We All Love To Hate The Bond Market

We have decided that hating everything is all we will do for a while. Just review the week, for instance, and the ugly US midterm elections and the anger in the air that has not spared even Singapore, as we read about Facebook who would not back down from anti-Singapore government rhetoric.

Happy Singles Day! Go shop your anger away.

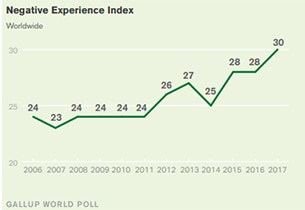

We know we possibly have the right to hate because World Happiness levels have hit rock bottom with “global mood at its gloomiest since the first such survey in 2006”, since the Gallup started tabulating results through even the Global Financial Crisis.

2018 Global Emotions Report. Source: WEF

2018 Global Emotions Report. Source: WEF

Ironic, perhaps? That’s if the economy is so good, for indeed 2018 is expected to have the fewest countries in recession ever (minus South Africa and Argentina), and there is so much hate and discontent, what would happen if recession struck?

For all the pessimism, it looks like everyone can become great bond traders. After all, bonds are Pessimism’s best friends, except for some of the happy high yield stuff, for the safe haven nature of the investment. Equity folks should typically be more optimistic people (and less angry, perhaps)?

Hating Bonds

Plenty of reasons to hate bonds which have lost just about US$500 billion globally this month, according to some reports. It is a small sum, in perspective, compared to the US$247 trillion in debt outstanding (historic record), a number that includes US$63 trillion of government debt. It is impossible to expect to lose 500 bio every other week and that loss is unrealised, in any case.

Worried friends have been calling about what is our take on Hyflux’s “application for super priority for rescue financing” in the courts.

Without delving into details, for there is none that the public can avail themselves to, we can only guess that the cash injection will not be going towards paying off creditors anytime soon and we are looking at boom times for the lawyers.

Talking about poor treatment of creditors and bond investors getting the thumbs down at restructuring meetings such as an alleged incident of a certain chairman who yelled “You can walk out of here, you won’t get a cent back”, to a substantial bond holder, we also have other chairmen of bankrupted companies appearing on Straits Times Me & My Property section a few months post-default, with no mention of the default, of course.

No wonder the first question, financial advisor friends ask these days is, “Will default or not?”.

Wait a minute here. Nobody should buy a bond with the thought of default which defeats the purpose of buying a bond in the first place. We certainly do not think that way when we buy equities and they are certainly higher up the risk ladder than bonds.

More Reasons to Hate Bonds

It is definitely more than Hyflux that bugs us these days.

Globally, we have former Dow 30 component (from 1896 till 26 Jun 2018) General Electric cut to BBB status and Ford (BBB/Baa3/BBB) teetering on junk status, as their credit spreads grind wider, in line with or wider than high yield junk names.

Source: Bloomberg

Source: Bloomberg

Ford is the top 15 biggest corporate debt issuer (US$150 billion outstanding) in the US outside of the financial sector too.

For comparison, we have junk-rated Netflix (Ba3/BB-) of 2026 maturity yielding 5.45% USD versus a Ford 2026 going at 5.65%.

The Italian government is not far behind for its Baa3 and BBB rating, for its USD 2023 paper is going at 5.15% and the largest Italian bank, Unicredit SPA (Baa1/BBB/BBB, US$ 201 billion in bonds outstanding) paying 6.26% USD for its 2027 senior paper, to make slightly lower rated Ford and junk-rated Netflix feel better.

There will be more to worry about next week for GE (US$ 65 billion in bonds outstanding) with its shares getting decimated last week, down 15% on the month and 50% on the year.

And we have even more credit woes to expect next week after China’s surprise state edict to her banks to increase their private sector loans to a third (from its current 25%) of their total lending.

The news did not go down well with the markets which learnt on the same day that Chinese bondholders are being paid in HAM instead of cash, in a unique case of barter.

Source: Bloomberg

Source: Bloomberg

It does not help that there are just nothing but corporate scandals and more scandals that emerge each day as we read that the “ex-chairman of one of China’s state-owned banks has just been accused of taking about $240 million in bribes, squandering state assets and maintaining a string of (presumably expensive) sexual relationships”.

Yes, we are talking about the almighty China Huarong Asset Management Co (2799 HK, US 43 billion in bonds/loans outstanding) whose future remains unclear as their USD 2027 paper trades at 5.77% for its Baa1/A ratings (to make Ford and Netflix feel good)!

Source: Bloomberg

Source: Bloomberg

More losses and bad loans in store for the Chinese who seem to be getting away with all these frauds as we read just last week of a massive loan fraud that occurred between 2010 to 2014 involving US$6.1 billion and a “sliced up” bank chairman.

No unnatural deaths reported this week but we had the suspension of “3 clerks promoted to executives at Chinese state firm” to raise more eyebrows and wonder how much more losses we will see soon?

Source: SCMP

Source: SCMP

Locally, the Singapore bond market has other problems besides Hyflux and CW Advanced Technologies’s S$55.25 million default in June this year.

What about Lippo Group (linked to Lippo Malls Indonesia Retail Trust, OUE and First Reit etc) whose deputy chairman’s home was raised last month on corruption charges?

What about Vibrant Group (S$ 66 million in bonds outstanding) which suffered a “suspicious fire” in China that led to the destruction of vital accounting information?

Lendlease Group (LLC AU), Singapore investors’ favourite Australian real estate bond issuer with S$650 million in bonds outstanding, had to call off a US$ 500 million bond issue on Friday after shocking A$350 million writedown that wiped 18.3% off its share price.

At this rate, we are not happy about bonds at all.

Keep Hating

There is one thing that the world is not in supply of—bonds.

The US government just saw their 2018 borrowing needs surge to US$ 1.34 trillion which is more than 2016 and 2017 combined.

US National Security Adviser Bolton, just called the US national debt an “economic threat” which makes plenty of sense because the US government paid US$1.5 billion in interest payments daily for 2017, a sum that would rise to US$ 2 billion per day in the coming years, or roughly 1.8% of GDP in 2019.

More bad news this week as the US Treasury department’s 30-year bond auction drew the weakest demand since 2009 even as 30-year mortgage rate in the US rose to 4.94 %, the highest level since Feb 2011.

The reasons for the poor demand for US government debt are plenty.

1. Supply reasons obviously

2. The end of quantitative easing from central banks (the US on pace for $30 billion a month)

3. The stagnation of Asian demand from countries such as South Korea, Singapore, Thailand and Taiwan as trade slows

4. The lack of demand from Europe and Japan as the cost of hedging makes negative yielding bonds in Japan and Europe more attractive to local investors than USD debt

5. Finally, the FOMC is still bent on hiking interest rates a few more times in the years ahead which would drive yields higher (and prices lower)

The icing on the cake would be liquidity and we are talking about 2 types of liquidity here—financial conditions and the availability of funds as well as the liquidity in the depth of the bond markets.

As it is, liquidity indicators have pointed to rapidly tightening financial conditions. We do not need access to expensive research to know because it is evident from signs like the hedging costs (mentioned above) and in the Libor-OIS spread which is the difference between what banks pay versus the recommended Fed Funds rate (theory).

We can imagine liquidity conditions will only get worse from here as central banks continue unwinding their balance sheets which means even if interest rates are not raised, the amount of surplus cash in the markets will continue to shrink unless banks go on a lending spree which is hard to imagine given asset valuations from equity to real estate are looking peaky.

The other bigger concern for the layman and investors would be market liquidity—the availability of finding bids or offers for bond instruments.

As we have been informed, it is considerably harder to get prices these days and we are not referring to Vibrant or Lippo Reit bonds which, as we understand, have not traded for a long time.

It extends to even names like Ford and Huarong, where we hear sellers have difficulty selling, having to settle for prices well below what is displayed on the screen. It would almost appear as if banks have come to a certain truce amongst themselves in creating an impression of stable prices minus the intention of honouring those prices.

The exit of players and the trend of the market towards smaller deals as Bloomberg reports that the dearth of secondary trading risks breaking the cycle of liquidity and exit of investors and ultimately the exit of secondary banks which threatens the market as investors demand more for the risk they are taking—a vicious circle.

Source: Bloomberg

Source: Bloomberg

We Love to Hate Bonds

Looking up defaulted bonds on Bloomberg, we noticed the amount of SGD dollar debt defaults is ranked 5th in the world for the past 4 years. As a currency, Singapore dollar debt outdid Canada, UK, Norway, South Korea, India, Hong Kong, Japan, Turkey, Switzerland, to name a few, only falling behind the US dollar, Chinese yuan, Europe (EUR dollar) and the Russian ruble.

That is some claim to fame for a small market like Singapore’s even as we noticed the numbers did not include the mega restructuring’s like Ezion and conveniently left out the Marco Polo Marine’s and Ausgroup, to name a few.

Finding out that bonds may not be a “store of value”, unlike HDB flats, is perhaps the biggest lesson we have learnt (or not learnt) in recent years as we still see new issues lapped up greedily in complete disregard for the higher registered SIBOR rates and the highest SOR rates we have seen in 9.5 years.

We love to hate them bonds, besides hating lots of stuff that is happening in the world and the environment out there. Yet, there is no denying that some bonds could be the potentially safer place to be in the days and months ahead if one chose discerningly.

It is not always about the default risk but the price one gets for taking on the risk.

Did we mention the regulatory changes that will see a slew of subordinated issues hit the street next year?

We would love to talk about how much we hate it too but, with just a few hours left to the end of Singles’ Day sales, we’d better go shop our anger away.