Singapore Corporate Bonds 2018: No Time To Be Bullish

Peak Year 2017 – A Recap

We will remember 2017 as the peak default year for the Singapore corporate bond market with just under S$2 bio worth of bonds come under some form of restructuring, 9 oil and gas related names, leaving no oil and gas company with bonds outstanding spared.

Coming hot on the heels of the 5 defaults in 2016 affecting about S$1 bio, the markets have been kinder in 2017 as buoyant stock markets gave their best returns since 2012, in excess of 18%, with the total market cap breaking $1 trillion, which helped diversified portfolios take the blows in their stride, giving the markets a semblance of calm as negotiations continued behind closed doors.

Then we were buffeted by the wave of en-bloc sales, lifting spirits even higher as the media scrambled to cover their tracks after crying wolf on real estate bonds back in 2016 and bank analysts retracted to turn decidedly bullish barely a year after bracing us to expect the worst.

Singapore government bond markets saw their best gains in 5 years as interest rates fell across the board, lifting prices and keeping corporate bonds supported.

While we saw peak maturities in 2017, with over S$22 bio in bonds retired or called-back (excluding defaults and restructuring bonds that are in limbo-land) and S$24.9 bio in new issuance, the amount of wealth generated in en-bloc sales alone is S$7.3 bio and the STI added another S$130 bio in wealth effect which suggests there could have been a lot more demand for bonds.

With retail demand in the driver’s seat, undeterred by the defaults in the O&G space, drawing great comfort from the real estate sector euphoria and the lower interest rate environment, we saw a peak number of perpetuals issued, 15, breaking the record 12 in 2012 on a smaller notional of S$4.975 bio (vs S$5.68 bio in 2012).

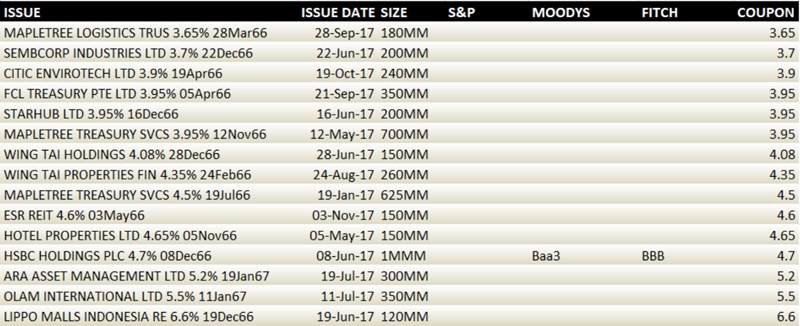

2017 saw a race for the lowest coupon paid by a perpetual bond, and Mapletree Logistics, at 3.65%, and Sembcorp Industries, at 3.7%, managed to dethrone OCBC’s 2015 3.8% lowest perpetual coupon record (although its yield is now much lower). 6 out of the 15 perpetual issues paid coupons under 4% and only 1 issue out of 15 issues was rated by a rating agency, a sure sign of investor demand or desperation?

Table of SGD perpetual bonds issued in 2017, ranked on coupon (lowest to highest).

Table of SGD perpetual bonds issued in 2017, ranked on coupon (lowest to highest).

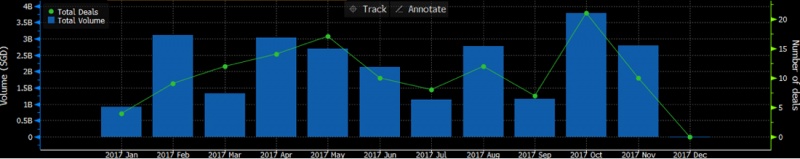

October was the peak issuance month, recording 21 new deals and re-openings, as the market scrambled for papers in a chase for yield as the wall of maturities and bond buyback tenders took their toll on the marketplace.

Buyers did not have much of a choice with issuers bailing from Singapore markets for a variety of reasons besides the bad press that the high yield defaults were attracting, but also from the massive boom in the Asian bond space which has cannibalised the local SGD corporate market that was never a first choice given the lack of transparency, illiquidity and reputation for huge mark-ups.

Geo Energy tendered for their SGD bonds (which saw dog days at lows of 65 cts) after a 3 times over-subscribed USD issue, First Sponsor called back their bonds, Gallant Venture and Medco did tenders and redemptions. Century Sunshine, Ciputra and Keong Hong called back and exchanged their bonds in refinancing exercises successfully, seeing overwhelming demand for their new issues.

We saw some crazy price moves in 2017 not just for the O&G “fallen-angels” but for regular bonds which made some savvy investors some decadent profits, to rival Chinese IPO returns, as we had predicted in our 2017 No Rain, No Rainbow outlook, “looking out for the rainbow and hoping then for the pot of gold”.

Examples.

Raffles Education 5.9% 3/05/2018 +16%

Gallant Venture 7% 6/4/2018 SGD +21% (bond tendered in Nov 2017)

NOL 4.65% 09/09/2020 SGD +30%

Geo Energy 7% 18/01/2018 (bond tendered back at 100 in Oct 2017) SGD +38.88%

OUE Lippo Healthcare 6% 6/2/2018 SGD +45.9% (on OUE’s majority stake)

China Fishery Group (in default) 9.75% 30/07/2019 USD +50%

Parent holding company of China Fishery Group (in default) Pacific Andes 8.5% 30/07/17 SGD bond trades at 20 cts

Hyflux 6% SGD Perp callable 2020 -20%

With our eyes well feasted, we may start wondering if there are any good deals left for us to take a nibble at, if there are any bonds trading at discounts (under 90 cts), that are not in some form of default?

The answer is that there is none… except for Hyflux which has 3 bonds due for calls in 2018 and such a difference it is from this time last year when we pointed out in our 2017 Singapore Corporate Bonds Outlook: No Rain, No Rainbow, a list of bonds whose prices have floundered.

2018: Not Bullish on Singapore Corporate Bonds

We do not want readers to continue reading if they are like the happy stockbrokers we have met recently who tell us they do not care if the coupon is 4.8% or 4.5%, as long as they are happy with a familiar name because these folks are a painful reminder of some other people we know stuck in the Ezion rut at the moment.

This is also not meant to be a critique or trade advice of any sort, harsh as our original plan to title this “2018: Don’t Buy SGD Corporate Bonds” which was a bad idea as it could lead to unnecessary attention from any “blog surveillance” agency out there even if we do not make “the cut” for the Ministry of Finance’s “influencer of Singaporeans on matters on the national economy” team.

Not bullish on SGD corporate bonds? Aye, things have changed and nothing sums it up better than this quote from a client that was cited by a US bond broker writing on Zerohedge that The Market Mood Is Definitely Changed.

“You want me to buy a big block of bonds someone else wants to sell so they can realise massive profits… and you want me to do this on the very day the bond market turns decisively bearish?”

The reasons are many-fold, macroeconomics, regional market trends, global trends and the local market development.

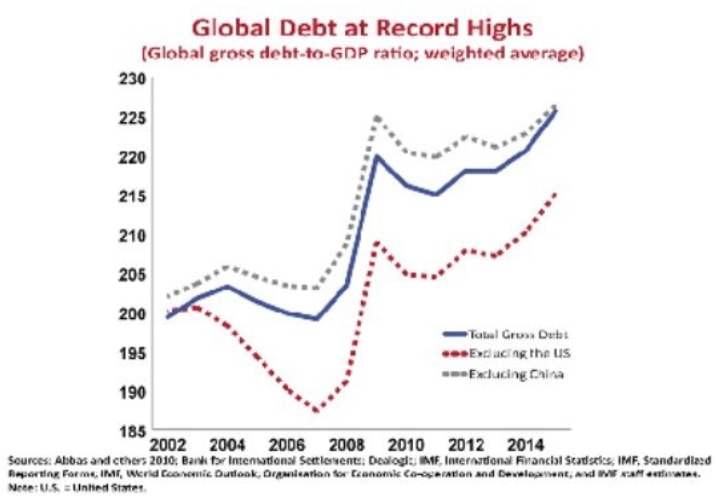

Global Debt At Record Highs

We need not be concerned as much because GDP growth is picking up if the stock markets are any indicator of that (note that Donald Trump uses stock markets as the main indicator of economic health).

We could talk for days and so much has been written about debt levels and all the fears about China but we draw comfort from the other asset bubbles in stocks and real estate that will keep the wealth flowing in the direction of bonds.

There is less to fear about China than we think because it is well known that most of the Chinese corporate bonds in USD or not, are bought by Chinese investors or Chinese linked companies which makes contagion not an issue.

Source: WEF

Source: WEF

Central Banks Turning off the Spigots and the Upcoming Rate Hikes

Turning off the QE spigot is a big worry and far deadlier than rate hikes which do nothing to the money supply. When QE fades, we will have to rely on the real economy for money supply growth. Nonetheless, we will assume that the central banks will make sure that there will be no disruptions like they have been doing for the past decade. No worries then?

The rate hikes (4 expected in the US this year) are a bother because they impact fixed rate bond prices, raise borrowing costs for issuers and investors on leverage, eats into corporate profit margins and affect global fund flows.

From our conversations with asset managers, they are rightly confused about the Singapore interest rate situation which has been mighty volatile with overnight rates breaking 3% pre year-end and crashing to 0.1% last week. This makes the Singapore markets more difficult to predict and anticipate than easier candidates in the developed world.

Credit Quality Cannot Get Better

It is easier to reconcile the Chapter 11 statistic that new bankruptcies in the US saw the highest percentage jump in 2017, from 363 to 699 filings, since the Financial Crisis because Singapore saw 9 bond defaults in 2017 compared to 5 in 2016, just 1 in 2015 and none other than Lehman in 2008.

Yet credit quality is about as good as it gets and credit spreads are as low as they can go with the most liquid High Yield ETF (HYG US) indicating under 5% yield.

Dividend yield on HYG US (iShares iBoxx USD High Yield Corporate Bond ETF)

Dividend yield on HYG US (iShares iBoxx USD High Yield Corporate Bond ETF)

Singapore, too, saw the lowest coupons on perpetual bonds every issued. We understand.

Should we worry about 2018? That perpetuals will see higher coupons?

The good news is that Wall Street Has No Idea What’s Going to Happen to Credit Markets in 2018.

Source: Bloomberg

Source: Bloomberg

We will venture to be more bold, with more confidence because Singapore interest rates are way lower than the US, to suggest that there could be more risk on the plate although we really do not have any idea what will happen.

Singapore in 2018

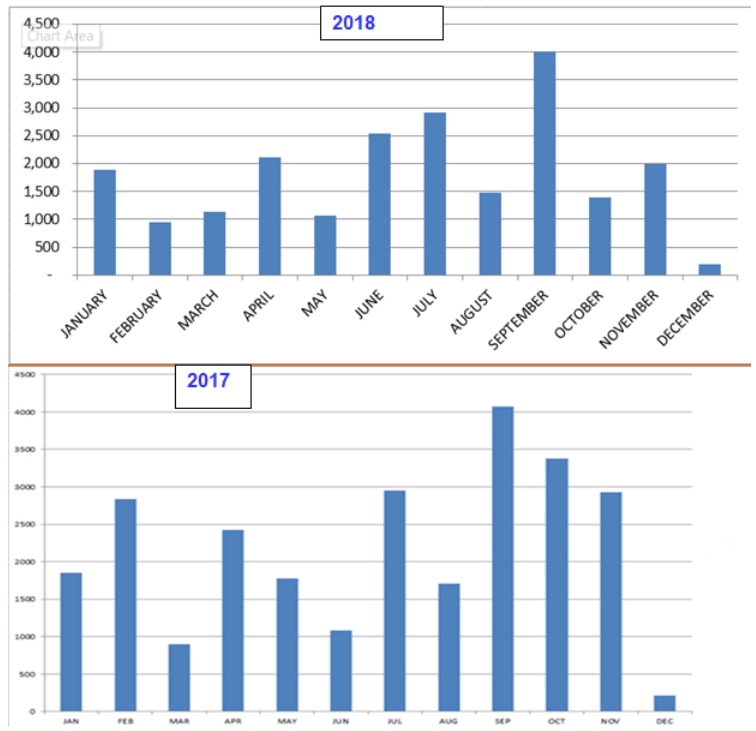

The maturity profile of 2018 is a lot less heavy than 2017, given over S$ 1.5 bio of maturities already bought back and another S$1.35 bio in default or restructuring.

Maturity of SGD bonds in 2018 vs 2017 (unverified for accuracy)

Maturity of SGD bonds in 2018 vs 2017 (unverified for accuracy)

The chunky maturities will be well spread throughout the year taken up mostly by the 3 local banks and HDB issues.

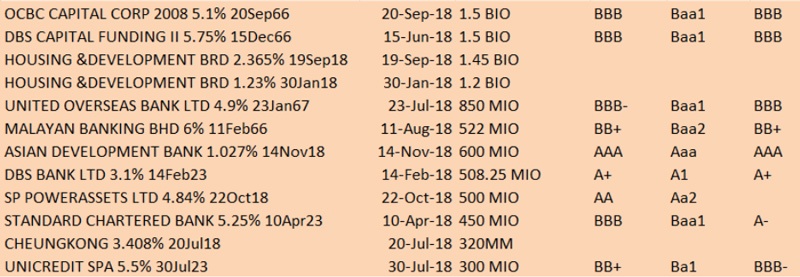

Top 12 SGD bond maturities for 2018.

Top 12 SGD bond maturities for 2018.

There is really not too much to worry about in terms of demand and supply.

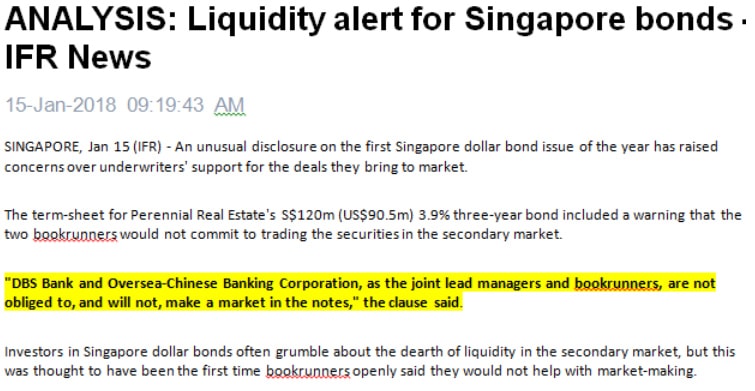

A Possible Liquidity Crisis

That is the main issue we foresee as the largest risk to the local bond market which has been ratified by an IFR article from last week which alerted subscribers to a certain and subtle change in tone in the investor term sheets which highlighted that the bonds subscribed may be subject to illiquidity in the future.

Taken from an email alert from IFR

Taken from an email alert from IFR

It may or may not be an isolated instance, yet we found a similar change in language for the new Guocoland perpetual bond issued last week compared to their last bond issue from last year which was rather hard to extract, given it was on page 99 of the IM (Info Memo).

“(a) Limited liquidity of the Securities issued under the Programme

There can be no assurance regarding the future development of the market for the Securities issued under the Programme, the ability of the Securityholders, or the price at which the Securityholders may be able, to sell their Securities.

Although the issue of additional Securities may increase the liquidity of the Securities, there can be no assurance that the price of such Securities will not be adversely affected by the issue in the market of such additional Securities.

The Securities may have no established trading market when issued, and one may never develop. Even if a market for the Securities does develop, there can be no assurance as to the liquidity or sustainability of any such market. Therefore, investors may not be able to sell their Securities easily or at prices that will provide them with a yield comparable to similar investments that have a developed secondary market.

This is particularly the case for Securities that are especially sensitive to interest rate, currency or market risks, are designed for specific investment objectives or strategies or have been structured to meet the investment requirements of limited categories of investors. These types of Securities generally would have a more limited secondary market and more price volatility than conventional debt securities. The lack of liquidity may have a severely adverse effect on the market value of the Securities.” ~extracted from page 99 of the IM

When we compare this to last year’s issue, we could potentially stand corrected as last year’s issue was a senior paper and, thus, required less disclaimers.

“Limited Liquidity of the Notes issued under the MTN Programme

There can be no assurance regarding the future development of the market for the Notes issued under the MTN Programme, the ability of the Noteholders, or the price at which the noteholders may be able, to sell their Notes.

Although the issue of additional Notes may increase the liquidity of the Notes, there can be no assurance that the price of such Notes will not be adversely affected by the issue in the market of such additional Notes.”

Buy at your own risk

We discovered it is not odd at all, in Singapore for corporate bond prices to remain unchanged or elevated, come rain, hail or shine, until someone tries to sell a chunk of it.

As a fund manager exclaimed over lunch last week, there is no way he would be buying SIA bonds when the prices have not changed in 3 months which passed our fact-check test. A handful of them prefer to allocate their funds to USD issues, swapping into SGD proceeds to better their returns and assure themselves of realistic market prices and liquidity.

For the retail investor and other fund managers, there is comfort in knowing prices do not change but there is no comfort in knowing that there will be little market appetite during the times when there is a need to liquidate.

That is the liquidity crisis risk that we would expect for 2018 as friends have informed us they experience difficulty selling even S$5 mio worth of HDB bonds to anyone without taking a massive discount to the “screen price”.

Great news for the Asian bond markets which is where most issuers are flocking to, according to some investment bankers that we spoke to. Times are too good for issuers to consider the local Singapore markets unless they get a cheap deal and we have heard that some foreign houses are exiting the local currency game, allocating less resources (including balance sheet) to providing market liquidity and, or, lead a SGD bond issue for that matter.

Will it be the start of a great shrinking market? Ruled by the Aunties and Uncles?

We cannot be sure of that but we were told by several Aunties recently that it is not good to be too smart about things. “100 is cheap and 106 is not”, to quote.

We cannot advise anyone at the same time to take a plunge into SGD bonds in 2018, as well, if they do not understand this bizarre 1-month Sibor chart.

Chart depicting 1M SGD Sibor rising to a 9 year high of 1.33114% in Dec 2017 before plunging

Chart depicting 1M SGD Sibor rising to a 9 year high of 1.33114% in Dec 2017 before plunging

We cannot explain why DBS’s CEO said “SIBOR would remain elevated”, to follow LIBOR before that plunge, noting that both benchmarks are on their way to obsolescence as local mortgage rates are increasingly benchmarked to DBS’s 9 month fixed deposit rate.

We cannot explain many things about the SGD corporate bond markets these days, like why some of Nam Cheong’s bondholders got paid off even after the restructuring was announced or why Swiber defaulted less than a month after their last bond redemption in Jun 2016.

We cannot explain why SIA bond prices never change but other bond prices fluctuate along with interest rates or why Hyflux bonds are seeing such dog-days.

Perhaps, it is just not the time to be bullish on the Singapore corporate bond market?