How To Get Rich In Singapore?

Weekly Market Bash

We cannot have a weekend without a bash at the markets, can we? 2 years on since the passing of founding father, Lee Kuan Yew, on the 23rd of March, only for us to find out stock and bond markets tied to the US Congressional vote on their national health program which most of us know nothing about even if it makes good headlines. The message with specific instructions we get from reports for common folk is that “Yes” is good and “No” is bad, based on some bizarre reasoning that if this act does not get passed, the rest of Trump’s policies will stall.

What does a healthcare act have to do with tax cuts? Nobody seems to be asking. Yet people at the bar have turned political experts, all of a sudden though not so sudden since we had taxi drivers with US election opinions last year, smugly telling me that the USDSGD will head to $1.3950 because it would be a “No”.

How fabulous, I think. So easy for a one track mind to ignore everything else out there, especially the real economy with economists (people who study the economy) now giving fortune tellers a run for their money, predicting that because things are so good now, the reflation trade and inflation will head south soon. But aren’t they all in the business of selling bonds?

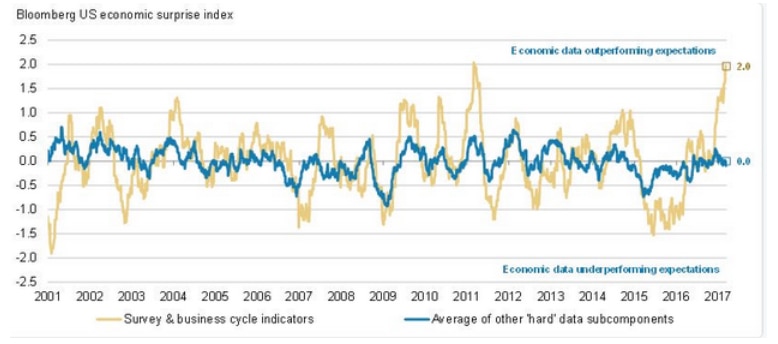

Therefore we have a situation here where economic data in America is surpassing expectations most in 17 years, with negative surprises at zero as visualised below, with leading indicators at their highest level in a decade, which perhaps justify the S&P stock rally, but markets preferring to respond to political events.

Source: Morgan Stanley

Bash over.

Americans Are Getting Rich

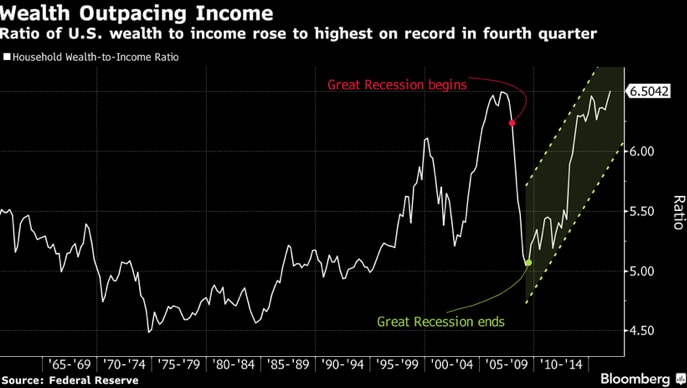

US household wealth to income ratio has hit a new record of 6.5 times (meaning 6.5 years of income as wealth).

Source: Bloomberg

According to CNBC, American millionaires have hit a new record of 10.8 million, with 1,700 new millionaires a day, mainly due to the significantly higher values of all asset classes with the advent of unorthodox monetary policy a.k.a. QE since the financial crisis.

You Cannot Be Rich If There Is No Poor

Singaporeans are faced with the least prospects of becoming millionaires these days even if they are ranked 10th in the world for 2016 in terms of household wealth, about half arising from real estate, slipping from 8th, but the trend of slowing wealth growth remains intact which is understandable because there is no QE in Singapore. No crying foul please because wealth had grown 6% annually in the past decade and half.

We ask ourselves if we can quantify what is being rich and we will not know. For instance, having a million today (= millionaire), according to Bloomberg, is only as good as having $300k (not a millionaire) back in 1980.

We only know we feel richer by looking at the chap next to us, mainly judging them on their exterior i.e. usually, the car or their house or bag or clothing, which means we would feel bad even if we are driving a much nicer car than 10 years ago.

We should also know that we cannot have 7 billion rich people in the world with all her limitations in resources. Besides it is good enough to know that the Singapore pools lottery is already minting over a hundred millionaires a year—2 Toto’s per week and 1 Big Sweep per month.

Price of Happiness in Singapore

I would steer clear of Singapore if I was a poor refugee seeking to make my fortune because it appears doggone hard to make it here.

The land of Singapore:

- Highest IQ (on average) in the world

- Singaporeans are the happiest and healthiest in Asia

- Singapore has the smartest kids in the world

- Singaporeans are ranked 6th globally for innovation

- Singapore is 2nd safest country in the world

- Therefore Singapore ranked world’s most expensive city again

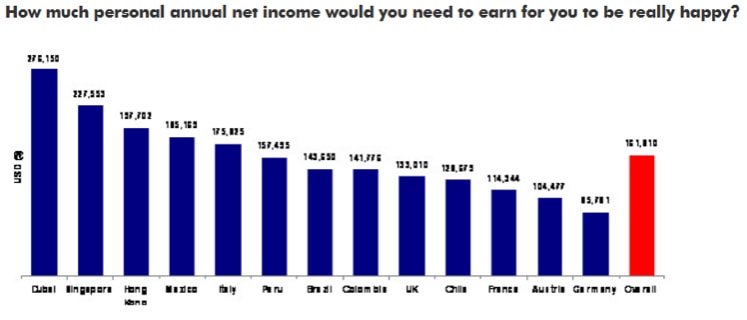

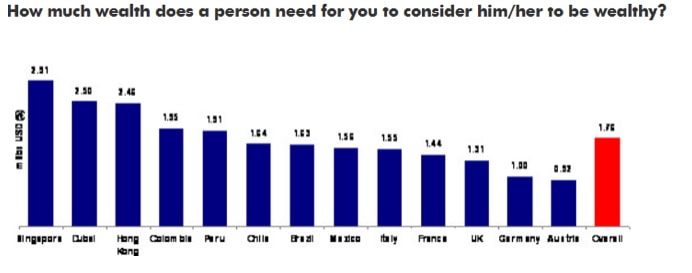

Because Singaporeans are so smart, the price of happiness in Singapore measured in annual income, from a 2012 survey, was second highest in the world. Yes, the price of happiness is not US$75,000 in annual income, as we read about back in 2010, but US$227,563 for Singaporeans with US$ 2.9 million in disposable assets, the highest in the world.

I know the FT says Singaporeans are the top in the world for math and CNA says Singapore student top both math and science, well, there is something wrong with their math here.

US$2.9 mio in assets does not give US$ 227,563 in returns even if you invest in junk bonds paying 10%. (unless you managed to get the latest Kimly IPO to get 120% returns back but US$2.9 mio would not get you enough public offer shares which was only S$ 0.95 mio (3.8 mio public shares times 25 cts) because the profits were reserved for the 170 mio placement shares.)

So it would be safe to say that Singaporeans are not happy bunnies yet because net income per capita is still around US$ 56,000 minus the lottery and Kimly IPO winners.

How To Make Money?

Definitely not in Singapore Savings Bonds (that are paying lower and lower interest rates) and probably not in real estate, after what we have been harping over the years that the sweet spot in Singapore housing is probably $ 2 million or, “Dual household income of USD 130k, leveraged at 80% and assuming a loan service interest rate of 3% (conservatively) will allow a 24 year mortgage on a magic number of SGD 2 million on a property”, or that $1.5-1.6k psf for the not-too-claustrophobic 1,300 square feet.

Given it is not likely that we will see 6% annual wealth growth (average between 2000-2015) now that we are one of the richest countries (per capita) in the world, salaries are not going to be soaring as they had used to.

That makes it too bad for those who are just starting to accumulate their wealth at this time.

And that probably explains the reason behind our observation last week that the investor with $5k to spare has heightened urgency to double his money than the person with more. And that probably stems from the need to get rich.

There are many roads to riches as we list below.

1. Earned income

2. Asset appreciation—land, real estate, bonds, stocks, gold

3. Monetising Intellectual assets/ property, software, social networks like Facebook and user networks like Uber and AirBnB

4. Goods/services production using 2. And 3.

All the items except 1.Earned income depend on access to capital, just as earned income depends on the individual’s skills. And all the items involve creating wealth in the system which does not help in the cause to get rich because the one with the higher income, more land or bigger factory will get richer.

Other methods to riches are via wealth transfers, where wealth is not created but transferred from 1 party to another.

1. Inheritance

2. Lottery or Casino gaming

3. Crime that goes undetected

4. What about trading forex and binary options? Forex is a situation of betting on the relative value of 1 currency against another – no value is created in the end because it is a zero-sum game where one party wins and the other loses in a 50-50 situation i.e. one richer vs one poorer. Because 99% of the 4 trillion transactions per day foreign exchange market are speculative and you cannot initiate a trade without someone on the opposite side.

Access To Capital and Trading Forex

I think we can more or less agree that the average person with more capital or access to more capital is likely to get richer over time than the person with less, with risk thrown in.

But what capital get you most bang for the buck?

It is the amount you can borrow against your dollar to make more money and no one would lend you money to buy the lottery but they will lend you 3 to 4 times your down-payment to buy your house or to buy bonds and shares.

Yet some places will lend you up to 50 times to trade Forex and futures and perhaps that is why it is taking off in Singapore and MAS had to issue a warning against binary option trading last week when unregulated platforms defaulted on clients.

Beggar Thy Neighbour or Thyself?

Forex is a high-risk high reward game, with better odds than the lottery (theoretically, 50-50) and an undeniable way of becoming rich and even better, rich by making someone poorer which is the real meaning of rich.

Source: Channelnewsasia

However, on what and whose logic should you become rich if you do not have the intellectual capital or skill to trade Forex? It is hard, despite its decent odds, because there are very FEW who become VERY RICH at the expense of making MANY BECOME VERY POOR.

That is the sure proof reason why Moneysense and SIAS will not include Forex trading in their retail investor education series.

Nonetheless, it is the world of the zero sum game for you and me, and the sinking feeling in my tummy when I see the US dollar sink into quicksand. No luck for riches today. Much better off selling economy rice with the view to IPO as the new Kimly—even poor people like me need to eat.