since “1945, there have been 27 years when the S&P has achieved gains in January and February. The stock index then finished up for the year in every one of those years.” according to CFRA strategist, Sam Stovall.

Sell Stocks or Sell Bonds?

Us, in Asia, find it even harder to see any economic cheer with Singapore and Hong Kong doling out pretty unexciting, unpopulist and rather “stoic” budgets because 2017 looks like a write-off.

While we have Goldman calling to sell stocks, we have Bank of America warning of a possible bond market rout because traders are calling the Fed’s bluff and only see 2 rates hikes this year, starting in June even though the Fed wants the market to prep for 3 in their forecast back in Dec 2016.

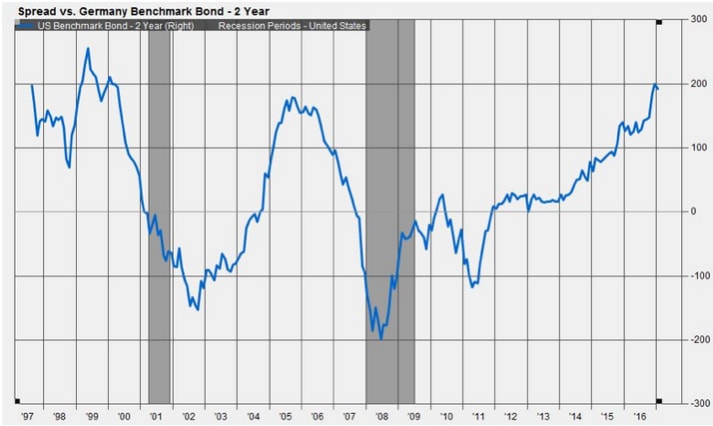

The biggest investors in US treasuries have been dumping bonds of late with China’s holdings dropping the most on record in 2016 and Japan culling the most in 4 years. This has been buoyed by the speculative accounts buying against the widest bunds vs treasuries spread since 2000.

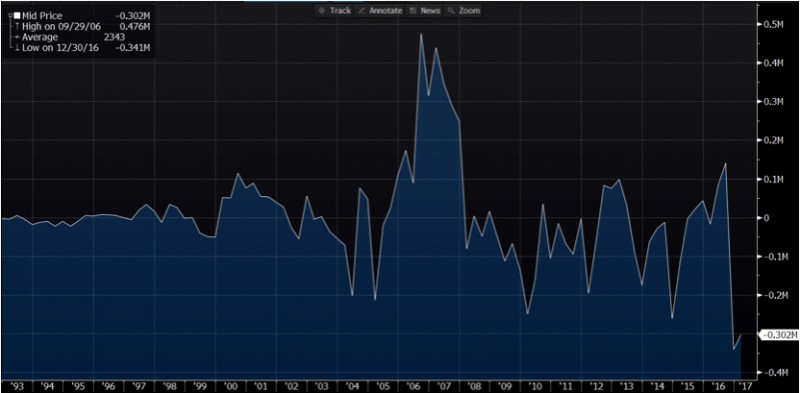

And of course, we have the largest shorts in history that keeping bond prices up.

CFTC 10Y US Treasury Notes Net Futures Positions—record short

The Big Picture

Looking at the big picture, we have to accept that the days of QE have come to an end, no matter what the BoJ or ECB says because even BoJ Kuroda has ruled out further lowering negative rates.

Economic data has never been rosier as compared to a year ago and plans are underway for fiscal stimulus not just for the US as Trump has vowed to rebuild “highways, bridges, tunnels, airports, schools, hospitals” and more, but China and her new Silk Road project.

For Trump’s nationalism rhetoric and building walls, prices and wages are only going to soar and uncertainty is good for gold and bonds only for the short term. Because it is expensive to hold gold as an asset if it does not pay you any interest and holding German 2y bunds at -0.95% is a foolish idea unless one expects the yield to collapse to -1%.

Pimco also thinks the inflation rate will definitely accelerate, as the US targets 3% growth, 50 year and 100 year bonds and trade wars, which are generally bad for small trading nations like Singapore and while it is a distasteful topic, MAS has also warned that Singapore’s interest rates are “expected to take the cue from US interest rates”.

Maybe Goldman is wrong, again. This is the last chance to sell bonds and not stocks?

And some investors may not be aware, but the SGD Commerzbank bond they bought is rated junk by Moody’s, which is why the rating is not used in marketing materials.

Just some food for thought.