It’s Obscene: Let Them Buy Real Estate, We Buy Real Estate Companies

Market Bash: It’s An Obscene End To July

It makes sense to end the month of July on an obscene high rather than a low because we have mostly forgotten what Low means, with the S&P avoiding a 5% drawdown for the longest stretch since 2009 – 181 days in all.

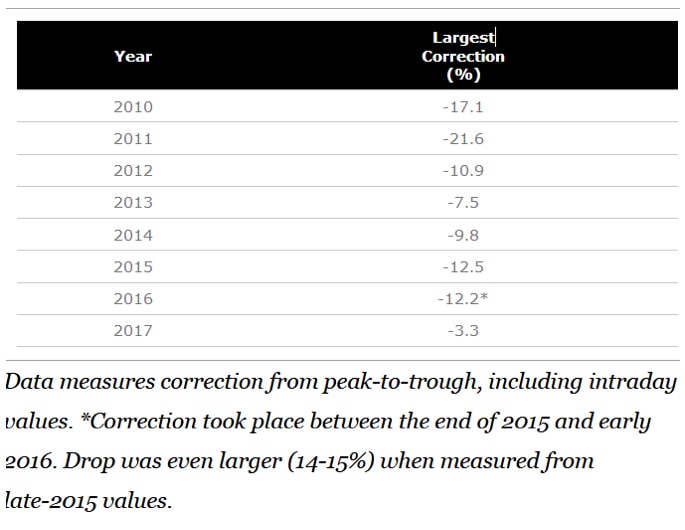

2017 stands out as an exceptional year with the lowest % pullback in the S&P from its peak compared to every year since 2009 where we have healthy corrections of 10%, with the exception of 2013 where the pullback of 7.5% is more than double what we have seen in 2017.

Source: ETF.com

Even more powerful is Investopedia’s finding that the average recovery period from a 1% decline has shrunk from 80 days in 2015 to 25.5 days in 2016 to just 14.5 days in 2017!

However earnings have been nothing but fabulous so far and, for the record, every single friend we have been talking have reported sitting on indecent returns for their personal portfolios, with the only complaints we hear being how they sold their Tencent a week too early to miss that extra few cents of gains.

Obscene is the latest catch phrase with Anthony Scaramucci as the latest addition to President Trump’s team and his obscenity laden tirade in his interview on the national news which means we can now forget about trying to teach the kids otherwise about swearing given the US president’s penchant for profanities and of course, poor spelling.

Trump bad spelling and global influence must be growing because Singapore’s Today papers had a glaring typo this weekend.

On the favourite topic of fake news, or post-truths, being non-readers of local media, we are hugely amused by the unverified, unofficial and un-condoned outing of our esteemed Straits Times and their award winning correspondent who was found to have regularly quoted “a regular commuter” in his columns drawing a Donald Trump favoured, witch hunt by a local blog. Our apathy towards ST’s financial columns aside, after our article Singapore Bonds: Fact Checking The News written last month, it is still a must read.

Source: Mothership

Obscene is back in Singapore too as some 244 beyond-Toto-lucky families in Serangoon are about to pocket 2 million obscene bucks (they had only expected 1.6 mio) each for their successful en bloc sale to an Oxley-led consortium, taking the number of en bloc sales in 2017 to 6 for a total of nearly 2 bio dollars.

Thus, UOB’s CEO did not have to think too hard when he proclaimed he “sees signs Singapore residential home market bottoming”. Errr, those 244 families will be out there property shopping soon, or once they get over their initial shock that really brings out the “Scara-mooch Scara-mooch, will you do the fandango?” (excuse the pun intended for Scaramucci) mood in us as we rejoice for them.

That is when the Oxley consortium raises the S$499 mio to pay for the deal after another Oxley consortium raises the S$575 mio to pay for their Hougang deal in May. Bonds, maybe?

Not so obscene will be the losses suffered by Rich Singapore Investors Stuck as Bond Restructuring Drags which gave us a novel idea that Oxley can pay for their S$499 mio partially in Oxley bonds where the 244 families will receive some funds in cash and part in bonds which will be a cool solution because in the worst case, they will just get their homes back?

The cautionary bond restructuring article out of Bloomberg is a possible fail for journalistic endeavours because investors appear to be chasing after bonds with renewed zest as the new ARA SGD perpetual (unrated private company) was taken to a ridiculous new high of 103.5 this week and even Olam came out to join the party, reopening their SGD perpetual bond, as a blow to current bond holders, at a steep 1% discount to secondary market prices. Perhaps Olam was too anxious to pay up to avoid any deal failure possibly from Noble Group contagion, down on its luck Noble which cannot seem to get anything right these days even after a white-knight rescue just a fortnight ago.

It is a pity that Noble is not the business of copper, trading at a 2 year high.

That Oxley Magic

Something must be up for Oxley to go on that spending spree, buying up over a billion dollars worth of HUDC apartments for redevelopment. Something must be up because Oxley’s year to date return on its stock price at 35% is just more than double the STI return of 15%. This is a company that just pays 0.51% in dividends against the STI’s 3.18%. In the last 12 months, Oxley stock has returned 51%, against the STI’s mere 16%, of which 15% came in 2017.

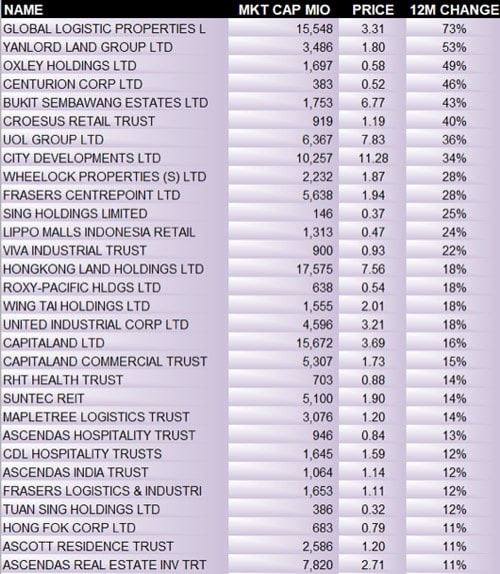

In the last 12 months, only GLP and Yanlord managed to outperform Oxley at 73% and 53%, respectively.

This effectively gives Oxley the highest Price to Book value among all the real estate companies in Singapore at 1.8 times meaning the stock is trading at 1.8 times above the book valuation of its primarily real estate holdings. More importantly, this number excludes the 2 recent acquisitions that were dealt at prices above market expectations, a remarkable feat.

Considering that Capitaland is going at 0.9 book value and paying 2.7% in dividend, folks gloating about their gains should reconsider their opportunity loss and Capitaland should be looking to learn from that Oxley magic.

The Real Estate Stock Rebound

If there is a real estate rebound, it would only be apparent in real estate stock prices and not the real estate market. The URA Residential Property Price Index is still notching lower as of 30 June this year at 136.6 which is a happy thing because it is only a 0.1 decline from the previous reading of 136.7 in March. Yes, the decline is slowing at last.

Examining the chart of the URA price and rental indices against Oxley’s share price, Oxley which was listed in 2010, stands out as a real winner as we throw in Capitaland for good measure.

Chart of URA Residential Property Price Index, URA Residential Property Rental Index, Oxley and Capitaland share prices.

Nonetheless, Capitaland is also 16% up in the last 12 months, matching the STI performance for the same period.

Looking at the real estate firms and their salivating performance makes one wish one had not bought into that troublesome condo for the hassle of finding a tenant, managing the bills and, on top of it all, PAY TAXES!

We present a table of the top 30 best performers in the last 12 months, dropping out some small names.

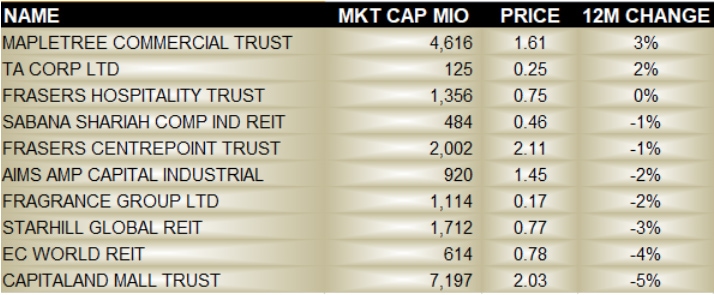

There are the losers as well and we can count one of our largest REIT as one of them—Capitaland Mall Trust, falling prey to the global retail malaise that has shuttered many more malls elsewhere in the world. Singapore’s disputably most beloved mall, Vivocity, gave Mapletree Commercial that leg up to underperform less.

Table of the 10 worst performing property counters

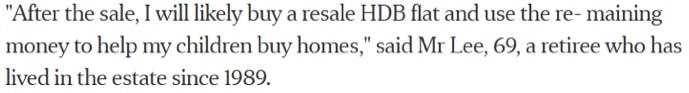

It does look like optimism is running ahead of the underlying market which probably makes sense if those en bloc millionaires are going to be out there shopping as one of them is quoted saying he would use the money to help his children buy homes as well after buying an HDB resale flat for himself.

Source: Straits Times, noting the grammatical error

The Obscene Sense in Buying Property Companies

There is no magic formula as to why property companies are running ahead of property prices because common sense tells us that if prices have bottomed, it is likely that the property companies will be sitting on gains if they sold their stable of real estate at current market prices for surely they will be carrying the stuff on their balance sheet at cost price.

The book value at which real estate companies value their stock of properties would be a conservative number which is probably why we have Oxley trading at 1.8 times the value of its assets as investors bought the company up this year.

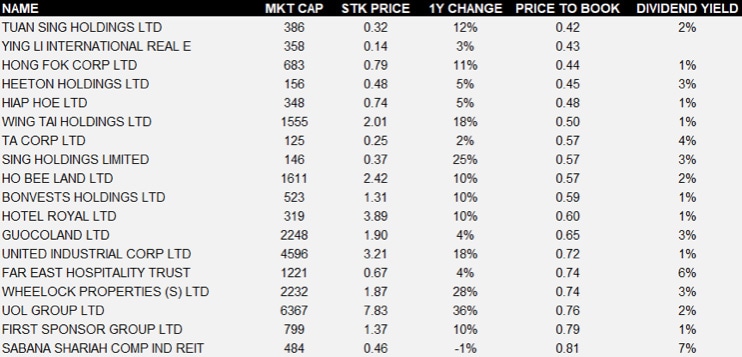

Yet we have a host of companies that are trading under their book values as we speak, granted that some have also made exceptional returns on their stock prices this year. Naturally, it would be poor sense if just book values were examined, for the value of swamp land in Myanmar may take years to come to en bloc potential.

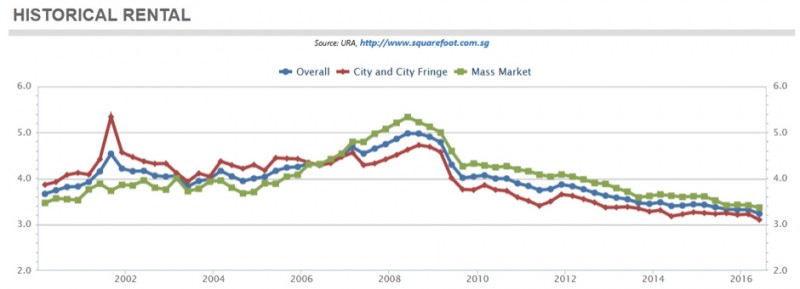

If we view the dividend payouts to make up for the rental yield, returns are not too shabby given that rental returns are not looking to at 4% anytime soon, looking at the chart below and the URA Rental Index, whilst showing rental flat-lining as of 2Q17, still has rentals going at 7 year lows.

Obscenely Rich From Those En Blocs

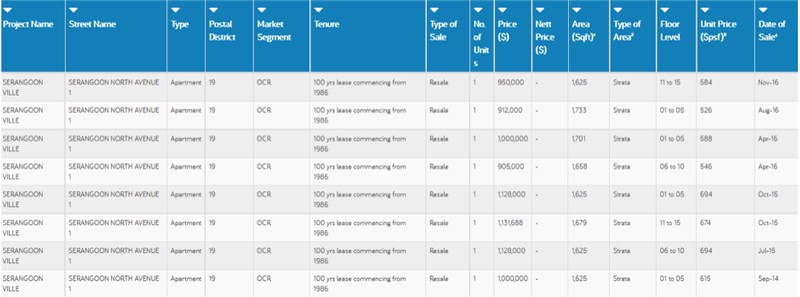

Most of the 244 families of Serangoon Ville would be sitting on at least a 100% return, given there were only 8 transactions for that estate since 2014, and kudos to the lucky chap who sealed a deal for Serangoon Ville just 8 months back in Nov 2016 at S$950k.

With 2 major Oxley-led en blocs in the bag for 2017 so far, it stands to reason that the property market will see demand from obscenely rich resettlers, greedy en bloc speculators and first time buyers besides all the pent up demand from property investors waiting on the sides for the government to abolish that additional buyer’s stamp duties and charges, if they have not found a way around it.

It is just difficult to envisage prices rebounding in a hurry back to the peak price years of 2012-2013. It is even harder to expect rental demand to rocket for rental returns to back up above 4% which will be a lost cause, in any case, if interest rates edge higher at same time.

It is easier to realise that, for the expected buying in the months ahead, the property market has bottomed at current market levels. Real estate companies will finally be able to realise some profits from their inventory which is even better for companies that are conservatively valued.

The mentality for real estate has always been that it is biggest bang for buck because you can borrow a lot of money from real estate but who says we cannot borrow a million bucks to buy some Oxley and make 51% in just 12 months? Half as lucky as the en bloc millionaire but much better than that 1.96% rental yield the buyers are hoping for their Gramercy Park condo.