Banking Talent Highly Sought After in Singapore and the Philippines

Singapore and the Philippines continued to exhibit uninterrupted, double-digit demand for banking executives during the month of November, a feat previously achieved during both months of September and October. This is according to data provided by the Monster Employment Index.

The Monster Employment Index (MEI) is a monthly gauge of online hiring activity across Singapore, Malaysia and the Philippines, tracked by Monster.com. It comprises data for overall hiring activity in each country, as well as specific data in the banking and finance sector.

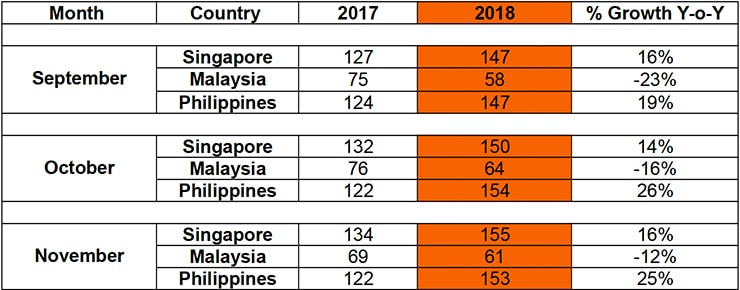

In line with figures reported during past months, hiring of financial talent in Malaysia for the month of November continued to decline. The year-on-year dip reported during the month was 12%, while October saw Malaysia experience a 16% annual decline.

The Philippines, albeit 1% down from its annual demand of 26% in October, reported an impressive 25% year-on-year boost during November. Singapore gained 2% from its October figure of 14%, clocking 16% year-on-year growth for the month of November.

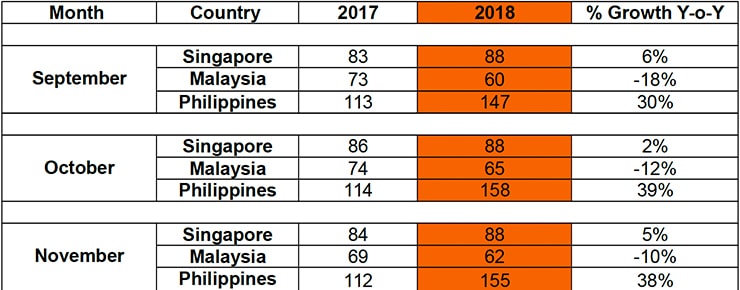

BFSI Industry:

Once again, the Philippines outperformed its Southeast Asian peers in terms of availability of banking and finance roles, reporting a gargantuan 38% year-on-year growth for the month of November. Despite displaying positive annual growth, Singapore only reported a 5% annual growth for the month. However, this is a 3% improvement from the 2% growth recorded by the republic in October.

In line with the annual decline reported in October, Malaysia failed to make a mark with its abundance of banking and finance roles during November and reported a 10% annual decline.

“The fintech component of the finance industry has seen considerable growth and is poised to bring massive positive change to the lives of consumers. In Southeast Asia specifically, where the prominence of cash outweighs other payment methods, there is ample opportunity for digital banking to flourish. The existence of facilities such as contactless payment, robo-advisors and peer-to-peer money transfer services in Southeast Asian countries with more robust banking infrastructures is changing people’s lives for the better,” said Abhijeet Mukherjee, CEO of Monster.com—APAC and Middle East.

“Financial institutions are recognising the immense potential which is yet to be realised by the banking industry, and require sufficient manpower, preferably those with a working knowledge of the latest tech trends, to help scale innovations.”