Bond Markets Are Ba De Ya, Dancing in September

Are we living in an artificial simulation? That will be the big question making headlines in the coming months as the world eagerly anticipates the reboot of the Matrix series and mostly because it is just too easy to believe we are living in an artificial simulation as Elon Musk would wholeheartedly agree with. Things just keep getting more bizarre since we wrote about Bizarro Markets – A New Paradigm last month.

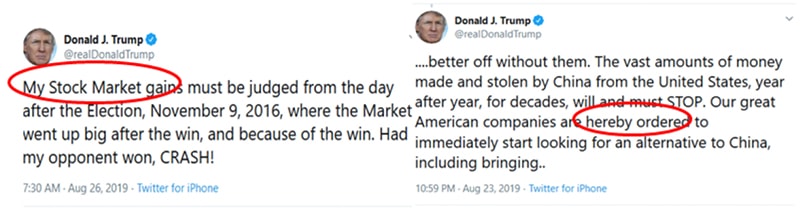

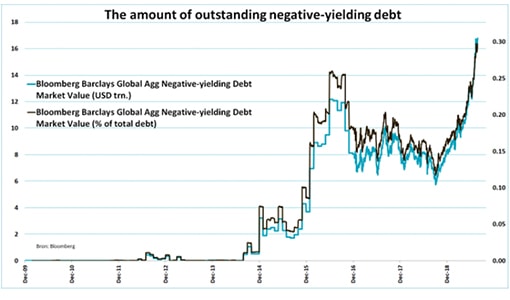

Yes please, let us be living in a video game because reality is looking quite farfetched after this week in the markets. We also learnt a new word—“prorogue” from the Brexit fiasco, and stare at 17 trillion worth of negative-yielding bonds with US stock markets within 3% of their all-time highs and Donald Trump talking about nuking hurricanes, buying Greenland, claiming that he is the “Chosen One”, “hereby ordered” US companies to exit China, invite Putin to the next G7 which will be hosted at his golf club, referring to “My Stock Market” and lying about a phone call with China to support stock markets.

Signs of brain damage?

Probably. Because the World Health Organisation estimates 9 out of 10 of us are breathing polluted air which harms the brain, especially children and it would seem the current generation of young adults is affected, along with the politicians running the show as an estimated 20% of American adults mentally ill which means it is not too hard to imagine Trump as potentially impaired.

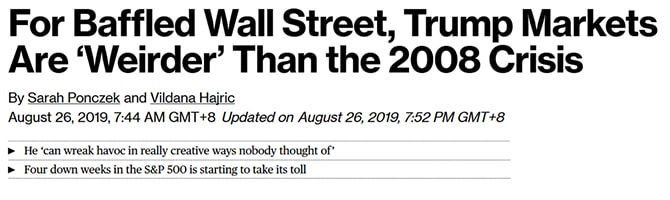

Markets have given up because the next financial crisis is TRUMP, “who can wreak havoc in really creative ways nobody’s thought of before”.

Source: Bloomberg

Source: Bloomberg

Trump has wrested control of markets as former New York Fed economist Eggertsson observed at Jackson Hole that “when Powell was giving his speech, I could see everybody on their iPhones, refreshing Twitter, waiting for the tweet from Trump”, because “the big policy uncertainty, now, of course, is Trump. It’s obvious”.

Source: Bloomberg

Source: Bloomberg

We conclude Trump will do anything in his power to make sure stocks go higher and there is no greater evidence for our conspiracy theory, besides the fact that he lied about the “Chinese phone call”, than the other fact that Norway Central Bank recommends that the sovereign wealth fund reduces European equity exposure and boost North American investments by $100 billion (nearly 10% of its AUM) even as US insiders sold an average of $600 million of stock per day in August, according to one research firm.

So we had the whole market protesting even harder, as we predicted 2 weeks ago in our post, In Protest – What Markets and Riots Have in Common.

Italy’s 10-year yield drops below 1% for the first time, the 2-year vs 10-year and the 3-month vs 30-year US treasuries inverted the most since the crisis, 94% of all Swiss-franc corporate bonds have negative yields (from 50% 5 months ago) and Argentina decides to default for the 3rd time as we remember.

The total amount of the negative-yielding debt within the Bloomberg Barclays Global Aggregate Index has reached another record-high of USD 16.8 billion comprising 30% of the index (up from 27% less than 2 weeks ago) and $3 trillion were sold at their offering with negative yields.

Source: Jeroen Blokland on Twitter

Source: Jeroen Blokland on Twitter

Pension funds protest Financial Vandalism and “the true madness is pension funds being forced to invest in assets which will be guaranteed to lose, such as in the case of long-dated inflation-linked gilts at real yields of -3%… It is financial vandalism and the government and central banks need to wake up to this”, said Mark Dowding, chief investment officer at BlueBay Asset Management, which has pension-fund mandates.

Source: Bloomberg

Source: Bloomberg

There is hostility building up against central banks and amongst central bankers as Danish watchdog chief, Jesper Berg, suggests the Europe’s banks are close to a tipping point on negative rates at which “something needs to give”, as European bank shares test new lows.

Are we living in an artificially simulated bond market?

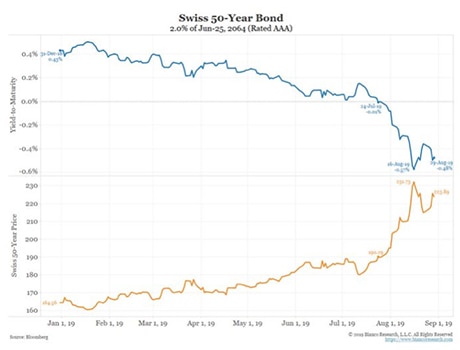

Jim Bianco: “Why would anyone in their right mind buy a negative yield 50yr bond? Because its price (orange) is up 36% YTD! July 24 is the day its yield went negative, a month ago. Why own it then? Because it’s up 18% in a month!”

Wait.

The world is richer than ever. A quick survey of fund manager friends peg returns between 8-15% year to date and it is hardly a surprise as this is the best August for US bonds in the last 4 decades, up 3.3% for the month and 14.1% for the year for their best return of any year since 2009.

Source: Bloomberg

Source: Bloomberg

It is an eerie feeling when Singapore gets singled out for having the highest yield in the developed world and towers over emerging markets like Thailand, Latvia, Slovenia, Bulgaria, Croatia, Israel, Czechoslovakia and the gang. In other words, Singapore bonds are the worst performers in the world this year as we had pointed out in May which is true because the 20-year Singapore government bond is only up 7-odd per cent since last month in a disappointing show versus even Greece.

Source: Bloomberg

Source: Bloomberg

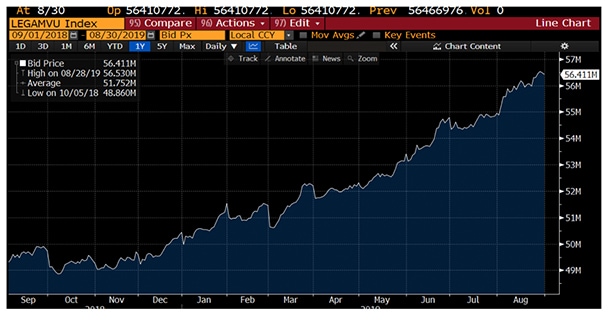

To put into perspective, the market value of the Bloomberg Barclays Global-Aggregate Market Index which measures 24 local currency markets has swelled to $56.4 trillion, and we can assume the $1.45 trillion monthly increase (2.6%) is almost entirely caused by valuation gains as it sits on 2.03% monthly returns, assuming negligible yields.

Bloomberg Barclays Global-Aggregate Total Return Index

Bloomberg Barclays Global-Aggregate Total Return Index

The 3 month return is 4% and based on the same assumptions, we are staring at a whole ton of paper profits for markets and exploding wealth and we are talking about trillions of dollar gains.

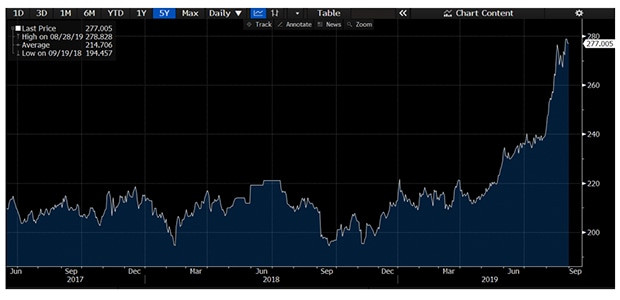

The most expensive bond in the world today is arguably China’s 100 year bond issued in US dollars back in 1996 that paid 9% then but yields around 3% today and trading at a cash price off 277 (up 16% on month) which means we are paying $2.77 to get back a dollar in 2096.

Graph of China 9% 2096 bond price

Graph of China 9% 2096 bond price

The Swiss 50 year bond had a better month at 18% returns comparatively but who is counting as hedge fund bond kings pull at their hair, underperforming their peers and lagging behind benchmarks as they stalwartly refuse to join in the market which is starting to feel like an artificial simulation and we are caught up in the Matrix bond world with “Aiii, Dancing in September” by Earth Wind & Fire playing in the background.

Source: Reuters

Source: Reuters

A quick search shows nearly 50 bonds out of the 2.5 million issues out there trading above 200 and nearly a thousand bonds trading above 150 in price, a staggering number to imagine all the profits there.

Graph of Global Market Cap vs Global Bond Market Cap (normalised). Source: Bloomberg

Graph of Global Market Cap vs Global Bond Market Cap (normalised). Source: Bloomberg

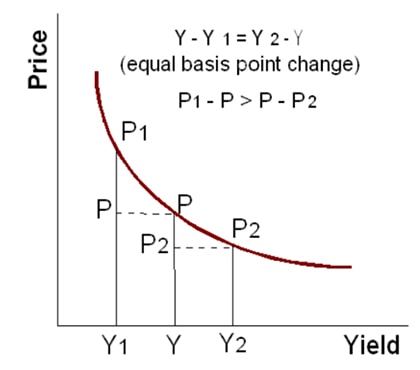

And the math is starting to get at our nerves because every 0.01% move lower in yields brings larger price gains for the buck as yields go lower.

Source: Analystnotes for CFA

Source: Analystnotes for CFA

This is the source of greater wealth and paper profits but it also portends to significant losses if yields reverse higher even if just little by little although we cannot see anything of that sort happening in this Matrix bond world or Bizarro market that is in state of protest right now as yields keep marching lower.

An investment manager friend shook his head lamenting the fast and furious gains of August which means the risk more severe trials and tribulations ahead even as he basks in the glory of the moment which reminds us of something we read some weeks ago about a certain zombie-ant fungus that invades an ant’s body, grows throughout its tissues, orders the zombie-host to climb up a tree and bite onto a twig, killing the ant. That is surely worse than breathing ourselves dumber each day and inundating our brain with enough pollution to thank Trump for the uncertainty that has made August the best August of our lives.

And while there is the worry and feeling that we are living in a certain Bizarro artificially simulated world complete with a fake Matrix reboot, the zombie markets march to the tune of “Ba de ya, dancing into September”.