Investing in Austerity: Chasing Michelin Hawkers

You do not need GDP numbers to talk to you to know that the economy is roughing it out just from the observation of the sore absence of birds-nest gold-flaked mooncakes in Change Alley this year that brings about that moment of reckoning that birds-nest is tasteless anyway. A more comforting way to clog up the arteries would be through those decadent durian ones, which proved popular, coming in various premium varieties, because it is perhaps not such a great idea to live as long as we have been forecasted to.

You do not have to look too far to know that household finances in Singapore are not doing too well when the spam SMS-es on your mobile device has swung radically away from adverts hawking Cambodian condos or Paya Lebar commercial spaces to payday lenders offering quick cash to the needy folks that no bank would have anything to do with.

To my dear friend, affronted by the slew of these SMS-es on her phone and her concern that perhaps her “poor credit score” has been leaked, I had to assure that I have similar influxes on my own device, contriving to assemble a mini collage of just a few of these messages, even as a new one popped up as I typed which says so much for personal data protection in Singapore.

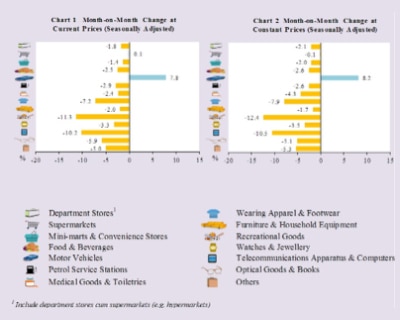

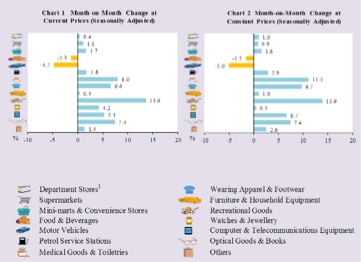

June was the month of the Great Singapore Sale and looking at the retail numbers, it would appear that Singaporeans have been buying a lot more cars and a lot less everything else. Are cars really coming to the rescue or do we have to thank another friend who has been actively growing his fleet rental business and informed me recently that he just added 2 of the new E-class (diesel) to his feel which has swelled from 6 cars in Jan to nearly 60 on last count?

And it does not really take a lot of brain power to add up the dots when the headline last week read layoffs in Singapore up in Q2, unemployment among degree-holders highest since 2009, noting “”sustained increases” in unemployment among residents aged 30 and above and, in particular, among those aged 50 and above for the fifth consecutive quarter.” Perhaps making up the bulk of those car leases, driving Ubers to keep our unemployment rate steady?

Mr Fleet-Rental then let on that he has since moved into the second-lien real estate financing business to help those in need, in particular those that banks shun even as MAS announces the relaxation of the killer TDSR rule. Risking his own money, it is no wonder loans are going at 6%.

Yet, what will we do without him and those payday lenders to oil the broken wheels of finance from the shadows? Banks are mercilessly shutting their doors to clients, in particular, those oil and gas companies that were the crowning glory of the bond league tables.

I was chatting with my dear friend who has been on her austerity crusade for some 3 years now, starting with her heroic efforts in planting sweet potatoes, for her thoughts on the retail situation and she cheekily informed me that UberEats was officially launched at the end of May, her being an early adopter and gunning for those 25% discounts from likes of them and their competition, driving F&B volumes up but values down which did not sound too plausible even if it is a sign of things to come when we have recreational goods sales crashing most along with discretionary items in in electronics and apparel, the sort of trend we see in a recession.

The market bond king, Jeff Gundlach said on CNBC television on Wednesday that he has been selectively shorting shares in some restaurants, airlines and retailers. In addtion, he also said that economic growth has been sub-par and that will continue to be reflected in certain names in the Standard & Poor’s 500 Index. “When the next recession comes—and it will—all those categories are going to get killed.”

Anticipating retail attitude changes and behavior will perhaps give us that investing edge if we are no good at picking that next loss-making start-up unicorn that will turn out to be a gem. And it not too hard to see the luxury trend dying quickly as we read daily headlines of Cartier’s parent Richemont warning that first half earnings will decline 45% while reading that middle end fashion chain Zara’s owner, Amancio Ortega, has overtaken Microsoft’s Bill Gates to become the richest man in the world this month.

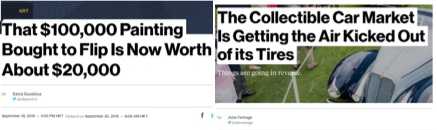

Although it is hardly evidence just by looking at some billionaires get richer than their peers that retail trends have swung towards the cost conscious austerity drive that some of my friends and I have adopted, it is getting clear from art and collectible cars markets that the demand for non-productive assets is fading quickly.

Discretionary spending is usually the first port of call on any austerity drive and global luxury spending is experiencing a tough spell.

Yet it is perhaps not too early to speculate that the trend will sustain especially with interest rates on stay in the US and on a collapsing trend in places like Singapore.

How can it be so when lower rates are supposed to be aiding not trickling or impeding, consumption.

1. Can we blame it on Janet Yellen and her cohort of central bankers for crushing our perceptions and thus, our desire to spend more ? Because if we had some optimism for our futures, chances are we will take out our wallets more often.Converting the investor world to bond lovers, my dear friend has a cheeky observation that bond investors are hardly optimists, profiting from bad news.

2. Populism is on the rise globally and the finger of blame has mostly been pointed at the widening wealth gap even as Barrons reports that there are “There are now 6.8 million millionaires in the US and, for the first time ever, one million people worth over $5 million.” The WSJ reports that despite US households collectively reaching “a record net worth of $89.1 trillion in the second quarter”, there is “no information about how assets are distributed among households”. And rural US is being left behind, a reason suggested for Trump’s popularity.

Rich people only need so much luxury as Warren Buffet pointed out that “There comes a point when money really has no real utility” and wealth is more concentrated than before.

This has led to the tall poppy syndrome and the death of ostentation in most places especially when banking bonuses are crimped, finances crippled as minimum wages rise elsewhere which will definitely not result in more Birken bags being sold.

We need not look further than President Xi of China who chose to eat at the dumpling shop back in 2013 instead of wherever else he may have had lunch, an act gamely replicated by Obama in his recent visit to a street-side eatery in Vietnam this year for a 6 dollar lunch.

3. Throwing in our lot with the uncertainty that the pessimistic central bankers are ladling on us which has led to the rise of populism since the Lehman collapse and heightened global uncertainty as evidenced in the US Presidential elections coming, likened by outlier candidate Jill Stein as choosing between “death by gunshot or death by strangulation”, the world can only expect another 4 years of fluidity, impermanence and the unlikelihood of any improvement in the situation. How can we expect ourselves to spend when company CEOs are not bullish or spending?

4. Then we have the Millennials who will be shouldering the bulk of spending as Generation X-ers and Boomers move on. More of them live at home with their parents, as we know, and are therefore, unlikely to be yearning for the high end brands their parents fancy. Millennials prefer experiences over products and research has shown are more frugal and more careful in their spending. It definitely makes sense because most of them should expect to live to 100 at least and that is 1 century put in perspective to worry too much about following annual fashion trends.

5. Growing environmental awareness is changing the ball game with India, the latest to ratify the Paris Agreement on climate change. The anti-pollution mindset, melting polar caps and conservation efforts has resulted in people like my dear friend choosing to pay more but buy less, favouring a lifestyle of sustainable consumption.

The End of The Age of Excess

I could be wrong but the age of decadent excesses is definitely coming to an end. And I would not be wrong to suggest that the transition could be smooth and simple if we just played along with the easy new trend of austerity.

Because things are bad, central bankers say so, politicians say so. Singapore’s political rhetoric has changed over the years away from economic growth to survival and sustainability as DPM Tharman urges us to “Prepare to ride change, be part of it”, just this weekend. As we noted last month, SG51 does not have much to cheer about and we are lucky to have Pokemon Go to help some forget their problems in a healthy albeit insomniac way (judging from the photo collage below, kindly provided by my dear friend, of Changi Village at midnight).

Feedback from friends who have hopped on the new trend resonate more or less the same theme of choosing a healthy lifestyle these days, saving money in the process, and feeling better about themselves and saving face at the same time.

Some Face Saving Activities

- Playing Pokemon Go in earnest.

- Take up cooking seriously for more home dining and entertainment or go for organic home cooking as an excuse. Fuss over ingredients and food quality which I observed is gaining popularity.

- Opting for minor repairs and touch ups for the home instead of the large scale renovations (good for small contractors and handymen).

- Gym/Yoga or whatever excuse as not to wear the latest killer (on wallet) heels or carry the latest handbag.

- Chase Michelin hawkers instead of chefs ! Has erupted into a fad these days.

- Cycling, jogging, gardening or reading instead of shopping.

- Outdoor hiking holidays instead of Milan shopping trips.

We had great laughs going through the list which is almost a guarantee of an extra 10 years of life if one pulled it through. And we all should not over react because July’s retail sales bounced back in a fierce way, judging from the chart below except for the restaurants bit (which we can blame on UberEats).

August’s numbers should be healthy for tech goods given the number of battery packs and phones bought for Pokemon-craze.

3 years from my friend growing her own sweet potatoes, austerity appears to be catching on as a new trend, eating less, spending less, keeping asset light, saving more, buying bonds, feeling pessimistic, chasing Michelin hawkers and living longer lives.

Good luck investing on that.