Singapore Rates and Currency Outlook 2018: The Existential Crisis

- 2017 has been a good and bountiful year prospering many a Singaporean

- Singapore is a rare case in Asia where the currency has appreciated against the USD and its basket, equities and bonds have have rallied in sync

- The SGD dollar has mean-reversed closer to its 10 year average of 1.34

- Government bonds have mostly outperformed on the lack of supply in the long end from a light auction calendar with the 10Y bond the star

- Bond swap spreads did not do too well as interest rate swaps followed SOR lower

- As we pointed out months back, there is an anomaly in the market when t-bills yield higher than SIBOR and the spread has only grown and sustained since

- The SGD has also strengthened 1% against the NEER basket since the advent of the longest period of neutral (zero appreciation) policy since 2003

- This could be due to the ever-appreciating policy stance of Singapore with only 1 depreciation attempt in the past decade back in 2009

- LIBOR will be phased out by 2021, having lost its credibility as a benchmark, being ascertained mostly by “expert opinions” these days. We would hazard to guess that SIBOR is in the same boat judging by the t-bills

- 2018 has 2 extra bond auctions and an extra new 10Y benchmark vs 2017

- Bond prices face a potential correction but should be supported by a credit market correction

- SIBOR will have to head higher after the FOMC rate hike as early as next week although the fate of SIBOR will be determined next year

- USDSGD has a self-fulfilling prophecy to head lower in anticipation of the MAS changing the policy stance in April as the Oct policy statement already suggested the “extended period” context was in past tense

For most Singaporeans, 2017 has been a bountiful year, minting new millionaires as every last HUDC estate gets its en-bloc sale, stocks markets returning double-digit profits to keep those car sales at healthy levels as retail spending runs on full steam, the unemployment rate halts its growth and we end the year with grandmothers and aunties taking an interest in the Bitcoin.

Everybody “more or less” made money this year. From millennials who struck gold in Bitcoin to those who had shrewdly invested in en-bloc properties as well as those who owned and live in them, to the retirees with their portfolio of Singapore bank stocks and the rest who have their toes in Nasdaq and even for those conservatives with their portfolio of bonds, junk especially, chalking decent capital gains !

Financially, on stable footing, as GDP growth hits a 3 year high and a silent revolution in the smartphone era, along with the Internet of Things. The Baby Boomers have been conquered with the constant bombardment of those Pay-lah, Pay-Now, Pay-everything ads in every nook and cranny of this island that it is no wonder that Singapore has become the world’s top source of cyber-attacks from those unprotected slave computers that trigger happy Singaporeans are happily surfing with.

Forgetting the grumbles with the MRT, scandals in the political ranks, missile tests and natural disasters around the world and in the region, Orchard road is teeming with shoppers for winter-gear as a casual Facebook count shows 8 out of 10 braving the missile tests for Japan to ski, shop and eat as the rest of Facebook is gallivanting across Europe, replete with photos of Michelin meals.

Life is good. Keep spending while it is good.

2017 Singapore rates have been an oasis of calm for the ordinary guy. SIBOR was well behaved despite the fears of rate hikes and the end of QE.

The market has been transiting into a new mortgage fixing trend—the rise of the DBS home loan rate pegged to its 9 month fixed deposit rate, origins unknown.

We are not certain how this came to be, but for the market, it has been an upheaval of sorts towards year-end, leaving traders mightily bewildered as the SGD bucks the NEER basket despite the zero appreciation stance and we come to face an existential crisis in our benchmark interest rates now that LIBOR will be phased out by 2021.

Let’s Recap For Starters

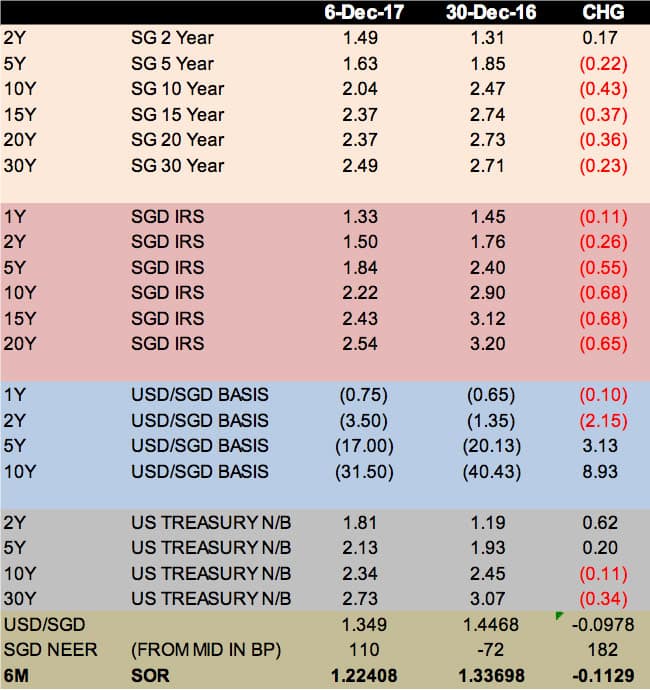

- SGD rates outperformed the US

- SGS underperformed the SGD interest rate swaps +0.17 to -0.43 changed vs IRS shedding 0.11 to 0.68% in a massive curve flattening exercise

- The SOR has fallen 0.11% on the year, reflected in the 1Y IRS

- The SG dollar is up over 7% against the USD

- The SG dollar is a whopping 110 ticks away from its ideal mid-point, strengthening 0.0182 vs 2016

The USDSGD

Last year, we suggested that the USDSGD saw a 6 year high (1.445) and should hold its own unless we see China devalue or some massive risk-off event in the region. That was mainly due to the 6 year high in USDSGD “diverging from Sibor rates, the NEER in a sweet spot which was less cause for speculation of further weakness versus the rest of the world”.

Graph of USDSGD 2009-2016

It is clear that North Korean missiles are exempted as a risk-off event although the main driver for the 6 year high in the USDSGD end 2016 was probably attributable to the ADXY Index (Asian Currency Index) at an 8-year low.

The 6% rebound of the ADXY Index in 2017, along with the breathtaking recovery in the MSCI EM stock index has simply put the USDSGD back to its 2016 lows in a reversion to its 10 year average of 1.34 as we can see from the graph below.

Graph of USDSGD 2012-2017 plot against the ADXY Index

Government Bonds and Interest Rates

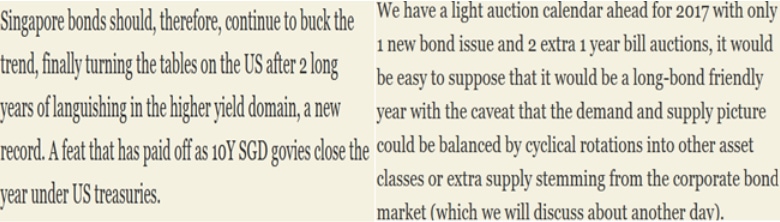

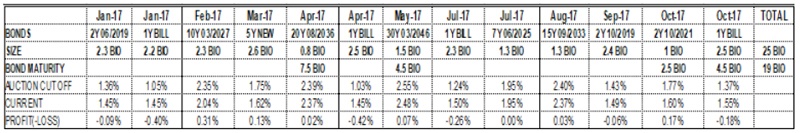

As we said last year, Singapore government bonds would continue the trend of turning the tables on the US after languishing for 2 long years, supported by the lower SIBOR and a light auction year in 2017.

Indeed, the year has been profitable for all the new issues above 2 years, given the scarcity of issues >2 years with under 10 bio in new supply versus a flood of short dated issues, a much better performance than 2016 where we saw most new issues underwater at year end.

Table of SGS issuance and their performance in 2017

The best performer would be the 10Y bond which delivered over 3% in capital gains since its auction in Feb 2017. The 10Y bond has also been the best bond of 2017 rallying 0.43% in yield terms year to date given the absence of supply since February.

Graph depicting the flattening of the SGD Government bond curve in 2017 with the 10Y bond outperforming

Yet bond swap spreads have been a major let down in 2017 with the interest rate swaps killing those who had hedged, in a big way, as market spent extended periods in negative swap spread territory, which is no longer seen as unusual after the phenomenon appeared and persisted in the US for a variety of impalpable reasons.

It is probably nothing out of the ordinary for Singapore given the incredible flattening of yield curves everywhere globally. Singapore rates are still standing tall in the developed world space where Japan and rest are still hovering near zero. The weight of new offshore corporate bond issuance also came to bear on the market and we saw some heavy flows such as the HSBC SGD 1 bio perpetual that was issued to take the place of the heavy and chunky maturities we saw in the corporate bond space this year.

Chunky issues and maturities do take a toll on the SOR if they are of the offshore nature, for they will have to be swapped back into USD. If that is not met by demand from the opposite side, it only becomes a one-way street as we have seen in the past. The missing piece in the puzzle would only be the USD-SGD basis swaps which have tightened on the year and something we are struggling to reconcile with.

We saw yields crushed in November, into the year-end as funding rates diverged on what we see as the “existential crisis” our market is facing. Government t-bills are yielding higher than SIBOR—an anomaly as we pointed out in October.

Taken from Imaginations Running Wild Part 2: SIBOR, SOR or A New Benchmark?

Monetary Policy and SIBOR

MAS is seen on the back-pedal this year because the market is all the wiser in this new age of zero appreciation policy, knowing that MAS is committed to an “extended period” which should cover 2017 at least, because Singapore has only 2 policy meetings per annum, compared to the 8 FOMC/ECB/BoJ meetings and the 11 RBA ones.

Thus, we have set a new record of 2 years without “appreciation”, a sure sign of times of slowing growth except that GDP growth is at 3-year highs? That gives reason to hope for policy tightening which is probably the reason for the SGD’s unusual strength.

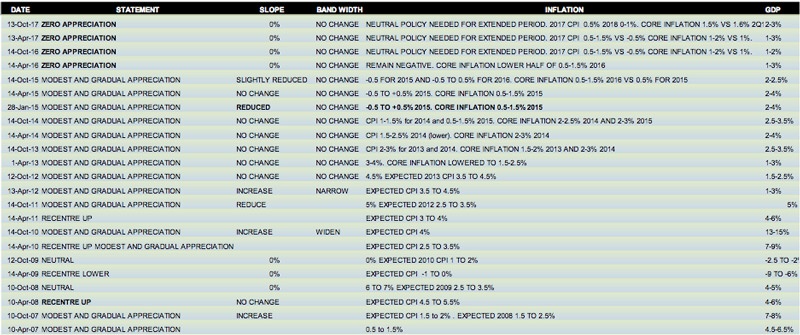

Table of MAS policy statements since 2007

The market would appear to have the MAS in a noose like they have with all the other central banks of the world.

Singapore’s case is simple, Singapore’s version of monetary policy without interest rates leaves little to the imagination even with the apparent lack of transparency in the mechanism.

MAS has a track record of ever-appreciation or neutral. It is foolproof reasoning for a country that practices monetary-policy-without-interest-rates, where policy weakening is for neutral currency strength.

As we said in Missing Out on EnBlocs and Monetary Policy 2 months back, there was only 1 occasion of SGD depreciation in April 2009, in the midst of an 18 month stretch of neutral (zero appreciation). We are heading into April 2018 for a 24 month home run this time.

The impact of zero appreciation (or neutral), only means that we can only look forward to going back to “modest and gradual appreciation”. The SGD NEER Index is already running ahead steadily, towards its record lifetime high that occurred between post Brexit vote and US elections last year that was after the surprise April 2016 “extended period” of zero appreciation stance.

The SGD could not help but appreciate 1% since April 2016 against the NEER basket!

Graph showing the steady climb of the SGD NEER Index throughout 2017 despite the zero appreciation monetary policy stance since April 2016.

With a stronger SGD, it goes that interest rates would be kept in check as the SGD forwards are kept in check, waiting for future strength.

We can live with the bizarre SGD NEER behaviour. We can live with overnight funds rising to 1.65% one day and falling to near zero the following week, which we suspect could be due to those confounded bond maturities and the basis swaps that matured. We can live with SOR trending well below MAS t-bills and SIBOR because we have seen the speculators push it to negative territory in 2011.

It is, however, difficult to stomach that the MAS bills yields would trend so much above SIBOR for such a sustained period, with the gap widening by the week judging from the graph below illustrating the gap growing between the 3 month SIBOR and the 3 month MAS t-bill with the 3 month SOR thrown in for good measure.

Graph showing the sustained and growing gap between 3 month SIBOR vs the MAS tbill

The market clearly has a love affair with long bonds, as evidenced in the rally this year. The short end has been unloved, yes, and we note that in the US and other major centres as well. Yet our t-bills yielded higher than the 2 and 3-year bonds during their auctions, coming well above 1.6% in the past weeks.

As we said before, SIBOR has lost its credibility just as LIBOR has, just as both rates have come to be “expert determined” instead of based on actual transactions.

This t-bill business could be just a symptom of the existential crisis we have come to in the entire monetary policy puzzle of ours that we will are not here to critique, hearing about the extensive industry and regulatory efforts to improve matters as if our regulator’s hands are not already full enough on Bitcoin and the housing euphoria.

2018 and the Existential Crisis

Global politics aside, Singapore ends 2017 on a high note. GDP, consumer prices, industrial production, the purchasing managers index and unemployment all look rosy.

Singapore GDP, CPI, Ind Production, PMI and Unemployment trend

Compared to her Asian counterparts, Singapore is a rare achiever, chalking currency (vs USD and NEER basket) and equity gains along with a substantial bond rally, as we can discern from the table below. That is great for any global fund which has put their bet on Singapore this year.

Table of Asian countries 10Y bond yields, currency vs USD and equity performance for 2017

The relative performance of countries against each other has been rather un-uniform if we note the glaring rise of Chinese, Indian, Korean and Philippine yields and the equity and currency performance has been disparate.

We are not sure what to make of this except that there are probably larger market forces at play for the “invisible hand” effect in terms of global fund flows than we can imagine which makes 2018 a blurry haze and much more difficult to anticipate than the happy days we enjoyed this year.

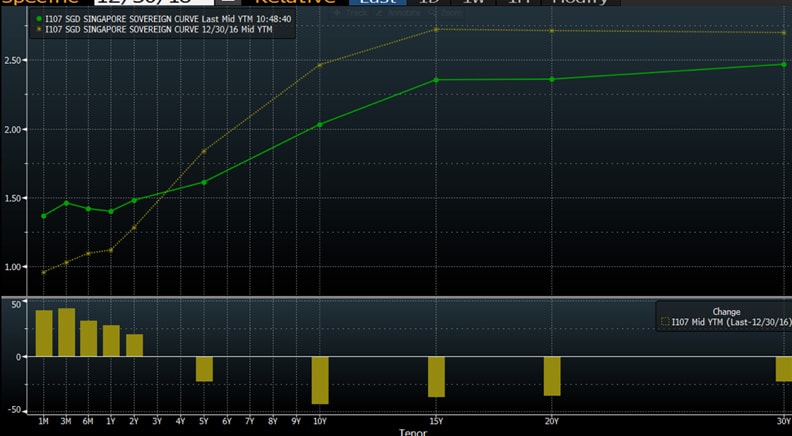

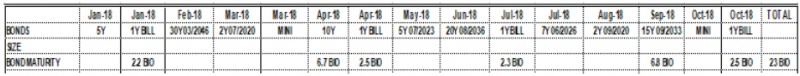

Examining the bond issuance calendar, we find 2 extra bond issues with a new 10Y benchmark coming in April, with only 2 new benchmarks to expect for 2018 after the 5Y in Jan 2018. That makes it 1 extra new benchmark over 2017 where we only had 1 new 5Y benchmark.

Issuance calendar and maturities for government bonds in 2018

We would be tempted to think that bonds would look heavy into 2018 after 2 full years of outperformance, where we saw the 10Y yield start 2016 at 2.6% and end 2017 at 2.04% when the 10Y US treasury rose from 2.27% to 2.4%.

Yet it is easier to foresee a correction of 20-30 bp in store for yields which will be tempered by a potential near-term tantrum in the global credit markets than a full blown sell-off. We will also have the FOMC to thank when the rate hikes come in as early as next week (14 Dec 2017) and SIBOR will cease to desist the LIBOR trend.

That would make the MAS t-bills look fairly priced.

It is impossible to make a decent call on the interest rate swap markets with people starting to question the benchmarks like SIBOR although rates are pegged to SOR which is derived from LIBOR and forward points which will be capped by expectations that the MAS will remove the “extended period” language in the next monetary policy meeting in April. As it is, the October 2017 statement was perceived to have referred the word in past tense which gave the SGD a mild boost against the NEER basket.

With that, we can expect USDSGD to test lower as a self-fulfilling prophecy and trend along with the ADXY as various global crises and flows come our way.

A Last Word

2017 has been falling down a rabbit hole for us, as we had anticipated last year. As Alice said, “It’s no use going back to yesterday, because I was a different person then.”

All we can say is that the year has been easier for the grandaunt trading Bitcoin, although we would not call it trading when it is just buying and buying and more buying. Lucky is the chap who had plunked his en-bloc proceeds into Bitcoin too and we would congratulate those have put their easy-to-come-by equity profits into deposits for apartments and houses to make more money in the years ahead.

For the rest of the folks in the markets, wondering what on earth has happened this year?

Some disruptions have occurred and we are possibly facing an existential crisis for now and for next year.

To 2018, with doubts abound, Cogito Ergo Sum.