Who Dares To Write About The Singapore Bond Market

Shock and awe?

We can’t blame Trump for it all.

Singapore bonds are ratcheting, towards their day of reckoning.

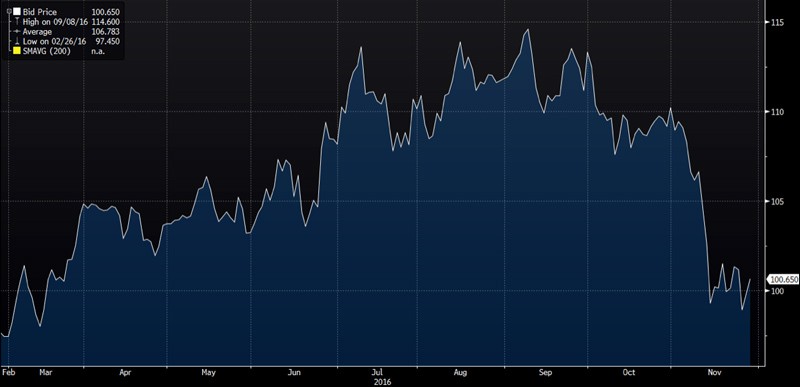

The best performing bond of 2016 back in October, the 30 year Singapore Government Bond which I had crowned the best “Quick Buck” bond of the year, that had returned 14% in 6 months, has been tipped off the throne in less than 2 weeks, more than unceremoniously and in disgrace which is something has happens only once in a rare blue moon that incidentally shone in May and will not happen again till Jan 2018. Bond is now just about 2-3% up, in very volatile times.

Chart of the 30Y Singapore Government Bond since issue in Mar 2016.

When the companies started failing along with their bonds, the entire Disneyland story came apart at the seams because perhaps, the Singapore bond market has always been a pipe dream?

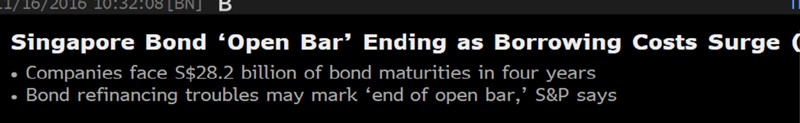

List of defaults in the history of the Singapore bond market to date.

It looks ugly when the record books have been a clean slate except for Lehman marring the picture until lightning struck 6 times since a year ago, making this the first anniversary of the first default since Lehman!

When it rains, it pours! There may be more to come from more distressed names seeking resolutions with their bond investors.

- ASL Marine – seeking extensions on their bond maturities

- Kris Energy – seeking to restructure debt maturity, lower coupon payments and ease bond covenants.

- Ezra Holdings – sought successfully to loosen financial covenants on their bond while delay in filing of accounts (could be due to Perisai Petroleum’s bankruptcy)

Who dares to talk about the Singapore bond market ? Who dares to call bluff on the economic outlook before it is formally acknowledged? Who dares to say anything but good about Singapore’s monetary policy?

Nobody would, if they were sane after their onshore education and their fear of death, or, even worse, some form of personal reprisal.

Singapore—The Scary City

Digressing a little, for the fear of speaking out loud, China has now seized some SAF armoured cars in transit, India is pushing for Gujarat to rival the Singapore derivative markets, China plans to build a new S$ 14 billion dollar port in Malacca after building a “scary” US$ 100 billon city a stone’s throw away from Singapore borders.

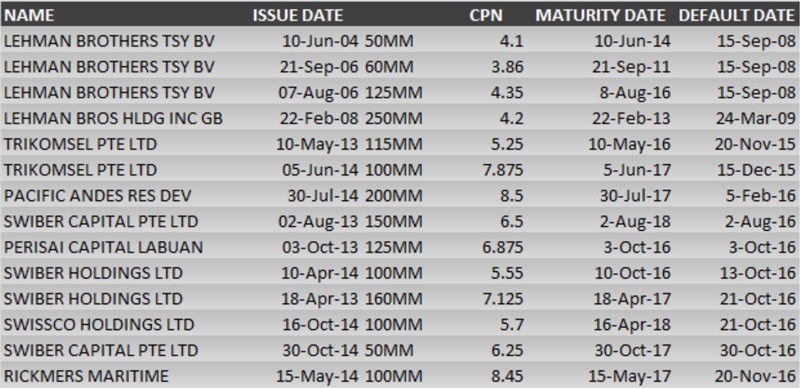

And not a bright spark to be seen in the financial markets as financial services registered their first ever year on year slowdown, albeit a small one of -0.7%, since the financial crisis in the recent 3Q16 final GDP number, that turned out to be less negative than expected yet still negative.

The stock market has little to go by as Singapore Charges 3 in Rigging That Saw Stocks Plunge by Billions, in the most serious incident of market manipulation in the city-state’s history.

And to date, Singapore still holds the record for having 133 traders rig the forex and interest rate market at the same time.

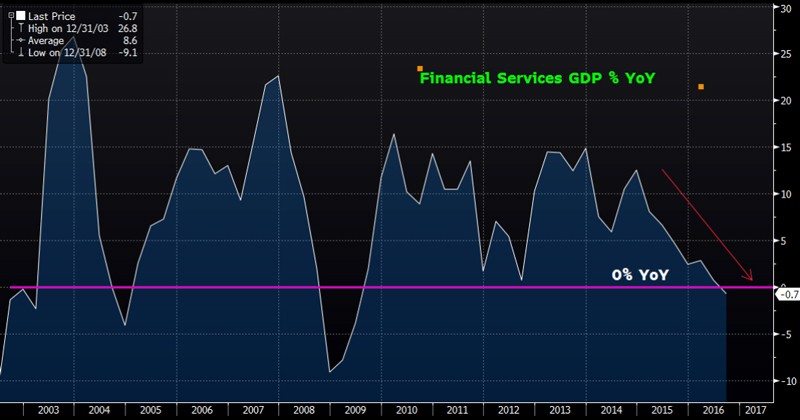

I would beg to disagree with Bloomberg’s audacious and cheeky “dumb money” chart about Singaporean bond investors because these poor folks are operating in a very harsh environment with plenty of sharks in the water who would sell a bond to a client who thought that “coupon had something to do with free parking”.

Let’s see how dumb the market really is—The Hall of Shame

Dragging out the bonds issued in the past 3 years, we tabulate those that have lost >5% and the results are surprising.

Singapore Corporate Bonds Hall of Shame

The biggest losers were those bonds issued in 2014 but we would have thought that after last Nov’s default out of Trikomsel, we would not see a 10% loss like the retail Aspial bond issued just this year.

Were investors really stupid in 2014 ? Or did they have another reason for their investment decisions?

There we have it. 2014—the year after 2013 where we saw a peak in Singapore real estate that delivered good fortunes into kitty for the investor, in a time when SIBOR was near zero for an extended period and the SGD dollar looked cosy in her comfort zone, putting cap on interest rates.

It was the best time to sell any bond, to be honest, and even easier if the owner of the windfall thought that the coupon referred to free parking.

Looking at the situation, just give me a good reason to buy?

How about half dozen reasons?

- Local Credit Quality: The government is rolling out measures to help the small guys in the O&G space, letting eligible companies borrow and expecting S$ 1.6 bio of loans in a year—trust me, there will be a trickle up effect ! https://www.businesstimes.com.sg/government-economy/mti-unveils-support-measures-for-marine-offshore-engineering-firms

- PB Market Overhaul: MAS has mandated that private banks must reveal bond rebates to clients for new bond issues—which means they will just stop selling bonds or focus on selling secondary market issues (no need to disclose mark ups). Supply will be limited with less new issues especially those high yield names that PB clients prefer – the HY papers.

- Economic Outlook Favours Bonds: Little growth expected and inflation too. Higher rates are not good for stock markets, so it still has to be bonds

- Housing Market Woes: Real estate markets still expected to be moribund and higher interest rates do not help. REITS will struggle to maintain returns as will dividend stocks.

- Regulatory Angle: We can expect the central bank to focus on keeping the calm on the interest rate front and supportive of the bond and housing market. While they have less influenced on the long end, the day to day liquidity management will allow their influence to reach out to the 6 month, at least which should be comforting to the investor.

- Supply: Supply is unlikely to soar in the coming months given 1. The lack of demand and 2. Stringent issuance. Already the SGS (government securities) issuance calendar for 2017 is a shadow of the 2016 calendar, a sign the MAS is ahead of the curve, as usual.

Retail bonds are expected to hit the street after a year’s delay which has been prudent given all the bad press about the market.

- Prices and Valuations: With every default and rate hike, we have the panic selling which is more prevalent in undeveloped (“dumb money”) markets like Singapore. It represents good opportunity for buy and hold investors to pick up good bonds at bargain prices.

Disclaimers and What To Buy?

The US-election result led sell-off in the SGD bond market has been a God-send for some investors. For the rest, it was a case of nerves and panic. I personally do not feel this is time to bet the house on the 30Y Singapore govi, even if it has come off some 10% since Trump’s victory.

There are bargains to pick to tide us through the volatility that will hit us in the months ahead into the 2017 which will include Trump’s inauguration and Brexit, not to mention the FOMC.

Thus I have some investors telling me they will stick to the short end under 3 year tenor, that pays a decent 3% (that will take about 9 rate hikes of 0.25% to achieve for the Fed). For the brave, foraging for bargains in the 50 to 70 cents offers out there has proven to be rewarding.

Yet I dare not talk too much about the Singapore bond market in the open and thus I have to leave off now. Though at least, I did try to talk about it.