Fussing Over The Mortgage Rate

Writing this piece 2 days before the MAS announces their semi annual monetary policy statement.

For all the investor education initiatives we are seeing out there spearheaded by various regulatory bodies, the main gripe is that if Singapore interest rates were easier to understand, then perhaps people will take a more active interest in managing their investments?

Singapore has one of the most complicated interest rate mechanism in the world – the market determined rate which is commendably laissez-faire and yet quite impossible for the average Singaporean to understand how SIBOR is derived.

Can Singaporeans do any better for themselves in their little mortgage market that is characterised by the few options of just SIBOR loans or fixed rate loans that do not go beyond 5 years?

Perhaps investor education should start at home and fussing over that mortgage rate?

With the 4th highest home ownership rate in the world, Singapore, at 90.3%, has also one of the highest level of household borrowing relative to GDP at some 76%. Of that number, home loans account for three-fourths.

Home Equity In Our Daily Lives

Mortgages are a subject close to the heart of many a Singaporean, even for the ultra high net worth individuals and their stable of properties, industrial, commercial or residential. For it has been a trend since the days of the Global Financial Crisis when minuscule returns on assets and low borrowing costs created a horde of yield hungry investors who took the opportunity to cash out on their home equity, borrowing to invest in higher yielding investments. Others took advantage of the low rate environment to load up on the investment property, some of which were hawked at distressed levels. For the more savvy investor, it represented a whole new opportunity of doubling up on their leverage when they leverage on their capital to buy even more assets to enhance their returns.

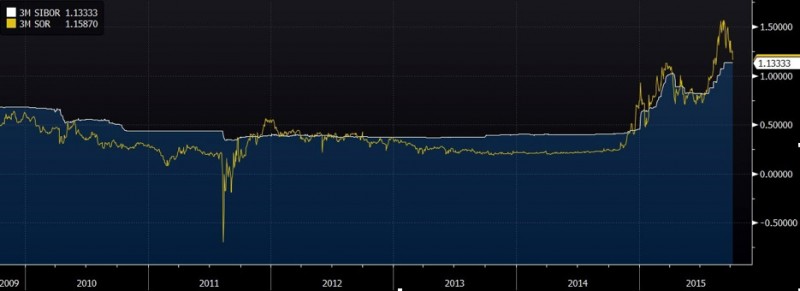

It has worked out well for most especially during the days in 2011 when Singapore’s SOR (Swap Offer Rate) rates dipped into the negative territory and remained contained between 0.25-0.5% for the 3 years that followed. SIBOR (Singapore Interbank Borrowing Rate) also held steady, under 0.5% for the entire period, giving investors a peace of mind and lulling and dulling the investing acumen a little to ignore the financing cost angle.

SIBOR rates have risen about 150% from 0.45% to 1.13% within a span of 9 months and suddenly has become a cause for concern as the media picked up on it and we have MRT stations billboards and screens advertising solutions for the higher interest rates that should be eating into pockets of some although we have the authorities to thank for their pre-emptive loan measures aimed at curbing speculation back in June 2013 which saved many a potential home investor the horror of not just buying at the high (debatable if the “high” was the result of the loan measures) but facing higher financing costs too. A far sighted move indeed, public welfare at heart, with the general level of ignorance on how Singapore interest rates work.

URA All Residential Property Price Index

The Double Whammy From Various Angles That We Pointed Out Before

- If cost of financing rises, the cost of the asset adjusts lower commensurately for the returns to remain the same.

- If returns on the asset, such as rentals, fall then the price of the asset has to adjust lower commensurately, yet again.

- If the price of the asset, such as a bond, falls for other reasons than the higher cost of financing, then the opportunity cost of investment is negatively impacted.

Using the extreme example from a previous post “The Widow Maker In Real Estate”

“My question is this: How much will property price come off by for a 1% up move in interest rates? This is entirely plausible because our mortgage rates are still about 1% and moving on to a 2% handle is not an impossible scenario. It will really start to burn when it hits 3% bringing about the dreaded margin calls on those loans that are leveraged to the hilt (= sub prime foreclosure scenario).

Using rough math, 1% for 25 years = 25% more you will be paying (the amount should be less due to amortisation effect), on 80% leverage, so we have about 20%! Unless you have a wage hike of 20% or a rental hike of 20%, the property prices should come off by 20% to equalise?”

It is not true of course because the latest statistics show that real estate loan to valuation ratio is about 40% for Singapore, and thus we should be working on a 10% number for a start. In addition, that is not how property markets work, simply based on returns, because we have the demand and supply side to the equation for home owners who are willing to put up with negative equity for the roof over their heads. Investors typically react the same way given that real estate is a long term investment and their investment horizons stretch much further.

In the case of other investments such as fixed income instruments which is the popular asset class of choice for home equity proceeds, given that they promise steady returns, investors usually do not mind the pinch of higher financing costs as along as the returns are in the positive zone. That is mostly the case unless if they are forced out of their investments on margin calls on extreme price drops.

Fussing Over That Mortgage Rate

Wealth accumulation is the in-thing and it is all about growing the assets. However, if liabilities start impeding asset growth then perhaps the best solution is balance sheet reduction? Deleveraging?

Asset price drop, Liabilities constant = negative wealth accumulation!

The key to success would appear to be in Liability Management.

Yes, managing that mortgage rate would be a viable investment strategy that one has some degree of control over if one cannot influence the direction of asset prices and returns.

- Derivatives

2 years ago, we noted that folks with access to the derivatives market were using interest rate derivatives to lock in their multi-million dollar mortgages for 5 years at 1.25% (net 0.8% at that time). That mortgage would be paying them money now because they will be receiving 6M SOR in exchange for the 1.25% and 6M SOR is 1.35% last.

Now is that not a good deal?

The same deal today would cost more than 0.8% that he had first paid with the 5Y rates at 2.3% and 6M SOR at 1.35% as the curve has steepened in the past 2 years.

The alternative would be via interest rate options but those are usually shorter terms and paying those premiums upfront are costly. Of course there are receiver options one can sell instead, which means one would take on the role of paying a fixed rate when the strike is hit after receiving a premium upfront.

- Fixed Rate Mortgages

For those people who had opted for fixed rate mortgages last year, paying 1.3% for 3 years or 2.18% for 5 years etc, they would be mighty relieved that 5 year interest rates swaps are at 2.3% today.

As a consolation, we managed to find a 5 year fixed rate deal offered by a bank currently that is just 2.45% which means a premium of just 0.15% for the bank. Comparing this premium to the typical 3M Sibor + 0.70%, one would be rather flattered by that although it is not the usual way of assessing a mortgage deal, a credit trader would instinctively sell at the tighter credit spread i.e. borrow.

- Carry/Funding Trades

Swiss franc mortgages taken out by the Croatians and Poles ended in tears when the Swiss National Bank un-pegged the CHF from the EUR in January, a stronger CHF leaving them with liabilities larger than they had estimated.

Nearer to home, we had AUD mortgages funded in the cheaper SGD and in 2015, rising SGD interest rates cost borrowers dearly as AUD rates fell to their lowest in history. For those borrowers who had locked in a currency swap, they would have lost out on their principals as well with the AUDSGD weaker than when they had bought their properties.

This is not to say that funding in another currency is a fruitless task. Funding in EUR, for example, has been viable given the absolutely low rates, keeping the currency effect in mind.

- SIBOR or SOR Floating Rate

This is where the bulk of the mortgagees stand, having little option with the derivatives front, and finding the fixed rate always higher than the short term rates. Thus they choose from the few choices of 1M to 6M SIBOR or SOR.

Singaporeans have it hard, living with a monetary policy most do not understand – with no central bank guidance on where interest rates will head.

In January, we outlined a simple strategy for those with SIBOR mortgages to hedge themselves.

“What options do we have?

Not alot. There are no SIBOR or interest rate futures and interest rate swaps are quoted OTC, the same for swaptions and other options. There are no bond futures and such.

That only leaves us 2 liquid instruments in fx and fx options.

If we assume that CPI is falling and that economic growth will be lacklustre and we have the market currently expecting the MAS to ease the SGD strength in April this year, we have a case to worry about higher short end rates.

This means that buying USDSGD is a good idea, because there is every sign that SIBOR is pre empting the USDSGD move and it is really too much hassle to hedge against the NEER basket especially when the USD is the bulk of it.

The alternative would be to take advantage of the high vols to sell some USDSGD put options that will earn you a premium as well as give you the opportunity to buy at a lower level than current spot.”

3M SIBOR is 1.13% now compared to 0.45% at the start of the year and the USDSGD is 1.395 after starting the year at 1.325.

Now can anyone tell me if it is worth fussing over that mortgage rate?