Immature Markets? Monkey Trading? Look Who Is Talking?

On the off chance that some readers may not be aware that we are sitting through a particularly nasty spell in the markets most of which are now in “bear” territory which has happened only 23 times in the past 85 years. The official definition of a bear market is a 20% correction or more, the dangerous territory we have been flirting with for the whole of last week.

In a couple of months, this epic would be diagnosed by the army of analysts and strategists who would have recovered some of their old bravado to emerge from their hiding holes, where they are currently ensconced and furiously spamming our mailboxes with those Chicken-Little-The-Sky-Is-Falling reports, to declare this is a classic case of Maynard Keynes’ “animal spirits”. And for people who have sat through a crisis or two, we know that the world does not really end on bear markets as history would have. For in the past 85 years, “On five of those 23 occasions, stocks still ended up positive on the year. . .”

As we had pointed out last August, this is the 3rd longest bull run in history.

It has been over 2,300 days of rally for the S&P 500 without a 10% correction, the 3rd longest bull run in history when interest rates are at 5,000 year lows, according to BofA.

Period: Dec. 4, 1987, to March 24, 2000

Run in index points: 223.92 to 1,527.46

Change: 582.15 percent

Duration: 4,494 days

Period: June 13, 1949, to August 2, 1956

Run in index points: 13.55 to 49.74

Change: 267.08 percent

Duration: 2,607 days

“Arguably the only reason to be bullish risk assets right now is there are no reasons to be bullish” – BofA

And from August, we have come to January.

My dear friend, who is now back in a trading role had cautioned me against reading too many of those mind numbing 2016 reports. Want to tell us what will happen in the next 12 months? How about just getting through the next 12 hours?

Well, the most powerful man in China markets, Xiao Gang, chairman of China Securities Regulatory Commission (CSRC), got it right that “The abnormal stock market volatility has revealed an immature market, inexperienced investors, an imperfect trading system and inappropriate supervision mechanisms.” That brings us back to our Monkey Trading Challenge story from last year well before the market peak.

Valuation models are important but so are sentiment gauges and guessing where investor mood is heading is the million dollar question. If you ask me where China is heading now, I would probably say up more than I would dare say down. And I really do not need a doctorate to tell me that. And if anyone disagrees, I would challenge them to the monkey stock trading challenge!

Now how about that as the case for animal spirits in 2016 so far?

No. I shall not talk about China any more from here because we need look no further than the shores of Singapore and her bond markets for immaturity, from the plenitude of feedback I have gathered from various parties in recent weeks.

My friend recounts a story from over a decade ago. In comes to Singapore, brilliant and renown trader, famous for a stunning coup in JGBs, who decided to semi retire here to end an illustrious career. He sees flaws in the Singapore government bond curve and decides to try and normalise the yield curve by putting on some bond swap trades to pit the under valued against the over valued. Singapore bonds ended his working career for good when the local markets rejected the idea of short selling and made sure those long bond swaps turn positive (i.e. yield higher than swaps) and those short bond swaps got even more negative (i.e. yield lower than swaps). It hastened his retirement, did not damp his spirit the slightest and after 15 years, markets have not changed much.

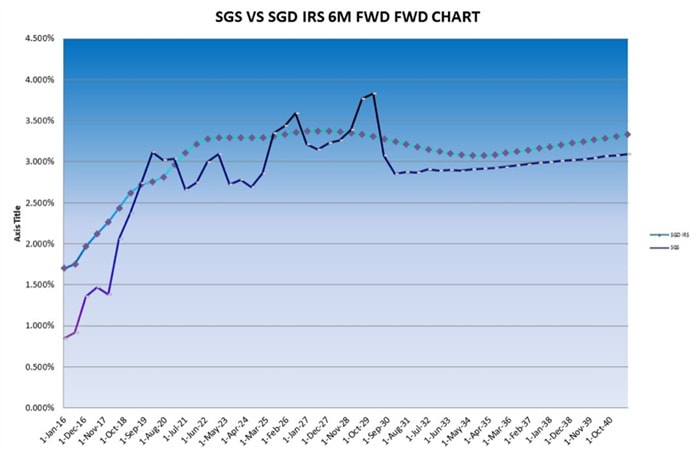

The premise for “normalising” a yield curve is so that it would not look like this picture, courtesy of my friend, the trader. The graph illustrates the non-uniformity of government bond yields (dark blue line) between tenors when you strip the curve into 6 months segments for comparison.

After 15 years, the curve still looks pretty Third World, in her words, because in the First World, the kinks all represent arbitrage opportunities yet no one in their right minds would attempt to touch Singapore because of the lessons of the past. And the mindset remains as industry experts and practitioners alike tell me and everyone else that the Singapore bond markets trade differently. Singapore is different so we cannot expect the market to behave like it does in “other places” which makes us look a little provincial as a AAA, developed country that has an idiosyncratic market?

2 years ago in 2014, banks told customers the same thing and that 5% is high yield for Singapore because Singapore is different and most corporate bonds trade on price terms so don’t worry about credit spreads and rising rates too. Good because customers all bought into the story and are now paying the price for being uneducated because not only is 5% not high yield for Singapore after 2 defaults (one current and one impending), rates have risen to 7 year highs.

It is an endemic problem, too, with savvy institutional investors are caught up in the same way. A salesperson informed me that some of his institutional clients cannot buy corporate bonds that are not specifically rated even if their parent guarantors are. These are financial professionals, all with certificates and degrees to prove for it, who would invest in a bond only if it had a rating in its Bloomberg description page (long live Bloomberg!) and thus some bonds here are highly undervalued to their offshore equivalents while the rated papers are hoarded carefully at ridiculous values. No point in trying to right this because short selling is impossible in Singapore, like it was 15 years ago, and the chap who said “do not sell anything you do not own” is still around, I hear.

Overheard in a lift, a fellow who is presumably a bond advisor telling his friend that the bond must be good because the bank was willing to award a high level of leverage for investors to buy it. Upon consulting a few advisors, I managed to verify that this belief is quite prevalent.

A misinformed marketplace is an immature one? Singapore? China? Markets in their infancy and less than 2 decades old, on their long trek to adulthood with lessons learn, sacrifices made and monkey trading along the way. All the more the importance of education, if you ask me, if I can manage to convince my dear friend to give a seminar on interest rates and bonds and maybe we can even get that chap in the lift to attend it as part of his CPD (Continuous Product Development) hours.

All this “pearls of wisdom” coming from me? Look who is talking?