Every Crisis Is the Same, the Only Difference Is Yourself

Who would have thought that an innocuous sell-off/correction (10%) from 2 weeks ago after the S&P 500 hit its all-time-highs on 19 Feb 2020 would be nothing compared to what happened last week, marking a bear market (20%)? We do not want to think about what this week will be like as we commiserate with haunted gazes of friends on the front lines of the financial markets turn from the lost look to blank stares to resignation and defeat—as if someone lands a blow to your face (week 1), then socks you in the eye, (week 2) before breaking your jaw (this week).

Just 2 +/-4% moves in the past 8 years and we went into +/-9% territory this week in affirmative crisis mode.

“Every crisis is the same, the only difference is yourself”, a dear friend of ours wisely replied to the question of how bad is this compared to SARS, Lehman, 9-11, dot-com, LTCM and the Asian Crisis, as she took a break from her rant about being seated just a mere 2 inches from the next person at dinner and the impossibility of “social distancing”. Millennials view the Wuflu as a “Bye-Boomer” virus, clearly oblivious to the on-going financial crisis that has stripped many of us of our appetites and sleep for the past 3 weeks and the weeks to come with a market correction in the last week of February escalating into a bear market (a week later) and into a VAR shock this week on a black swan oil crisis.

Who would have thought that Covid19/Wuflu cases would snowball into a global avalanche as France, Korea and Spain try to bring the epidemic under control? How did Italy jump from 113 cases on 23 Feb to 21,157 (1,441 deaths) at last count?

Source: Global Times

Source: Global Times

Donald Trump had to backtrack on his virus is a “new hoax” claim in less than 2 weeks to announce border shutdown and an emergency rescue package as politicians, mayors, celebrities get diagnosed positive, all large scale events closed and soccer games and marathons continue in the absence of a live audience.

We have fund manager friends who left the office early in disgust on Friday because they could not bear to continue looking at the fluctuating screens after a wild week with 10 year US yields closing 0.76% last Friday before touching a low of 0.31% on Monday only to close the week on a massive sell down to 0.96%. Nothing has been spared except for short positions, not Bitcoin nor Gold, safe for mask companies and funeral homes.

This has to be documented for posterity however patchy our account may be because it will be one to remember for the future.

Week 1

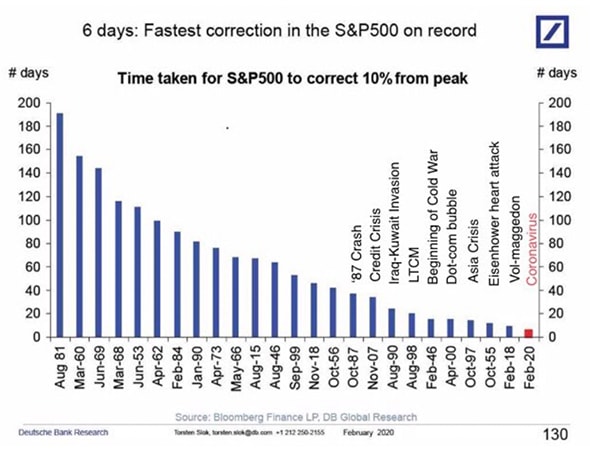

Friday, 28 Feb—Ugly ending, unimaginable and beyond belief because these things just do not happen so quickly (6 days!), a 10% correction less than 10 days after an all-time-high! Worse still, without a pull-back to give folks a breather, all because of a sprinkling of Wuflu cases around the world (a few hundred or so in Italy and Iran). Left hanging on to Hope as Trump calls for rate cuts after 7 consecutive days of stock market declines.

Source: Business Times

Source: Business Times

Source: Twitter

Source: Twitter

Source: CNBC

Source: CNBC

Week 2

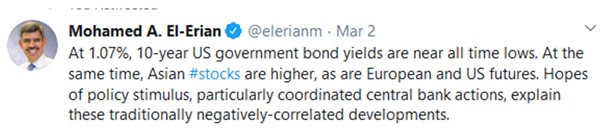

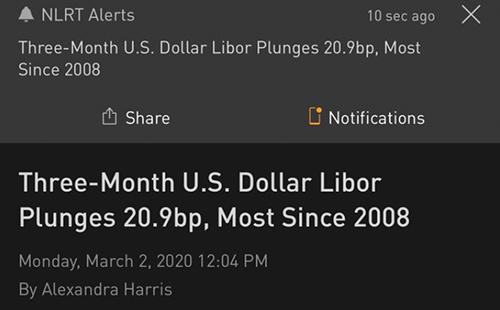

Monday, 2 March – Reality check after Warren Buffet just said a week ago that it did not make sense to lend money to the US government at 1.4%, yields on the 10-year government bond fell to 1.05%, near all-time lows and Libor plunges on expectations (not Hope) of a rate cut. Stocks rebounded 4.6%!

Tuesday, 3 March (US)—Respite with markets deciding 6 days was too fast and furious and Biden’s results at the polls gave folks some relief that socialism is off the cards and good for Wall Street.

Source: CNBC

Source: CNBC

“As the bulls go wild on today’s bounce, a reminder: we had 11 sessions in the 2008/09 bear market when the Dow surged 4%; and 7 of these same whippy moves in the 2001/02 malaise. These happen more in bear markets than in bull markets by a huge margin.”—David Rosenberg

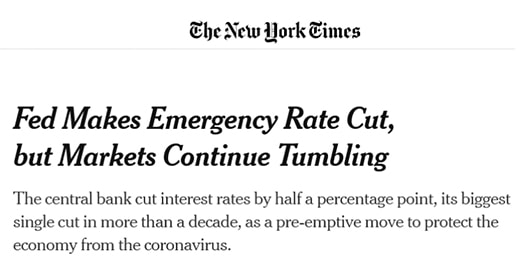

Wednesday, 4 March—Fed caused panic with an emergency 0.5% off-cycle rate cut signalling things must be bad, bad or worse than we thought, common sense telling us that rate cuts are not going to cure a pandemic or make someone book a cruise anytime soon? Yet Donald Trump waivers on a stimulus with a no-show on his corona-package promised earlier.

Source: NYTimes

Source: NYTimes

Source: Bloomberg

Source: Bloomberg

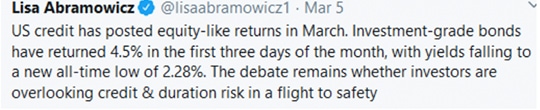

Thursday, 5 March—Lost in Translation, Trump talks crap, liquidity starts to freeze up (leading to more volatility) as trading conditions deteriorated and stocks closed in an up, down, up, down week so far and US 10 year yields sliced under 1% as 1.92% (where it opened the year) becomes a thing of the far and distant past with no visible signs of distress as high-grade bonds continue to be seen as safe haven.

Source: Twitter

Source: Twitter

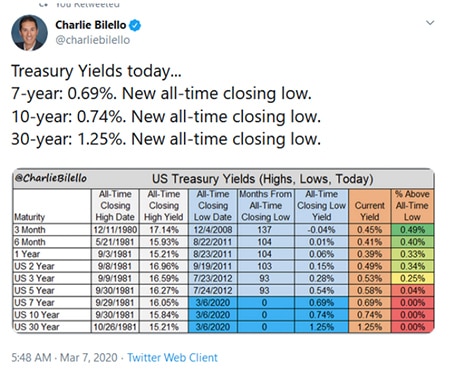

Friday, 6 March—Unbelievable by EMF, bond yields continue to plummet (breaking 0.8% for the 10-year) with no signs of the bottom and breaking records, traders flying blind and admitting they really have no clue having come thus far. The bears emerge, calling out the excesses we have blinded ourselves to and a vote of no confidence in central banks.

Source: Bloomberg

Source: Bloomberg

What a week it has been—“I have no energy left to speak” with our eyes clouded over in disbelief over what has transpired in such a short period of time.

Source: NYTimes

Source: NYTimes

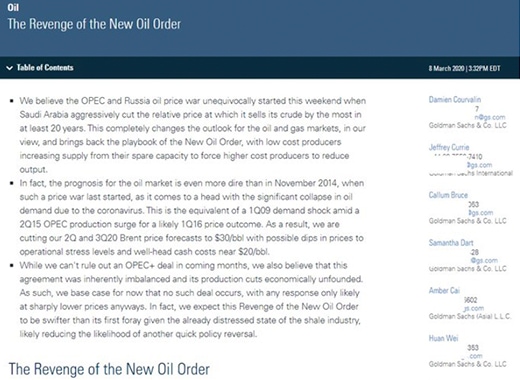

Sunday, 8 March—Black Swan! So Middle East stocks nosedived as much as 10% on Sunday (because they work Sundays) because Russia refused to play ball with OPEC and output cuts which led to panic selling in the oil markets on Friday, plunging the most since 2008. Upon confirmation that Saudi Arabia intended to hike output for an all-out price war, Monday would rank as one of the top worst workdays for anyone in finance in the last 20 years. Although one may beg to ask if things could have turned out differently if Aramco had not done its IPO in December?

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Second swan … Global Pandemic as Italy shuts down.

Source: BBC

Source: BBC

Third Swan … Liquidity Crisis as on Credit-Market Stress.

Source: Bloomberg

Week 3

Monday, 9 March—Full Moon night and a financial market crisis that makes the last 2 weeks look like child’s play!

Goldman Sachs cut their 2Q and 3Q20 Brent price forecasts to $30 per barrel with possible dips to $20 and markets plain ignored North Korea’s projectiles because no one who bat an eyelash if an asteroid hits earth with some even praying hard for it as we hear of friends cautiously checking their blood pressures before going in to work. Oil tumbled 31%, the most in 29 years, US futures triggered a trading halt after plunging 7% and treasury yields plunge to record lows (10Y hitting a low of 0.31%, closed 0.76% Friday). And no one was really thinking about the virus at all. Vix broke 50 and hit 60 intraday. Stocks down 7.6%.

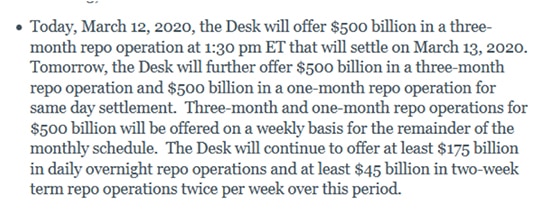

The Fed hit backs by increasing its repo (liquidity) operations in the market as the entire US yield curve fell below 1% for the first time in history.

Source: Federal Reserve

Source: Federal Reserve

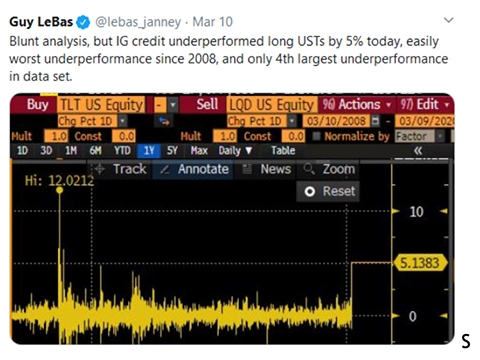

Alas to no avail because alarm bells have been triggered in credit markets and for the first time since 2008, Investment Grade bonds underperformed US treasuries by 5% which is a big sign of a VAR shock! And the death of the Risk Parity trade i.e. Everything is tearing as things fall apart.

Source: Guy LeBas on Twitter

Source: Guy LeBas on Twitter

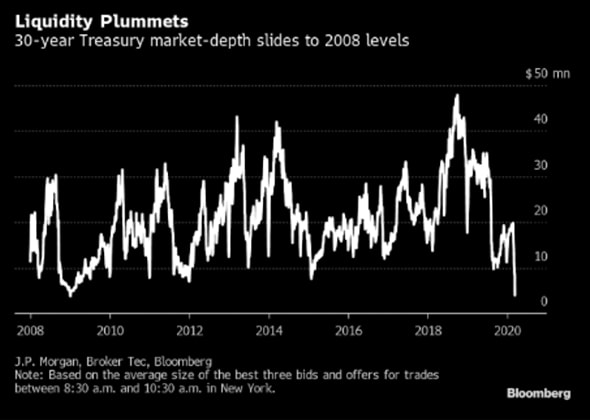

Tuesday, 10 March—Swinging sentiments drove a rebound in stocks and bond yields spiked higher, only to spook markets more as liquidity continues to ebb and the Financial Conditions Index became the tightest since 2009 as Italy went into full lockdown for the entire country in just 3 days from the first lockdown. And before we knew it, US treasuries futures saw a mind-boggling Limit Down, rising to 0.8% after a 0.31% touchdown less than 24 hours before and liquidity has all but evaporated in Europe, Indonesia, Mexico and even 30 year US government bonds. Stocks rebounded nearly 5% on news of a corona-package from Trump that has been promised for over a week now and oil prices staged a strong comeback. America runs out of toilet paper. Stocks up 4.94%.

Source: Federal Reserve

Source: Federal Reserve

Financial Conditions Index. Source: Bloomberg

Financial Conditions Index. Source: Bloomberg

Source: CNN

Source: CNN

Source: Bloomberg

Source: Bloomberg

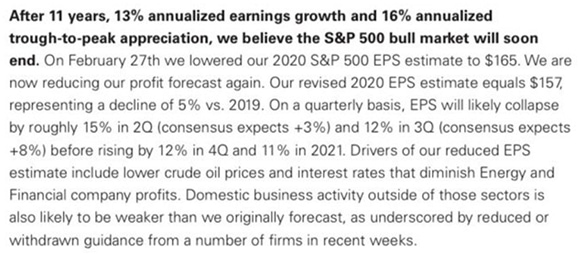

Wednesday, 11 March—Official responses start with Taiwan mulling a ban on short-selling, the Bank of England and Iceland cutting rates by 0.5% as well, Singapore preparing a second stimulus package, Woolworths refusing toilet paper refunds to greedy buyers and yet, S&P futures gapped lower because even Goldman threw in the towel to acknowledge the bull market will end soon (yes, tomorrow). Stocks down 4.89%.

Source: Carl Quintanilla on Twitter

Source: Carl Quintanilla on Twitter

Thursday, 12 March—Bear Market on the excuse that Donald Trump announced a travel ban. Financial conditions made a new low since 2009. Things getting out of control in Italy that the doctors are forced to triage patients deciding who gets to live or die.

Source: CNN

Source: CNN

Financial Conditions Index. Source: Bloomberg

Financial Conditions Index. Source: Bloomberg

Even the most liquid market in the world—US treasury bonds—saw their liquidity drying up to a trickle and market makers only accepting trades on order basis due to the excessive volatility.

Source: Bloomberg

Source: Bloomberg

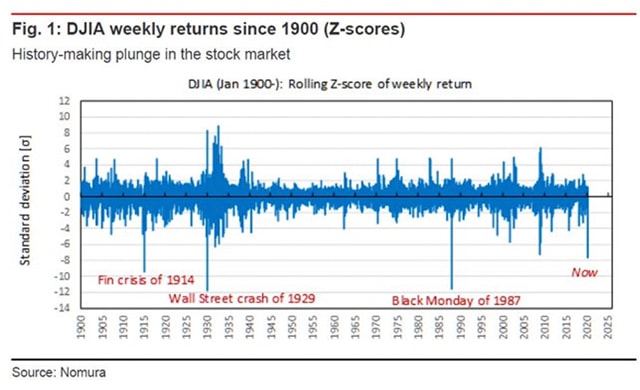

The S&P makes its biggest (Limit Down) fall of 9.51% for the fastest bear market ever in just 19 days, a 7.7 standard deviation move (impossible).

Source: Tracy Alloway on Twitter

Source: Tracy Alloway on Twitter

Friday the 13th of March—Dead Man Walking. No humans, only zombie brains left and yes, a 9.29% (Limit Up) rally as liquidity continues to evade us. Ray Dalio, the pioneer of the Risk Parity Trade, is down 20% on the year, the Fed offers a trillion dollars in reverse repos, in addition to bond purchase to “address highly unusual disruptions in the market for Treasury securities” (which sold off with 30-year US treasury bonds underperforming junk for the day).

What started as a health crisis has morphed into a market crisis, into a liquidity crisis and, coupled with the oil price war, financial crisis (credit and funding) delivering a VAR shock. Nothing really works anymore—Italy and Spain both banned short-selling, loads more countries are closing borders as Nike and Apple close stores globally, the FRA/OIS spread is in distress and we head into Week 4, blood pressure normalising because every crisis is the same, the only difference is yourself.

For posterity.