Stock Markets: You Ain’t Missing Anything For The Peace of Mind

– Markets are handling a lot of information and developments right now and US stocks have made a new record high

– Folks who had missed out feel an urgency to be invested

– While the STI has not made much progress in the past 3 months, some stocks like DBS have gained 30% since Donald Trump’s election victory

– Is it not time to take a break?

– Waiting for a crash, many uber bears who have put their money where their mouths are have given up

– Yet market influencers have been voicing their concerns for the past 3 months but markets are not paying heed

– The list of folks in the bear camp is growing as some, including Warren Buffet raise their cash holdingsProminent CEOs like Jamie Dimon and Lloyd Blankfein have sounded

– Prominent CEOs like Jamie Dimon and Lloyd Blankfein have sounded alarm bells in the past week

– Strategists and technical analysts also echoing their bosses with their “don’t say we didn’t warn you” warnings

– In the past 9 years, faith in central banks and company share buy backs has richly rewarded investors

– Nonetheless we won’t be missing out on anything for some peace of mind

Nothing has been the same since Chester Bennington was taken from us, the crazy pace accelerating from the time David Bowie left us and went back to space.

When we think mind-blowing, we really do not expect the mind-blowing up week after week, taking a huge toll on us that we would be numbed senseless by another North Korean missile that missed its target on Friday morning and a London tube bombing with no deaths in the afternoon for markets to shrug both off nonchalantly and proceed to make a new record for the S&P 500 at 2,500 on Friday. So much traditional seasonal weakness of September call by the Stock Traders Almanac.

Let’s recount the things we really do not want to know about this week.

- US Federal Debt tops US$ 20 trillion as of 7 September, according to the US Treasury dept.

- The Republic of Austria, officially 62 years in existence since 1955, successfully issued a 100 year EUR bond paying just 2.1% per annum to the public, raising EUR 3.5 bio in the process. Bond maturity date 20 September 2117.

- The Bank of Japan officially owns 75% of Japanese ETFs by market value, looking set to hold 80% by the end of 2017.

- Total global debt hit a new record of US$217 trillion in 2017 which is 327% of global GDP, setting a new record for Debt/GDP ratios.

- Toys R Us hired a bankruptcy lawyer after Vitamin World announced their plans to file for Chap 11, which is just as well that they managed to last since their LBO in 2005 by some PE firms which piled a lot of debt on them.

- Bitcoin fell 24% from its 1 Sep record high after China announced a ban on cryptocurrencies, details unknown, but serious enough for the 3 largest bitcoin exchanges to stop offering local (but not Hong Kong) trading. Bitcoin 10-day volatility now at a dangerous 109%. [Incidentally, Google, YouTube, Facebook, Twitter, Wikipedia etc. are also banned]

- Norway’s world largest sovereign wealth fund has topped US$ 1 trillion for the first time on 12 Sep, and now seek to change their 30% bond holdings to just 3 currencies – the USD, EUR and GBP. This would mean a reallocation of roughly US$ 275 bio out of other bonds, if approved.

- Apple Inc launched the iPhone 8 and X (“Ten”) to own not only our thumb prints but our face-prints as well.

Fathers are Getting Impatient

As dutiful children, we usually inform the fathers if we thought the market was due for a correction which we wrote about last month in Total Eclipse and the Market Crashes. There was real fear in the confluence of factors found in the Hindenburg Omen, the larger number of STI stocks holding below their 200-day moving averages, crazy geopolitics, the Dow Theory, the Russell Index and all.

Now the fathers are getting irate and the brownie-point bank is fast depleting as the fathers are asking impatiently about “the so-called crash”. 1 month is a long time to wait but hey, DBS is lower (-2.28%) on month, we would reply, but he did not sell DBS, of course. No one who bought DBS at S$12 a decade ago and watched it plunge to S$6 and then rebound to S$22 in July this year would be selling now. This is probably how some retired chartered accountants think about their portfolios given their knack for inventory cost accounting, even though the troublesome Olam (bought at $3) was dumped at $1.5 back in 2013 when the stomach grew too weak and developed peptic ulcer symptoms.

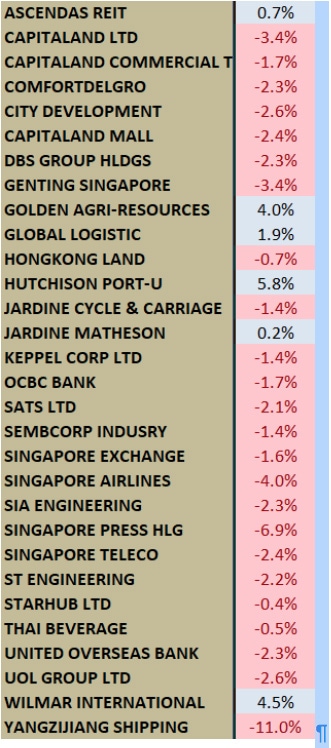

In reality, the past month has not been good for the STI, falling 1.3%, with her member stocks mostly in the red for the past 4 weeks.

Table: STI Component Stocks 1 month performance

In fact, the STI is now conspicuously in the red after 3 months, at -0.7%, versus the Hang Seng’s lofty +8.5% and paling even against, nuclear-threatened Korea which managed to eke a 1% return for the past 3 months, for its 1.2% gain in the past month erased the losses of the past 2.

Hey Dad, But You’ve Done Well

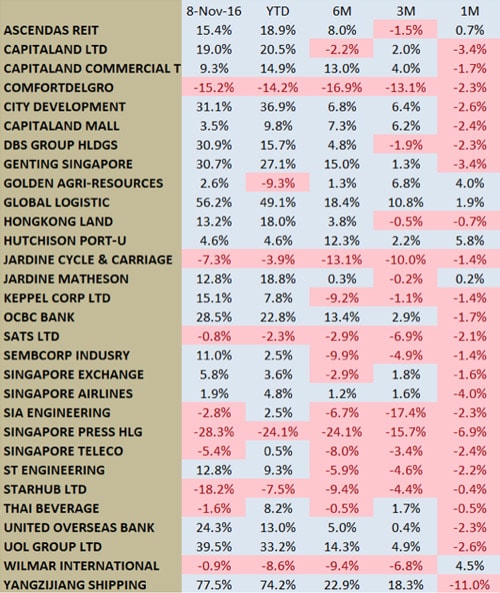

In a rebuttal to the fathers, things have gone pretty well for the STI since Trump won the elections. Just examining the returns to date since DBS is up over 30%!

Table: STI Component Stocks Performance since Trump’s election victory

If you have held DBS for over a decade, at $12, watched it fall to $6 and saw it rise from the ashes, does that not call for a celebration and a well-deserved break?

That is so much we can say for fathers who are still holding on to non-existent Ezra, an investment we never advocated and still they say, “Father knows best”.

The Long Wait and People are Giving Up

3 months has been a long wait for us too, for the opportunity lost, for a quarter of a year! Most portfolios do not have the luxury of a 3-month wait because they need the fixed income to survive which is why the Singapore bond markets have shone.

The good news is that the many uber bears have given up. The latest being Hugh Hendry who shuttered after 15 years with a parting line of “it wasn’t supposed to be like this”.

Those who are left are sensibly not outright bearish even if they make their disapproval known.

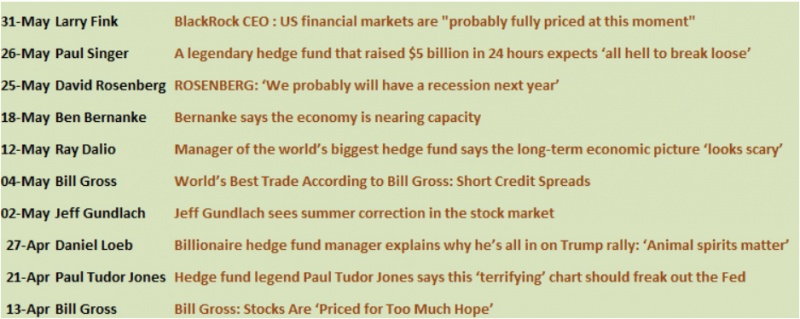

Let’s see what the global influencers had to say 3 months ago as we had summarized in Market Defiance Part 2: The Covfefe Conundrum and The Crash To Come.

Coming to the end of 3Q17, the list has gotten longer according to Bloomberg, “billionaire hedge fund manager Leon Cooperman joined a long list of money mavens who foresee trouble for U.S. stocks …Many others have expressed similar concerns in recent months, including Paul Tudor Jones, Scott Minerd, Philip Yang, Larry Fink, Jeffrey Gundlach, Howard Marks and fund companies Pacific Investment Management Co. and T. Rowe Price Group Inc.”

Warren Buffet has also raised cash holdings to 15%, above his historic average of 9% while Seth Klarman is holding 42% in cash.

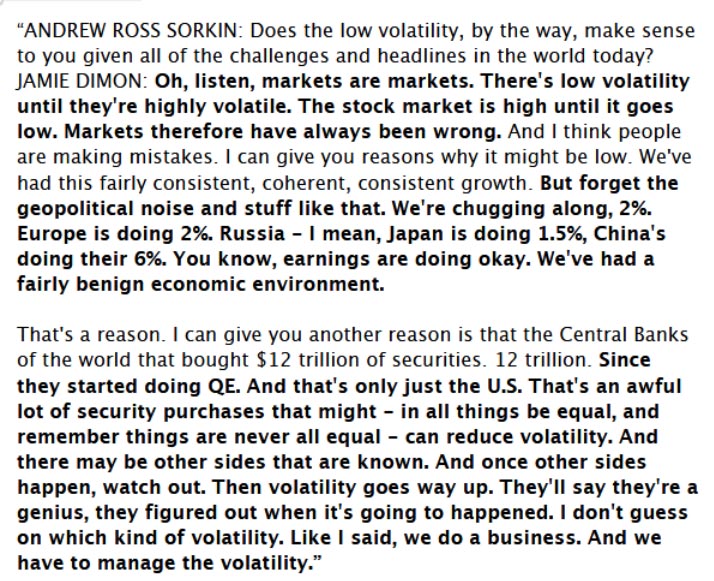

Influential CEOs’ have been voicing their fears in the past week as well. Let’s look at the views of JPM’s Jamie Dimon and Goldman’s Lloyd Blankfein who have both come out to warn of another poor trading quarter after Citibank came clean last week to forecast a 15% drop.

Jamie Dimon expects a 20% drop in revenue and expects a spike in volatility because “markets have always been wrong”.

Lloyd Blankfein also thinks the same, saying “Things have been going up for too long … That unnerves me”.

Source: Business Insider

They Are Still Saying Don’t Say We Didn’t Warn You

The bears have said their piece, and those who have put their money where the mouths are have mostly given up as we read more and more of their anguish and exit. We can feel the pain of the latest China bear to cave in, Mark Hart, who lost $ 240 mio and, as Bloomberg puts it, “damn near lost his sanity”.

Source: Bloomberg

For the rest who have not put their money where their mouths are, they are telling investors to worry.

Citibank has calculated the odds of an imminent market correction (within 3 months) at 45% while Goldman Sachs bear risk indicator is at 67%, last seen right before the global financial crisis.

UBS is also urging caution this week as technicals and sentiment signals do not support further upside momentum with only marginal new highs to expect.

What better time to issue those “Don’t Say We Didn’t Warn You” disclaimers than when your CEOs’ feel the same? And even better to be remembered as the last one who sounded the alarm?

You Ain’t Missing Anything for the Peace of Mind

The fathers don’t get it but we are just giving ourselves peace of mind.

Perhaps Donald Trump and his team are on the right track because they have not been proven wrong in their claim that the stock market is a big vote of confidence in their economic plan, a fact that is trumpeted routinely by the US President himself on Twitter and again this week by his treasury secretary, Steven Mnuchin, on a CNBC interview.

There is not much an economic plan and the world is waiting patiently because it stands to reason that the status quo would remain, as it has for the past 9 years, as summed by former PIMCO CIO as their “desire to return to a comfort zone”.

He wrote in Bloomberg, “investors’ willingness to set aside considerable unusual uncertainty. They remain deeply comforted by the notion that central banks continue to cover their backs, that corporate cash will continue to be ploughed into the markets via dividends and share buybacks, and, to a lesser extent, that the global economy is in the midst of a synchronized upswing. Indeed, in recent years such faith has richly rewarded investors who have been conditioned to buy the dip, regardless of its causes.”

A month from our premature warning to the fathers, and we still feel the same way. Load up on cash, deployed into short-term safe haven instruments of which there are quite a few of, especially in Singapore where we have some bonds whose prices never change.

Knowing corrections do and will happen, we know we are not missing out for the peace of mind from the next missile test, hurricane, act of terror or central bank meeting.