A Look at Singapore’s HENRY (High Earners, Not Rich Yet) Generation

A good friend was raging about her hospitalisation insurance bill that spiked 40% higher (despite no claims for 12 years)—a whopping $1k higher for both herself and her teenage son ($500 each) without warning from none other than GE (tsk tsk, as usual). And can we guess what she did after the rant? Promptly paid up that $3.6k in cash which was still affordable for 2 people unlike another friend who had to deliberate harder on whether it would appear bad form to fly herself business class to NY, leaving 2 kids and a helper in cattle. But alas, they all stayed home.

It does feel good when you see headlines like the one below on how rich Singaporeans are, feeling smugly comfortable for the 200-odd thousand local millionaires in the world’s richest 1% with over US$936,400 to their name.

Source: Business Insider

Source: Business Insider

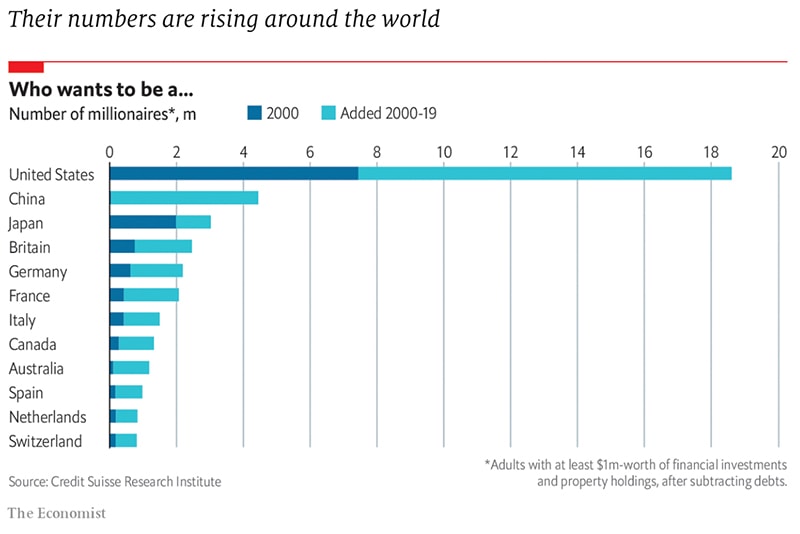

Headlines have been popping out since the publication of the Credit Suisse Research Institute’s Global Wealth Report on the 21st of October which ranked Singapore as the 6th in the world ranking of household wealth per adult although we cannot correlate why Hong Kong would still be protesting this weekend for coming in 2nd.

Source: The Economist

Source: The Economist

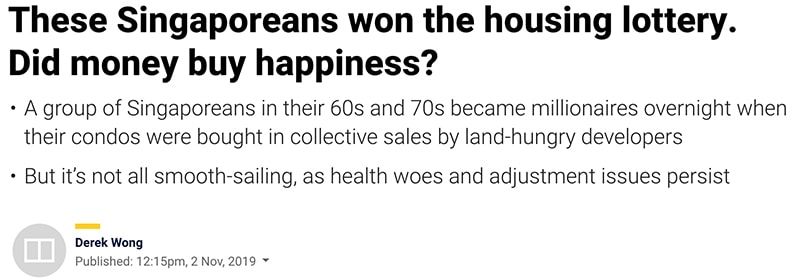

It is cold comfort, however, when put in perspective because the millionaire population is multiplying rapidly around the world and Singapore’s extraordinary rise from 183,737 millionaires in 2018 to 207,000 in 2019 (+12.7%) is partly attributed to the blockbuster en-bloc housing lottery in 2018 with 35 residential deals valued at over SG$10 billion (65 deals worth SG$19.1 billion between 2016-2018).

Source: SCMP

Source: SCMP

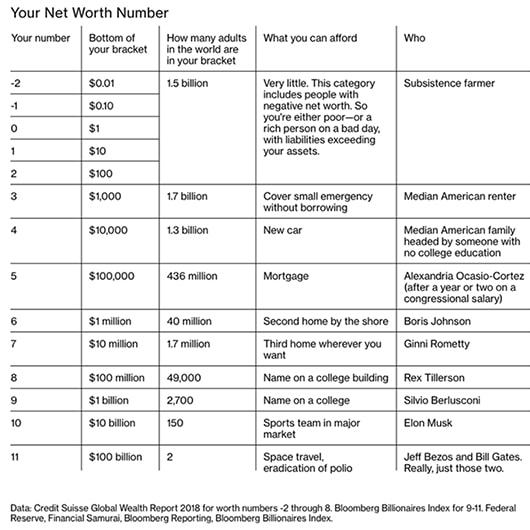

There is even a net worth number for the extra feel-good factor even if living amongst rich people actually makes one feel poorer (until you take a look at the rest of the world—good idea). Bloomberg compiled a “wealth number” to see where you stack up against the rest of the world although we note it just adds up to 5 billion people leaving out the other 2.7 billion who must presumably be off the financial radar.

Source: CNBC

Source: CNBC

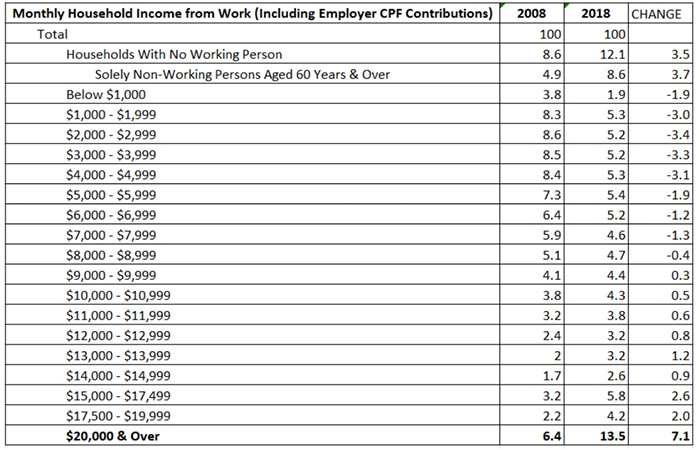

For those Singaporeans who missed out on the gravy train, there is still plentiful to cheer for because things have gotten really good in the past decade since the global financial crisis of 2008. As far as statistics go, we were pretty much taken aback by how well the country has done in terms of household wages.

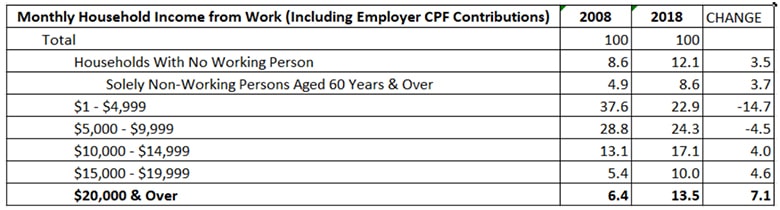

Taking a look at the table below, BIG SALARIES have grown at the fastest pace in the past decade putting 13.5% of households in the affluent highest-income category.

Source: Singstats

Source: Singstats

To put it into perspective, 14.7% of households have been lifted out of the lowest income bracket, totaling nearly 20% of the bottom 2 quintiles into the higher wage brackets with the highest bracket leading the charge as seen from the breakdown below. That is an amazing feat for wage growth for the country.

Source: Singstats

Source: Singstats

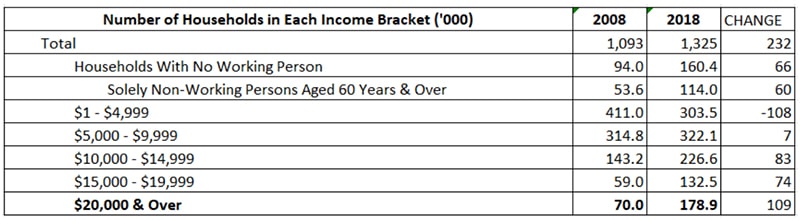

This translates into an astounding 78.9% growth in high income households (top 2 quintiles) over the past 10 years. In other words, the 183 thousand new households out of 232 thousand are high earners as tabulated below.

Source: Singstats

Source: Singstats

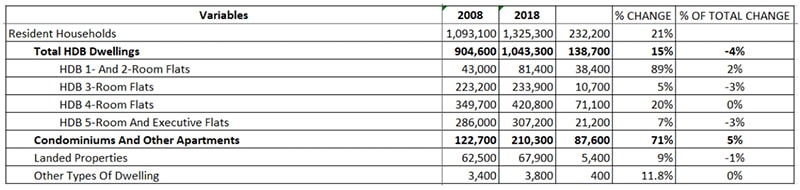

It definitely shows up in the housing composition of the country with an extra 87,600 condominiums (+71%) over the past decade to cater for the extra 183 thousand newly rich households, suggesting perhaps there are still not enough condos to go around which explains the building rush and hot new launches? HDB flat ownership, on the other hand, has fallen from 83% in 2008 to 79%.

Source: Singstats

Source: Singstats

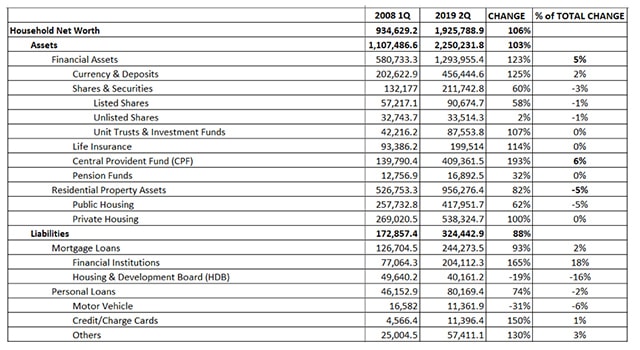

Singapore’s household net worth broke out of the SG$1 trillion mark end-2009 and has grown over 106% in the last 10 years. In addition, the pace of increase is driven by financial asset accumulation (significant increase in CPF and currency deposits) while liabilities, of which the bulk of lies in mortgages, have not kept pace which suggests general deleveraging as opposed to what we would like to imagine when we read about the record highs in mortgagee listing sales and foreclosures going on in the residential and retail sectors (362 is not a lot of households in the grand scheme of 1.325 million households).

Source: Singstats

Source: Singstats

Source: BT

Source: BT

Nonetheless what we can glean from the spectacular data set is that Singapore should have accumulated a fair share of the HENRY (High Earners, Not Rich Yet) crowd with the phenomenal household wage growth in a relatively short period of 10 years which means not all the high earners have become High Net Worth yet.

You see, in the US, if your household income is $250,000, you are in the top 5%. But in Singapore, it is now much more commonplace at 13.5% (>$20,000 per month), from just 6.4% 10 years ago.

In Investopedia, “High earners, not rich yet (HENRYs) are individuals who currently have significant discretionary income and a strong chance of being wealthy in the future. The term HENRYs was coined in a 2003 Fortune Magazine article to refer to a segment of families earning between $250,000 and $500,000, but not having much left after taxes, schooling, housing and family costs—not to mention saving for an affluent retirement.”

The definition varies for this label that has just been revived as a mini-cultural phenomenon in recent times and as the originator, Fortune magazine editor Shawn Tully notes “in the ensuing decade, times have only gotten tougher for this hardworking group. They’re not investment bankers or CEOs or CFOs, they’re the auditors, assistant treasurers, hometown attorneys and upper-middle managers that power America’s economy. They enjoy a nice lifestyle and no one should feel sorry for them, but they’ll never be rich. In fact, I suggested in my story that a more appropriate title might be Gallic version HENRIs, for “high earners, not rich indefinitely.”

Source: Fortune

Source: Fortune

He even illustrated with a photo of what it is not HENRY, as seen below, which is to fly first class because of private school fees and that sort of brought to mind the friend who left the kids at home (HENRY-esque indeed).

HENRY has also been mostly used to refer to the millennial generation who earn well above the median wage but fail to make ends meet because it is “all about maintaining a particular lifestyle— whether that’s travelling to the latest jet-set destination, eating at a trendy restaurant or splurging on a spa treatment and green juice” and so on with the “pressure to keep up with their well-heeled buds on social media”.

Source: New York Post

Source: New York Post

It is a verified fact with CNBC running a piece, “In debt trying to keep up with the Kardashians”, staking that if Kylie Jenner “likes” something, at least 1 of her 115+ million fans will buy it.

Source: CNBC

Source: CNBC

Yet us older non-millennials have had our moments blowing money away before on those watches and cars and, for the girls, the handbags and baubles. And now, HENRY we feel because rough sums are telling us that child-raising is expensive business.

A rich friend whose third child just graduated from university recently admitted it is like a Ferrari for each one of them.

Yes. Pre-school fees, tuition, international school fees, extracurricular lessons in tennis, golf and swimming, life coaching sessions, not to mention the electronics, clothes, food, airfares and then the university fees. This is not considering the legacy to bequeath because as the Credit Suisse Global Wealth report noted: “While millennials were challenged to accumulate wealth due to poor job prospects, high house prices and low incomes globally, their parents were helping them financially through means such as giving inheritances.”

No wonder 25% US millionaires consider themselves just middle-class and we surely empathise. The race is to get the kids/heirs the head start from these private bank boot camps complete with “Shark Tank” opportunities as reported by Bloomberg.

Source: Bloomberg

Source: Bloomberg

Yes. It can be a race, but it is also an option which we suspect is the reason why Singapore is ranked 185th out of 188 countries in the world for fertility rates according to World Bank data although the Department of Statistics have it even lower at 1.14 in 2018 and 1.16 in 2017 and the number of babies born in Singapore fell to the lowest in 8 years at 39,039 (out of which 32,413 were citizen births). Has the “Ferrari realisaton” hit home?

Source: World Bank

Source: World Bank

Math tells us that a healthy population should have a fertility rate of at least 2 because if we assume an equal number of men and women then 2 would be an ideal replacement number for every childbearing woman. But it is not just the babies, even marriages in 2018 fell to its lowest since 2013, according to Channel News Asia.

Is this a cause or effect of HENRY or perhaps neither? Yet it is worthwhile monitoring for a while and establishing that HENRY profile for the heaps of business opportunities in the future even though the troubles of HENRY are just beginning and compounding (for their time in the spotlight of the headlines these days).

Source: Equifax

Source: Equifax

To be continued…

[Read Part Two: More on Singapore’s HENRY (High Earners, Not Rich Yet) Generation]