Random Market Thoughts: Time for a Selfie

Running scared, worried, troubled or sleepless as you watch the market systematically decimate your Keppel blue chip stock without pausing to take a breath for the first 10 trading days of 2016? Down 25.6% in the blink of an eye for a stock that holds a dear place in almost every single respectable retiree’s portfolio since its founding in 1968 by none other than Temasek Holdings as their earliest investment.

12 month picture of Keppel Corp share price

From its 6.6% weight in the STI Index, Keppel’s weighting has, in 8 years, fallen to 3.26%, less than half of its former glory and now indicating a gross dividend yield of 9.92% on its last price on expectations of further deterioration of their annual revenues into with 2015 registering an 18% drop, another 6% in 2016 and 3% in 2017.

The Keppel “selfie” shot since 2008 looks pretty doleful, like a profuse bleed since its peak of $9.54 less than 9 months ago.

It got me to wonder if we like those selfies only during happy times? Choosing to hide under covers during times of trouble in our investments?

Well, the markets’ love for selfies has evidently diminished if GoPro (GPRO US) Inc’s stock price is anything to go by, falling way more than halfway below its IPO price back in Jun 2014.

Does that make monkeys the only happy selfie addicts these days? Even if a US court just ruled recently that works created by non-humans cannot be subject to copyright making the monkey selfie below free to be shared.

2016 has been a let down so far, and after a fortnight, it looks set to be hardest year to make money in 79 years after 2015 has been declared the hardest year to make money in 78 years.

For equities, only Jamaica, Slovakia, Bosnia, Latvia, Lithuania, Malta, Tunisia, Ghana, Mauritius, Bangladesh and Laos have registered small gains against the meltdown of 10.6% in global market capitalisation which works out to be about US$ 640 billion so far, $91 for each of the 7 billion world population.

The oil rich and oil related are undoubtedly the worst hit compared to the Chinese, who are just back to where they are a year ago which is enough to drive the rest of the world into a frenzy and a lemming-like exodus resulting in an attack on the HKD-USD peg on Friday amidst calls for calm out of regulators who were similar in calling for restraint in the prior rallies.

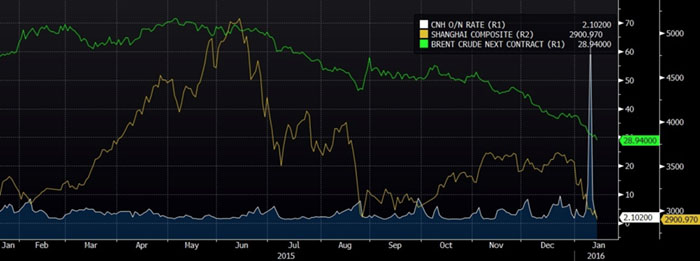

Selfie moment for the situation. No doubt China correlates with oil and that sharp spike in overnight interest rates to 66.815% on the 12th of Jan is pure indication of how the regulators there are losing their tight fisted control in their new currency regime as part of the IMF basket.

This weekend’s UN lifting of Iran sanctions points to the week of 18 Jan possibly being the worst week we will have for the capitulation of the last oil longs as we head into the last week of January and the FOMC meeting results on 27 Jan (28 Jan 3 am SG time) that will surely spur more capital flight out of China even though the probability of a hike has been discounted to zero according to surveys.

There are few opportunities until the US Presidential elections to pull off those hikes because markets will start feeling the heat in the primaries till Super Tuesday, 1 March 2016. Undoubtedly, that will be another game changer for the USD where all the world’s faith lies in and for all the reports we have out there, there is none talking about a global recession albeit slow growth or slowing growth, at most, for China which is still expected to deliver an unimpressively impressive, by every other country’s standard, 6.5% yoy growth.

Thus, for all those wannabe long term investors out there, “This is your Selfie moment.” The long term investors that we wrote about last year…“The average value investor underperforms a buy-and-hold investment in the S&P 500 by –92 bps. Value fund investors typically do not hold their investments. Instead, they chase trends, allocating away from value funds after a period of underperformance and towards them after a period of outperformance. In other words, average value investors do not adhere to the contrarian allocation as one would expect; they are actually trend chasing. Unfortunately for them, however, the value premium is mean-reverting. After periods of outperformance it tends to underperform, and vice-versa. Trend-chasing investors increase their allocation to value funds before (and sometimes just before) the funds reverse direction and head back, downward, toward their long-term averages. And they reduce their allocation before the funds head up again. This poor timing has cost value investors an average of –131 bps per annum.”

The crowd is hurtling for the exit and the selfie moment for the STI has Sembcorp Marine, Sembcorp and Keppel, matching the oil price drop along with Nobel Group, another darling to basket case.

While there is hope for Sembcorp Industries because half of their revenues arise from their utilities business, the bellwether industry, seeing that the Dow Jones Utilities sub index is the only green dot in the sea of red for all the other indices out of America, Keppel’s infrastructure and property divisions that contributes one-third to profits will struggle to make up for the lagging two-thirds.

Analysts are now trying to outdo each other in predicting how badly Keppel and Sembcorp Marine’s order books will take to the rout in Brazilian O&G companies, calling for 30-70% of orders being cancelled, none too worried about their cash positions, sitting on their billions in cash with little due in terms of loans and bonds (Keppel none in 2016 and Sembcorp, S$ 224 mio).

Dividend projections all forgotten and P/E, even forward P/E ratios, are blurred memories. For Noble it is 3.02 times, Keppel 6.43 times, Sembcorp Marine 8.88 times and Sembcorp Industries 4.05 times, against the STI P/E of 12.16 times and average dividend yield of 4.55%.

My good friend tells me that she drives fast so she won’t get hit and avoids crowds so she won’t fall sick. What would Warren Buffet say?

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful.”

And Warren Buffet is digging deeper into his big oil as CNBC reported, buying more shares in Phillips 66 (PSX US).

So take out and dust those selfie sticks, all of you. And let’s see those photos in 6 months time.