Locker Room Talk: Trump’EM Down but Not Out for Singapore

Brexit times five or Brexit times ten?

Feels like that moment in that Rocky movie with Stallone floored, bruised and bloodied.

And we have been warned on Brexit by Moody’s and S&P to be credit negative, risking another downgrade if the UK does not retain market access.

Pent up markets have gone and out done themselves again and who says they never learn? Treating the entire Trump surprise victory in the US elections as a Brexit, the market skipped the disappointment of the fall-out bit, to head just for the happy rally ending for the S&P 500.

There was a mad rush to dig up all of many threats Trump had made during his campaign, that no one was thought was executable and now imagining them as real as his election victory but the task was just too darn laborious and thus, for most, it was easy to just follow what the rest was doing.

That pretty much sums up the 2 trading days following Trump’s upset win.

Fear mongers got the best out of it and our feeble minds can only grasp simple rules which are to – dump anything Muslim (Malaysia and Indonesia), dump EM and all related to the TPP trade deal that is suddenly off the cards, play for inflation although it has been clarified that Trump cannot officially fire the FOMC and dump Gold and bonds, dump gun stocks (no more gun bans), buy US stocks and you get the drift, after a while.

A dear female friend of mine proclaimed the Trump victory as legitimizing “locker room talk” from her perspective and she feels at liberty to call any guy a “dickhead” or “himbo” if she wanted to without the fear of harassment. A shallow interpretation, I am afraid, and distorting the meaning of “locker room talk”, for her pint size which will not fair too well in society, but I, wary of her newfound “licence to abuse”, dared not tell her.

For, we in Singapore have the luxury of reading about global scandals. Who from South Korea would not gladly vote for Trump last week when Koreans are confronted by the fear they could have been ruled by a cult for the past 3 years?

And Indians in India probably feel just as sour in the government’s sudden announcement to withdraw 500 (US$7.5) and 1000 (US$15) rupee notes from circulation, sparking commotions in the streets and banks as their 1 billion populace rush to meet the deadline for exchange their notes, and no doubt a crime wave to follow with millions of people brandishing their life savings in public.

The worst person to be other than the poor African American 7 year old boy who was thrown out of his house for “voting” (for he cannot vote) Trump in school, is probably the Indian in America waiting for his green card with a stash of rupees he cannot account for back at home in Delhi?

Global Political Confidence Has Sunk To a Low

Distrust for politicians has turned to resignation while dislike for each other as the Clinton campaign fizzled after she “rallied such voter blocs as Latinos, blacks, women or gay Americans by telling them not just that she was on their side, but that her coalition would not seek to win the votes of those Americans they dislike or distrust”.

Social polarization is not uncommon in populist politics and we find good comparables to Trump around the world, none more obvious than fellow billionaire former global leaders such as Italy’s flamboyant Berlusconi or Thailand’s renegade Thaksin, the first democratically-elected prime minister of Thailand.

Has the Wealth Gap resulted in an “Intellectual Gap”?

We cannot be sure but we have the answer to the other question—Brexit was no fluke!

The Inevitability of Nationalisation, Protectionism and Recession

Now that we have Donald Trump’s rise ratifying Brexit, we can be sure there will be more upheavals ahead given the increase in public apathy towards their politicians and the dark horse candidates out there as we see Bulgaria’s incumbents give way to the socialist led opposition party in their elections yesterday.

Markets are going off tangent on expectations even before Trump takes office in January and it is not pretty. We are looking at a “global recession” when the trade wars take off and even the US is not sitting pretty unless Trump gets his spending plans passed which will most definitely take some time.

And time is not what we have right now because we are in an unnaturally long economic cycle that started in 2009 and lasted 7 years when the national average period of economic growth, going back to the end of WWII, lasts about 5 years.

Trump’s protectionist agenda during his campaign has been blamed for much of the price action we are seeing in the markets, summarised easily in one digestible word “Trade Wars”.

If Trump were to pursue these policies, Willem Buiter, chief economist at Citi, wrote in a note to clients that it might spark a global trade war, “which could easily trigger a global recession.”

Locker Room Talk For Singapore

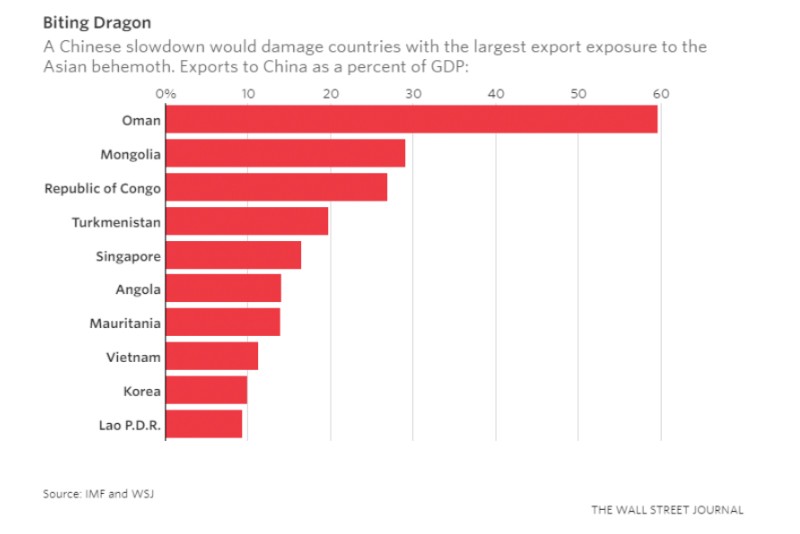

What is this? WSJ—If China Stalls, Here’s Who Is Most Exposed, how did Singapore end up ranked 5th?

Trade is important for little Singapore.

“A trading nation (also known as a trade-dependent economy, or an export-oriented economy) is a country where international trade makes up a large percentage of its economy.

Smaller nations (by population) tend to be more trade-dependent than larger ones. In 2008, the most trade-dependent OECD member was Luxembourg, where trade was worth 313.08% of GDP, while the least trade-dependent was the United States, where trade made up 30.41% of GDP.

Small countries or city-states that are extremely reliant on international trade are sometimes called entrepôts, which typically engaged in the re-export of products produced elsewhere, or finance and services (see offshore financial centre). Modern-day examples include Hong Kong, Singapore, and Dubai.” Source: Wikipedia

With Donald Trump blaming the US’s economic ills on “the consequence of a leadership class that worships globalism over Americanism”, I think trade war is a good bet.

So much for those disparaging comments, which are baseless without analysis, that Singapore is done in by the non-ratification of the TPP because Singapore was one of the 4 founding countries of the original agreement.

The good news is that trade does not stop and life goes on. Singapore still has 21 other free trade and partnership agreements in place.

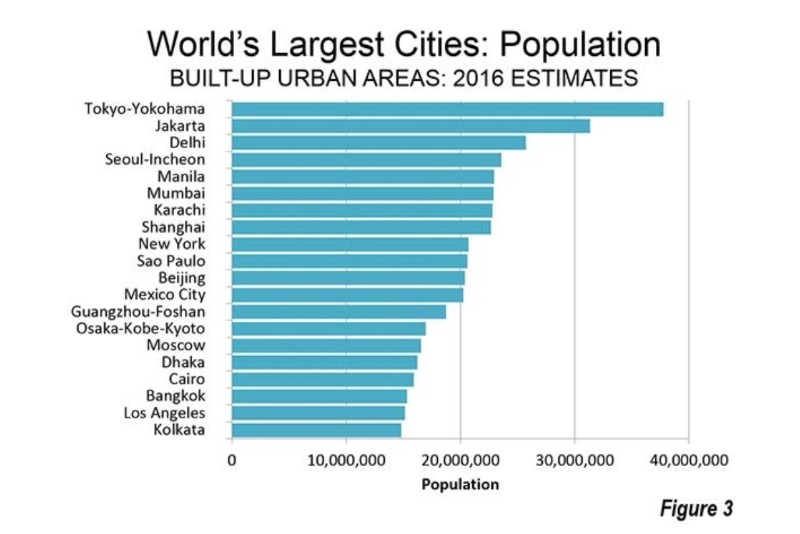

And the better news is that globalisation continues with or without the US because the US really needs the rest of the world as much as they need the US and the UK (Brexit) because opting out now will cause the American corporates and banks to lose out on the fast growing populations and cities of the world.

“Most of the world continues to pursue free trade, even as Trump derides the North American Free Trade Agreement, or Nafta, as a “disaster,” and Brexit excises Europe’s second-largest economy from the continent’s integrated market. China is pushing for a pan-Asia free-trade zone; the 10-member Association of Southeast Asian Nations is forming a common market; and African countries have started negotiating a continent wide free-trade area.

Today’s globalization is also drawing in countries previously left out. Textile and apparel manufacturers from Bangladesh, China, and Turkey invested $2.2 billion in Ethiopia last year to open factories to export to the U.S. and Europe. The Philippines, long a laggard in a region replete with hyperconnected economies, has become a major hub for call centers.

New institutions are forming to support these trends. In June the China-backed Asian Infrastructure Investment Bank, a development organization akin to the World Bank, approved its first four loans, totaling $509 million, for projects in Bangladesh, Indonesia, Pakistan, and Tajikistan. Two months earlier, the New Development Bank—founded by Brazil, Russia, India, China, and South Africa, and headquartered in Shanghai—announced its first loans. They totaled $811 million and will fund renewable energy projects in the BRICS countries, except for Russia.”

And Singapore will be part of it as it continues to be one of the easiest places in the world to do business, in 2016 ranked first by the World Bank and, second in the world by the “Doing Business” report.

Long seen as the Monaco of the East, PM Lee acknowledges challenges ahead, “in economic restructuring and preparing citizens for disruptive technologies”, in the backdrop of a global recession and extreme political uncertainty, locker room talk is best taken the Rocky way.