Sell In May and Go Away: Adage or Old Wives Tale?

Is there a better time to be afraid than when G7 finance ministers meet in Sendai, northeast Japan, possibly one of the most radioactive places on Earth after the costliest natural disaster in human history, the 2011 Tohoku earthquake led to a nuclear disaster at neighbouring Fukushima.

That was the question posed to me by a friend who happens to be a trader, naturally.

Do we really need more irradiated finance ministers or central bankers in the world? Definitely not, especially when drinking water is presumed safe in London with its traces of cocaine, in the financial capital of the world.

We cannot be sure that the radiation in the air has not affected financial decision making when we cannot be sure the BoJ knows what they are doing when the biggest beneficiaries of BoJ’s monetary easing to negative has been the foreign hedge fund who had bought the 30Y JGB issued in December 2015 at 1.4% (for 30 years) and sitting on profits of 30% for the bond and another 10% on the currency (against the USD), at the expense of the local Japanese investor (not privy to currency gains) who would suffer the triple whammy of lower local equities (due to the correlation with currency strength) and foreign investment losses (on currency strength).

Yet it does not mean that just because folks in Singapore are drinking NEWater will be spared from the megalomaniacal global central bankers in their relatively uninfluential spot as the 4th largest financial centre of the world.

So what happened to sell in May and go away?

Markets have stuck with the game plan.

1. The USD (DXY) Index looks set to rally for the 7th consecutive May (9 times in the last decade). Yet do note that the USD has sold off 6 consecutive June’s.

2. The S&P 500 has sold off marginally but we note that the past 3 May’s were rally months.

3. Oil prices have staged a huge rebound since March and May continued the bull run, alebit at a slower pace of just under 5%.

4. US bond prices slightly off, corporate bonds mixed.

Sell in May and Go Away, typically refers to the S&P 500 or US stock markets, taking into account seasonality effects because according to: the Stock Trader’s Almanac, since 1950, the Dow Jones Industrial Average has had an average return of only 0.3% during the May-October period, compared with an average gain of 7.5% during the November-April period.”

That has strangely held true most of the time because I did my own little statistical table and over the last 30 years, we had 17 occasions when the 1H outperformed 2H of the year (13 times) but the average returns on those 17 times was 8.42% vs the average returns on the 13 times at 0.35%.

On average, the average 1H performance for the past 30 years has been 5.08% versus 3.51%!

Surely this is all expected given that Black Monday and Lehman occurred in the second half of their respective years. In the past decade, however, we would be pleasantly surprised to find that 1st half only returned 2.13% for the S&P 500 compared the the 2nd half return of 4.23%, nearly double and including the Lehman crisis too!

It is so much stats that we can play around with that debunking the Sell In May and Go Away becomes an old wives’ tale more than an adage. And it may be a consolation to Singapore investors that, it has not held true in the case of Singapore’s STI Index at all with 1H outperforming 2H 7 times out of the last 16 occasions.

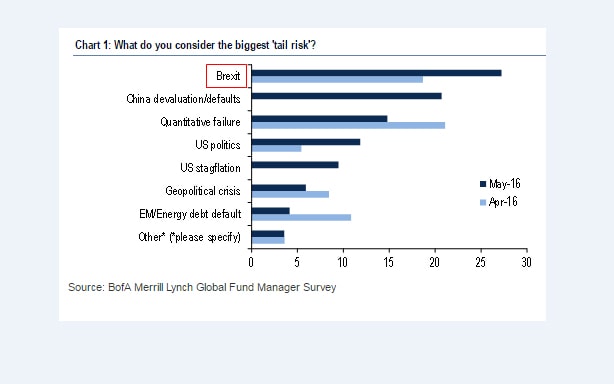

It may well be that, It Does Not Pay To Sell In May but the level of uncertainty is so high now that it is just too hard to think about the central banks (the FOMC rate hike in June) and best to ignore them as we had said a few weeks ago but the case to sell in May grows as we are faced with Brexit votes, Trump for President, rising pace of defaults, slowing corporate profits, elevated expectations of a recession, geopolitical crisis and much more that monetary policy cannot determine anymore as the Telegraph reports that Global Funds Fear “Summer of Shocks” despite boom in money growth.

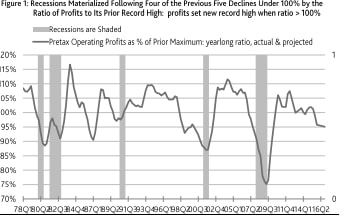

Indeed Moody’s has once again highlighted that the stock market is projecting a back to back annual dip in profits for 2015 and 2016 which has always led to recessions, as risks build up in the employment sector, usually the first casualty as profit margins are squeezed.

Source: Moody’s Weekly Market Outlook

The gloom sentiment is pervasive as government bonds have rallied, curves flattening in a world where US$9 trillion worth of bonds around the world trade at negative yields, which is a good reason to avoid them like the plague because US 10Y Treasuries have sold off in the last 5 June’s (8 times in the last decade), and also noting that German bunds saw their worst June in 30 years of data just last year.

There is only 1 nice thing about June—the USD (DXY) Index has sold off for the 6 consecutive June’s, following it’s 6 consecutive rallies in May.

Yet with the outlook looking bad for bonds, bad for stocks, worrisome for the economy, geopolitics, financial regulations and more (including irradiated G7 finance ministers), an adage is still an adage, is it not? Just Sell in May and Go Away.