Ignorance Is Bliss In Singapore Bond Markets

Over a chat with some smart people, I got to thinking how some people are too smart for their own good, not as an admission of any intellectual inferiority but plain common sense that we cannot expect others to think like us or have the means to.

The conversation was over the observation that Singapore interest rates have risen substantially in the past fortnight but investors were still buying bonds at higher prices, quite oblivious to the happenings of the real marketplace where we have Singapore government bond prices down 0.5 to 2%, and the Federal Reserve of the US getting ready for their first rate hike for 2017, with the market pricing in a total of between 3 to 4 this year, each for 0.25%.

My poor friends who have never worked in the world of private wealth, whose interactions was only with their private bankers whom they bark out their orders to, have no idea that the real world is not theirs but a world where the common man is unable to access interest rate information but for the much delayed updates from their bankers.

How would anyone know where the 5-year interest rate is unless they have access to Tullett Prebon’s Singapore interest rate screens on Reuters? Even Bloomberg subscribers do not have access to the pages automatically unless they are specifically permissioned as users, having to make do with the generic Bloomberg feeds that are approximations of where the live market prices are and even if they do, what is a layperson suppose to do with a bunch of quotes for IRS, CCS, basis swaps, SIBOR basis swaps, OIS and FRAs?

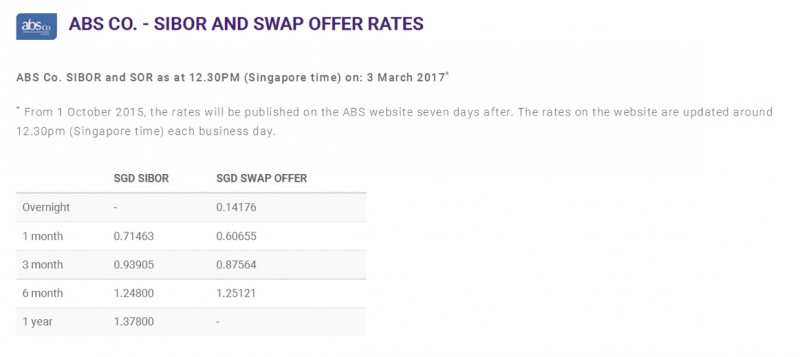

6M SOR? That is a fixing that is inaccessible to the public and only on a subscription basis by the Association of Banks Singapore who has decided since 2015 to release the information to the public a week later.

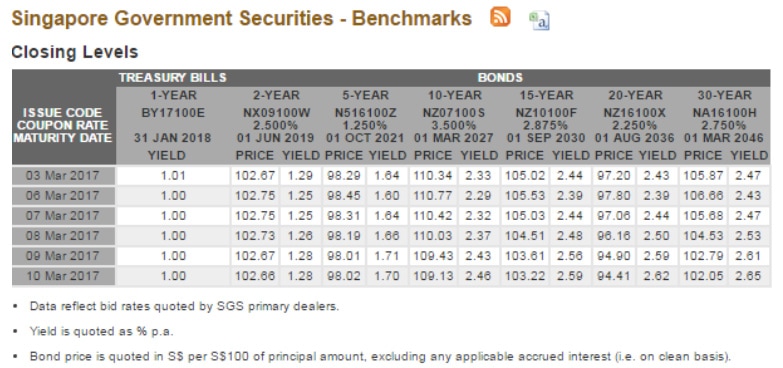

Even if you are resourceful enough to find the answers on government bond yields on the MAS website, you would be looking at a screen like this which is not terribly hard to figure out after a while.

Now, is it any surprise that there are people still buying bonds when the rest of the world is selling them?

Ignorance is Bliss and It is Free of Charge

What is the point of MAS telling us that Singapore rates should take cues from rising US rates, when the public does not know where the rates are except that savings accounts are paying close to zero and their mortgage rates are somewhere under 2%, depending on where SIBOR is and SIBOR could well be the most manipulated index around given that Singapore does not have an interest rate policy which means it is technically priced off the charity of a bunch of banks and the “market forces”.

My dear friend who used to assiduously post pieces on the bond markets and interest rates has long since given up on her lonely crusade and gone back to paying work while many other experts I know prefer to only share their thoughts with paying clients who are mostly not locals because Singaporeans are not in the habit of paying for good information given our media outlets are free of charge (even the New Paper is now free) and our banks send out nicely packaged PDF reports for their privileged clients that most investors are.

Thus, we end up with a happily ignorant public who do not really have to worry too much about the complicated world of interest rates even if we are on the brink of a rate hike cycle which is not really important until mortgage rates spike that extra 1% which only adds $10k per annum on a $1 mio quantum loan, not too unbearable for our median household income of $104k ($8,666 monthly in 2015).

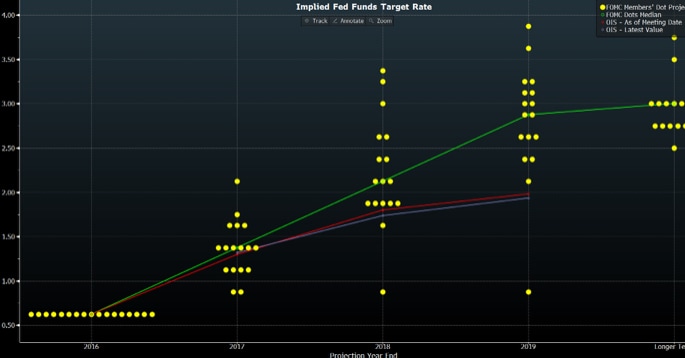

Besides, the market is paying scant heed to the Federal Reserve, expecting only a 1% hike in total till 2019, well below the central bankers’ median target, if we note the green line versus the market’s purple expectations.

I Am No Expert Or I Will Be Charging You

I cannot burst the bubble on those smart folks and what they are thinking but I can let leak a bit just to console myself that I have done by part to society. And it is that there are big flows afoot in the credit markets as US ETF inflows have fallen 84% in the past week with outflows from the IShares iBoxx $ High Yield Corporate Bond ETF (HYG US) seeing a steep outflow of $1.47 bio, shortly after hitting its 15 month high in February, that we wrote about last month in Sell Stocks Or Sell Bonds?

To put into the perspective of a picture as seen below, we note that the outflows are substantial to match the drop in oil prices (-10%), Russell 2000 (-3%) and 10Y treasury yields, among other assets that give cause for concern in the face of a series of rate hikes that the market is not completely pricing in.

There are many reasons for lower bond prices even when financial conditions are better than they have been for the past 15 months which either suggests market complacency or something better, like easy monetary conditions and the absence of credit risks and I am not about to embark on a lesson here, suffice to say that the sharp correction in the HYG ETF is probably due to higher interest rates and 10Y US yields at their highest levels since 2014.

Whilst some folks may believe that high yield bonds are less correlated to higher rates than the investment grade stuff, it would not do too well to rush into the trade with the FOMC next Thursday, 16 March, morning at 2 am with a press conference to follow, and definitely not when the market is pricing in less hikes than more.

We will have to wait for that reality to bite and it could be all likely that the dip in the HYG is nothing more than a fussy correction from its 15 month high from Feb and ignorance is bliss if investors continue to swipe up bonds happily oblivious to the going-on’s of the interest rate markets for we do not want too many smart people out there to spoil the broth for us just because they are too smart for their own good.

Leave The Singapore Bonds Alone!

I, for one, think that it does not pay to think too hard or too smart in Singapore and while I do not have much interest in the Singapore markets, adopting a golden rule of only entering the fray during periods of distress, I do think that the lack of transparency on interest rates will pose long term problems for clients even if it benefits the bankers by keeping the public in the dark and the smart folks can beat their chests in despair as Singapore bond prices buck global trends and decide to leave the Singapore markets alone.

That is what I would be doing for now, looking to pick up the HYG at lower levels, getting some bang for the buck and leave ignorance in bliss.