Debt and the Wealth Gap: A Recipe for Disaster

Sometimes we can count ourselves lucky to be kept busy with other problems in life such as 2 funerals and a wedding while combating an army of roof rats, that leaves one with an irritating naïve nonchalance with respect to all the peptic-ulcer-inducing stress that the rest of us, who have been immersed in markets day in and out have been suffering from.

We are describing our dear friend who has been blissfully immune to Trump, Turkey, Trade Wars, Tariffs, Tencent, Tesla, Treasuries, Turnbull and all things Terrible for our mental well-beings which is getting no boost from the “Crazy Rich Asians” movie, that has stripped that “feeling rich” mentality from many in the high net worth category.

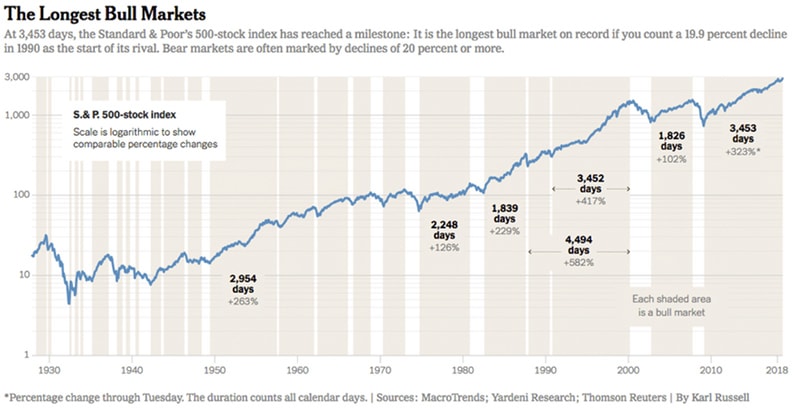

But why? The S&P 500 index has just made history with a record breaking 3,455 day bull run, raking folks $18 trillion in gains during that time.

Source: NYTimes

Source: NYTimes

With such great wealth created in stocks, real estate and Bitcoin and record low unemployment, surely most folks can feel a little more relaxed than a decade ago? Yet, there are certain factors at play making the case for higher stress levels in our lives.

Why is there a rise in levels of dissatisfaction evidenced by the rise of populist regimes all around the world, and as nearby as Malaysia?

Now, we refuse to get dragged into the HDB debate that is taking up a lot of Singaporeans’ time these days, worn out by the markets and losing out in the Fear of Missing Out game as new highs are made and fortunes are won by the brave (also because we may take up the HDB subsidies sometime in the future).

It’s debt and the wealth gap, our dear friend smugly informed us. Back from Penang, she gushed about her encounters with several Grab drivers who admitted that they had no choice but to part time as drivers to make ends meet within the debt burdens they are shouldering, grateful for the opportunity and for the affordability of cars in Malaysia.

Today we will try and dissect the sources of our unease with our finances and the economy, using mostly America as an example, for the abundance of news and data sources out there.

The Wealth Gap

In the US, the top 10% of households are benefiting from the $18 trillion profits, owning 84% of the value of all shares owned by households, compared to 81% in 2007.

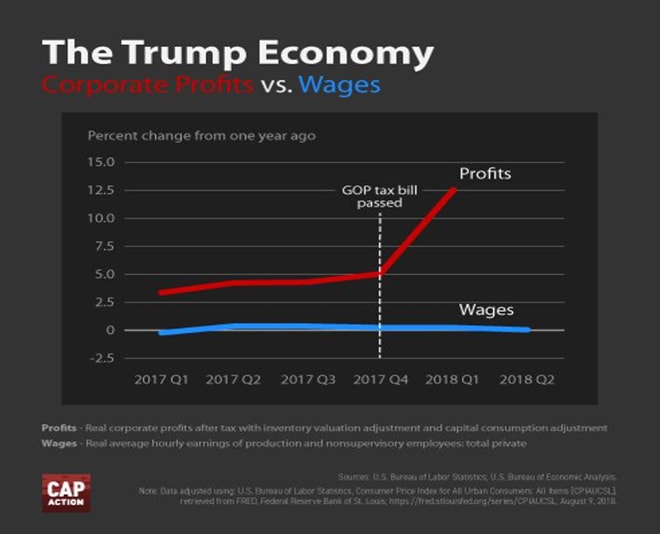

Thus the middle class, whose wealth is heavily concentrated in their homes, have been left behind in the record breaking rally in the stock market that is driven by profits (due to tax cuts) and a shrinking stock market (due to buybacks).

Source: Topher Spiro, Twitter account

Source: Topher Spiro, Twitter account

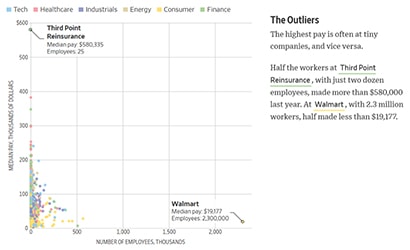

Our heads grapple with the fact that America is minting more millionaires than ever when nearly 80% of Americans have less than $100,000 net worth and 30% of households have no wealth which is plausible given than half of Walmart’s 2.3 million workers make less than $19,177 in wages and we realise why the rush to get rich, asap, because 2 in 5 Americans polled in a Federal Reserve survey, do not have enough savings to cover a $400 emergency expense.

Source: WSJ

Source: WSJ

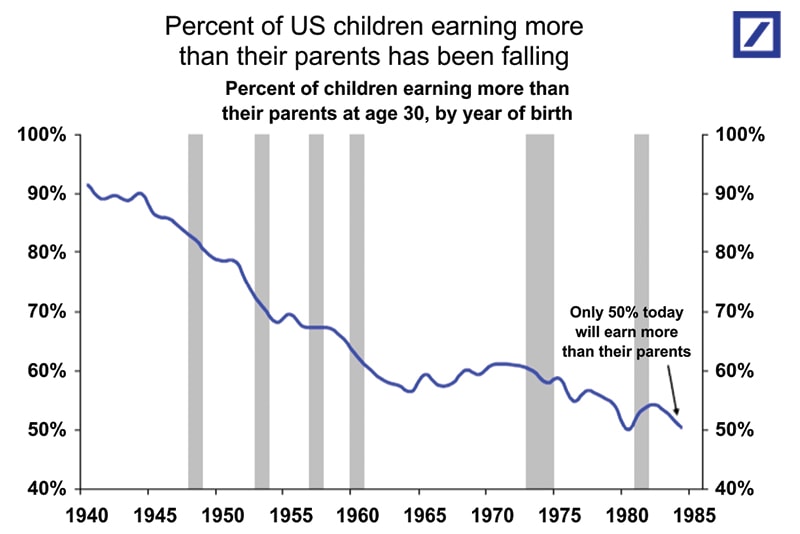

Thus it is no surprise that the rate of 65-74-year olds filing for bankruptcy has tripled since 1991 and it makes us feel slightly better about ourselves here in Singapore except that we worry for the kids, if the US trend is anything to go by.

For, the percent of US children earning more than their parents at age 30 has never been lower which should worry Singaporean parents as well since Singapore has the 4th highest GDP per capita in the world.

Source: 13D

Source: 13D

More worrying for parents, Singaporeans included, would be that 63% of Generation Z and 1/3 of millennials (between 23-40 in age) expect an inheritance for them to achieve financial stability.

Source: CNBC

Source: CNBC

The picture is getting clearer for us now. Yes, we are stressing for the kids too, the kids are getting angry, we are getting worried for ourselves and how to continue to grow and preserve the wealth for ourselves and them in this environment of job insecurity, low wage growth and political uncertainty. Why can’t we all be Crazy Rich Asians?

Collage of various recent headlines that contradict the phenomenal stock market gains.

For Singapore, working hard still helps get a good life and we have friends forking out well over S$40k a year on kindergarten fees and last we read, factories here do not have to install those “body-catching nets” like China’s Foxconn to dissuade the suicidal employee and neither are our 24-hour McDonald’s filled with homeless people like in Hong Kong.

The Debt Crisis

Wealth gap and small picture talk aside, there is a bigger problem that lingers in our thoughts daily as we see friends hunt for bonds that appear to be in lack of supply this month in Singapore as maturities outstrip new issues and folks cannot get their hands on enough bonds to buy.

If there is anything the world is not short in supply of, for all the food, water, oil, rare earths and other scarcities, it would be debt.

Yes, the debt pile is growing led by the US government, on a borrowing binge, issuing US$ 1.36 trillion in new debt over the past 12 months.

Overall, global debt levels rose by the biggest amount in the first quarter of 2018, by $8 trillion to an all-time high of US$ 247 trillion which makes the S&P 500’s US$ 18 trillion gains (in nearly 10 years) look a tad paltry.

This is as household/consumer debt reaches untenable levels in America with households estimated to be US$13.15 trillion in debt, the highest level in American history (matching the highest level in stock markets which is accruing to 10% of the population).

Global debt levels have quadrupled in the past 17 years as US spending on interest payments hits all-time highs (US$ 538 bio in 2Q18) in a time when tax receipts have all but collapsed which means they will be borrowing more.

US government tax receipts; Source: St Louis Fed.

US government tax receipts; Source: St Louis Fed.

An Eyes Wide Shut Moment?

No wonder the Congressional Budget Office “sees fewer Fed rate hikes”, Trump better get interest rates down to cope with the country’s interest expense especially when central banks around the world have started to shrink their balance sheets.

That brings us to a sort of Minsky scenario in Hyman Minsky’s famous financial instability hypothesis.

3 Stages of Debt: The Hedge, the Speculative and the Ponzi stages

The Hedge—banks and borrowers cautious, usually after a crisis. Loans are made to borrowers who can afford to repay both the initial principal and the interest.

The Speculative—loans are made to borrowers who can only afford to pay the interest, usually against an asset that is rising in value.

The Ponzi—loans are made to firms and households that can neither afford to pay the interest or principal based on a strong belief that asset prices will rise.

As astute investors begin to question if we are in the late stage of the economic cycle, at lowest unemployment levels and slow wage growth, uneven wealth distribution accompanied by high levels of uncertainty global politics and trade, it’s no wonder that we are stressed.

Ask us to imagine how much worse the folks starting out their lives and careers, without assistance, feel?

No, thank you.

Debt and the Wealth Gap—A Recipe for Disaster

We hate ratios.

Yes, if one earns 30k a year in the 1990’s and buys a 300k property, it would 10 years-worth of wages. Is it the same as one who earns 100k and buys a 1 mio dollar property now?

Not in this age of disruption and uncertainty where the median job tenure has fallen and technology to-come threatens even more jobs.

The trouble is that we live in such a golden age of surplus, abundance and excesses, with goods, services and technology that humankind has never possessed before now at our disposal. It is hard to temper our expectations of a better life (and wealth) down even if it means straining our finances by taking on more debt.

Losing what we have is amplified in the endowment effect, when we assign a bigger emotional price to something we own or had access to. Fearing and anticipating loss is a worse feeling, and the fear of not growing and preserving wealth troubles the wealthy as much as a kid would fear not being able to afford the lifestyle his or her parent had provided.

It is the end of summer 2018 and the borrowing binge in US bond markets will restart with new vigour in September even as Singapore raises the bar for local mortgages. We will not be drawn into the HDB debate because we are looking at a bigger picture—that debt and the wealth gap is a plain recipe for disaster that we do not need to wait for 99 years to happen.