Cognitive Dissonance in Global Markets

One just cannot but feel something is wrong, cognitively, when we get, for instance, hit by someone from behind on the road to have the offender vehemently insisting that it was our fault.

Eyes roll, why did the LTA invent curved road markings? Because Mercedes and Grab cars, alike, will just simply drive straight on?

It is cognitive dissonance at work here as our brains desperately try to make sense of July—the state of mind where we are grappling between opposing realms of logic and reality, our own reality and that of the crazy person who rams into us and tries to choke us into admitting guilt.

It is not to be mistaken for irony that we wryly observed in McDonald’s this weekend because McDonald’s cannot claim to be fast food when the wait for a Big Mac took well over 25 mins.

Neither is it the dumfounded feeling of disruption when we realised that every single Body Shop we knew of in existence has shuttered since the last visit 6 months back.

Worn Out By Donald Trump

We are not the only ones worn out by Donald Trump’s massive disruption of the world, world order and world markets since he took presidential office 18 months ago.

The US White House has set a new record for staff turnover—37% in 12 months till June 2018, and does not include those who had left in the first 6 months of Trump’s reign. At the senior level, the turnover rate is estimated at 61%.

And we cannot help but pay attention to him daily because we cannot have a week without Trump keeping the Queen of England waiting in the sun for 15 mins before Putin kept Trump waiting for 30 mins. We have Trump proclaiming victory (what victory) at NATO as first mover advantage at his early press conference despite vociferous denials by the other global leaders later. Trump praising Russia then denouncing Russia 3 days later, while decrying news sources as fake. And finally, Trump talking down the US dollar and threatening more tariffs on China.

Psychology Today tells us it’s called gaslighting—making the victim question their reality and gaining power over the victim.

Gaslighting techniques:

1. Tell blatant lies

2. Deny they ever said something, even though you have proof

3. Use what is near and dear to you as ammunition

4. Wear you down over time

5. Actions do not match their words

6. Throw in positive reinforcement to confuse you

7. Know that confusion weakens people

8. Project and distract you

9. Align people against you

10. Tell you or others that you are crazy

11. Tell you everyone else is a liar

Source: Psychology Today

In normal times, it would have been easy to side with the US against China or Russia, for instance, because of their history of blatant human right abuses and of course, China’s record of pilfering Western technology (although Singapore had her Terrex’s returned). Yet, it has come to a disturbing head that we would probably root for anyone else but crazy demagogues.

Cognitive Dissonance in the Markets

Markets are worn down. We read UBS’s comment on Zerohedge 2 weeks ago, that “If a cabinet secretary resigns and no one cares, does it matter? Sterling traded above Friday’s close in Asian time. It is almost as if investors do not know who David is”. David Davis was Theresa May’s right-hand man in the UK’s stalled Brexit plans.

Perma-bear David Rosenberg of Gluskin Sheff tweeted just a few days ago, “Didn’t see anyone mention Friday’s Umich sentiment data showing consumer auto buying intentions in July sagging to Nov. 13 levels; and home buying plans sliding to their lowest level since Dec. 08. Yet over 60% are bullish on the stock market outlook. A case of cognitive dissonance?”

It is almost as if markets are unable to cope with all the disruptions from political theatrics, and ignoring everything that is happening on the macro stage to a complacent calm—that comes from the fact we are all in this together for fear of missing out and nothing much ever did come out of all those potential crises in the past decade since Lehman.

Cognitive Dissonance 1 – Buybacks and Insider Sales

Stock buybacks are at all-time highs, at $680 bio at least so far, Apple alone responsible for $100 bio, while institutions and hedge funds have been net sellers throughout the year. The rate of insider sales has climbed sharply from end 2017, to $8 sold for every $1 in stock bought in June 2018.

Should shareholders be selling to realise their gains instead of waiting for elusive dividends?

We cite Doug Kass of Seabreeze Partners on Friday, 20 July 2018.

“After a great deal of thought and following a discussion with my investors and limited partners I have decided to liquidate all of my long holdings (which include many which I believe have a favourable intermediate term outlook).

I am now undertaking my across-the-board long selling program.

I will have an extensive discussion of my rationale in Monday’s opener – and I will also make the case for an approximate (and playable) 10% market correction over the next six months.

The S&P now stands at about 2805 – that’s right at the top end of my long-standing 2018 trading range.

I will continue to hold onto my gold and short (SPY) positions.”

Source: Zerohedge

Cognitive Dissonance 2—Reconciling that it is all about FANG or FAAMNNG

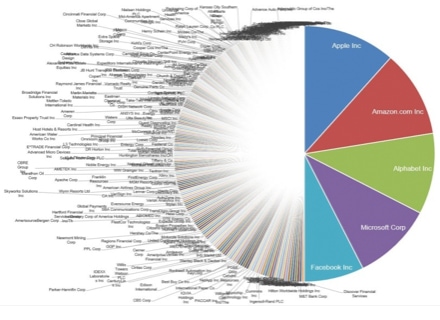

That Amazon accounts for 40% of the S&P’s year to date gains? Just 3 stocks have accounted for 71% of the S&P 500’s year to date gains—Microsoft, Amazon and Netflix.

That we are living in a market dominated by those few large caps like Ali Baba and Tencent is doing in China?

As Michael Batnick courteously provided on Twitter, the market cap of the top 5 S&P 500 companies = $4,095,058,706,432 while the market cap of the bottom 282 S&P 500 companies = $4,092,769,755,136.

It is mysterious and breathtaking, as CNBC’s Jim Cramer surmised, where markets are, for no particular reason.

Cognitive Dissonance 3—Do We Buy Or Sell Bonds?

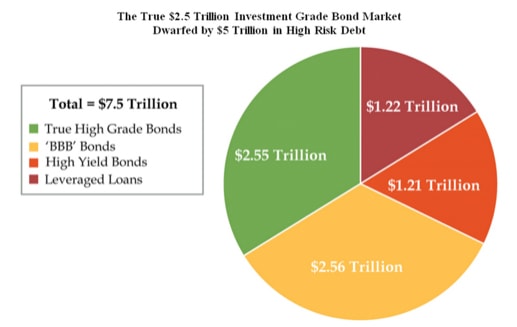

The bond market is one big conundrum as summer passes. Plagued by illiquidity, the saving grace is perhaps the forecast for issuance to dry up in the months ahead.

Yet credit quality continues to deteriorate as Bloomberg reports the corporate bond market is getting junkier, as BBB (one notch above junk) debt now take up the majority of the market, compared to just a third back in 2000.

Source: Bloomberg

Source: Bloomberg

With only 3 companies in America that are rated Aaa – Microsoft, Johnson & Johnson and ExxonMobil, investors are buying into safe investment grade funds that are made up of a majority would-be-fallen-angels as Moody’s warns that typically 10% of lowest investment grade issuers would be downgraded to junk.

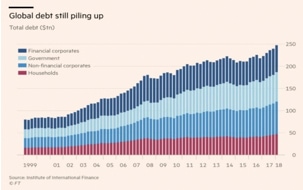

How can we be sure if bonds would be the safe haven if there should be a correction in the stock market then, especially when Debt to GDP levels are higher than ever, all around the world, prompting a warning from the Institute of International Finance?

Source: FT

Source: FT

Recession fears stare at us in our faces as yield curves flattened to pre-2008 levels, textbook models are battling the this-time-it-is-difference crowd, giving regulators and analysts massive migraines when it is not so hard to use a little common sense to see that flattening curves have become the best hedge for the stock markets’ strength in the past months.

Yet how can anyone be confident of the US treasury market when the US budget deficit is now projected to rise to nearly $1.1 trillion in the fiscal year that begins in October and the White House expects yields on the 10 year Treasury note to average 3% in 2018 and 3.2% in 2019 (even though Donald Trump is unhappy about higher interest rates)?

Cognitive Dissonance 4—Economies Shifting to Different Gears

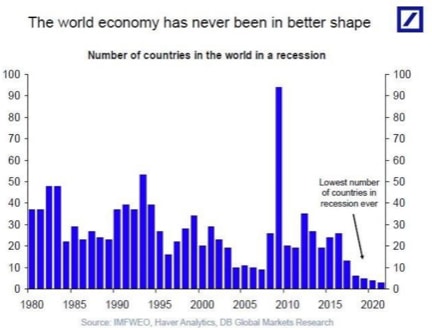

It has been a good few years that the global economy has been moving in unison with no significant recession in any significant economy out there. In fact, 2018 has been touted to be the year with the fewest countries in recession ever!

Source: FXStreet

Source: FXStreet

How do we orient our heads to uneven economic growth in the months ahead?

Cognitive Dissonance Like A Deer Caught in Headlights

For the friends we spoke to, none had much to offer except to confess they are similarly afflicted by the dissonance and certain discomfort we are feeling.

While we can take some mindful inspiration from the Thai boys rescued from the cave after 9 days in the dark, we find ourselves enjoying this mindless clip of a determined lemon rolling down a hill, being the 9th something millionth person to watch it for pure escapism.

Perhaps that is why markets will not care about the next Brexit minister who resigns or if folks do not intend to be buying cars or houses down the road—because they are watching that cute little lemon.

Complacency rules for the moment as we struggle to make sense out of the current reality even as we smugly note we have not made a single mention of the most hyped word in markets for July—Trade War!

Disrupted markets give rise to cognitive dissonance and the irony is that we will be deer caught in headlights soon if we do not take a stance.