Frauds, Ponzis, Glorifying Greed and Gambling

We are not sure if it is just us or is anyone out there paying attention to the number of frauds and Ponzi schemes surfacing on an almost daily basis. Amidst the universal collective desire of every human soul (with a trading account) to get rich quick, YouTube adverts are being thrown in our faces by self-professed successful Singlish-accented Singaporeans including Gurmit Singh touting everything from property investments to forex trading to digital options to cryptos, selling the dream of financial independence and guaranteed riches.

Markets are reeling from the Archegos and Greensill scandals, risk chiefs are being axed around the world and Singapore has not been spared with Hin Leong, Agritrade and gang last year, which saw billions wiped out and charges of forgery by a former billionaire, OK Lim.

Then, we had yet another commodity-related scandal by this Envy-named company with investigations underway as charges continue to mount against its multimillionaire trading whiz kid owner.

As crypto scams grip the world with the collapse of two Turkish crypto exchanges last week with the usual run-of-the-mill crypto securities frauds, over a hundred Singaporeans have filed police reports alleging fraud by online cryptocurrency trading platform cum MLM scheme, Torque.

Scandal-ridden Novena Global Healthcare which once attempted to buy Newcastle United and LA actor, Zac Avery who ran a US$690 million Ponzi scheme and the many others like them, what do they have in common and why were they not called out much earlier?

If big time investment bankers making millions of dollars can miss Archegos, it does not matter how many people are calling out Tesla on Fintweet because words are cheap. Try being the minion stuffed with the job of vetting a billionaire or an LA actor living a high life or a Singaporean trader with a lavish lifestyle running a company called Envy or a crypto CEO driving an expensive sports car.

A friend who works in credit assessment for a bank recalled asking the boss of a fintech company of sorts about their superior “algorithm” and was instantly rebuked by an affronted millionaire on the defensive and proceeded to get his loan from another more eager bank.

Sounds familiar? Yes, Greensill Bank professed of a superior “algorithm” too and counted former U.K. prime minister David Cameron as a special adviser because being finally being accused of forgery and fraud.

“I left that meeting . . . travelling down in the lift, thinking to myself, this has many of the elements of a Ponzi scheme.” Ex-Treasury head, after a Greensill meeting, to FT.

Take another example of another friend who is licking unknown wounds/losses from the Envy nickel fiasco and gave us some pointers of how he let his guard down:

– The vendor was a regulated and licensed fund manager and the CEO was reassuring

– The termsheet looked “iffy” initially but the explanation was credible enough that outsized returns can be achieved by hefty discounts on long term contracts

– Why the need for investors when returns were so good? The rationale was to ensure investment scale to achieve the target

– Invested and got money back consistently and so worries were assuaged

– Whilst there were worries about the source of the commodity, the company provided detailed videos of the goods

– Was suspicious because the last annual report of the purported supplier was in 2016 but did not question

– Checked statistics and found that the transaction size would be more than half of current production but was told it was stockpiles

Upset with himself for not pursuing his doubts because the returns looked too good to be true for a “risk-free” commodity financing trade, we only wonder sometimes how “conservative” investors would be lured to overstep their boundaries and how different it would have turned out if they had gone full “risk-on” and bought lumber, copper, Bitcoin, Dogecoin, Tesla or something else instead.

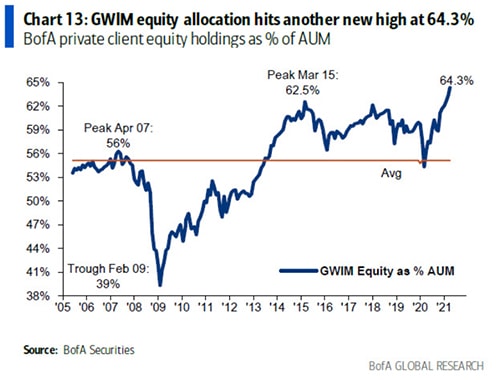

It is a buy everything (but bonds) market and that is where we are coming to.

The mood of “Buy Everything“ has left folks craving for more and nothing sums it up more like a dear friend’s son last week when she urged him to open a Futu or Tiger account and get his free Apple share. The sensible 20-year-old was aghast and reminded her, “But mommy, that is gambling.” Just like he pointed out when he was but nine, a decade ago that she wasn’t doing him any favours teaching him how to read a USDJPY chart because it was just gambling and he may well become a Buffet fan one day. That is exactly how Warren Buffet reacted, believing “millennial-favored stock trading app Robinhood is contributing to the speculative, casino-like trading activity in the stock market and benefitting from it.”

The boy has seen it in his peers and colleagues in the army, hooked like zombies to day trading and punting, and it is even easier these days when folks can buy fractions of shares and cryptos which trade 24/7. Trading has been gamified and like his mother, they stopped phone games after Pokemon left some bad memories on their lives even as phone gaming continues to hook millions of folks from the elderly to children just as social media has overtaken most people’s lives. (PS: Steve Jobs, Bill Gates, Zuckerberg and gang raised their kids tech-free.)

Just this week, Germany’s financial watchdog is accusing Binance of violating securities rules over its launch of stock tokens, which would allow folks to trade fractions of stocks 24/7, much like cryptocurrencies.

“Creating a budget.” 14 views

“Tax planning basics.” 95 views

“How to get rich trading options.” 21,743,860 views

“In business school, I studied corporate finance, valuation and strategy when I should have been studying social media, memes and crypto pumping.”

Doug Boneparth, on Twitter

It is a problem that authorities are probably unsure how to address without infringing on personal rights but few would dare call out, just like they would not dare to much like for all the frauds and ponzis mentioned above. It is partly due to the fact that cryptocurrencies have proven us wrong and wrong again over the years that it doesn’t matter even if Warren Buffet, Charlie Munger or great minds like Nassim Taleb think that Bitcoin is a “gimmick” or a “game” or resembles a Ponzi scheme even if Dogecoin started as a joke. We will always read only about the success story of the broke chap who became a millionaire because he believed in Elon Musk and Dogecoin.

What does that sound like?

Cinderella, of course, and about 99 per cent of the K-dramas people watch because life and markets have become one giant big fantasy and it’s the “Buy Everything and Wear Diamonds” mood in the air.

Who would dare speak up as a finance professional, economist, financial reporter or respectable academic against the tech titans who have become larger-than-life billionaires, with their wealth growing by the day with more piling in?

It is gambling, glorified to the 20-year-old NS kid who sees what is happening on Reddit, on TikTok, YouTube and among his friends and peers.

“25yr old son in L.A. A friend stopped over. I asked what he was up to lately. He said he got laid off last March…”It’s been really good though, because I’ve been making a lot more money. I could go back now but financially it makes sense not to.” “But more disturbingly is my son telling me half the girls he knows in L.A. are now making money from OnlyFans, which I didn’t even know existed until he told me about. And yes, those girls are either working far less or not at all. 50k annually is typical. This is not good.” — Randy Woodward, on Twitter

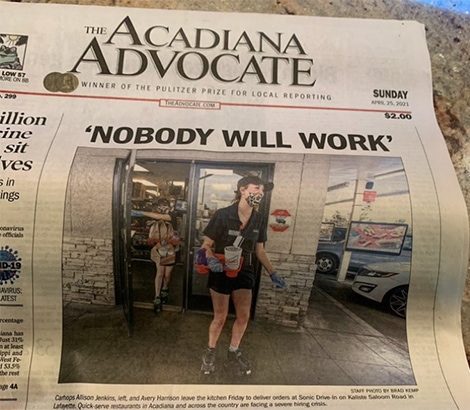

Paid work is the side gig and American companies cannot hire enough low wage staff even after paying up. The main gig is gambling and only a few independent news sites would acknowledge that at this juncture (wait till the bubble bursts and all the mainstream news media would jump on the I-told-you-so bandwagon) because even JPMorgan would set up a Bitcoin fund to serve clients’ needs and Wells Fargo and DBS and gang would let you do what you want with your money.

Everyone would pretend to understand how important it is to have 5,000 cryptocurrencies in circulation, the SPACs and NFTs as well. Independent new sites like Currentaffairs.org may call Cryptocurrency a giant fraud but no one would have dared call out Archegos or Greensill last year. Everyone would pretend to understand how stock markets work except Warren Buffet and Charlie Munger when valuation metrics are in their own twilight zone for the fear that they would be proven wrong.

EV to Sales valuation metric of the S&P 500. Source: Crescat Capital

EV to Sales valuation metric of the S&P 500. Source: Crescat Capital

Yet we have to speak up without fear of being labelled anti-fintech and non-progressive.

Young Koreans hooked on Bitcoin trading sparks “crypto addiction” fears, reports Chosun Ilbo in Korea and IT companies are losing workers who choose (succumb to) the easy path to riches.

“I enjoyed working, but I realized it made more financial sense to focus on my investments considering the returns I can gain for the amount of time I put in.” — Han Jung-Soo, former IT worker

Where does that bring us?

Back to the ponzis and frauds, we were talking about earlier—greed. Even Lebanese central bankers are involved in embezzlement to get their loot.

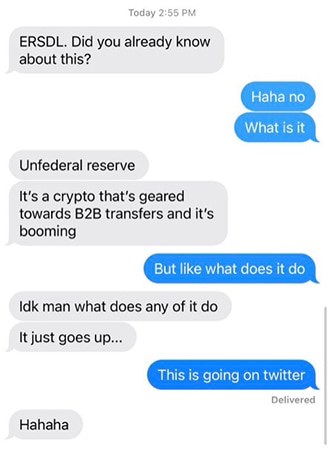

Really, we cannot trust anything these days including new potato chip flavours like Korean fried chicken wing or maple bacon, but we would not pretend to because we are sure that majority of the folks piling in right now have the same mindset as the chap in this screenshot below. And we are also sure the sentiments are the same for most of the Reddit frenzied crowd piling into Gamestop two months ago.

Source: Will Hershey, on Twitter

Source: Will Hershey, on Twitter

We really like the 20-year-old “but mommy, that is gambling” son of our dear friend, as well as dear Warren Buffet and Charlie Munger who have raised their cash levels to a near-record high of US$145.4 billion so far without buying much and selling much more. The kid is an old soul at heart but we would qualify that we would stand to be corrected, while holding our breaths, like Barrack Obama’s friend mentioned in his memoirs.

George told me that he had been forced to abandon his short position after taking heavy losses.