Covid-19 Crisis in Singapore Bond Markets

“There’s nothing wrong with being dead. The best thing about being dead is that you don’t know about it. That is the best thing. It’s like being stupid, it’s only painful for others so it’s fine.”—Ricky Gervais

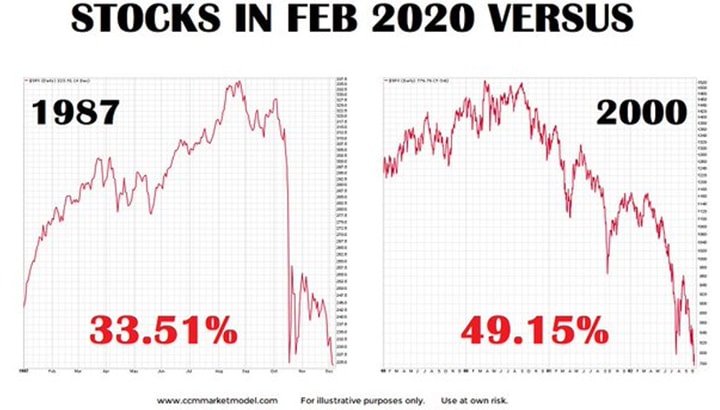

Are we retarded? We cannot recall a time when the US stock market managed to set an all-time high (3,386.15, 19 Feb 2020) despite Apple’s “Wuflu” (Wuhan Flu/coronavirus/Covid-19) profit warnings a day earlier and South Korea only had a handful of infections only to be followed by 7 continuous days of relentless selling (-0.38%, -1.05%, -3.35%, -3.03%, -0.38%, -4.42%, -0.82%), bringing the index back to June 2019 levels (shaving 13% off last week’s all-time high) as reports of uncontained outbreaks spring by the hour. That’s about 64 countries as we write and South Korea reports hundreds of new infections by the day to break 3,000 in less than a week.

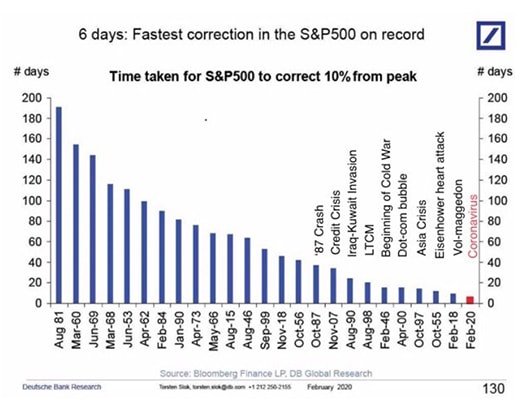

Yes. We made a new record for the fastest correction ever, taking just 6 days to correct from its peak.

Source: Twitter

Source: Twitter

All of a sudden, people are waking up to the realisation that the Wuflu has landed and emptying supermarkets of toilet paper from Italy to Indonesia to the U.S., as an Iranian member of parliament reportedly died from the Wuflu and as their Vice President and Deputy Health Minister tests positive while the German health minister admits that infection chains can no longer all be tracked even though China appears to be getting things back under control.

Ministers in Singapore are taking pay cuts as are the senior management of Temasek and her stable of companies and airlines implementing unpaid leave. The health crisis has become a financial crisis and we cannot keep up with the bond yields making new lows daily just as Warren Buffet said it made no sense to lend money to the U.S. government at 1.4% on CNBC on Monday (the 10Y yields were 1.56% on 19 Feb), we went on to see 1.37%, 1.35%, 1.33%, 1.26% to close the week at 1.15%.

Warren Buffett also said that negative headlines, including on the coronavirus outbreak, do not dampen his view that stocks are a good place for many people to invest for the long-term, but he happens to have had his worst year since the financial crisis in 2019 and spent a record $2.2 bio buying back shares while sitting on a record cash pile of $128 bio.

It’s interesting that Warren Buffet typically has his worst years just before stocks crash. In 1999, just prior to the Dot-Com Bust of 2000, the company’s book value grew just 0.5%, while the S&P grew 21%. The stock market peaked just a few months later.

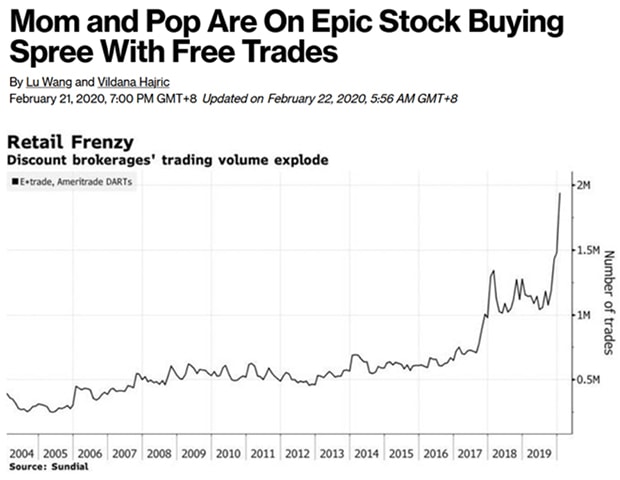

So it was the Mom’s and Pop’s doing the buying at the peak, which is as retarded as a cougher who refused to go home from work because she did not have the Wuflu but would still put people at risk by lowering their immunity.

Source: Bloomberg

Source: Bloomberg

A random poll around the bar during happier times (about 2 weeks ago) and nobody would be happy with buying anything like the 10Y US treasuries at 1.6% returns and live with those returns. But they will not be pleased to find out now that only 30-year bonds would give you 1.67% (historical low) and they could have netted a profit of nearly 10% if they have bought US long bonds just 2 weeks ago at 2.09%.

Clearly, no one buying the 30-year bond 2 weeks ago would have the intention of living with 2.09% returns for the next 30 years. Or the person buying the 10-year bond at 1.15% on Monday would be keeping it for the next 10 years more than the burning greedy desire to make 11% on the price when Donald Trump gets his way and rates go down to 0% just like how it has been working (or maybe not working so well) in Europe and Japan.

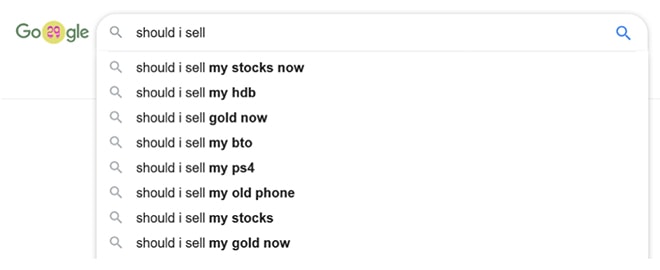

At this point in time, after our Valentine’s Day and Year of the Rat rants earlier in February, we proclaim we are no longer in a position to advise on how the market situation would play out because the Wuflu is causing a Covid Financial Crisis which we do not want to be part of and if you do not believe us, just open Google search and type “Should I sell” and guess what pops up?

Source: Google Search

Source: Google Search

Yet, we would caution that there is a definite liquidity crisis brewing right now in bond markets, including Singapore’s, after the flash crash last week with bids running scared and becoming scarcer.

Wait a minute, what crash are we talking about? Bonds should have rallied but they have not. The US junk bond ETF (HYG US) saw its largest 1-day outflow on history on Tuesday but junk aside, the investment grade bond ETF (LQD US) saw its largest outflow on record on Friday, 28 Feb although it managed to close the day on a record high in price! Presumably on the back of expectations of Fed intervention just as stocks erased about 2.5%% of their losses in the last 30 minutes of trading. (That could possibly indicate the end of the purge.)

Source: Bloomberg

Source: Bloomberg

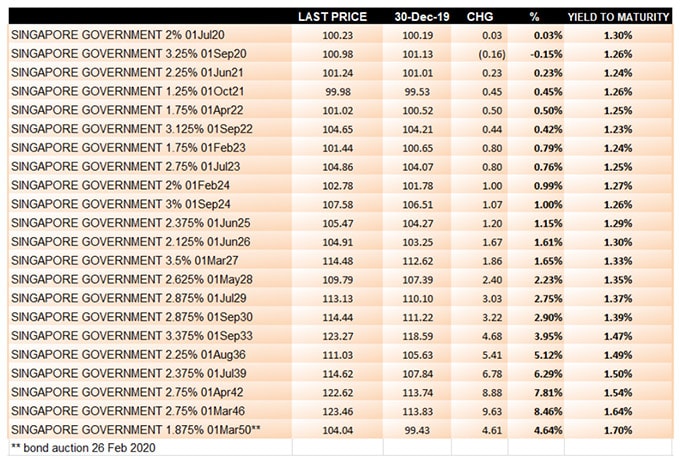

Back in Singapore, some severe bond losses for investors who were not lucky enough to have participated in the new 30-year bond auction on Wednesday, 26 Feb, for its unappealing price of 1.9% that sent a shock into markets and everything soaring. In two days, the bond rose 4.3% (27 months of coupon) in price to trade at 1.7% (see table below), a windfall profit indeed compared to folks who preferred the 6.5% coupon that Oxley offered on Monday or the 5.1% that ESR Cayman offered last week and sitting on capital losses and unable to sell their papers after the market rout on Friday leaving the market without much bids or appetite.

Table of Singapore Government Bonds (prices unverified)

Table of Singapore Government Bonds (prices unverified)

It was not just the government bonds. Even high-grade papers priced on a spread to the benchmarks saw impressive returns such as the newly issued HDB 7 year bond traded 1.9% above its issue price of 100, more than its entire year worth of coupon which is a measly 1.76%, which is not bad for someone who had bought it a fortnight ago.

Nevertheless, margin calls were triggered on Friday at exchanges, brokerages and private banks starting with Japan Index futures after Donald Trump failed to impress markets with Wuflu strategy which saw a rush for the exit with some even selling the family silver when they could not get a bid for their junk just to raise cash.

The perpetual bonds were first to go, given that the AT1 indices started their precipitous drop from all-time high (12 Feb) sometime last week, falling some 4%.

Graph of the Markit iBoxx EUR Contingent Convertible Liquid Developed Market AT1 Index

Graph of the Markit iBoxx EUR Contingent Convertible Liquid Developed Market AT1 Index

And it was the same in Singapore, the bulk of the selling saw drastically lower prices across the board, sparing none including the Temasek-linked names such as Capitaland, SIA, Mapletree and such, although the AT1 or perpetuals took most of the hit, particularly those bought on leverage from the graphs we post below.

Graph of Stanchart 5.375% Perp (price unverified)

Graph of Stanchart 5.375% Perp (price unverified)

Graph of SocGen 6.125% Perp (price unverified)

Graph of SocGen 6.125% Perp (price unverified)

Graph of Julius Baer 5.75 Perp (price unverified)

Graph of Julius Baer 5.75 Perp (price unverified)

Bond yields above 5% again when all else is falling to zero is not a surprise when it comes to high-yielding and risky AT1’s, but we were even more surprised to find decent blue-chip debt yielding above 3% when our expectations for the future fell from 1.9% to 1.7% for the next 30 years.

We compiled a rough table (uncomprehensive) below although the prices cannot be verified.

Table of senior papers yielding above 3% (unverified)

Table of senior papers yielding above 3% (unverified)

We are not sure how retarded things will get from here. A friend was complaining about getting sent home from the pub when the infrared thermoscan registered 39 degrees on her forehead, yet the trusty ear thermometer (the more accurate one) at home flashed 36.4.

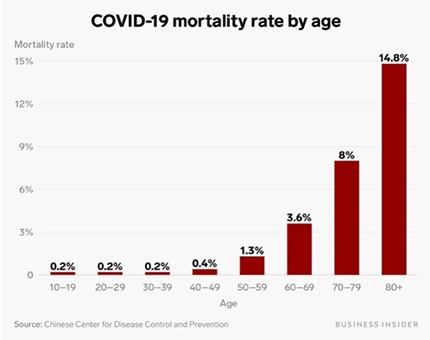

But we should be getting worried for the US politicians because many of them would fall into the higher-risk-of-death group from statistical evidence so far.

Source: Business Insider

Source: Business Insider

Even though the McClellan Oscillator data going back to 1998 shows Thursday and Friday being the most oversold reading out of 5,471 data points, it is still early days into the pandemic and we will definitely be needing those rate cuts going ahead even as China approaches peak infectiousness and treatments get more effective (remember even SARS went into abeyance quite quickly).

The truth is that no one knows how badly it will turn out—the experts, the politicians and the CEOs—but we see plenty of opportunities in the Wuflu panic that is leading to a Covid Crisis. It has been reported that 94% of Fortune 1000 companies are seeing supply chain disruptions related to the coronavirus.

Source: CCN Markets

Source: CCN Markets

The #CoronavirusOutbreak has cut China’s carbon dioxide emissions by about 100 million metric tons. That’s about as much as Chile emits in a year.