Central Banks to the Rescue in Covid Panic

“The darkest hour is just before the dawn” and we are living in Covid times when at 9 p.m. half your friends are frantically scouring the web for Singapore’s daily Covid stats and it is getting later each day (past 9:30 p.m. on Sat night). Whatsapp messages are all in speculation that we will definitely see a spike in cases because the roads and food centres are busier than ever this weekend despite the sobering speech from PM Lee Hsien Loong.

They must be spending their Resilience Budget windfalls, a cynical friend was commenting even as the economic impact is just starting to show and the financial markets remain quite frozen with 99.9 per cent of the world processing the avalanches of central bank initiatives and emergency actions besides governments’ fiscal rescue packages and such.

Who can keep up with all the developments when the office is down to a third of its strength and cynic friend notes that the toilets at work actually smell good for once although the fear of redundancy is greater than catching Covid-19. People are starting to notice the lady in the office who spends 5 minutes to wash a single cup in the morning, hogging the sink and rinsing it two dozen times and wondering if she has any work to do because up next is her jug and pot.

It is pointless to think ahead for the economy with Covid sweeping the world by storm and once we pass through this panic, pain will overtake our lives. So much for all of us ranting at the impossibility of the relentless all-time-highs of stock markets in the past, we will not be associated with anyone who wishes the illness to pervade or for companies to fail in a financial crisis with livelihoods at stake.

Covid-19 will bankrupt you more than it will kill you, but we have seen trader friends losing track of the day of the week, having not had proper sleep in five weeks and hearing of folks crying at work, buckling under the pressure of a market grinding to a halt—the victim of a liquidity crunch.

Do not buy Singapore bonds! A friend advised us because there is no price for anything and the central bank is not there to support (yes, Singapore is one of the few central banks out there not in the new business of buying bonds that investors need to sell in this period) and we have traders tell us they are not in the business of national service to support markets because the bank comes first.

We should step back and review the flurry of central bank actions around the world in the past week. It is still ongoing, and to get a sense of the new reality after downloading over 200 headlines, we found we missed the Bank of Canada’s second bazooka unleashed late Friday night, another 0.5% rate cut and plans to buy $CAD 5 billion worth of government bonds every week “until the economic recovery is well underway,” another infinite QE after the Federal Reserve announced their intention to buy corporate bonds, mortgage-backed securities and even qualifying bond ETF’s, earlier in the week which many folks missed out because no one is thinking very much.

It is too much of a good thing that we know the extent of the Federal Reserve’s firepower because in a surprising twist on Friday, U.S. dealers (for the first time since last year) borrowed no cash from the central bank’s repo operation.

Source: Reuters

Source: Reuters

Summary of Central Bank Actions (inexhaustive)

19-21 March

- RBA CUTS CASH RATE TARGET 25 BASIS POINTS TO 0.25%

- RBA: TARGET YIELD ON 3-YR GOVT BOND AROUND 0.25%

- RBA: PURCHASES OF GOV DEBT ACROSS YIELD CURVE TO BE CONDUCTED

- Guatemala Central Bank Cuts Policy Rate 50 Basis Points to 2.25%

- NORGES BANK CUTS POLICY RATE BY 0.75 PERCENTAGE POINT TO 0.25%

- GERMANY WANTS TO SET UP EU500B RESCUE FUND FOR FIRMS: SPIEGEL

- BANK OF THAILAND CUTS KEY RATE TO 0.75% FROM 1.00%

- ROMANIAN CENTRAL BANK CUTS KEY RATE TO 2%

- BOE Announces Details of Schedule for Bond Buying Plan

- ECB EMERGENCY BOND BUYING PROGRAM AWAITS FINAL DETAILS TO START

- ECB SAYS PILLAR 2 CAPITAL RELIEF FOR BANKS AMOUNTS TO EU120B

- FED EXPANDS MONEY MKT FACILITY TO INCLUDE SOME MUNICIPAL DEBT

- MEXICO CENTRAL BANK CUTS REFERENCE RATE 50BPS TO 6.5%

- BANXICO WILL CONDUCT USD AUCTIONS AMONG CREDIT INSTITUTIONS

23 March

- BANK OF THAILAND SAYS IT’S READY TO BUY MORE GOVERNMENT BONDS

- THAILAND TO PROVIDE AT LEAST 1T BAHT LIQUIDITY IN NEW MECHANISM

- RBNZ to Start NZ$30b Bond Purchase Program to Support Economy

- BOJ ANNOUNCES ADDITIONAL BOND PURCHASES, BUYS 3-10 YEARS DEBT

- ICELAND CENTRAL BANK TO START DIRECT PURCHASE OF TREASURY BONDS

- ROMANIAN CENTRAL BANK’S BOND BUYING WILL BE CASE-BY-CASE

- Riksbank to Buy Covered Bonds From Issuers Including SEB, SBAB

- RBNZ Joins QE Club With Plan to Buy Almost Half Nation’s Bonds

- FED ANNOUNCES EXTENSIVE NEW MEASURES TO SUPPORT ECONOMY

- FED WILL DO OPEN-ENDED TREASURY, MBS BUYING IN AMOUNT NEEDED

- FED WILL INCLUDE PURCHASES OF AGENCY MBS IN ASSET BUYING

- FED SETS UP TWO FACILITIES TO PROVIDE LIQUIDITY FOR CORP. BONDS

- FED SETS UP NEW PROGRAMS TO SUPPORT CREDIT FLOW TO BUSINESSES

- FED SETS UP TALF FOR ABS BACKED BY STUDENT, AUTO, CC, SBA LOANS

- FED EXPANDS MONEY MARKET LIQUIDITY FACILITY TO VRDNS

- KENYA CENTRAL BANK CUTS BENCHMARK RATE TO 7.25% FROM 8.25%

- Bangladesh Bank Cuts Repo Rate to 5.75% From 6%

- RIKSBANK NEW LOAN OPPORTUNITIES WITHIN CORPORATE LOAN PROGRAM

24 March

- *PAKISTAN CENTRAL BANK CUTS KEY RATE TO 11% FROM 12.50%

- *CENTRAL BANK OF MYANMAR TO CUT POLICY RATE TO 8.5% FROM 9.5%

- Korea Doubles Rescue Funds to 100 Trillion Won to Shield Economy

- RBNZ Relaxes Bank Capital Further to Help Businesses, Homeowners

- *PHILIPPINES CUTS BANKS RESERVE RATIO 200BPS EFFECTIVE MARCH 30

- Colombia’s Central Bank to Buy Corporate Debt to Calm Market

- *BANK OF THAILAND EXPANDS LIQUIDITY FACILITY FOR MUTUAL FUNDS

- Rupee Bond Traders Await RBI’s $2b Debt Purchases: Inside India

25 March

- *DR CONGO CENTRAL BANK CUTS BENCHMARK RATE TO 7.5%

- *BANK OF CANADA TO BUY PROVINCIAL MONEY MARKET SECURITIES

- *FED HIRES BLACKROCK FOR AGENCY MBS, CORPORATE CREDIT PROGRAMS

- Malaysia Central Bank Grants Six-Month Loan Deferment to Consumers, SMEs

- *Malaysia Central Bank Measures to Ease Businesses Cash Flow, Boost Liquidity

- *Malaysia Central Bank: Will Let Banks Use Reserves, Draw on Buffers to Increase Liquidity

- *ESTONIA CENTRAL BANK BUFFER TO LOWER SYSTEMIC RISK BUFFER TO 0%

- Switzerland Frees Up $26.5 Billion to Help Banks Keep Lending

- *SNB: COVID-19 REFINANCING FACILITY AVAILABLE FROM MARCH 26

- *SNB SAYS DEACTIVATES COUNTERCYCLICAL CAPITAL BUFFER

- *SNB: NO UPPER LIMIT ON AMOUNTS UNDER NEW REFINANCING FACILITY

- *BANK OF CANADA ANNOUNCES NEW CASH AND SWITCH BUYBACK OPERATIONS

- *BOE GILT-PURCHASE OPERATION FULLY COVERED; OFFERED 2.71 BLN PNDS

- *ECB IS SAID TO BE BROADLY IN FAVOR OF ACTIVATING OMT IF NEEDED

26 March

- BOK Concedes Its Pledge for Unlimited Liquidity Amounts to QE

- *BOJ TO SUPPLY USD FUNDS AGST POOLED COLLATERAL FROM 03/30

- *BOK: MAY PURCHASE MORE GOVERNMENT BONDS IF NEEDED

- *BOK TO PROVIDE LIQUIDITY TO MARKETS UNLIMITEDLY FOR 3 MONTHS

- *MAS SUPPORTS $LENDING THROUGH NEW US$60B FACILITY FOR BANKS

- *U.K. BANK REGULATORS EASE SOME ACCOUNTING RULES, CITING VIRUS

- *MALAWI CENTRAL BANK TO REPURCHASE 8B KWACHA OF GOVT SECURITIES

- *POLISH CENTRAL BANK OFFERS TO BUY SIX TYPES OF BONDS AT AUCTION

- *BOJ BUYS 201.6B YEN OF ETFS, 3RD TIME TO PURCHASE RECORD AMOUNT

- *ECB SAYS IT STARTED BOND BUYING UNDER EMERGENCY PROGRAM TODAY

- *BANK INDONESIA’S WARJIYO SAYS `NO LIMIT TO OUR BOND PURCHASE’

- *MAURITANIA CUTS KEY LENDING RATE TO 5% FROM 6.5%

- ECB Dropping 33% Limit Good for Periphery, Semi-Core Sovereign Bonds

- *SWEDEN’S RIKSBANK TO INITIATE BUYS OF COMMERCIAL PAPER 2 APRIL

- *CZECH CENTRAL BANK CUTS COUNTERCYCLICAL BUFFER TO 1% FROM APRIL

- *CZECH CENTRAL BANK CUTS KEY RATE TO 1%; EST 1.25%

- Canada Triples Planned Purchases of Mortgage Securities

27 March

- Zimbabwe Suspends Managed Float, Pegs Currency to U.S. Dollar

- ECB buys Greek state bonds, yields fall sharply

- Namibia Central Bank Cuts Lenders’ Capital Buffer to Zero

- Czech National Bank cuts interest rates by 0.75 pts to 1 pct

- *FED FX SWAP LINE TAPPED FOR $206B BY BOE, BOJ, ECB, SNB IN WEEK

- *BOE PLANS TO INCREASE DAILY PACE OF BOND BUYING NEXT WEEK

- Peru Lowers Reserve Requirement Ratios to Bolster Lending

- Chile Cenbank Releases Rules to Help Banks Fund, Refinance Loans

- ECB Begins New Bond Purchases, Throwing Weight Behind Virus-Hit Nations

- *RBI CUTS REPURCHASE RATE TO 4.40 %

- *RBI TO CONDUCT AUCTIONS OF TARGETED LTRO FOR UP TO 1 TLN RUPEES

- *INDIA RBI TO CUT CRR BY 100 BPS TO 3% FOR ALL BANKS

- Bonds Rally in India With RBI’s $50 Billion Liquidity Pledge

- South Africa Eases Bank Rules to Free $17 Billion for Loans

- *COLOMBIA CENTRAL BANK LOWERS LENDING RATE TO 3.75% VS 4.25%

- *BANK OF CANADA LOWERS BENCHMARK OVERNIGHT RATE TO 0.25%

- Bank of Canada to Purchase Assets Across Yield Curve

- *BOC RETAINS BLACKROCK, TD FOR COMMERCIAL PAPER BUYING PROGRAM

- *POLOZ: OBJECTIVE NOW IS TO IMPROVE MARKET FUNCTIONING

- *RIKSBANK CONTINUES PURCHASES OF GOVERNMENT AND MORTGAGE BONDS

- *FED LETS BANKS DELAY CAPITAL HIT FROM LOAN LOSS ACCOUNTING RULE

We decided to list down as much as we could because there is a huge amount of information and developments to digest on top of the various stimulus packages announced and to be announced in the days and weeks ahead.

And tomorrow will be the second busiest day for Singapore after last Thursday SGD$48 billion dollar Resilience Budget and Friday’s SIA bailout because the Monetary Authority of Singapore will be announcing their semi-annual monetary policy statement. It is largely expected to be a flattening and re-centering of the SGD NEER (means to weaken the SGD against the trade basket) and, hopefully, throw in some words of comfort for the suffocating bond market although it is unlikely to convince banks to return to normalcy after weeks of wide pricing and unwillingness to bid, noting that MAS is largely missing from the headlines above except for one (to try spotting Wally).

We will not waste our time imagining the economic pain that lies ahead after the virus (if it ever goes away or if they chance upon a new Tamiflu that worked early for the H1N1), but there are some key takeaways from the inexhaustive list of central bank actions.

1. Rates are going to be zero bound for a while.

2. Central banks are stepping up to back-stop the financial system and markets.

3. Some central banks are buying government bonds and some are buying corporate bonds too.

4. Each country is doing their version of QE.

5. Not all central banks are equal.

This is really not the time to panic or stop thinking, there are opportunities abound as we navigate the financial crisis. Systemically important corporates and banks could well be safe havens such as SIA perhaps? Imagine JPM senior 2-year USD paper and other similar names were yielding over 4% earlier in the week even after the Fed announced their intention to buy?

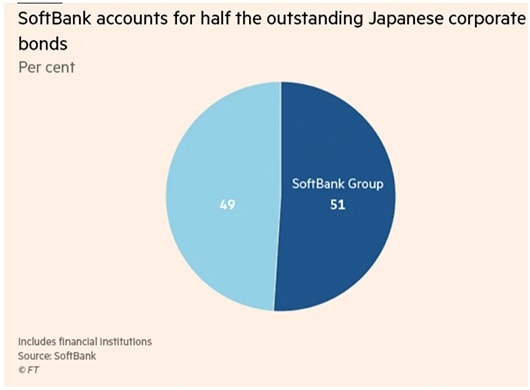

Another case in point: Softbank is ultra-junk (Ba3/BB+) but Softbank accounts for half of Japan’s corporate debt market—the systemic risk is perhaps more difficult to stomach?

Source: FT, 21 May 2019

Source: FT, 21 May 2019

Nonetheless, there is still a considerable backlog of sell orders out there and it is time to be circumspect about the situation: digest the prospects of the insane amount of stimulus that has just been delivered in the past two weeks and take a deep breath for another day of mayhem while waiting for the latest Covid stats from MOH. And of course, we also have the MAS Monetary Policy Statement.