Opportunities in Natural Disasters and Recovery

– Hurricane Harvey poised to be the second most costliest catastrophe in history

– Most serious monsoon floods in 40 years for India, Nepal and Bangladesh

– Insurance stocks fell while auto and home improvement stocks rallied

– Pre fab homes have been ordered and cleaners will be hired

– Yet 70% of home damages will probably not be covered as homeowner policies only cover wind damage but not flooding

– Auto and commercial property insurance cover flood damages

– Positives outweigh negatives for insurance companies because premiums are going up and there will be more demand for insurance

– It is better to be a tenant of a flooded home than a homeowner?

– Natural catastrophes: earthquakes, floods, heatwaves, landslides, tsunamis, volcanic events, avalanches, droughts and wildfires are on the rise around the world. Some studies have found that natural disasters may even promote growth and productivity, heightening economic efficiency

– Some studies have found that natural disasters may even promote growth and productivity, heightening economic efficiency

– More disasters = more opportunities?

– Get ready for more Catastrophe (CAT) bonds which could be opportunity for Singapore as a financial centre

A Disastrous Week

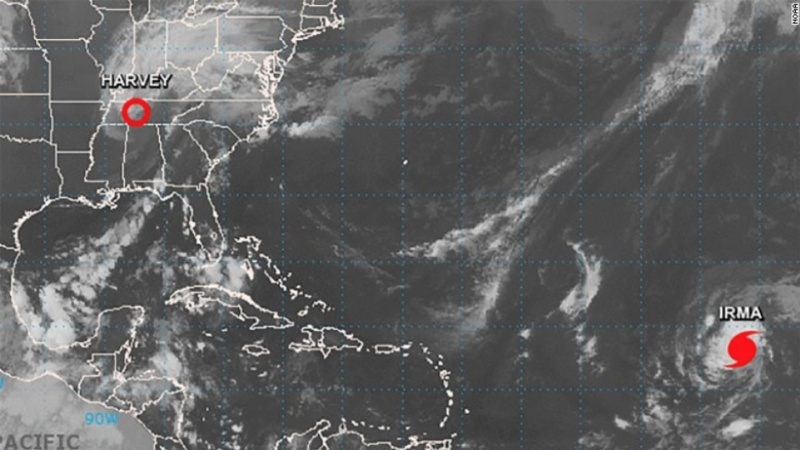

It has been a week of catastrophic disasters with Hurricane Harvey’s floods displacing over a million people in Texas, death toll estimated at 50 and still rising. Harvey is now estimated to be the costliest storm in US history, at US$ 190 billion, according to AccuWeather, much higher than Hurricane Katrina’s US$ 160 bio in 2005.

Floodwaters are still deluging Houston, the 4th largest US city, as the potential new hurricane, Irma, approaches the East Coast sometime in the next week although they could be third time lucky, like Hong Kong which managed to skirt Typhoon Mawar this weekend.

Source: CNN

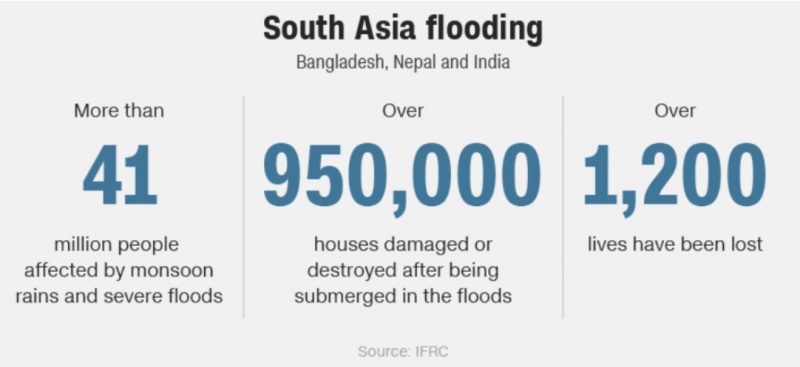

It is not a contest for lives lost because the most serious monsoon flooding in 40 years within Nepal, India and Bangladesh have claimed at least 1,200 lives so far, affecting 41 million people and looking worse by the day as monsoon rains continue to batter South Asia.

Source: CNN

And if we can be bothered, yes, Yemen is flooding this week as well with the death toll at 15 on last count.

All this is happening as some are praying for rain in Singapore, just a bit to overcome the oppressing heat, for the sake of parched gardens, higher water bills and the algae bloom in the Singapore River that is choking the little fishes to death in with the CO2.

Potential Disaster Alert: The North Korean Déjà vu

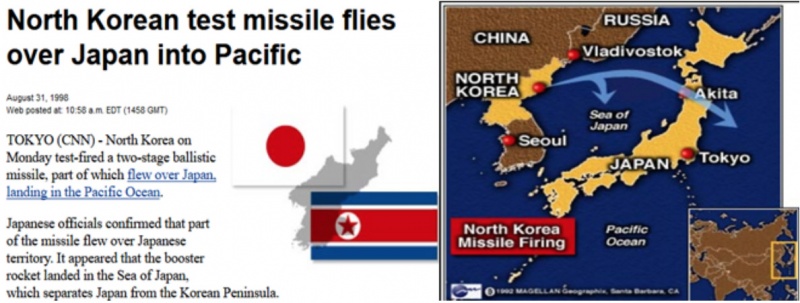

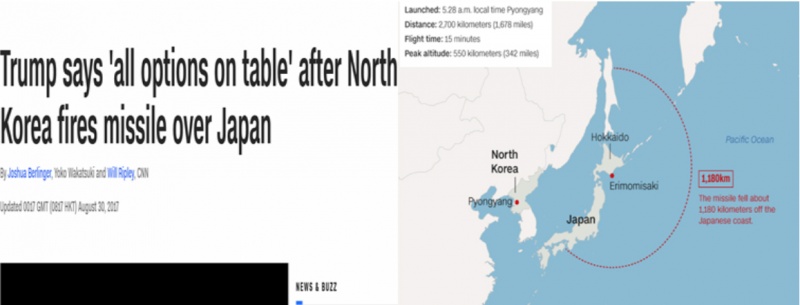

We have to stop counting the number of fishes big and small, seals, whales, walruses and more, giving up their lives in vain each time North Korea, a disaster in itself, pulls off another missile stunt, like the one on Tuesday that landed off Hokkaido as we hear of an underground nuclear test this weekend.

Much as markets made a big deal over it, with Gold and Bitcoin (at a new record of US$ 5,000) reaching for the stars, it would appear that end August is missile-season, in the absence of hurricane season for them, because this is like 19th anniversary of 1998’s missile launch, something we picked up while googling for this week’s event. Just compare the 2 headlines below, 19 years apart, and we could be deceived. [Do note N.Korea’s Foundation Day on 9 Sept]

Source: CNN 1998

Source: CNN 2017

It may be alarming, although we cannot decide between North Korea or Melania Trump’s choice of stilettos for her Texas trip. We suppose we will be quite busy with Kim Jong-Un and hurricanes next week.

The Opportunities of Disaster in Disaster

Disasters affect everyone even if we are not in the disaster zones and people tend to forget about their own problems, count their blessings to step up to help, putting aside their own needs, as we observe a good friend of ours packing up soap and t-shirts to be sent to the shanty town of Tondo, Philippines, after their, possibly, third or fourth major fire this year as part of a charity drive, feeling the need to do something for somebody somewhere after the constant bombardment from media outlets on the extent of devastation left in Harvey’s wake.

Markets tend to be more mercenary as hurricane impact reports cascade from Moody’s to Morgan Stanley, pointing out the economic implications while politicians seek to further their agenda on the debt ceiling debate which will impact the FEMA, the US Federal Emergency Management Agency that is still choking on Hurricane Katrina’s US$ 25 billion debt. The National Flood Insurance Program, set to expire on September 30 (unless extended), has only US$ 1.7 bio left in its coffers and US$ 5.8 bio left it can borrow from the Treasury department.

As the estimated bill for Hurricane Harvey fluctuates between 10 to 190 billion, depending on source, insurance stocks took a major hit, with the S&P 500 Property & Casualty Insurance sub index falling 3.4% on the week versus the S&P 500’s weekly gain of 1.4%.

S&P 500 Property & Casualty Insurance Sub Level

Hurricane Harvey has single-handedly lifted the auto industry from its doldrums as the NY Times reports an estimated 500,000 vehicles will need to be replaced, exceeding the vehicle losses of Hurricane Sandy and Katrina both combined (450,000).

Home builders and home improvement stocks soared in the aftermath as TV channels broadcast the widespread devastation. “AccuWeather is expecting areas of Houston, the fourth biggest city in the U.S., to be uninhabitable for weeks or even months, because of water damage, mold and dirty and disease-ridden water.”

Source: CNBC

FEMA has already ordered 4,500 pre-fab homes from housing manufacturers for families affected by the storm, each costing an estimated US$ 100,000. These will probably come in after the great clean-up of damage and contamination as 13 Superfund sites (heavily contaminated former industrial zones) have been flooded or damaged which is a health risk.

Flooding is expected to last another 2 weeks, leaving behind toxic chemicals and sewerage which will have to be cleaned. With damage stretching 300 miles (visualising Singapore to Perak), 200,000 homes damaged by flood, and 12,600 homes destroyed, along with loss of drinking water and power for many more, there will be a lot to do in Texas.

Throwing in the infrastructure that needs to be rebuilt, Hurricane Harvey is looking to give the state’s GDP a nice leg up in the coming months and years. We need not even bother with Louisiana’s damage which is just starting to roll in.

It’s Not All Bad News For Insurers

CNN reports that latest estimates show about 70% of home damages, estimated at US$ 25-35 bio, caused by flooding will not be covered by insurance.

Source: CNN

The only flood protection available to most homeowners is out of the National Flood Insurance Program, a federal program set up because private insurers were reluctant to take on flood risk. Even with Texas accounting for about 12% of their policies, over the years, there has been a sharp drop in coverage as folks held back on insurance given their last flood was 16 years ago, and described as a once-in-500-year event.

The S&P rating agency summed that the largest exposures for the insurance sector would be property and auto. Yet they are sanguine about the extent of losses because while wind damage is typically covered under most personal and commercial polices, flooding is not covered under private homeowners’ policies.

Auto insurance comes with standard protection from flood losses. Morgan Stanley lists Allstate, Berkshire Hathaway and Hartford Financial Services as the largest underwriters.

Commercial insurance’s biggest worry would be business interruption claims, difficult as it may be to come to settlement, being more complex and contentious to assess, according to legal experts from the Law-Now website.

Experts are expecting most insurance and reinsurance companies exposed to damages to be able to weather the hit from Harvey except for personal the odd small player with their entire exposure to Texas.

The positives outweigh the negatives for insurers because premiums are going UP after this, reinsurance rates will be re-priced just in time for a lot of people who are looking to buy insurance now!

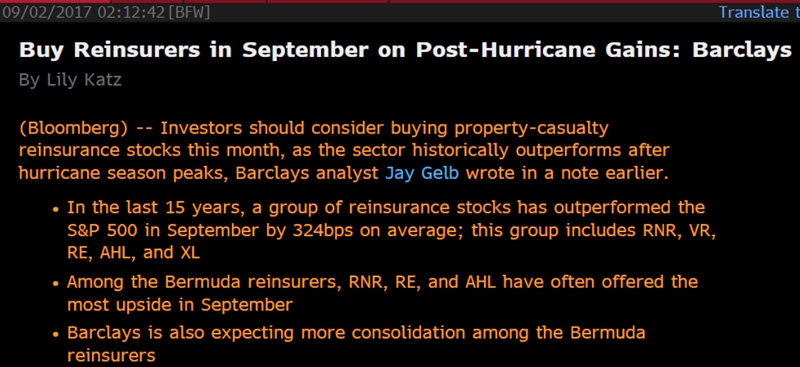

Sounds more like an opportunity in the long run as we note from Barclay’s note below that the property-casualty reinsurance sector historically outperforms after hurricane season peaks.

It’s Not All Bad For Tenants

We are saddened when we read the story of the mortgaged family, with the home improvement loan and furniture on hire purchase who lost everything in the flood.

Isn’t it easier being a tenant?

“Sorry your house is flooded, better you than me. I cannot live in your property any longer but you are probably insured. I have lost some of my belongings that I could not carry with me hence, I am giving you notice that I am terminating the lease.”

It can go something like the above.

Foreclosure laws in Texas do not allow mortgagees to walk away from their liabilities even if their homes become uninhabitable as a result which will be a painful burden for some who will have to continue financing their mortgages even while paying for alternative accommodation and forking out for repairs before getting their insurance claims in or getting a federal government loan.

The pain is greater for some more than others as far as Harvey is concerned but it is also a blessing that Hurricane Harvey came with just a month to spare for the expiry of the flood insurance scheme on 30 September.

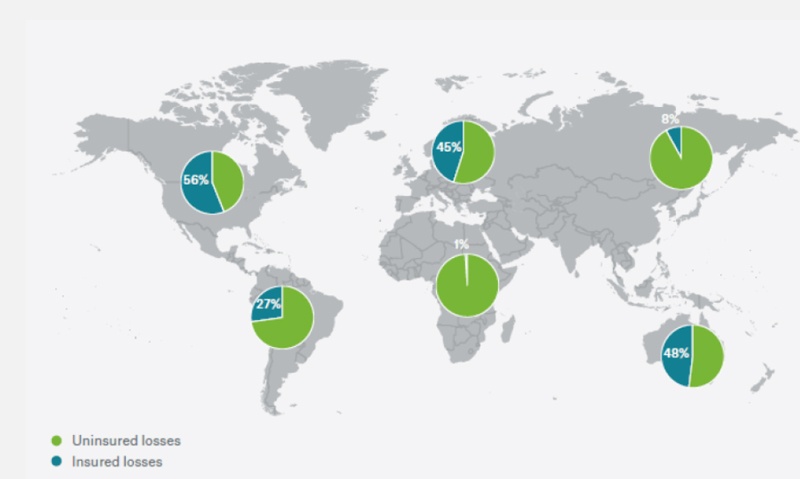

We need to also spare a moment to think about the thousands of uninsured folks in South Asia who will be getting much less help than Texas. We can observe from the slide below how little insurance coverage Asia and Africa have for the natural disasters of 2015.

Opportunities from the Rise of Catastrophes?

Natural disasters can be grouped into earthquakes, floods, heatwaves, landslides, tsunamis, volcanic events, avalanches, droughts, and wildfires.

Hurricanes and earthquakes dominate the list of costliest disasters.

Source: Wikipedia

The number of category 4 and 5 Atlantic hurricanes have doubled in occurrence since 1970, and existing studies suggest that greenhouse gases may cause more intense hurricanes with higher rainfall rates as time goes by.

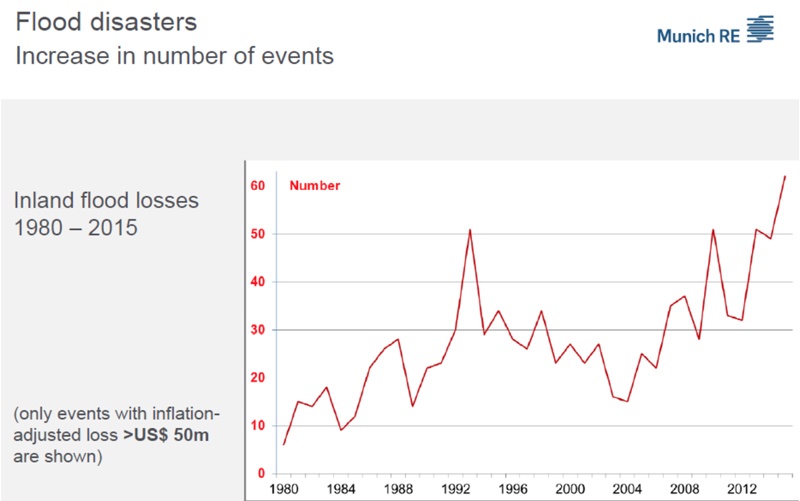

Flooding, typhoon or non-typhoon related, is on the rise as cities get more crowded.

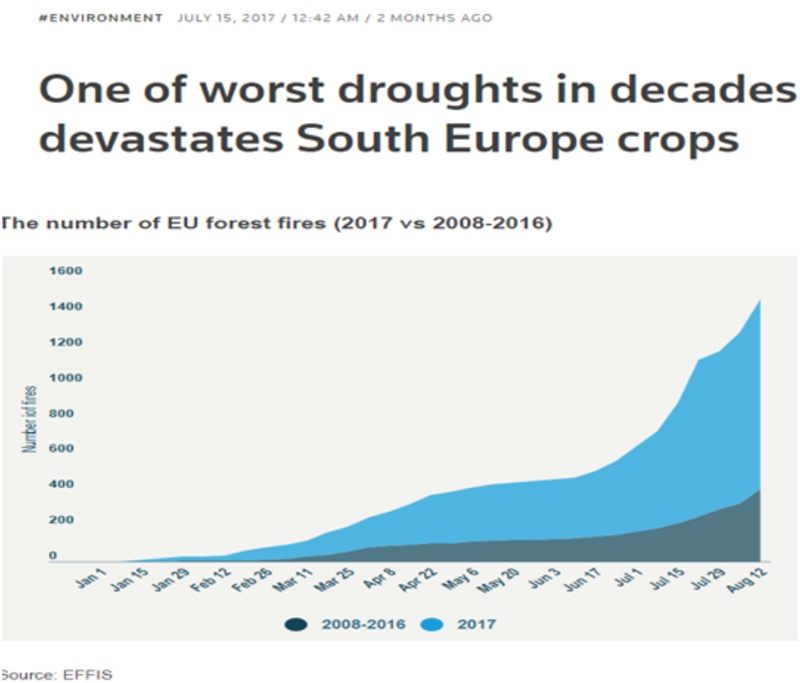

Some may or may not be aware of one of the worst droughts in decades for South Europe is devastating crops as we write as we pay cursory attention to the numerous wildfires plaguing Portugal, Italy and Croatia as a heatwave strikes the region.

In a WEF report, some studies found that natural disasters may even promote growth and productivity, heightening economic efficiency, albeit the cruel price it extracts from its human victims.

Question: More disasters mean more opportunities?

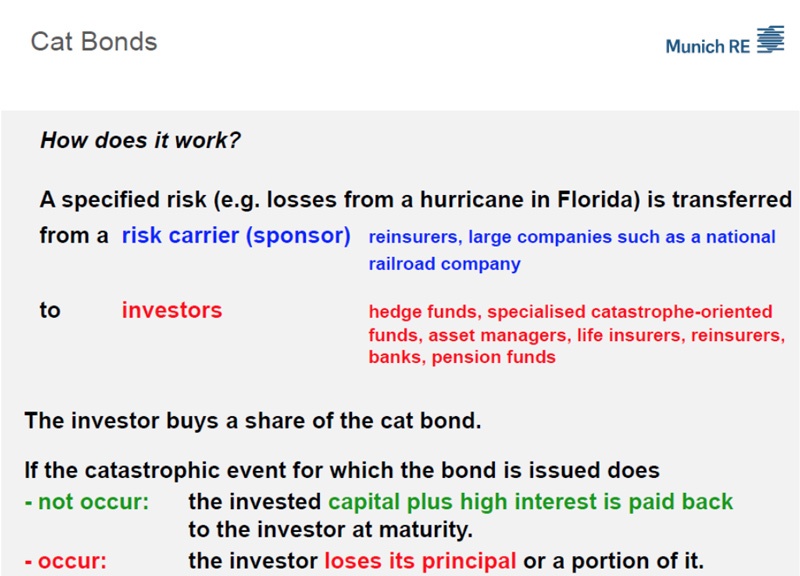

Opportunities in Cat Bonds

We can see opportunity for Singapore financial markets, looking at the under-insured state of developing Asia and the rise in natural disasters, there is room to nurture a Cat Bond market here.

Catastrophe bonds (Cat Bonds) were created in the 1990’s after Hurricane Andrew from the need by insurance companies to spread the risks they face in the event of a major catastrophe.

Paying huge returns, digital because it is contingent on the event of an earthquake, flood, heatwave, crop harvest etc, Cat bonds have become a portfolio staple for many a high-net-worth investor.

Most retail investors tell us they have absolutely no idea how to value that stuff because you need certain math to work out the probability of the next typhoon that would trigger the payout clause in their bond which could be structured to centimetres of rainfall or height of storm surges or record temperatures. Nonetheless they have some on their books anyway.

It is complicated but it is here to stay because Cat bond issuance has been making new records monthly and Asia will be a prime market for both investors and issuers for the foreseeable future.

Looking ahead, BBC Future produced a most interesting piece in resilience bonds, a transformative type of insurance to help in preparing cities and communities for weather-related disasters that now costs countries 6 times more, at an average of US$ 182 bio a year, than back in the 80’s.

Premiums would cost less for cities to use the savings to increase their preparedness. Cutting edge thinking indeed.

Disaster Recovery

A disastrous week for millions of people as we go dig up our home insurance policies to read the fine print for flooding and wonder at the same time if rising sea levels would constitute flooding some day?

On disaster planning mode, my good friend just ordered some potassium iodide last weekend after the nuclear tests and missile launches although she now worries that she bought the wrong substance and it could be potassium iodate instead.

Catastrophes are not a subject we like to think too much about, for all the pessimism surrounding it and the general feeling of helplessness in the face of Mother Nature even if there are signs it could be man-made events like global warming.

For the victims, we send our prayers and whatever help we can as we keep our heads up for the opportunities and changes that will happen during the recovery.