Market Thoughts: Vacillating Between Just Gloom or a Worse Doom?

What better way to spoil a friendship, for the lack of “lunch kakis”, most of whom are too depressed to eat and overwrought to talk, than to start a lunch conversation by innocuously asking, “Hey, didn’t you say you would buy Tencent at $300?”.

A baleful glare and we quickly switched the topic to our own troubled portfolios carefully omitting Tencent’s twenty per cent jump in the last 2 days of the week.

20 bucks for lunch becomes a mild grumble these days when this time last year, friends were rushing to shout the meal. Now, going Dutch seems to be the best policy.

Gone are the days when private bank clients wish out loud they had themselves a banker who would advise them there is nothing much to invest in or even suggest a safe haven in Bitcoin which has managed to preserve its value in October.

Misery levels are running high and we were shocked when we inadvertently discovered that various friends have considered the meteor-strike theory, separately, and concluded that they wouldn’t actually mind a meteor to strike for the state of the world today.

Is stress the reason for the flu epidemic?

Stress hormone cortisol increases blood sugar levels, suppresses the immune system and aids in the metabolism of fats. And so we succumbed to the flu while friends are struggling with their blood sugar, as our portfolio valuations crumble.

Thank Goodness for the Flu

Give yourself a pat on the back. October is over and what we have seen is nothing short of what we have never seen before.

- 16 Down days in October is the most for any month since the 1970’s and tied for 3rd worst month since the S&P 500’s inception in 1928 (Source: Sundial Capital Research)

- Global stock markets have lost US$ 8 trillion in market capitalisation in Oct 2018, the worst month since Oct 2008 (and $15 trillion for the year so far)

- The S&P 500 gave back all its gains on the year and Apple Inc is under 1 trillion in market cap again.

- Amazon lost more in market capitalisation than what the entire company was worth in 2016, taking 18 years to hit a market cap of $250 bio and losing that much in 8 weeks.

- Only 20% of assets classes have generated positive returns in USD terms this year, lowest since the 1970’s stagflation episodes and the Global Financial Crisis.

- For the crazy sell-off in stocks, bond yields have not significantly declined, giving little comfort to investors

Thank goodness for the possibly stress-induced flu to have kept us sane because no one we know has seen such a prolonged lapse of constipated fear and pessimism in 16 down-days.

On a bright note, isn’t it such an honour to be part of history?

Vacillating Between Just Gloom…

November comes, trade wars potentially shelved, American mid-term elections around the corner, Brexit and Italian problems near resolution and China staging a remarkable rally.

It feels like we can go back to the old times of 2017, not having to think too much but we know, deep inside, that something in the markets has changed fundamentally.

Is it just the usual gloom of a correction that time will heal or is there a certain doom of a financial crisis lying ahead?

It is all right to be vacillating!

One minute, we have Donald Trump tweeting a potential trade deal with China, causing the Chinese indices to soar 4% in 2 hours and then we have Larry Kudlow coming out to say he is not optimistic about reaching a deal.

One minute we had American sanctions against Iran starting 5th November, and then we have Trump exempting 8 countries from Iranian oil for fear of Europe, Iran, China, Russia, India and gang forming an alternative payment settlement network to SWIFT, to which the US would have no visibility.

As Doug Kass said, “It’s a Mad, Mad, Mad, Mad World” now where Politics is Making economic Uncertainty and market Volatility Great Again, #MUVGA.

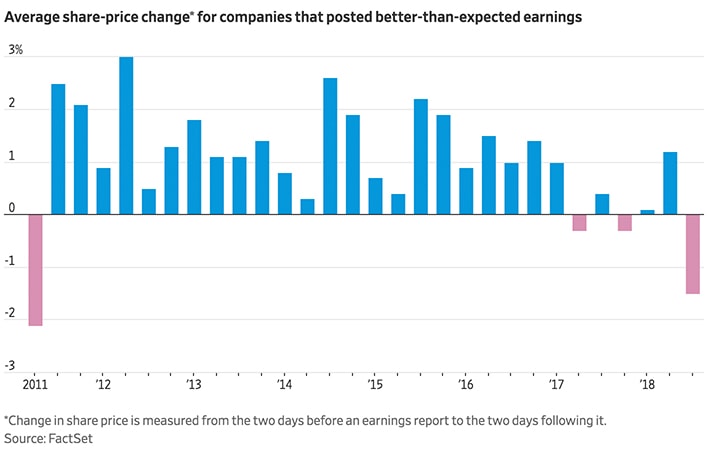

Yes, we know that gloom abounds when WSJ reports that “Investors are selling the shares of firms that hit quarterly earnings expectations at the highest rate since 2011, a sign of concern over how long the good times can last for American corporations”.

Source: WSJ

Source: WSJ

Doomsayers are out in a show of force, calling for a lost decade to come in equity markets as earnings will revert to their long-term mean.

Armed with charts that shows some serious technical damage to stock prices and the indices, there is every reason for us to believe that the data will find its way into most of the algorithms out there that are responsible for most of our daily gyrations, although, according to Morgan Stanley’s Mike Wilson, we can be sure to “expect violent rallies along the way but with market liquidity about as bad as we have seen in our careers, trying to capture them will be difficult”.

The bull camp expects buyback activity (which has equated to 3% of total market cap this year) to resume after earnings season, a “short squeeze higher”, a resolution to the trade war, year-end buying for portfolio window dressing.

Then we have brilliant hedge fund minds who forecast a 20% rebound before a 40% crash next year or the statisticians with data backed responses like “extreme oversold conditions tend to lead to above-average forward returns with a higher probability of a positive outcome than other periods”.

In addition, it is too early to signal doom because there were 22 market corrections since 1974 and only 4 eventually ended up as bear markets (i.e. 20% lower) and it will be another 21 months till that happens, according to BofA.

Yet, there is only 1 consensus so far in all the economic reports floating out there which is not found in any “economic cheerleader” aka central banker’s rhetoric—the global economy is in its late-cycle, and that we are close to the final inning.

That justifies the GLOOM and that would be the better case scenario, of just slowing growth and possible technical recessions.

… or a Worse Doom?

Why do we feel a sense of doom?

And is it not bad enough that we have just been informed we are eating plastic and will be eating plastic for the rest of our lives?

Source: Bloomberg

Source: Bloomberg

“The current political climate is as hateful & volatile as I’ve ever seen in my lifetime. If people are pissed off and angry with unemployment at 3.7% I shudder to think what will happen when 6%-8%+ unemployment is coming back.”—Sven Henrich on Twitter.

Populism (and hate) is on the rise around the world with new developments weekly. Just as we had Brazil elect a mini-Trump and Angela Merkel announcing her leadership secession this week.

The US dollar’s hegemony seems to be coming to an end as Central banks send out a message of doom with gold buying at highest levels since 2015.

Politics is forcing globalisation to take a step back and even if trade tensions ease, because the unease and mistrust will linger for a prolonged period of time.

The risk rises daily as we come to the realisation that we are in the late innings of the current economic cycle and we start to see real estate markets correct around the world to compound on stock market weakness, for torrid wealth destruction.

Property market doldrums headline. Source: Australian Financial Review

Property market doldrums headline. Source: Australian Financial Review

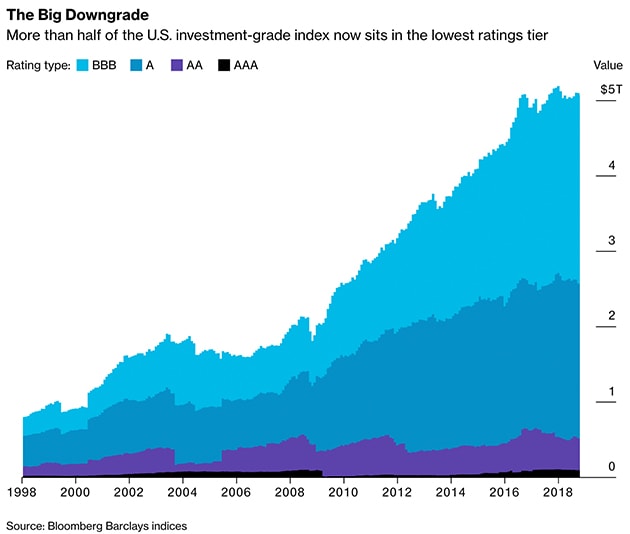

Real estate and equity markets aside, the strains on the bond market grows daily.

The US Treasury will be borrowing over US$1.3 trillion in 2018, more than 2016 and 2017 combined as the FOMC continues on a hiking path.

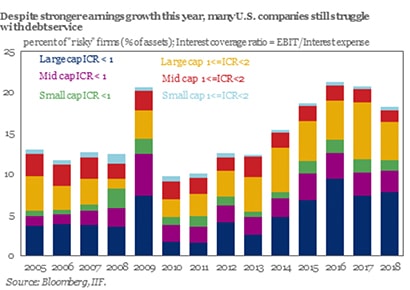

Meanwhile credit quality continues to deteriorate as this week’s GE downgrade to BBB+ will swell up the ranks of the lowest tier investment-grade bonds by another US$100 bio. Morgan Stanley expects as much as US$ 1.1 trillion of these BBB papers to be downgraded to junk in the next downturn which makes sense given the percentage of companies struggling with covering their interest expense.

Graph of the Investment Grade Bond Index composition Before the GE downgrade. Source: Bloomberg

Graph of the Investment Grade Bond Index composition Before the GE downgrade. Source: Bloomberg

Graph depicting % of companies struggling with debt servicing. Source: Bloomberg, IIF

Graph depicting % of companies struggling with debt servicing. Source: Bloomberg, IIF

At the same time, we cannot keep up with the Chinese defaults which have not affected us all that much given that the local Chinese investors have been the worst hit.

As we read on Zerohedge, if we had 8 global crises in the past 50 years, surely we can expect another one eventually and so “the question is not if, but when”.

Let’s not forget about the impending pension crisis that will add to the social stress (and hate) should a downturn arrive although stress hormone cortisol will probably just cause a global scale flu pandemic or global diabetes outbreak?

Let’s Not Choose the Meteor

We are kidding about the meteor but here are some headlines we have snapped for posterity (and for a good laugh in the future).

Source: Bloomberg

Source: Bloomberg

Quote from The Chartist, on Twitter: “Some days, weeks, even months this job is really hard and tests every fiber of ur sanity and self-worth. It also cleanses you of ur arrogance, false fronts, and hypocrisy. In their place comes humility, honesty, and empathy and those things that can change the world.”

Source: Zerohedge

Source: Zerohedge

A possible solution?

Source: Independent

Source: Independent

“Don’t be a cry baby!”, as we questioned a friend who was lamenting his fund is down just 8% this year, “Weren’t you up over 20% in 2017?” and we earned another baleful glare for this crazy week, still undecided between Gloom or Doom.

Why did the stupid stock market have to make a new high and free fall?

Why does the lowest-income households in the U.S. on average spend $412 annually on lottery tickets, which is nearly four times the $105 a year spent by the highest-earning households when the odds of winning last week’s Mega Million Powerball jackpot of US$2 bio was about 1 in 300 million?

Why are people still grabbing those new condo launches?

“A lot of decisions are statistically wrong but intuitively right for the person making them… People are often wrong, but few are crazy.”—blog post: No One is Crazy, Morgan Housel

Vacillating away between gloom and doom, we gleaned some inspiration from another friend who has set aside a “short market” hedge strategy to earn a new car in the next 12 months, knowing the main portfolio will not be delivering that new car and we would not venture to call that crazy because we intend to earn our new car with a weekly lottery ticket which would also serve to lift our spirits for those few days until the next draw.