Singapore Bond Market: I-Can-Afford-The-Default Syndrome

- Things are looking up for global equity markets and the global economy

- There is still a part the Singapore bond market caught in restructuring activity

- Some Singapore investors have come a long way from boasting about their junk bond portfolio to now comparing how many defaults they can stomach

- There have been “distressed sales” going on in the restructuring space, leaving us to envy the investors who managed to pick up assets cheap, perhaps to relist as an IPO in the future while the current investors pick up the tab

- The treatment of investors appear just a little high handed especially when the regulators let the restructuring companies run amok without censure or supervision.

- Perhaps we need a tribunal of sorts to examine why almost every O&G company with bonds have gone to the dogs although it would be hard to prove mismanagement on an industrial scale

- Singaporeans are still very rich because the rest of the bond market is outperforming

- Singapore perps top the list of USD and SGD perpetuals issued in 2017 for lowest coupons paid

- It is more a function of the wall of maturities which makes it a seller’s market, thus allowing risk to be underpriced

That Edgy Feeling

The 3rd quarter of 2017 has passed, ending with the S&P 500 on a historic high. Donald Trump and Bitcoin are still around; no war, trade or military, has erupted; no wall has been built; no major fallout crises of any sort in student debt or Chinese housing bubbles, has occurred; Kim Jong-Un is stronger than ever; ransomware attacks, leaks and hacks are still going strong; stock and bonds are riding high; and, for once, the nearly every economy in the world is on the same page of slow tepid growth and we will have the Federal Reserve begin unwinding their balance sheet at long last, starting in October.

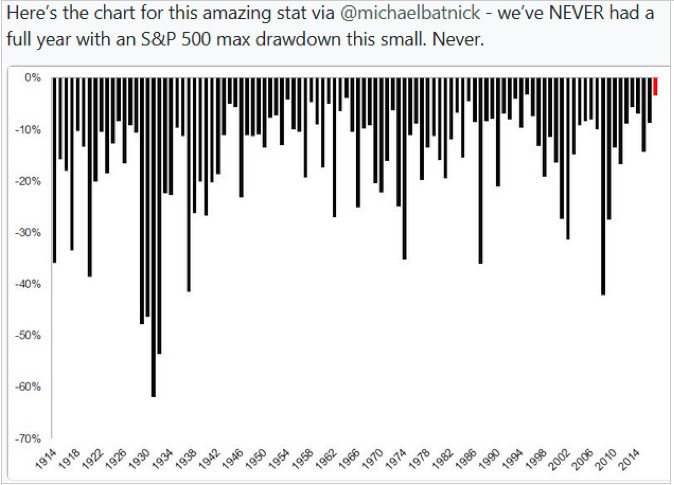

Someone out there must be feeling confident because the S&P 500 has never had a full year with such a small drawdown; so far for 2017, because we have just 3 months left.

Taken from the Twitter feed of @ReformedBroker.

Yet the rest of us are on tenterhooks of sorts, on the edge, feeling as if something ominous is heading our way as others are caught up in the limbo of the corporate bond market debacle in Singapore, with another round of restructurings occurring as we write, leaving virtually no O&G bond unscathed as the authorities scramble to assemble some plan for action which includes a proposal for a bond insurance scheme to help minority bondholders.

At the same time, we have friendly folks badgering us to suggest something for them to buy, for there is sure lots of money out there when you keep getting asked “what’s best to buy” although we are not sure if they really wanted real answers more than their need for affirmation of their wealthy status.

Wow, You’re So Rich, Ah….

It is funny and bone-chilling at the same time as a friend observed from encounters with accredited a.k.a. “rich” investors over the years that 5 years ago, conversations centred around the latest local bond in the personal bond portfolio as a boasting point versus the conversations these days that veer towards personal bad default experiences, each trying to outdo each other with the number of defaults they have stomached while sipping French wine. Wow, you’re so rich, ah, defaults mean nothing to you! (I-Can-Afford-A-Default Syndrome)

How is the progress looking since we wrote The Great Singapore Bond Market Bail-In – Ezion Holdings and gang?

Well, Marco Polo Marine and Pacific Radiance are going through with restructuring. A small percentage (6.79%) of Ausgroup’s bondholders have agreed to a debt for equity swap. Swissco pulled off a “distressed sale” of 26 vessels to some lucky private investors, at the expense of present Swissco investors, including the bondholders. Nam Cheong somehow managed to partially pay coupon and principal for their lucky Series 002 note holders, drawing angst and despair from the unluckier tranche holders.

This week, Ezion shot down a noteholder’s demand to redeem their DBS “guaranteed” bond, citing that their shares have been merely suspended since 8 August and thus, does not fulfill the condition for redemption.

We are not here to comment on these crazy developments that appear just a tad high-handed because bondholders “are so rich” but it surely cannot be true that almost every O&G bond in Singapore has gone to the dogs?

While it is all good that the market is moving forward with nice sounding developments like a proposal for an insurance scheme to help bond investors buy junkier names in the future, a joint proposal submitted by SIAS with Rajah and Tann Singapore, the imminent need is for some regulatory intervention on and supervision of the restructurings running amok in the marketplace right now, coming from some of the industry bellwether names like Ezion, Nam Cheong and Ezra, just to name a few.

Perhaps a tribunal or an investigative committee? To find out what went so wrong? Or what’s been going on during the good old days, to lead to “distressed sales” that will give a new lease of life to the O&G industry, leaving investors and bondholders to pick up the tab?

Where Did All The Money Go?

That is a question people are trying to avoid because perhaps we can’t handle the truth. A good question, nevertheless, in every bankruptcy.

For we know that market capitalization is useless and does little to help a company unless they intended to tap the equity market at higher valuations. Bonds are different because bonds are cash flow and hard cash flowing into a company would have to be deployed. Did the money just vanish in the course of doing business at a loss? Perhaps buying assets at overvalued prices? We cannot be sure.

In any case, the money left the hands of the company, went somewhere and into the pockets of others. And now it has come to distressed asset sales?

While it would be a tall order to accuse the entire cohort of O&G shippers of wilful mismanagement, the is a need for some closure, ultimately, to understand what went wrong, especially if new O&G shippers (who have bought over Swissco’s and NamCheong’s, etc, cheap assets) will resurface to IPO in the years to come.

We will end, not saying much, but with a Hemingway quote.

There is Still Lots of Money for Lots of Bonds and Perpetual Bonds

What defaults?

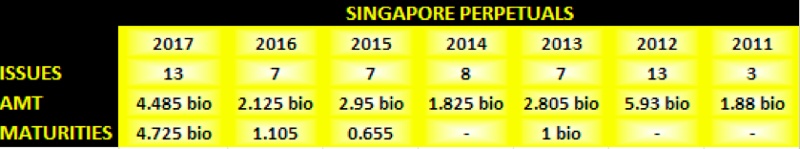

Singapore bonds are back with a vengeance in a race to the top, so far in 2017. Just look at the slew of perpetual bonds ($4.485 bio worth) hitting the SGD market in 2017, in dead heat to break the record low set for a perpetual coupon in Singapore after OCBC’s 3.8% stunt back in 2015.

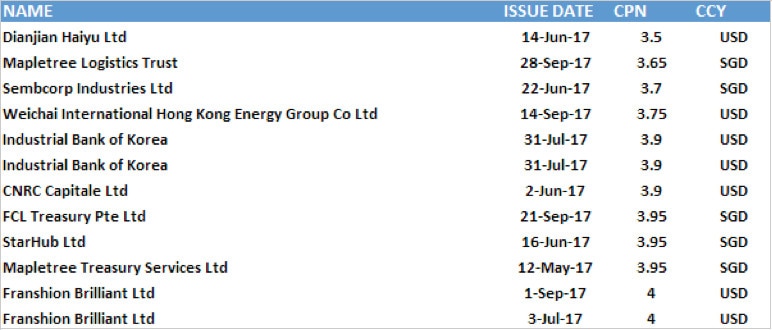

Mapletree Logistics Trust is in the lead at the moment, notching a record low coupon of 3.65% for their perpetual, followed closely by Sembcorp Industries at 3.7%.

From the looks of it, the market is not tired of Fraser Centrepoint either because they managed to pull off a low 3.95% coupon just last month for their perpetual bond, solid achievement considering their last perpetual was issued at 5%, 2 years back with the additional consideration that the Fraser group of companies, on a borrowing binge, is responsible for 11 out of 83 issues in the Singapore market this year.

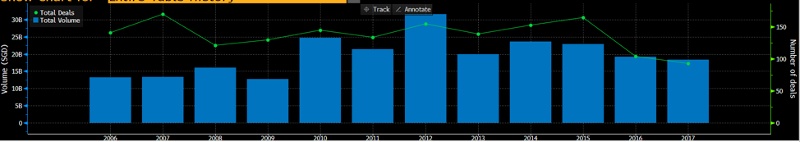

The only year we saw more perps issued was 2012 ($ 5.93 bio issued), the peak bond year for Singapore with $31.6 bio worth of bonds issued, a feat not to be repeated even as 2017 is shaping to beat 2016’s dismal $19.2 bio.

Graph of total corporate bonds issuance for Singapore

Why are investors willing to live with the low yields is both to do with the wall of maturities this year as well as the ultra-tight (i.e. expensive) credit spreads globally, trading back to their pre Lehman lows.

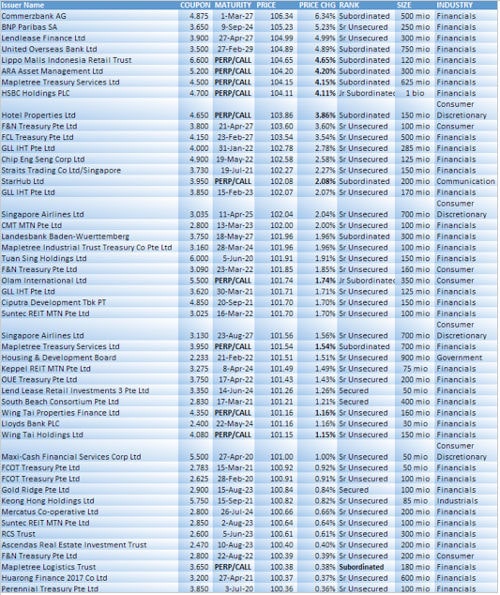

Taking a look at the perpetual bond market summary below which includes a maturity of $500 mio of Genting perpetual in Oct, we note that demand from the maturities still exceeds supply so far.

Summary Table of Singapore Perpetual Bond Market Stats (unverified for accuracy)

There are not enough bonds to feed the wall of bond maturities in 2017 with an estimated $ 24 bio worth of bonds coming due and just $ 18.4 bio issued so far. Thus, it is not surprising that 4 of 5 bonds issued is in the money.

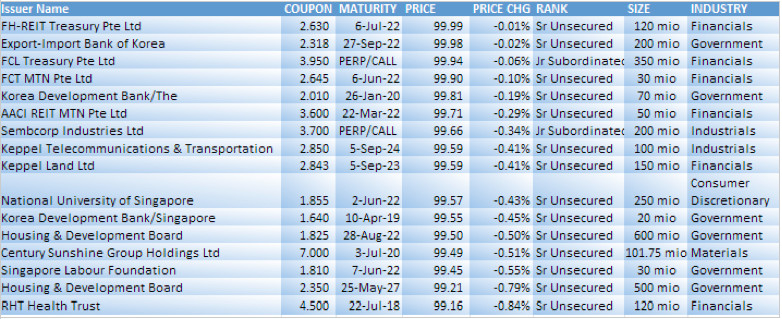

Let’s look at the top performing bonds of 2017 just to see that the SGD perpetuals are right up there, along with the subordinate debt (assumed to be higher risk).

Table of top performing Singapore bonds issued in 2017

We note that even Mapletree Logistic Trust which holds the record for the second lowest perpetual issued bond yield for 2017, is trading above its issued price as we present the list of lowest coupons for perpetuals in SGD and USD that were issued in 2017.

List of SGD and USD perpetual bonds issued in 2017 ranked for lowest coupons.

What is more startling is that the entire list of SGD and USD perpetuals paying sub-4% coupon issued in 2017 are dominated by Asian names, no doubt supported by the bulk Asian investors.

It would appear that there is an overhang in the demand situation for Singapore, at least, coupled with the disregard by private investors for the yield curve as we observe that the list of the year’s underperformers consists of the more interest rate sensitive names like HDB and NUS, although the recent sub 4% Sembcorp and FCL perps cling close to their issued prices.

Table of top performing Singapore bonds issued in 2017

The Moment of Truth

For the little they have to choose from, it is a seller’s market as investors scramble to find the bonds to plug the gap from their maturities, unaware that there is a mini correction underway in the sovereign markets around the world as central banks attempt to normalize their yield curves.

The Federal Reserve will begin their balance sheet unwind starting in October as the ECB and BoJ face similar pressures to curtail their asset purchase programmes.

Thus it would not be too presumptuous to assume that our little market will likely to face its moment of truth sooner than later, that, perhaps, risk could be a little underpriced even if it is the price of risk for “safe and non O&G” names.

What better time to reflect if you are being under-compensated than this quiet Autumn week with holidays galore globally, China and Korea out for the entire week, although we know you can afford the default(s) but what we really want to know is Where Did The Money Go?