Inflation Rule of Thumb Means You Should Not Buy Bonds

“Stupidity is far more dangerous than evil, for evil takes a break from time to time, stupidity does not.” — Anatole France

Another SNAFU of a week, as Covid-19 struck at the heart of Singapore and a lite-CB/lockdown is underway. As stupefied as we have become, the launch of a local umbrage-coin and conversations everywhere never stray too far from crypto-talk: Doge, Ethereum, Bitcoin and more, in the 11,000 coins (and growing) casino for the masses, including children.

Our thoughts go out to the 88-year-old cleaner of the Changi Covid cluster, wondering how octogenarians end up cleaning high-risk toilets of their own volition, exposed to the viral plumes of droplets from the flush bowls. We recall how folks who were running away from and blaming all things Chinese just a year ago, are the same folks running away from and blaming the Indian subcontinent now.

No, we are not experts on the topic of the worst outbreak of violence in the Gaza strip since 2014, but we would wonder how the HAMAS managed to amass such a massive arsenal of rockets and firepower, firing nearly a year’s worth of rockets in two days?

Neither are we experts on the matter of how the single most important gasoline pipeline in the U.S., 5,500 miles long, which is connected to nearly 30 refineries and almost 300 distribution terminals, supplying to half the U.S. east cost daily, managed to get cyber-hacked for ransom, leading to some comedic scenes of folks storing gasoline in plastic bags even as Singapore supermarkets managed to circumvent another toilet paper run this weekend.

Instead, we would be sufficiently informed to share our thoughts on the real elephant in the room that has been hogging the headlines in the world of finance—inflation, which is the topic du jour these days from wealth advisers to hedge funds to manufacturers to retailers, including Morgan Stanley, would call a Red Hot Economic Recovery.

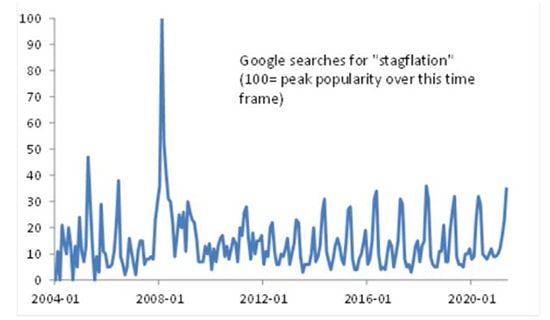

Since the print of the largest CPI jump this week that is best compared to the early 1960s for historical comparison—the steepest monthly surge in core CPI, at +0.9 per cent, since 1982 and the fastest gain from a year earlier, at +4.2 per cent, since2008, Google searches for the word “stagflation” spiked.

The highly contested topic of inflation divides the markets, pitting the majority against central bankers and regulators in denial (the “inflation is transitory” camp, although now some acknowledge “transitory” = maybe three years) with the street split in their views. They range from outrage at loose monetary policies creating moral hazards to bemusement and incredulity at the central bankers’ absurdly predictable antics and rhetoric, whilst any taking the side of the regulators would usually be seen to be clouded by personal financial agendas.

Taken from Twitter

Taken from Twitter

Almost everyone of any importance has had their say, with Gundlach warning of inflation this week and Druckenmiller expressing his outrage at the central banks, again, for the moral hazard created with stimulus cheques accounting for about 94 per cent of the record rise of 21.1 per cent in March household income and a distorted K-shaped recovery.

Prescribed hedges for inflation would have cryptocurrencies leading the pack, vociferously championed by eminent investors like Druckenmiller, celebrities, billionaires in Norway and Elon Musk, then we have folks touting real estate, value (not growth) stocks, watches, baseball cards, NFTs, commodities and what-nots, with the sole exception of bonds which we will come to later.

There are two schools of thought on the in-our-faces inflation numbers—one that it is transitory (central banks mainly) and the other, that it is here to stay. And it is not just about the CPI, asset inflation is the larger concern as we notice runaway real estate prices all over the world as people panic buy homes from Peru to Germany with as many as 45 per cent of listed homes selling for more than list price, according to Redfin and a record 58 per cent selling within two weeks of listing. Cryptos, stocks, watches, cars, art and various asset classes are soaring that Non-Fungible Tokens would emerge as an asset for investors to chase leaving those who cannot afford them in the dust and even less able to afford as price go “to the moon” ?.

The arguments for transitory inflation are simple—base effects from the lockdown last year, pent up demand for commodities like lumber and various metals, global disruptions in shipping and chips, the transition to an ESG economy with various green initiatives requiring specific commodities like copper and such. With unemployment rates still not at ideal levels and more retrenchments to look forward to as A.I. innovation and automation could cause U.S. banking to shed another 200,000 jobs over the next decade, there is little to worry about for runaway inflation.

Why should we worry then?

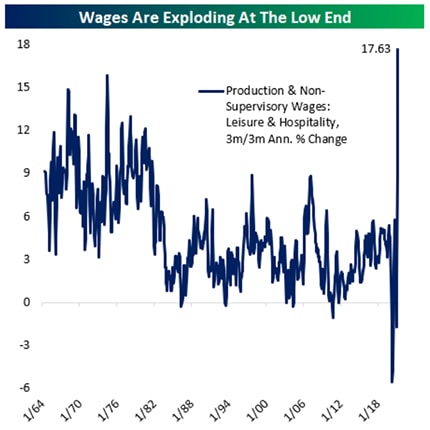

Wages are going up. This week McDonald’s raised the hourly wages for company-owned restaurants by an average of 10 per cent. Waiters are rejecting sign-on bonuses as employers struggle to find low-skill workers and indeed, many are choosing to be day-traders which have been nothing but hugely profitable in markets where even “a monkey could make money,” as Druckenmiller pointed out on CNBC this week. Meanwhile, wages are exploding at the low end in an inflationary time bomb because wages tend to be “sticky” in populist regimes, especially those still engaged in the moral hazard of meting out stimulus cheques and other unemployment benefits.

Source: Georges Pearkes, on Twitter

Source: Georges Pearkes, on Twitter

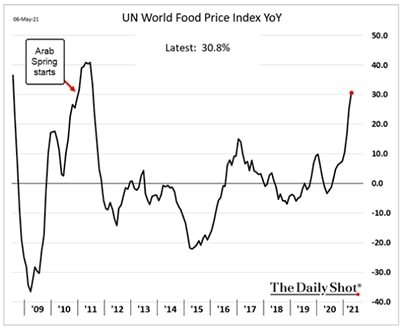

Soft Commodities/Food Prices are on an upward trajectory (to an 8-year high) not because just people are eating more but also due to the disruptions in transits, labour and bad weather affecting everything from the price of palm oil to corn to wheat to soybeans which are animal feeds, and in turn affect livestock prices—thus, driving food inflation. As it is, Coca Cola and Kimberly-Clark and J.M. Smucker will be raising prices due to higher commodity costs (toilet paper too!, whose prices were hiked by 10-20 per cent in China earlier in April) which will perhaps give McDonald’s another reason for higher prices in the future?

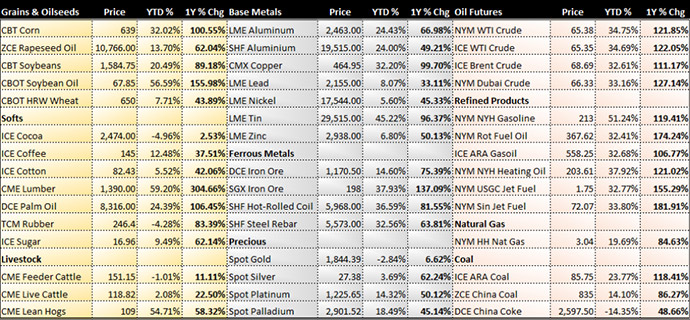

Hard Commodities. Some call it the start of a commodities supercycle and the latest warning is sand, a valuable construction resource, and potential sand crisis ahead but the world is facing imminent shortages in construction materials, EV battery-making materials, chip-making materials, which is causing prices of metals like copper, steel, nickel, palladium and rest to outperform. Unlike soft commodities, these are of finite supply and once the supply runs out, like oil which is seeing a price renaissance, there will be a mad grab.

Table of Commodity Prices

Table of Commodity Prices

Disruptions in shipping and chips. Used car prices have surged as production cuts happen all around the world on the shortage of chips as other electronic products also face production problems. Sony warned this week that Playstation 5 supply will remain tight into next year.

Environment and weather. Taiwan’s unprecedented drought is leading to the global shortage of chips but environment concerns are also the reason why commodity and chip and EV battery demand is exploding. The quest for a green economy and society is also the reason why prices are climbing. Given that the initiative is a long-haul affair, it is unlikely to abate anytime soon as demand will outstrip supply in the years to come.

We can go on for a while here and talk about the enormity of the wealth created by the wild assets rally (minus bonds) that has spilt over into the inflation front, particularly real estate which is a favourite place to park excess wealth from say, cryptos or the fact that investors are losing faith fast in their central banks and money presses that is spurring them to jump on a devaluation of fiat money bandwagon and into NFTs, watches, art and all.

What do we think?

Inflation is a vicious circle. And it looks like its roots have sunk in because the University of Michigan’s gauge of consumer inflation expectations have “Americans pencilling in higher inflation not just over the next year but over the next five years.”

For a reality check, we have the highest 5-year inflation breakeven rate in over 15 years suggesting that inflation expectations have not been so high since 2006.

Source: Bloomberg

Source: Bloomberg

We cannot claim to have some fancy time machine algorithmic model to read the numbers coming ahead like the central banks claim they do, for their steadfast denial of the inflation story.

Yet we know the general truism about inflation is that inflation is bad for bonds.

Holding bonds will not make one rich as holding the other asset classes and indeed, we have had a few friends reallocating out of bonds this week for the allure of value stocks.

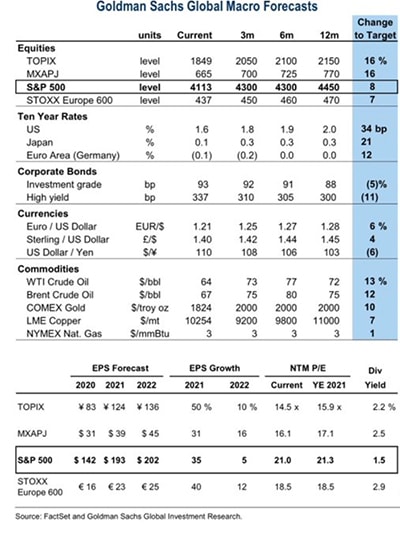

We found the latest Goldman 12-month macro forecasts and it does not look too promising for bond prices as well, with yields expected to edge higher even as total negative yielding debt pool has dropped from roughly US$18.4 trillion as of December last year to US$12.2 trillion this year (another $12 trillion to go?) But 1.6 per cent for the next 10 years does not seem like much these days versus 0 per cent in cash and the hope of a better entry point.

As central banks remain the buyers of last resort in the sovereign bond space, foreign buyers are shunning U.S. government debt at an unprecedented pace. On the central bank front, there are signs ranks will be broken as the ECB hinted at a decision to slow bond-buying in June, Bank of England slowed its emergency bond-buying and signalled it is on course to end stimulus while the Bank of Canada, Reserve Bank of New Zealand have started tapering. Who will be left holding the baby?

Yet if a vicious circle plays out, the end of central bank stimulus may end the frenzied asset rally which would, in turn, deflate prices. That would end up favouring bonds once again and so it goes.

We are not sure because inflation or, rather, inflation expectations are tricky business but at this moment, it looks like a red hot recovery and inflation looks sticky. The rule of thumb remains that inflation is bad for bonds.