Markets and Liquidity: Alienation, Fragmentation and Futility

“You will never get out of life alive”, a quote from a touching graduation speech by a NZ class senior, Jake Bailey, who was diagnosed with cancer shortly before his graduation.

And the scene from Apocalypse Now replays in my head, Colonel Kurtz’s last words, “the horror… the horror…” to the news updates on terrorism in Paris. Terrorists who are alienated from society, driven to acts of savagery on innocent masses, prompting populist governments to declare war on terrorism, against an enemy unseen, undefined and unleashed by further alienation.

The theme of alienation resonates with what I have been trying hard to conceptualise as what is unfolding in the markets we had concurred since last year that a liquidity crisis has hit the bond markets that is evident in the heightened concerns of regulators around the globe as central banks run on a tight rope between economic stimulation and interventions against the US Federal Reserve on a tightening cycle.

“Shocks may originate in advanced or emerging markets and, combined with unaddressed system vulnerabilities, could lead to a global asset market disruption and a sudden drying up of market liquidity in many asset classes,” the IMF report warned.

We all know that the main reason behind the collapse in liquidity is regulatory, rules preventing proprietary trading in banks; rules requiring the “too big to fail banks”, domestic and global, to bolster their balance sheets either by shrinking it or through capital raising; and all those rules to safeguard customer interests which meant it was cheaper not to do business sometimes.

The Great Divide In Access To Liquidity

I am not sure if many people have noticed the growing divide between those who have the access to funds and those who do not. From ground level, we see lending guidelines target the masses, restricting their ability to property/asset ownership and yet, “landlords” have access to capital aplenty. Giants like Apple is able to raise money at near rates while struggling commodity and shipping companies are unable to pay their dues. Indeed, Apple Inc managed 2 bond issues in 2015 at lower rates than their last lowest borrowing of 0.45% for 3 year USD in 2013 — ¥2.5 trillion 5Y at 0.35% and CHF 875 million 9.5Y at 0.375%, which is to be contrasted to companies like Cheung Wo Intl Holdings which had to pay 20% for just US$ 20 mio for 3Y with a call next month.

The Great Divide In Investment Liquidity

Bonds

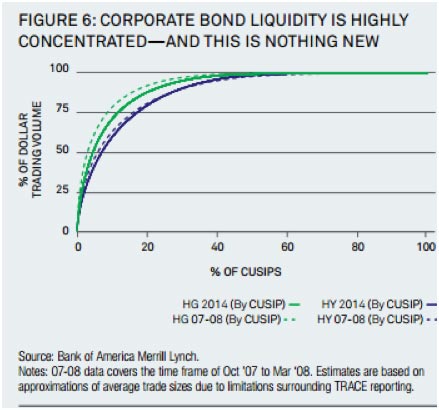

The great divide extends to investments as Morningstar noted recently that 80% of the turnover for bonds is concentrated in 20% of corporate issues, shutting the rest of the market out which is not a new phenomenon at all and in fact similar to pre-crisis levels given that 20% of corporate issues account for 80% of market size.

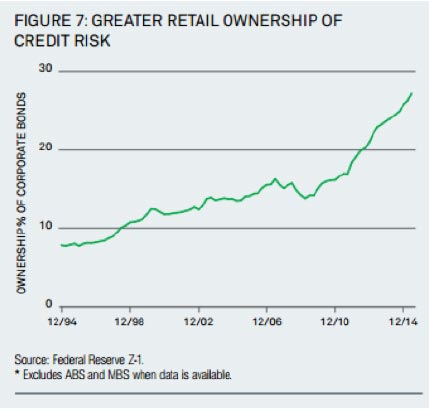

Yet this big difference this time is that debt ownership has largely shifted into the hands of the retail folk who are vested directly, or via mutual funds and ETFs which are oft indexed to the 20% liquid issues with high turnovers.

Stocks

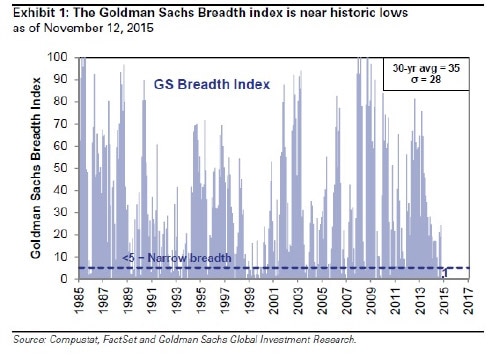

It is happening in equity space too, as Goldman Sachs notes that “Five firms – AMZN, GOOGL, MSFT, FB, and GE – totaling 9% of the equity cap of the index have accounted for more than 100% of the S&P 500 YTD return.” This is a sign of narrowing market breadth which has been calculated to be near its lowest levels in 30 years although the report is inconclusive as to the end result based on history.

And it is not just in the US. China is indulging in the “I buy you and you buy me” game as Bloomberg reports that the “Public Goes Missing from Hong Kong IPOs as State Giants Buy”, giving IPOs an illusion of success.

“China’s government-owned enterprises have dominated both the buy side and the sell side of Hong Kong IPOs this year. State sellers accounted for 77 percent of the $19.3 billion in proceeds from deals above $1 billion, while government buyers comprised 62 percent of the cornerstone shares.”

Similarly, in the ETF world, the top 4 ETFs account for 45% of total turnover with a single ETF, the SPY US taking up the lion’s share of 1/3 of total volumes.

Repercussions

… are plentiful as we hear about corporate bond markets in deep freeze with helpless investors in Singapore watching prices plummet without so much as a mere bid in sight with private banks resorting to trading amongst themselves, brokering bonds between investors as distressed bond desks sniff about greedily in the background.

IPOs run scarce, with the exception of China and Japan, and those ‘cornerstoned” by respectable anchor investors just like Singapore’s largest IPO for 2015, chilli crab restaurant, Jumbo Group, which succeeded based on sovereign wealth fund support.

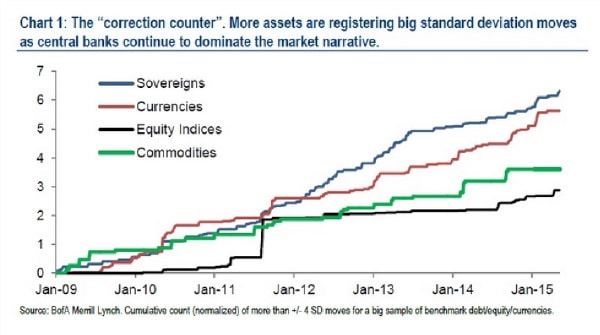

On a global scale, alarm bells are ringing as statistical anomalies rise in frequency with liquidity being blamed by many.

“Statistical anomalies have been happening more frequently, with short-term moves in many assets exceeding historical norms.

Barnaby Martin, a credit strategist at Bank of America Merrill Lynch, made this point earlier this year. “The number of assets registering large moves — four or more standard deviations away from their normal trading range — has been increasing. Such moves would normally be expected to happen once every 62 years.”

The Weakest Link

It is alright when the sun is shining to be underpinned by heavyweights, be it in stocks or bonds, which are held by the heavyweight investors in the likes of central banks, sovereign wealth funds, mutual funds and the ETFs.

So strange that it has become for Bloomberg to point out, besides the observation above, that volatility itself has become more volatile; for risk free assets such as US treasuries to yield higher than interest rate swaps; for banks to be net short corporate bonds (less than zero inventory) for the first time ever; for repo rates to fracture between banks; and for credit derivatives to yield less than their underlying bonds (pre crisis phenomenon).

It would be easier to say that the risk is in a black swan event but a black swan is not one unless it is unpredictable and thus it is safer to conclude the weakest link therein lies in the weak.

The weak central banks with little clout or reserves in the global scheme of things, the weak companies needing to refinance their liabilities, the weak investors that depend on leverage for their purchases, the weak ETFs that have no control over their AUM or even the weakening bubble in the real estate markets that could turn ugly.

A Final Word

Repeat : It is alright when the sun is shining to be underpinned by heavyweights, be it in stocks or bonds, which are held by the heavyweight investors in the likes of central banks, sovereign wealth funds, mutual funds and the ETFs.

Robo-advisors would tend to agree with me as well, alienating the lesser worthy investments and the EM exodus continues in fervour after too many good years as we read daily about those funds flowing back into the DM world.

The clock is ticking but the logic remains that when crisis strikes, we stick to the bellwethers even if Lehman was considered one a long time ago. And we can continue to harp about the narrow exit that lies ahead sometime in the future when the cornerstone investors pack up their bags, but that is something that they would not do tomorrow or at least without a profit or good reason.

That looks like the likely outcome — deteriorating liquidity, for investors and for investments, further alienation and fragmentation in the marketplace and most certainly, higher costs of insuring for acts of terrorism.

My thoughts with the families and friends of all the victims of the Paris attack.

By Wilfred Owe, 1918

Move him into the sun—

Gently its touch awoke him once,

At home, whispering of fields half-sown.

Always it woke him, even in France,

Until this morning and this snow.

If anything might rouse him now

The kind old sun will know.

Think how it wakes the seeds—

Woke once the clays of a cold star.

Are limbs, so dear-achieved, are sides

Full-nerved, still warm, too hard to stir?

Was it for this the clay grew tall?

—O what made fatuous sunbeams toil

To break earth’s sleep at all?