SG53: In The Mood for Gentrification

Damn, we missed the Apple (AAPL US) US$ 1 trillion milestone? The US$1 trillion in valuation that is pointed out by Ian Bremmer to be worth more than the entire American media industry (including Netflix, Comcast & Disney) + entire GDP of Indonesia?

No, it is rats infesting a dear friend’s roof, 2 months on, as her wild-eyed gaze suggests that is not something her gentrified neighbourhood is used to.

We were talking about a friend’s nephew who was dating a girl who had never been to a food court in her entire life in Singapore, probably only encountering local dishes whipped up by Violet Oon’s Kitchen or Chop Suey at Dempsey, not knowing what to make of it and admiring the golden era prediction of our late LKY in July 2007, words that had stuck and words that replay in our memories every time we come around to National Day, remembering him.

Source: National Archives

Source: National Archives

In this light, we would dedicate this post to the golden era of the gentrification in Singapore, 3 years after LKY’s death, sitting in a donut shop or shack, as it is called, nestled comfortably next a coffee shop that is selling S$7 milkshakes and Moscato bombolinis, at Whampoa market as old folks shuffle past with their groceries, and not feeling out of place at all.

Middle Aged Hipsters

Middle-age is perceived to be somewhere between the ages of 35 to 58 years old, disputably. For those like us heading into SG53 in our middle-ages, outfitted hipster style, some may get mistaken to be older siblings of their children, according to some boasts we hear.

Yes, the trick is the subtle hipster look and our friend swears by Uniqlo, Stella McCartney and Adidas which makes us wonder what is it with Adidas and Nike these days besides the fact that they are the favoured footwear of Silicon Valley execs, because we have been informed by affluent Chinese and Russians that they are daily essentials in the lives of the rich and hip?

We know it is a global trend after spotting counterfeit Yeezy’s in Bhutanese flea markets and hearing the kid regale us with stories of how friends have made killings with the Nike Off-White range launched last year at resale values quadruple store prices.

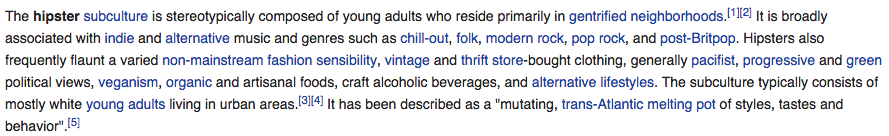

It the new hipster trend for the middle-aged because the original hipsters are supposed to be the boho-chic crowd of young adults who reside in gentrified neighbourhoods.

Source: Wikipedia

Source: Wikipedia

That was old Holland Village in the 90’s that we only vaguely recollect?

The millennial barista at the fancy pastel pink juice joint we patronised confidently informed us that we were wrong about a fellow patron when we suggested he was a fintech hipster in his 30’s, with his ragged hair, authentic looking punky t-shirt, baggy chinos, expensive looking sneakers (no socks) and even more expensive looking watch. He was 50, or close to and, Mr Barrista, with his man-bun, said. And rich from running non-fintech business besides the fact that Mr Barrista and his mates, who are in their 30’s (real millennials), cannot afford to dress like that.

Great, we thought, as we sipped our coconut-water-cold-brewed coffee (hipster drink), feeling un-Hipsterish and making a mental note of the bourgeoisie dress code.

Singapore’s Golden Age of Gentrification

Now, we have poke bowl shops next to a pawn shop, before pawn shop made way for new café which next to a crab beehoon coffee shop and there is no denying HDB estates are gentrifying when the vegetable stall in the market carries organic produce because mothers are feeding their precious babies kale.

With HDB flats going at over a million dollars, who needs a local pawn shop over 10 dollar waffles and 9 dollar milkshakes? (for the record, few children we spoke to knew what a pawn shop was)

Source: Propertyguru

Source: Propertyguru

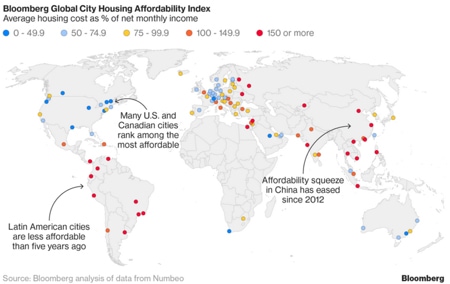

With a sigh, we note that the Chinese medical hall across from donut place has shuttered, a side effect no doubt of wealth pressures of the good sort (albeit bad for the proprietor), for Singapore remains one of the world’s richest countries at No.3 with GDP per capita of US$90,530, and makes NY housing look cheap.

Source: Bloomberg

Source: Bloomberg

It is the inevitable gentrification effect. Feeling bourgeoisie yet?

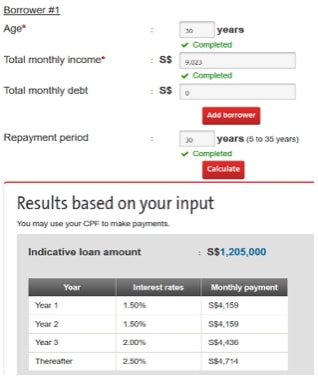

Yes, for it is the golden era we are living in right now as Singapore’s median household income of S$9,023 (in 2017) affords majority of the population a property worth up to S$1.2 mio, using the OCBC home loan calculator, and ranking Singapore second in the world in homeownership rates, at 90.8%.

Source: OCBC.com mortgage calculator for private property

Source: OCBC.com mortgage calculator for private property

It is just as LKY said in 2007, “If we maximise our opportunities in this golden period, in five years we will have a more vibrant cosmopolitan Singapore, not only clean, green and safe, but also a city, fun to work and live in for Singaporeans and for the many the foreign professionals and their families.”

11 years later, who would have thought we would find Nutella bombolinis in Whampoa and would queue for 10 dollar ice cream waffles in Toa Payoh?

Gentrification comes with the neighbourhood Jap restaurant, the juice bars, organic produce in the market, the porsches in the carpark, well-heeled golfers lining up for Michelin star chicken rice and more.

We could, if we wanted to, digress into the more uncomfortable topic of where Singaporean’s wealth lies (mostly in real estate) and the suitability of 99-year leasehold flats as a store of value, a hotly debated subject in cyberspace. Yet it is hardly a subject for conversation for the aging hipsters that we are aspiring to be.

Keeping Up with the Gentry

The bad news is that Singapore is not special. The world has changed and humanity has never had it better, according to Steven Pinker of Harvard, and health, prosperity, peace and happiness are all on the rise around the world.

The Jones’ of the world have caught up with Singapore, just as Indonesia has declared it will challenge Singapore’s lead in Asean stock markets and Vietnam, Thailand and Philippines look poised for much faster growth.

Singapore has failed to attract coveted unicorns to IPO since the smart nation blueprint and push for all things tech or fintech.

The financial market, one of the backbones of the economy looks poised to slow in job creation, according to the MAS.

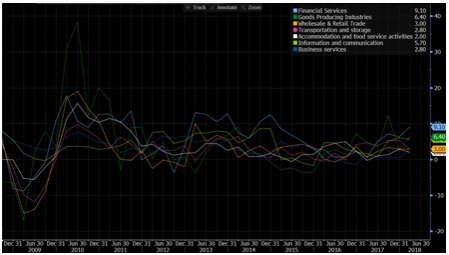

For the importance of financial services, we can see that it is playing a big part in recent GDP numbers, all 9.1% of it, and perhaps even more should Singapore get entangled in a trade war.

Singapore’s GDP breakdown by industry

Singapore’s GDP breakdown by industry

It does look like Singapore is still looking for the new formula as we came from SG50 to SG53, still trying to find ourselves after MAS MD, Ravi Menon, suggested that 2011-2025 will be a period of uncomfortable economic restructuring, that we have been keeping progress on every National Day since we wrote SG50: Joie De Vivre.

Joie de vivre: it has been as we continued to gentrify, which has been not that uncomfortable for some as it has been for others such as the middle-aged PMET’s laid-off in ever increasing numbers and many bankers along with them.

Singapore needs to find a new formula or resource even if we have some time (and global instability) on our side.

What did LKY think in his 2007 interview with the International Herald Tribune?

We summarise our favourite punchlines below.

- We have survived so far, 42 years. Will we survive for another 42? It depends upon world conditions. It doesn’t depend on us alone.

- If there were no international law and order, and big fish eat small fish and small fish eat shrimps, we wouldn’t exist.

- I think we have to go in whatever direction world conditions dictate if we are to survive and to be part of this modern world. If we are not connected to this modern world, we are dead. We’ll go back to the fishing village we once were.

- Worry? Yes, I do. Because of the vulnerability, the unnatural base. You know, our total trade—external trade is three and a half times our GDP [gross domestic product]. It’s more than Hong Kong’s. Hong Kong is part of China. We are not part of Indonesia or Malaysia. Our trade is more with the U.S., Europe, Japan and China than with Indonesia, Malaysia, Thailand.

- They are here because we’ve provided security, stability and predictability. If that sense of security and predictability is gone, the money will stop flowing in and will flow out.

- But this interconnected world is not going to become disconnected. Technology has brought this about. I do not see that technology disappearing. I think the problems will become more acute the other way, overpopulation, earth warming and displacement of millions, maybe billions of people, that is the greater danger.

- It scares me because many world leaders have not woken up to the peril that their populations are in… because it’s not an election issue. You know maybe 50 years, a 100 years, most of us would be dead. Leave it to the next president.

- For the majority in the heartlands, they don’t go to American schools or have that exposure. But from 20, it will become 30 percent going to tertiary institutions, universities. You asked me to predict what it will be in 50 years or even 20 years. I cannot, because we have left our moorings… it is the inevitability of modern society, as they travel, as they—the world is changing around us every day.

- You can be the greatest leader in the world. You cannot determine what your people and your country are going to face in subsequent years, because forces are at work which will play out in a different way.

How proud would he be with million dollar HDB flats, middle-aged hipsters and hipster joints, kale consuming babies and girlfriends who have never been to a food court?

It would be part of the changing world.

It is an inevitable change with Singapore’s best resource at the moment—our reserves and wealth, until we find the next best formula.

Happy SG53!