The Love Affair With Cheap Oil

It is mighty apt to be writing about oil as we close the week near 6 year lows in prices as OPEC decided, against market expectations to continue producing as much as it likes.

The immediate repercussion was a slam dunk in Brent crude prices, closing the week under US$ 40 for the second time in a month, near its lowest 6 year price back in August this year bringing us back to the dark days of 2008-2009 and levels last seen in the early 2000’s.

People are talking about oil again, which is not surprising, 18 months after its precipitous decline, and the world fast running out of invest-able assets that are not yielding negative as markets set a new record negative yield for German 2 year bunds just 2 weeks ago at -0.38%, about the same time DNB held their 2016 Oil Market Outlook conference.

This brings back memories to a year ago when my good friend invited me to attend the same and she went on to conclude that the Singapore corporate bond market was headed for a rocky patch as “defaults don’t happen the day of the oil price crashes. It comes in waves much later…” and yet we have not seen oil-related defaults this year even if bond prices have taken a big hit.

The 2015 oil story is one of pain till 2020, as my friend summarised.

“Why 2020?

- Pace of current fields running out

- Demand increase because of lower prices

- Considering the decline in demand growth

The truth is that we have overestimated a lot of demand and underestimated the supply shock.

It does look like the stalemate is here to stay unless something gives eg. supply outage, Saudi cuts, shale bust.

In the meantime, we have to recognise that industry CAPEX will be reduced, along with exploration work. Industry consolidation will occur and credits will be affected.

My big lesson for 2015 is that oil is a long love story unlike bonds, stocks, gold and the rest. Oil is the long drawn chess game where mistakes come at a heavy price and the future is near impossible to predict, as the chief oil analyst of DNB, Torbjørn Kjus, says that the demand supply balance is a circular argument that can, at best, be drawn for at most 2 years, with CAPEX changes taking about 5 years to filter through the industry and we have the example of 2012 when CAPEX spending did not even affect supply.

This lagged response in CAPEX change, along with the lagged effect from new start-ups and political manoeuvres like OPEC’s make the picture slightly hazy in the short term but pretty easy for analysts like Torbjørn to read, spending their days just adding the IEA demand forecasts to the supply numbers which are easily derived from field data.

And the conclusion is that 2016 would be a good year for oil but not the oil producers.

Saudi Arabia

It strikes me as odd that everyone watches the Saudis even though Saudi Arabia pumps less oil than the United States. That is because they are the swing vote and one of the cheapest oil around, running like a tap out of the ground and they can just turn it on or off at a whim unlike the deep sea rigs and shale producers who have to keep on running to cover their overheads and pay their bills.

And to Torbjørn, it makes perfect sense for the Saudis to keep on pumping this time round mainly because of what happened in 1986 when they decided to cut supply, suffering a huge loss of market share as other players stepped in to fill the gap in the supply driven downturn.

For this is indeed a supply driven downturn quite unlike the demand driven downturn back in 2009, as demand remains strong, with oversupply mainly from the shale industry and from massive investments from 5-7 years ago that are coming into production scene, not excluding peace in the Middle East which saw Libya emerge as a producer, and we shall have Iran as soon as next year.

Supply Outlook

Abandon wells… Canadian oil sands whose operating costs of US$ 35-40 per barrel, being sold to the US at US$ 30 per barrel (for they have no where else to go) and they shall continue to sell at a loss because shutting down is not an option, taking 6 months and a lot more money to restart operations. Deep sea drilling and offshore drilling follow closely which hopefully will cause less damage to the Arctic and then the shale industry will continue to slow which is all good news for the supply side of the equation as forecasts indicate that the US will return to become a net importer again next year.

All Saudi Arabia and OPEC has to do is to wait them out, a potentially risky move for the other OPEC states which are overburdened with heavy social budgets to keep the populace happy.

Then we have the budget slashes that will eat into future supply. When you stop investing, current wells will simply run out. Investment cuts have been steep for 2015 ranging from 12 to 38%, the mid cap oil companies cutting the most. Norway’s biggest oil companies came out on 24 Nov to estimate that exploration spending will fall by 35% in 2016 after Conoco Phillips declared they will exit deep water exploration by 2017 and we have daily announcements of investment reductions from across the globe.

Yet, we know that all these take time to filter through as mentioned above that CAPEX changes take about 5 years to take effect.

Meanwhile we have all startups from 5 years ago coming into production since last year which will add to supply which is likely to last 4-8 years as their production peaks.

Throw in the greenfields of Iran with the potential for up to 6 million barrels a day with the help of CAPEX for the next several years, which is fortunately held back the red tape of sanctions that are not expected to be lifted till mid 2016 for their nuclear deal earlier this year.

In all, still a decent slowdown in supply for the months and years ahead.

Demand Outlook

Numbers do not lie when they show that vehicle miles driven in the US has risen nearly 3.5% on the year, largely due to lower gas prices. Fuel guzzling cars are making a return, at the expense of struggling Tesla. US drivers cover more miles than Europe and China combined, thus we know that it is a no small number or impact.

EM demand is the key driver for the future, depending on the likes of India, Indonesia, Malaysia, China and the rest to fuel growth and without whom, there would have been no growth for the past decade. Demand also largely depends on macroeconomic growth which is a minus for the near term picture, given the weak growth numbers we are seeing out of China.

2016?

Oil under US$40 this weekend again. People are talking about oil again.

Can cheap oil last forever ? Perhaps till 2018?

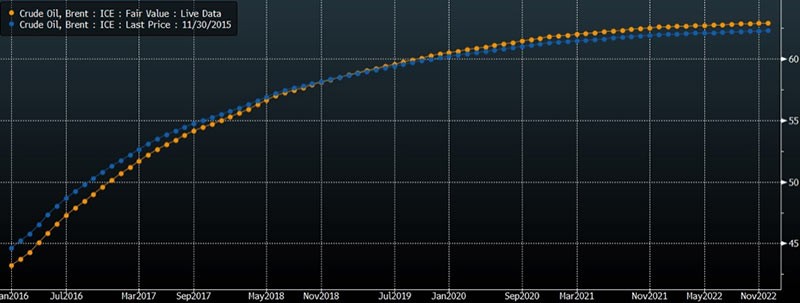

Take a look at the Brent Curve from Friday and what it was a week ago. 2018-2019 oil is now more expensive from a week ago.

It sure does not mean rushing out to buy into the oil companies who are just starting to feel the pinch this year, seeing the number of bankruptcies out there and more pain to come. But it sure means that markets are perhaps too bearish on the supply overhang just because OPEC decides not to turn off their tap of cheap oil.

And it will not take more than a headline or two to change sentiments as we have seen several times this year as how all love affairs go.