A Pre-Summer Review of SGD Bond Markets

Weekly Market Bash

On the MCE expressway and you get to wondering why Lane 4 to the exit is suffering a single lane congestion, finding out as you dart opportunistically into Lane 5 that there were 2 dozen cars trailing a minivan, all at their own leisure. The phenomenon continued on the ECP with a trail dutifully following a bus, the cars behind blissfully unaware and probably afraid to miss their exits. And my mind started to wonder about lead in the drinking water, a problem plaguing just about 3000 US cities, brought to light last year by the US city of Flint in Michigan, where nearly half its population live in poverty, made worse with their children poisoned.

The idea is quickly discarded as we come to reflect on the orderly meltdown of the markets on Thursday after accusations of corruption in Brazil (what is new?) and on news that Trump’s campaign made at least 18 undisclosed contacts with Russians, which we all suppose is wrong? It was all but erased with an orderly rebound on Friday to make sure we ended the week on an optimistic high, a huge challenge for many a hapless humanoid trader pit against determined algo-bots.

So, Donald Trump has Russian contacts and tried to order the FBI off the case which should warrant an immediate impeachment, according to reporters who have now been found to drink too much and are dumber than average even if the London Press Club surveyed just 31 of them.

Source: Zerohedge

The irony is that what Donald Trump has allegedly done would not have raised a single eyebrow in half the world outside America because it is quite common for evidence to go missing, fires to break out in police departments and deputy prosecutors to be found dead, as folks have come to accept without judgement.

Quiz Question: Can anyone name not just one but half a dozen countries where Trump actions would be deemed acceptable?

End of bash.

Pre-Summer Review of Singapore Bonds

It is time again for that more or less mid-year bond review that we are bringing forward with urgency given the fragility of the market place that is alternating between risk on and risk off even if the equity markets are sticking to their guns ahead of the all-vital FOMC on the 15th of June, assuming Donald Trump does not get impeached immediately after Comey’s testimony next Wed.

The good news is that bond investors need not fret or lose sleep or break a sweat on their bond holdings compared to the 11.67% gains that the STI Index has chalked up year to date. Singapore interest rates have collapsed between 0.28 to 0.63% since the start of the year which should have net those bond portfolios some nice capital gains, so we thought it would be a good idea for that performance review of bonds vs stocks.

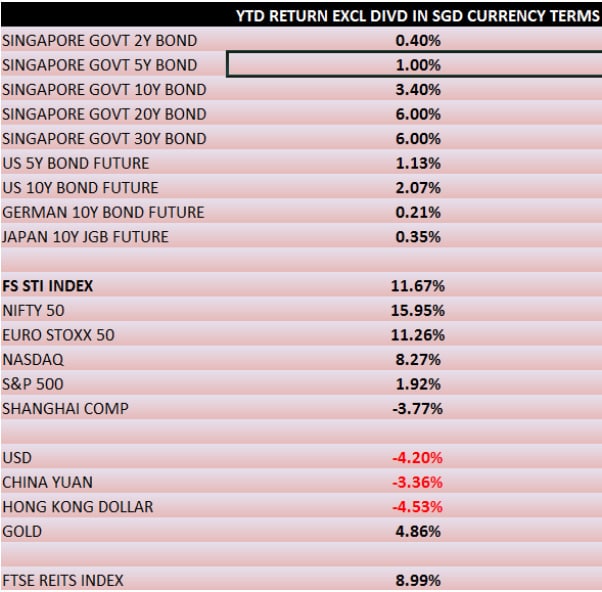

Let’s start with a summary of market returns, excluding dividends.

It does look like any American investing in SGD assets would be netting a pretty penny (capital plus currency appreciation), assuming they had invested on the first trading day of the year which is something normal investors do not practise. Yet we have to start somewhere and day 1 is a good start for accounting, although the picture is somewhat distorted if we start counting from the day Donald Trump was elected and the massive USD rally and bond sell-off that we have all but recovered from.

What About Good Old Singapore Corporate Bonds?

We must congratulate the local market for delivering some superb returns at last, giving bond investors capital gains to match the equity markets as we find over two thirds of the market on positive price gains, leaving just a handful of losers in the default department.

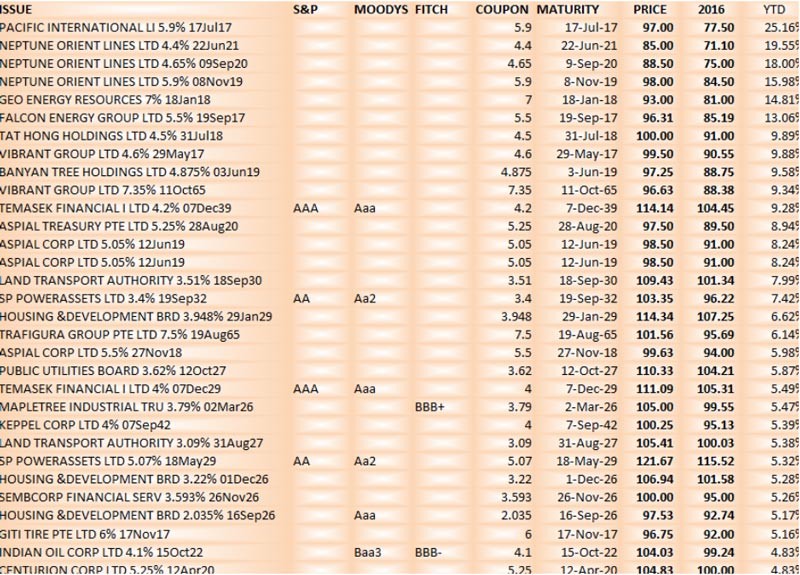

Bearing in mind the STI benchmark gains of 11.67% for those top 30 stocks of Singapore, we present our unofficial list of top 30 bonds, unverified for accuracy.

Table: Top 30 capital gains (excl coupons) for SGD bonds.

We see the usual suspects markets had loved so much to bash featuring high on the list, the NOL’s, Aspial’s, the privately owned shipping company, Pacific International Lines, PIL that probably got confused with the rest of the O&G field particularly if it had been associated with another “Pacific” named, Pacific Radiance which was embroiled in a minor scandal.

Natural winners would also be those ultra long-dated, 20 to 30-year papers, given the 6% run up in the government bonds.

Yet the award goes to NOL and their come back from their lows after losing their Temasek backing to CMA CGM in September 2016, when their bonds lost nearly half their value could still have some room to improve going by where the CMA bonds are trading now and we can also thank the freight rates rebound for that.

Graph of NOL and CMA bond prices.

Kudos, too, to Geo Energy Resources whom we hear have gone the shadow banking route to raise funds in a privately placed new bond issue done without the help of banks, which their stock price has gained sufficiently to show for.

Here is our list of top 30 companies-with-bond-issues for the year so far.

Top 30 stock gainers of companies with existing bonds

It is a good sign indeed when we have a nice mix of equity gainers that include some of the most beaten down bonds of 2016 although 2 in the group are still somewhat mired in financial distress.

Who would have thought that we had just pointed out these papers just a few months back when we wrote our outlook for 2017, Singapore Corporate Bonds 2017: No Rain, No Rainbow, that NOL, Falcon Energy, PIL would have made such a comeback for the same idiosyncratic reasons they were shunned.

Table of Distressed Bond Prices we published in Jan 2017

Who says fortune does not favour the brave investors who had ventured when others fled?

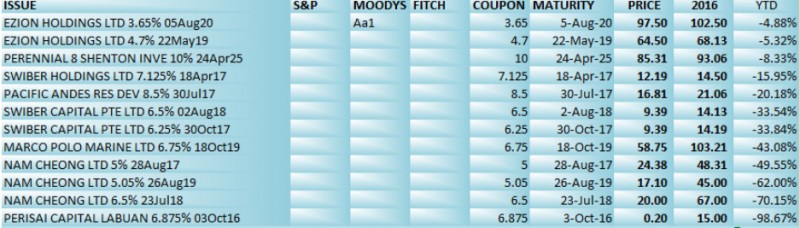

Granted SGD bonds are having a good year, we have to spare a moment for the losers, the brave investors who are left empty-handed in their quest for returns.

Not all on the list above of the bottom 12 bonds in SGD space are in default as we write, with Nam Cheong seeking to restructure their shares as their bond prices are decimated and; Marco Polo Marine still working out something and we are not sure what is going on with that Perennial bond which has seen better days some 2 years back with its price at the lofty highs of 120-150.

Not that we will be playing the blame game here today for we have had enough of that in 2016 because as we had said earlier this year, “Savvy investors will now be in the fray, after profiting in 2016, to grab the occasional forced-sale in those “distressed” names that could turn out to be sound and we can be sure there will be more panic moments ahead with the press hounding for the next default in their sudden change of heart after years of persuading us with their sweet talk on the bond market”.

Singapore Government Bonds—The Forgotten Heroes

Before we all start partying into summer for our astute investments, we have to recognise that the benchmark government bonds are not lagging too far behind. The 10Y Singapore government bond is already up 3.4% this year, or 5.5% including its coupon, and the 20-30Y bonds are up 6% just on their capital gains which means the 20Y and 30Y SGS have beat every single new bond issue this year.

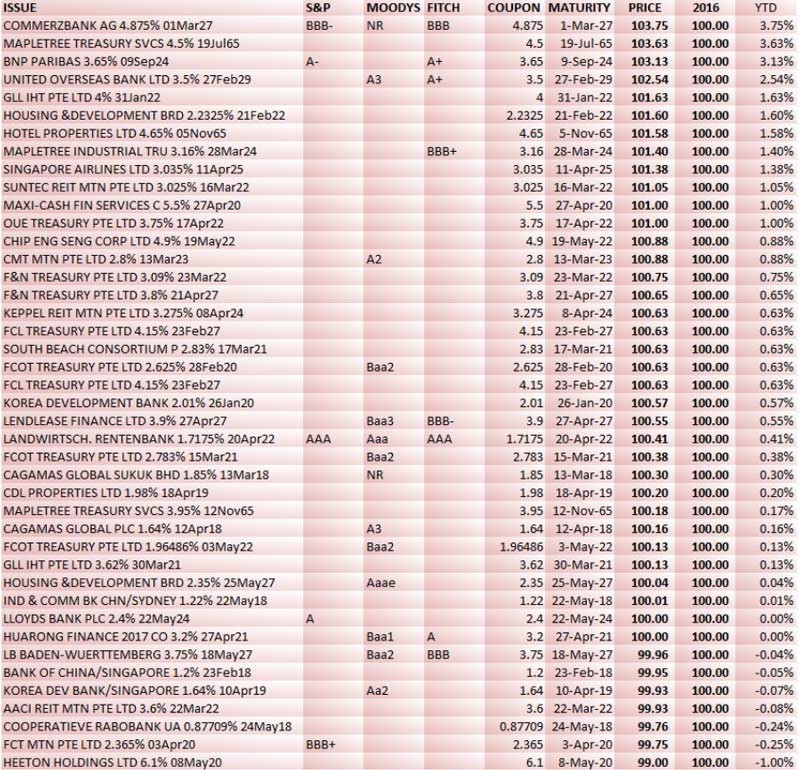

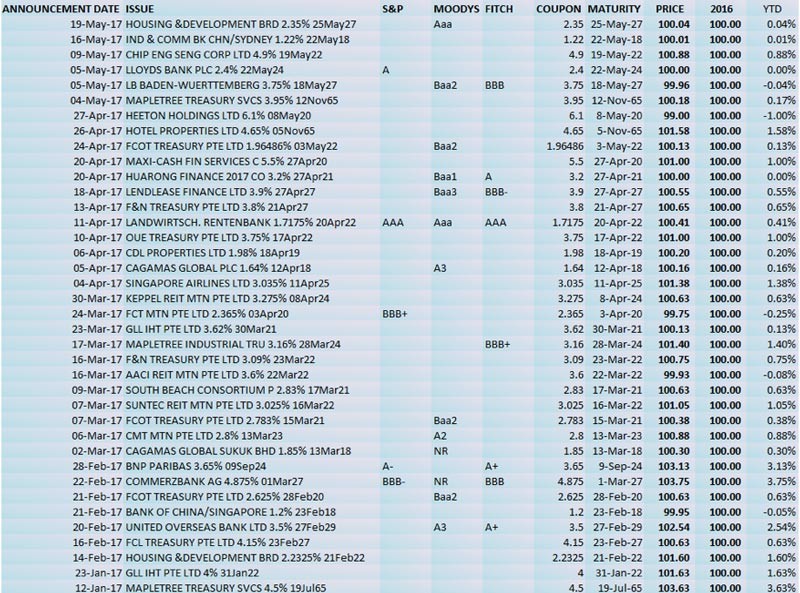

Table of 2017 bond issues and their price gains.

It gets worse when we sort the list in chronological order. It does seem that the price gains are reducing as interest rates edge lower, as they have in the past months.

2017 Issues in Chronological Order

A side observation would be that the Fraser Centrepoint group has been going flat out at issuing bonds this year, probably taking advantage of their rising stock price which could also be perpetuated by their ability to raise so much debt, 7 issues in all this year.

What Goes Up Must Come Down?

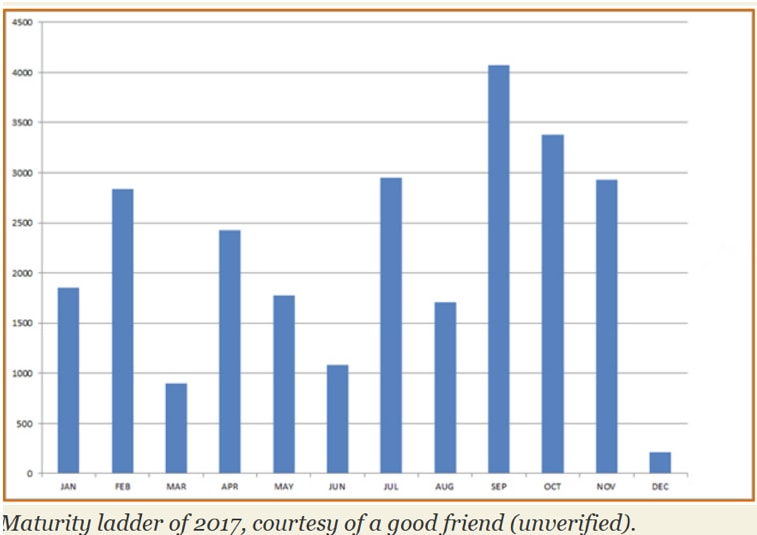

We had said earlier this year that 2017 shall be a tricky year with the largest ever bond maturities on record with approximately S$27 billion to either mature or be called, of which S$ 1 bio has either defaulted or been restructured.

Then we said NOL was largely to blame for the pile of S$ 1.3 bio in bonds trading at distressed levels (under 80 cts) which has now been shrunk, given NOL’s price rally.

The chunky bond maturities have largely buoyed markets so far as investors prep for the even larger maturities in the second half of the year.

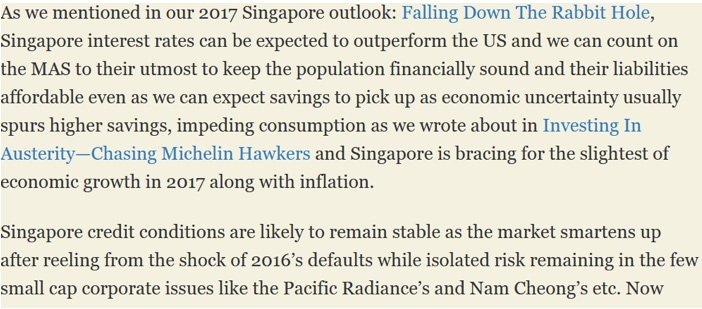

The outperformance of SGD bonds was only expected as we had pointed out too, that Singapore interest rates would outperform US rates as credit conditions remained stable with isolated risks remaining for 2017 after 2016’s shocks.

It is now time to take heed after coming out tops although my worries would be misplaced in the likes of those bonds which have come back from the dead, more than my worries of the bonds that have little room to buffer rate hikes. For that, I include those unrated issues with retail fan base, perpetual bonds that pay insufficiently over government papers without elaborating further to avoid flouting any advisory laws.

In a developed world that is enjoying the greatest period of prosperity and sustained economic optimism, we would suspect the logic that gains are for all to share. Not especially when we start worrying about the money printing presses of the 3 largest central banks of the world, from the rhetoric of the US Fed Reserve and the subtle hints coming out of Europe and Japan.

Yes, we sometimes get herded into the bond markets, unaware of the minivan leading the pack because there are 12 cars ahead of us, losing out along with us. But it surely will not make us feel any happier when we come out of the tunnel.