Market Thoughts: Feeling Grateful For Bad News

We do not really know (or care) what to complain about with such difficult markets.

Frustration rules Twitter finance talk with comments like “I’m already done with 2019”, “If it’s not Powell, then it’s another Fed speaker. If it’s not a Fed speaker, it’s Kudlow. If it’s not Kudlow, it’s Mnuchin. If it’s not Mnuchin, it’s Trump. If it’s not Trump, it’s an unconfirmed headline” and “The blatant attempts at manipulating the stock market are beyond the pale. Not about long, short or the next 5%; it’s about the devolution of capitalism and desperation of leadership”.

Are we to blame for shaking our heads and drawing a blank? After the worst December in 87 for stock markets, we have the best January in 30 years?

Economic data are falling off a cliff with China registering its slowest growth since 1990, Korean exports crashing 14.6% on the year, Taiwan export orders hit by steepest drop in 32 months, retail sales in Hong Kong sagging in the final quarter of 2018, the dramatic 47% plunge in the Baltic Dry Index since mid 2018 and every other headline out of the World Economic Forum in Davos from the IMF and CEOs’ screaming for slow down to growth or an imminent recession.

We drew a similar blank when we watched a friend order 50 packs of pumpkin chips after tasting some and admitting he will figure what to do with them when they arrive.

And we came to a blank on Venezuela too, because we have read too much about the plight of the 80% of Venezuelans who live in poverty in an oil-rich country that has suffered under a dictatorship that China, Russia, Turkey and Iran still support.

How are we expected to believe George Soros for calling out Chinese President Xi at Davos for running an authoritarian regime, using algorithms to weed out threats to his rule?

To draw the biggest blank of the week, we have to salute Papua New Guinea for pulling their version 1MDB, losing 100 brand new vehicles (including 40 custom Maseratis) procured late last year to ferry APEC delegates around the island’s very, very few roads, immediately after their USD 500 million inaugural bond issue in October.

Shaking Our Heads Over Good Things

Nonetheless, we ended the week with a flood of good news that too many people would shake their heads over.

Yet the clinical assessment would be for a friendly market environment for good times to roll in asset classes as, lately, correlations across assets, stocks, bond yields, and commodities have hit their highest level in almost a year according to the WSJ.

Indeed, it is the best way to view the temporary end (till 15 Feb) to the U.S. government shutdown when Donald Trump caved under political pressure last Friday.

Here, we draw a blank because it took a ton of chaos and heartaches for him to essentially sign the same deal as 35 days ago without getting his much-touted border wall to give the markets relief (and a rally).

Perhaps it did enough damage because the Federal Reserve has decided that they will not run off as much of their balance sheet of bonds as they had originally intended, meaning that we will have more QE left in the system that will leave the market more appetite for the wall of borrowing needs coming up.

Source: WSJ

Source: WSJ

It would be the biggest boost to markets if they do and even the idea of it, would be enough to make the market a happier place.

No, we do not like the idea of artificial markets boosted by central banks that have made all the global elite at Davos—even as Jamie Dimon’s wealth has tripled since the financial crisis because hostility towards the corporate elite is finally hitting the political mainstream.

We love to hate them, but not when our portfolios matter and China is the market hero this month for rolling out US$29 billion of tax cuts on 10 Jan, then inject record funds of US$83 billion into money markets on 16 Jan ahead of February’s holidays, before releasing another US$ 37 billion to banks last Friday due to changes in their reserve ratios. And, on the same day, encouraged banks to replenish capital by issuing (higher risk) perpetual bonds, buying those bonds and swapping them with the central bank for high quality bills.

How can we not love China and applaud their efforts to boost markets and keep the party going in response to market and economic data? What a well-run economy, market and population. Who cares if they support Venezuelan dictators? What does George Soros know? He is too rich to care about our portfolios.

Incidentally, Microsoft’s Bing was blocked in China on Thursday, joining Google, Facebook, YouTube, Wikipedia, Twitter, Netflix, Instagram, Tumblr, WhatsApp, BBC, NY Times, Bloomberg, Reuters, WSJ, Time, The Economist and several thousand others.

Have We Forgotten that Bad News Used to Be Good News?

Bad news used to be the ticket in the old pre-2016 days, the ticket for further easing to negative rates and QE-forever.

Markets would rally on the back of bad news and bite their lips when economic data improved.

And folks are starting to get back into the game as a trillion dollar fund declared on Friday that the Fed is at “Market’s Mercy”. By that, we can safely assume the US President on our side too for his fascination with the US stock index for the better part of his reign.

Source: Bloomberg

Source: Bloomberg

The worse the outlooks become, deteriorating sentiments and economic data falling off cliffs will be necessary ingredients for stimulus.

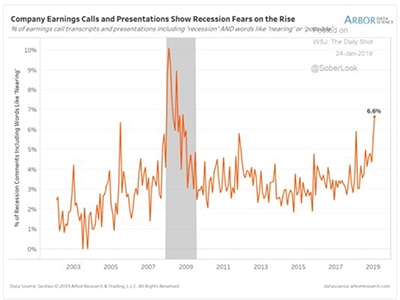

Thus, our joy at the fact that the percentage of company earnings calls mentioning recession has reached a post-crisis high and that Apple, Samsung, LG, Ford and gang have all lowered their earnings guidance as layoffs rose 29% in 2018.

We can sleep easy into any foreseeable downturn that Paul Krugman calls a potential “smorgasbord” recession with a mix of troubles than another major financial crisis.

Shaking our heads at the disaster everything has become, the big mess in the markets and not wanting to depress ourselves by thinking too much, we can only hope for a peaceful resolution in government support and be grateful for more bad news to melt away the world’s most-watched central bank’s resolve on rate hikes next week as signal to the smaller central banks to continue easing, so markets will go on and the other problems will go away.