The Singapore Monetary Policy Statement & The Thankless Job of Central Banking

October is looking to be a painful month with an estimated US$ 876 billion wiped off bond markets on the first week right when the Dow makes a historic high mid-week.

Forget fake news because we do not even know what to believe in real news anymore. Do we believe US Supreme Court nominee Kavanaugh? Do we believe Italy when they say they will pay their debts? Do we believe China’s latest large-scale chip espionage?

Does it matter if people lie? Donald Trump has made integrity look old-fashioned and we are not surprised when we read this week that the origins of his wealth and success came via some elaborate tax fraud.

Amazon may have raised minimum wage to US$15 this week but it was at the expense of stock and bonus awards, leaving many workers with less.

Do we believe Fed chairperson Powell when he says the economic outlook remains sunny, too good to be true and that the Fed does not detect financial instability as elevated now?

Source: NYTimes

Source: NYTimes

Over a year ago, the ex-Fed chairperson Yellen famously said: “I don’t believe there will be another financial crisis in our lifetimes.”

Source: Reuters

Source: Reuters

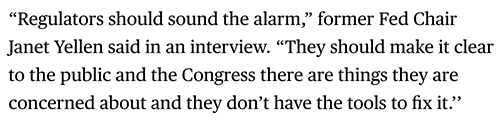

After leaving office, she recently told Bloomberg that “regulators should sound the alarm”, referring to the explosion in leveraged loan issuance but she could also be referring to the global bond market (up over 2 trillion in the past year with 1.27 trillion coming from the US government) or the US budget deficit which is expected to top US$ 1 trillion next year.

Source: Bloomberg

Source: Bloomberg

IMF chief, Christine Lagarde, has said that global clouds on the horizon have materialised and growth will slow ahead as 83% of new US IPO’s this year involve loss-making companies, a new record and companies slash their profit guidance at a record pace.

Unlike Powell, Yellen and Lagarde do not have the KPI’s of being the US Economy’s cheerleader. Have we ever heard any central bank say anything incriminatingly bad to suggest they are not doing their jobs?

For us, it is getting harder to believe and we are not alone. Much trust has been lost in the global system – in institutions and policymakers, as Christine Lagarde bluntly put, “In too many cases, workers and families are now convinced that the system is somehow rigged, that the odds are stacked against them”.

Trade wars and hostility has been tearing into the fabric of globalisation and populist nationalism has been on the rise.

Against this backdrop, we head into the MAS’s monetary policy statement (MPS) on Friday, 12th October.

The Calls

We go into the MPS as a country and market divided, evident in the roller coast SGD NEER which has been fluctuating between 0.4 to 1.45 points on the mid USDSGD rate in the past month.

There is no tolerance for hate speech (or criticisms) in Singapore, so economists have been pretty constructive with strong cases for their calls which fall in 2 camps—unchanged or further appreciation in the slope of appreciation.

No one is expecting anything mind-blowing in for 1. Recentre, 2. Band Narrowing or, 3. Reduction in slope.

Unchanged = 0.5% appreciation that is the general market consensus.

Further appreciation = increase from 0.5% to 1% appreciation.

Both equally mild outcomes?

What Happened Since April?

After 24 “extended” months of zero appreciation, the longest on record, the MAS decided to let the currency strengthen once again albeit “slightly” which folks assumed was 0.5%.

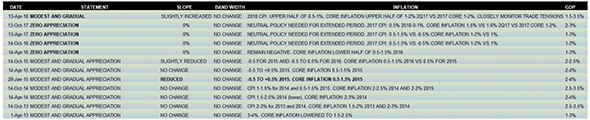

Table of Monetary Policy statements 2013-2018.

Table of Monetary Policy statements 2013-2018.

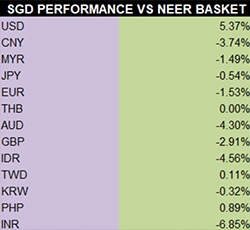

Since then, the Singapore dollar has strengthened more than 0.5% than most of the other currencies in the NEER basket with the glaring exception of the USD (-5.37%). (**How can anyone make a call on the USDSGD without making a call on the rest?)

Singapore Dollar performance vs our guess NEER basket 13 April – 5 October 2018.

Singapore Dollar performance vs our guess NEER basket 13 April – 5 October 2018.

The MAS SGD NEER Index has gained nearly 0.8% in the past 6 months, much less modest than the intended 0.25%?

MAS SGD NEER Index 2013- 29 Sep 2018. Source: Bloomberg

MAS SGD NEER Index 2013- 29 Sep 2018. Source: Bloomberg

Despite the “tighter monetary policy”, core inflation is at a 4 year high, at 1.9% yoy, and mighty close to MAS’s 2% target.

Singapore’s Core CPI 2012-2018. Source: Bloomberg

Singapore’s Core CPI 2012-2018. Source: Bloomberg

Singapore’s monetary policy success can only be judged by Sibor holding at a post-crisis wide against the USD Libor, Sibor managing to hold lower because of the concept of monetary tightening in Singapore equates to lower interest rates.

As such, Singapore managed to escape the monetary policy shock that is enveloping Hong Kong right now. The sharp spike in Hibor over the past 12 months (to overtake Sibor), is causing a mini rout in the real estate market and price correction.

What Is Happening With the Other Central Banks?

As we write, the PBoC has just cut their RRR (Required Reserve Ratio) for some banks for the 4th time this year. This is as the FOMC in on track for a 4th hike in December.

Starting October, Japan has halved its QE purchases, the ECB halves theirs again to €15 billion and the Fed ups its QT (Quantitative Tightening) to $50 billion a month.

In Asia, India, Indonesia and the Philippines have been on a tightening spree to stem currency losses. Elsewhere, we have mini crises in Argentina, Turkey, Venezuela, Greece, Russia and more.

Only Aaa-rated Australia and New Zealand have managed to resist hiking rates.

What will Trade-Dependent Singapore do?

A trade-dependent country cannot afford to be nationalistic and look inwards. A simple truth.

Singapore’s trade with her top 10 trading partners has grown substantially in 2017, notably with China and Malaysia.

Total trade growth with top 10 trading partners in 2017. Source: Bloomberg

Total trade growth with top 10 trading partners in 2017. Source: Bloomberg

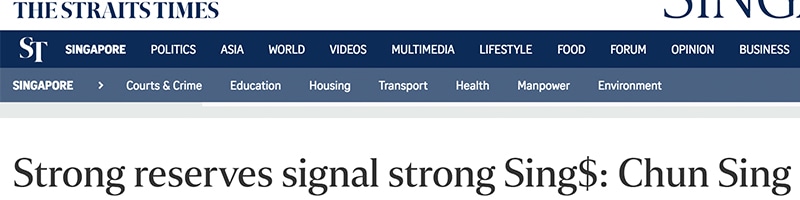

Just this week ahead of next Friday’s MPS, we had a surprise interview with Singapore Prime Minister candidate, Chan Chun Sing, with a sobering warning that “the damage from a prolonged trade war will be severe”.

Note Minister Chan had been quite happy about the strong Singapore dollar earlier this year, taking it as a signal of the country’s strong reserves.

Headline from February 2018. Source: ST

Headline from February 2018. Source: ST

The conservative path of action would be to wait on the 0.5% appreciation path for all the “dark clouds” that Christine Lagarde was talking about even as core inflation beckons.

From the political angle, it should be the path of further tightening to send a message to the markets of Singapore’s regional stability as a financial centre (for foreign investments) and that Singapore is playing ball in the global tightening game.

For all the pages of analyses and countless reports we have read out there representing many man-hours of hard work, thanks for hyping up the profile of the MPS and keeping the interest alive.

For all we know, after the tightening, the Singapore dollar may not necessarily strengthen all that much against the forces of the “dark clouds”.

The Thankless Job of a Central Banker

The big central banks of the world have it easier—they just need to look inwards and decide what they want to do, just by playing their economy’s cheerleader.

The Singapore central bank has more struggles because it juggles with a delicate balancing act between managing global market expectations, maintaining trade flows, guiding inflation and playing cheerleader, all with just a foreign exchange appreciation policy.

Central banking is a thankless job almost all the time because policy success is never appreciated and always taken for granted but blame will live on long after you leave. Yet, success is tough to measure because we can see what happened to Greenspan who was successful until the Global Financial Crisis even though Bernanke was helming the Fed then.

While we have seen many an ex-central banker get bashed, Singapore’s MAS has had an unblemished record in terms of policy success all the way and no one will be complaining about the outcome of this MPS in the future.

In fact, it would be a welcome distraction for a piece of honest and believable news. Thank you, MAS.

Hero Image: MAS