Numbed by Politics, Numbed by Markets and Numb by Linkin Park

Political Bash: Is there anywhere in the world you can feel safe these days?

Not in China where their second richest man and owner of their largest real estate company, Wang Jianlin, is in trouble with the state for “asset transfers”, another word used in China for national wealth loss. For in the eyes of the state, his wealth does not belong to him? He did become rich from the ordinary Chinese people who will not have a share in it as much as it belongs to the state?

Not for Chinese conglomerates such as HNA Group that fall out of “favour” for “favouring” their relatives and friends. The test of friendship showed up immediately when their bankers ran for the exit and Bank of America, Citigroup, Morgan Stanley and such have pulled their support for obvious fear of displeasing the Chinese state.

Not for China’s most prominent dissident after Ai Weiwei, Nobel laureate Liu Xiaobo, who managed to die in custody in a relatively low-key cancer death which is just fine for us. As long as we do not have to live there even as the light of democracy dims in the USA where their president is now examining his powers to exonerate himself, his family and associates from the ongoing probes into their wheelings and dealings that possibly erred against the side of patriotism.

We cannot feel safe enough to keep up with the news and “fake news”, including all those unreported or withheld news involving “nobodies”, and because the press has never been so unloved and mistrusted for CNN’s ratings to collapse, drawing less viewers than Yogi Bear re-runs.

It is just as well that half of China’s rich plan to move overseas, that is, if they could.

It is not safe in Saudi Arabia, for sure, where a crown prince was unceremoniously displaced for his addiction to painkillers. No miniskirts or Facebook or Whatsapp there as well.

This cannot be a more perfect week for us to feel scared for our little lives if we are not already feeling slightly uncomfortable so far. The sudden thought that grips us as we watch stock markets make record highs daily amidst the massive political uncertainties around the globe and the central banks from Europe and Japan start to sound slightly deranged in their insistence to continue with monetary stimulus, despite all the good news on the economic front that is ratified by the death defying new highs in the stock markets.

It Is A Numbing World

‘Numbed’ is a good word to end the week which ended in a tragic loss for the world as Linkin Park lead singer, Chester Bennington, has been taken from us.

From one of their greatest hits, NUMB, yes, we feel so numb and it looks like Linkin Park could have sung all the songs about how we are feeling today: looking for SOMEWHERE I BELONG because IN THE END, we are TALKING TO MYSELF, released on the day of Chester’s death.

Let’s not even look further than the physical blows they came to in the Taiwanese parliament, the chair-throwing, punching, water balloons and hair-pulling antics, the killings in Philippines and the scandals in Japan and South Korea where PM Abe of Japan is seeing lower percentage popularity ratings than Donald Trump, at under 30%, which makes Trump’s 37% approval, whilst lowest for any president, look a tad decent.

Do note these are the countries we invest in, for South Korea saw record high inflows so far in July, regardless of nuclear threats.

Gone are those days, before the advent of social media, of role-model exemplary politicians and leaders to be respected. It is no wonder that the new president of Singapore will draw a salary of no less than SG$4 million or so. For that, we should be grateful for, because our leaders are perhaps more worthy of respect than others.

There could be less than a few who will feel safe in a country where Winnie the Pooh is banned and Whatsapp is subject to censorship and potential closure. Yet, China is behind the curve because Brazil has banned Whatsapp since 2016 and using Facebook in the wrong way in the Middle East could get one arrested. Here is a list of bans.

Lucky Singaporeans need not worry about property forfeiture and unlawful arrests because former bankers are getting shot in Spain as it happened last week.

But even governments are feeling the heat because Kalashnikov is doing better than ever, doubling its revenue in the face of US sanctions from all the other countries looking to upgrade their arsenals.

Source: WSJ

From rising levels of global mistrust and fear, Kalashnikov is now developing A.I. weapons with robotics which makes good sense in reducing casualties and unnecessary waste of precious human lives.

There is a crisis at hand, as the OECD reports for 2017, in governments and public institutions and it also showed up in the Edelman Trust Barometer of 28 nations which revealed that the 4 key institutions of trust in democratic nations—business, government, NGOs and media, has declined yet again.

Strangely, or not so strangely, Russia and China rank amongst the highest for faith in their systems, which makes it a good case to ban Whatsapp as soon as possible?

Quite numbing indeed, and rest in peace, Chester Bennington, if you had found life too tiring to bear.

Feeling Unsafe and Numb and Scared in Markets

We are living in fearful times, under surveillance, buffeted by the global winds of political upheaval and change, faced with technological revolutions and terrorism, and central bankers acting like mad scientists playing with dangerous fiery experiments. Thankfully, it is not our job to understand all of what is happening around us, as ordinary citizens and workers.

I would not be able to live the life of a private banker in these times. It would be too hard to give such advice meted out daily from the central advisory desks without feeling a bit of uncertainty in those recommendations or, feel a pang of guilt in pushing for trades just to meet quotas.

It is troubling if the recent ARA SG dollar perpetual is flying off the shelves just because the banks are awarding substantial leverage to clients for the unrated and private company with a bunch of secured and senior borrowings that rank above the junior perpetual bond that investors are chasing.

Other bonds do not fare as well for the lack private bank rebates during their launch, or lack that promise of leverage, as a friend turned down the opportunity to buy a perfectly good 6-month bond paying over 6% because he wanted to fork out less than the principal for it.

Think again if we do not think that those sovereign wealth political machine funds are not frightened of the huge amount of sovereign risks they are carrying on their books because even the US has defaulted on her debt on several occasions—in 1790, 1861, 1933 and 1979, the last incident being just late payments.

There are worries, no doubt, now that serial-defaulter, Argentina, managed to tap the markets for a 100-year bond last month, shortly after her default in 2014, being her second default in 13 years. Luckily, we may have to wait to 2117 to find out if they will get their monies back which may be possible because Argentinian banks started charging a 1% cash deposit tax in March this year.

Is that why the Norges Bank, the world largest sovereign wealth fund, shifted to a 70% equity weighting, from 62.5%, this year? And the same goes for the Swiss National Bank which has been loading up since 2014, to a new record for US stock holdings, as of end 2016.

On the topic of safety, equities look like safer collateral than government promises of repayments, at this rate.

If there are few left to buy those negative yielding bonds, the yoke falls on the central banks who are sitting safe because they cannot default on themselves eventually, except to forgive or pardon their obligations, as Trump is potentially seeking to do for himself.

Reasons to buy those government bonds are fading fast in the face of central bank policy changes after nearly a decade of quantitative easing, pumping up their balance sheets to put money into the pockets of the banks, stimulating lending, growth and employment in the process.

The fear of a global bond market crash has been found to be the biggest risk investors are considering of late in a Bank of America survey.

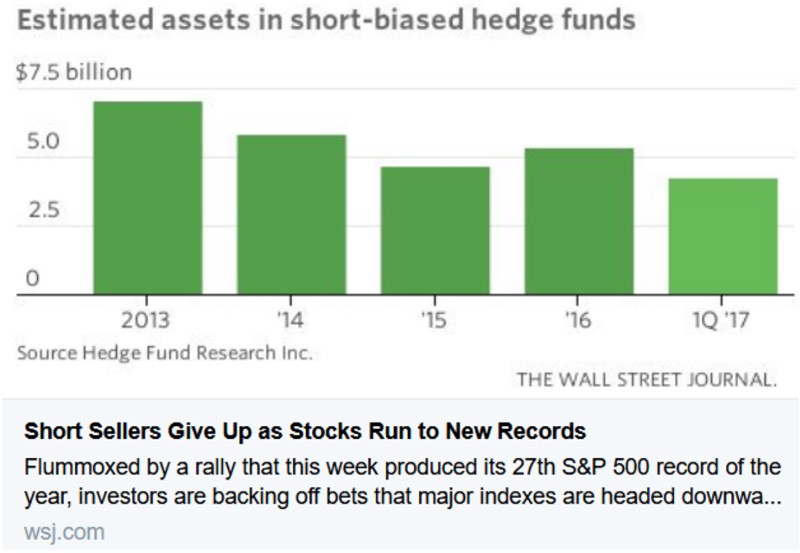

Equity short sellers are giving up on the chase after 27 record highs in 2017 as short interest collapse to 2013 levels.

Macro hedge funds are feeling the heat as some of the brightest minds give up on understanding and making sense of the environment. As a veteran who recently closed his fund said to Bloomberg, “I felt the intensity of following markets at a time of increasing political and economic confusion very hard… My entire career had centered on an understanding of monetary politics and I had trouble getting my head around it all. It was exhausting.”

In The End

It is pretty obvious that most of us would be feeling stifled and confused, and with the sheer weight of all the events happening daily, numbed into complacency to blindly follow the masses and hope for the best in those investments, because if we have to be really honest with ourselves, even for pseudo financial pros, it is impossible to see what will happen next.

Is it any wonder that the optimism in financial markets has really failed to spill over into the real economy?

The great visionary, Elon Musk, echoed the doomsday refrains in his recent tweet that “the world’s population is accelerating towards collapse, but few seem to notice or care”.

We are feeling NUMB, Mr Musk, looking for SOMEWHERE I BELONG and IN THE END, we are just TALKING TO MYSELF.

Thank you, Chester Bennington. Thank you, Linkin Park.