Just Thinking About Asset-Rich Cash-Poor Markets

We were in no mood to wonder who would have been in the mood for Black Friday sales when the week of 19th November would have been, arguably, the worst week for markets since the fateful US Nov 2016 elections—bad in credit markets, stocks (worst since 2011), oil (worst in a decade) and even cryptocurrencies, mired in the longest bear market since last December’s peak (-82%).

Then came Cyber Monday week and we had the best week for the S&P 500 and Nasdaq in 7 years after Fed chair Jerome Powell acquiesced to Trump’s “not even a little bit happy” opinion of him and hinted at a “Fed pause”, possibly not because his job is in danger for he is the richest Fed chairman since the 1940’s.

Perhaps the closer truth is that the regulators are shaken and warning that “adverse shocks could lead to a decline in investor appetite… The resulting drop in asset prices might be particularly large, given that valuations appear elevated relative to historical levels”. Sigh, if only they would do their job better.

There is cause to believe in elevated valuations because 2018 could be shaping up to be the 11th year out of 93 years that cash (1M tbills) outperforms stocks and bonds.

Can our poor (figuratively and literally) moods be excused? Sorry, Black Friday and Cyber Monday, I am just too poor.

90% of asset classes negative on the year, the worst year on record, so far. Nothing seems to be working.

Borrowing, Borrowing and Borrowing

Real estate investors are telling us how they have had industrial loan offerings pulled in the past month with lenders wanting better terms and higher rates.

We are not sure if it is a market trend or that there is something bigger afoot?

Investors are asking why safe haven US treasuries have not rallied much more despite a stock market plunge?

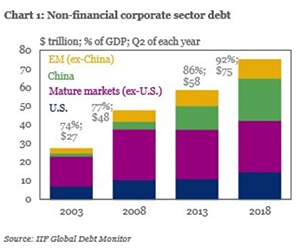

Why is corporate debt swelling globally to hit 92% of global GDP from pre-crisis levels of 77%?

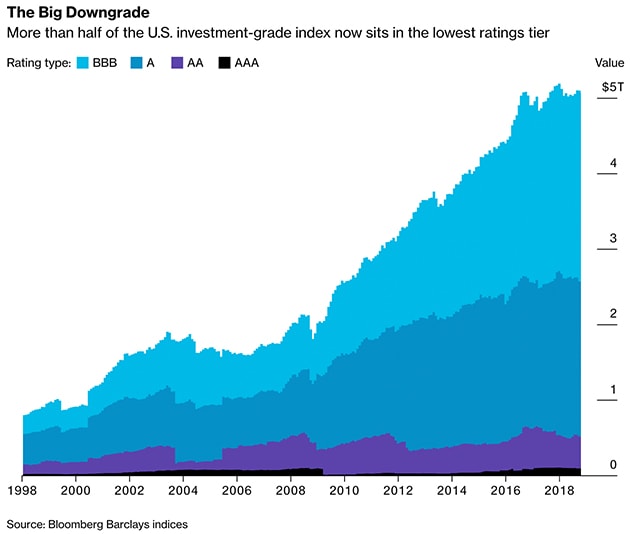

Why has US non-financial corporate debt nearly doubled since 2007 from US$ 4.9 trillion to US$ 9.1 trillion as cracks appear in 4Q18 when a record US$ 90 billion worth of A-rated bonds were downgraded to BBB?

Better still, a fifth of BBB- bonds are sitting on negative watch/outlook and in danger of getting reduced to junk.

Buying into IG (Investment Grade) bond funds these days only means that half our money is going into BBB names.

Graph of the Investment Grade Bond Index composition Before the GE downgrade. Source: Bloomberg

Graph of the Investment Grade Bond Index composition Before the GE downgrade. Source: Bloomberg

Indeed the iShares iBoxx $Investment Grade Bond ETF, LQD US, is on pace for its worst year ever, according to Pension Partners.

Graph of yearly returns on LQD US

Graph of yearly returns on LQD US

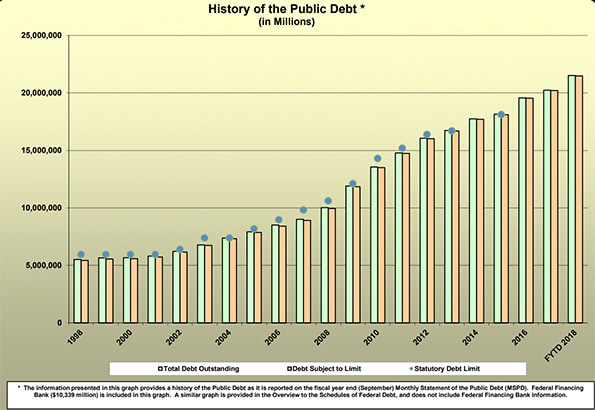

Meanwhile, the US government is borrowing more money in 2018 than 2016 and 2017 combined at a time when central banks are reining in their bond buying programmes.

Just take a look at the ever-growing US public debt picture—to be paid back by receipts from the future generations (without more immigrants).

Source: US Treasury Dept

Source: US Treasury Dept

Is There a Shortage of Money?

“Writing is often the process by which you realise that you do not understand what you are talking about.” Shane Parrish, on Twitter

We have been market bashing for the past 2 months, rambling on gloom and doom topics – higher interest rates, credit defaults, the wealth gap, the pension crisis and real estate fears.

The answer may be just as simple as there is no cash left to invest.

Why do we assume that there will always be money to buy more bonds and stocks and real estate?

Where is the money coming from?

- Credit—borrowings from banks and financial institutions

- Wealth gains—from stocks, bonds and real estate

- Central bank bond purchases—a magical process of buying bonds from banks and putting it on the central bank’s balance sheet thereby releasing money into the system

- Savings from wages and other sources of non-capital gain income

- Windfall gains—lottery, striking gold or diamonds or big discoveries or unicorns like Uber and monetising them

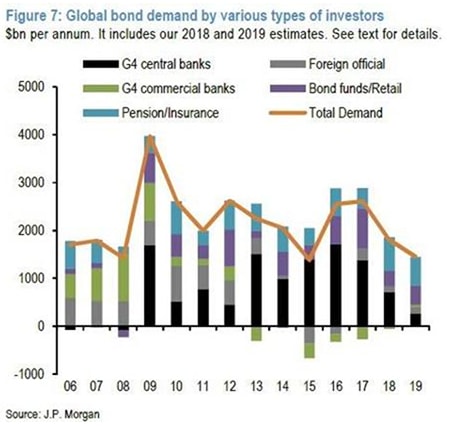

It’s, therefore, right that, JPM Spots The Next Big Problem: A Plunge In Global Bond Demand, from the central banks, commercial banks, pension funds, foreign reserves and retail investors.

Source: Zerohedge

Source: Zerohedge

JP admitted 2018 turned out worse than they had projected because they had overestimated the demand of not only retail investors, their biggest forecast error, but also of FX reserve managers and commercial banks.

By now, 2018 is no longer a surprise because we had bond and equity markets shrinking US$ 5 trillion, the biggest overall loss since 2008, not counting real estate losses.

Source: FT

Source: FT

It is a case of negative wealth effect and negative wealth means reduced borrowing ability to buy bonds, for instance.

The biggest piece of evidence that there is less money to lend comes from the fact that the most widely-used lending benchmark in the world, the 3-month Libor rate has continued to rise above the Fed funds recommended target rate, defying even Powell’s recent dovish slant.

Chart of 3 month LIBOR vs Fed Funds Target Rate

Chart of 3 month LIBOR vs Fed Funds Target Rate

It suggests that borrowers are paying up to get money or a shortage of money to lend cheaply and Libor is not to be ignored because Libor is reality (real life) as opposed to the Fed Funds Target Rate which is a guideline.

Perhaps it is time to start believing that cash could outperform because there is just not enough of it to go around?

Is Now the Time for Capital/Cash Preservation?

It would be a sign that we saw not 1, but 2 guys carrying 40 cm Birkin’s this week and recollected the study that Birkin bags have out-appreciated Gold in the last 35 years.

In our various discussions with friends, having a child may be a better investment for the self to help cultivate the personal qualities of patience, tolerance, forgiveness and, most importantly, Charity. Yet the Birkin could be a safer bet, emotionally, and as far as the PSLE results last week went where some Pokemon-trainer-parents were devastated by the performances of their little Pokemons.

Jeff Gundlach, billionaire bond hedge fund maven, called for capital preservation and avoidance of corporate bonds and safe haven US treasuries last week.

How does that add up when the Straits Times is telling us that bonds are best for preserving capital? We would not argue except that the new 5 year Temasek bonds have not moved in the past month (capital preserved) despite the massive 2% rally in the new Shangrila 5 year bonds which suggests perhaps that Temasek is too high-grade for its own good.

Other billionaires are getting their hands on dry powder, according to a Bloomberg report, and getting those loans in place in event of a downturn to avoid forced liquidation.

Source: Bloomberg

Source: Bloomberg

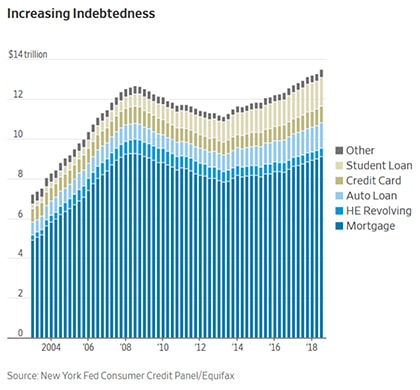

The average US household has also done their share of fundraising with all manners of loans rising in the 3rd quarter which is perhaps why there is less money for commercial banks to put into the bond markets.

Source: WSJ

Source: WSJ

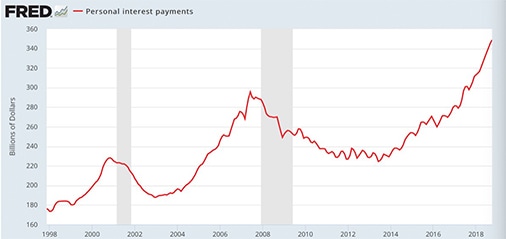

And there is even less money for Black Friday sales left in the retail guy’s pocket as the Federal Reserve shows personal interest payments on the rise.

Moral of the story: Borrow for the right reasons, if you can!

A Cash Poor Market

All the signs are pointing to an asset rich and cash poor marketplace right now, Libor speaks.

It is something folks do not normally think about, when prices go like the incredible times we had till the 21st of September this year and the peak in US stock markets.

All signs are saying that we reached a tipping point of sorts since then when we realised that borrowing has become a challenge even if it is a hard habit to break.

Cash becomes king when Libor (reality) bites, and we suddenly realise how asset rich but cash poor we have become, hostage to asset prices as opposed to asset returns, in profit and loss terms.

Regardless of the outcome of the Trump “trade war truce” which has just been announced, it probably does not make much difference till markets get the license to borrow without care again.

Just think about it.