The Wealth Gap and The Tall Poppies

It is elections time in Singapore and time to bring up the problems of the poor which is timely, I would suppose, even if Singapore does not really have a severe problem with poverty and a negligible homeless problem.

What has teared many of us this week would be the photograph of the drowned Syrian toddler Aylan Kurdi that reminded the world of the plight of the millions around the world displaced by persecution, conflict and poverty.

2014 saw a global record in the population of displaced people, at 59.5 mio, with half of them children.

We need to look no further than our region in South East Asia where boat loads of Bangladeshis, Laotians and Rohingas are invading the shores of Thailand, Malaysia and Indonesia, many of whom are subject to atrocities in the hands of human traffickers.

So here we are, unhappy about our situations when 1 in 6 households in Singapore has more than a million USD in disposable wealth and one of the highest GDP per capita in the world that is unfortunately accompanied by one of the highest income inequality in the developed world.

Wealth is a Relative Concept

Rich is a relative word and you only feel rich by comparing yourself against your neighbour, which partly explains why some of us feel exceedingly poor among richer friends and peers. And relative riches does bring happiness and satisfaction whereas being poor in an inequitable environment leads to unhappiness.

It is relative wealth and not absolute wealth that makes people happy and as the rich middle class watch the richer spiral out of their reach, the unhappiness and frustrations would potentially set in.

Inequality

Plutonomy, a term coined by ex-Citibank strategist Ajay Kapur, is a situation where economic growth is powered and consumed by the wealthiest upper class of society. Plutonomy refers to a society where the majority of the wealth is controlled by an ever-shrinking minority; as such, the economic growth of that society becomes dependent on the fortunes of that same wealthy minority.

Yet it is not just the problem of Singapore and income inequality has risen over the years to become the most worrying trend for 2015 as designated by the World Economic Forum.

In the Federal Reserve’s triennial Survey of Consumer Finances, they found that poor are getting poorer, that 90% of US families accounted for 24.7% of the share of wealth (compared to 33.2% in 1989).

There is no longer any need for proof that the poor are getting poorer and the rich, richer because even the Federal Reserve and Janet Yellen has admitted to it in the Federal Reserve’s triennial Survey of Consumer Finances, they found that poor are getting poorer, that 90% of US families accounted for 24.7% of the share of wealth (compared to 33.2% in 1989).

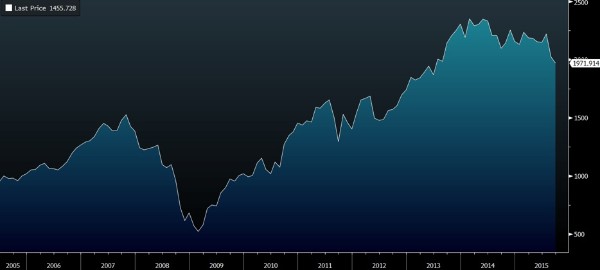

Common sense tells us that wealth begets more wealth itself unless it is wagered away, lost or stolen. Those coming from the higher base would have exponentially gained in the past 8 years from real estate and stock market that have risen astronomically. Indeed the wealth gap between the 0.01% richest and the 1% richest is growing in America.

For the person who has not benefited financially from the QE years, it puts such assets even more out of their reach.

For most of the countries house prices as a portion of disposable income has risen as a % to its long term average. In Singapore, it is not that bad if you earn GDP per capita and dream of owning an upscale home – it just takes about 34 years to pay it off.

I wrote a bit more on this a year ago.

Voicing Out

It is not just a favourite topic of the media these days as we observe a trend of populist governments coming into power making promises to close the inequality gap as Thomas Piketty’s Capital in the 21st Century shot to the top of best seller lists around the world.

We note a rising number of the ultra rich speaking up on various occasions like billionaire hedge funder, Paul Tudor Jones who said at a TED talk in March that “This kind of gap between the wealthiest and the poorest will get closed. History shows it usually ends in one of three ways—either higher taxes, revolution, or war. None of those are on my bucket list.”

Other billionaires including Cartier’s chairman Johann Rupert who “forecast that robots would “put hundreds of millions of people out of work,” which would widen the gap between rich and poor and stoke social unrest.

“It’s really what keeps me awake at night… How is society going to cope with structural unemployment and the envy, hatred and the social warfare? Because the people with money will not wish to show it,” he said.

Super wealthy clients could be targeted as unemployment surges, he said. That would make selling luxury goods more difficult.”

The Pope, the Archbishop of Canterbury, Lady de Rothschild and more are campaigning vociferously for some form of wealth redistribution.

My Thoughts

I have written this topic to death over the past 3 years and am not about to rehash the mounting pile of evidence that academic success is linked to one’s parents’ wealth or that 1 billion people live on less than $1.25 a day and that “805 million people go to bed hungry each night, and hidden hunger – or micronutrient deficiency – affects an additional 2 billion” when we have to admit that the planet cannot accomodate high-income status for all 7 billion of its inhabitants.

Why is the topic of inequality gripping billionaires and troubling them so?

Because “If poor people knew how rich rich people are, there would be riots in the streets”, according to Chris Rock.

As Johann Rupert, quoted above, says it does breed envy, hatred and the social warfare and Tudor is right that is will end in either higher taxes, revolution or war although we have not had an Occupy Wall Street for a while now.

And we can assume that billionaires possess some superior acumen to be a billionaire in the first place which is why we have been seeing a trend of world’s elite snapping up properties in geographically remote New Zealand, which they see as a shelter from the threat of terrorism, civil unrest and instabilities in the financial markets.

Geographically isolated Australia is the preference for the Chinese billionaires and Apple’s co-founder Steve Wozniak.

So are the Carribean islands, with little St Kitts and Nevis boasting of a Chinese billionaire resident, Jack Xu, within their 30,000 population.

If I was a billionaire, I would probably hedge my bets in a couple of spots around the world and have a bunker hidden away somewhere, a boat or submarine or plane to take me to my hideout and have the proper passports to live anywhere I want although I would be less keen on the Carribean for global warming reasons.

Not so easy for the non-billionaires to plunk away their less available millions on non productive assets lying in , I wonder what preparations would be in order after hearing of some hedge fund chaps buying boats as precaution which is no laughing matter when a former Bank of England advisor actually suggested that the public stock up on canned food and drinking food in preparation for a stock market crash that could, in his opinion, potentially lead to civil disorder.

His advice:

No.1: get hard cash in a safe place now; don’t assume banks & cashpoints will be open, or bank cards will work,” he tweeted.

“Crash advice No.2: do you have enough bottled water, tinned goods & other essentials at home to live a month indoors? If not, get shopping.

“Crash advice No.3: agree a rally point with your loved ones in case transport and communication gets cut off; somewhere you can all head to.”

I confess I did buy a few extra cans of baked beans at the supermarket the other day and a few of us bought the “zombie killer” baseball bat torchlight a year back.

More importantly, it got me wondering if the tall poppy syndrome will erupt as a social trend, and cutting off the heads of the tall poppies could give us a valid reason to sell that S&P Global Luxury Index which is only at a 2 year low.